The arrival of COVID-19 profoundly affected all aspects of personal and professional life within a few short months. From social distancing to stay-at-home orders, furloughs, job losses, and in some cases administration and bailouts, the impact of the pandemic on individuals and the broader economy has been substantial. Payroll numbers from the U.S. Bureau of Labor Statistics (bls.gov) make for sobering reading, and the April 2020 Duke University/CFO Global Business Outlook survey (bit.ly/36ja3Il) places CFO confidence at a low not seen since the Great Recession of 2008. Finance directors are poised for a prolonged period of disruption and adjustment.

Yet it’s important to remember that the coronavirus is only the latest in a long list of factors that have prompted the CFO role to evolve. In the last decade in particular, CFOs have faced a raft of changing regulations and enhanced governance requirements. They have had to get increasingly comfortable with new technology and automation, and they have needed to step into the limelight as prominent communicators and influencers. The modern CFO has fully embraced change to become a valued strategic partner, able to navigate complex organizations and lead an increasingly dispersed workforce.

With a proactive mind-set and a willingness to acquire new skills, the modern CFO is well-positioned to face these latest challenges, and those that will emerge in the future, with confidence.

AN ADVISOR IN UNPRECEDENTED TIMES

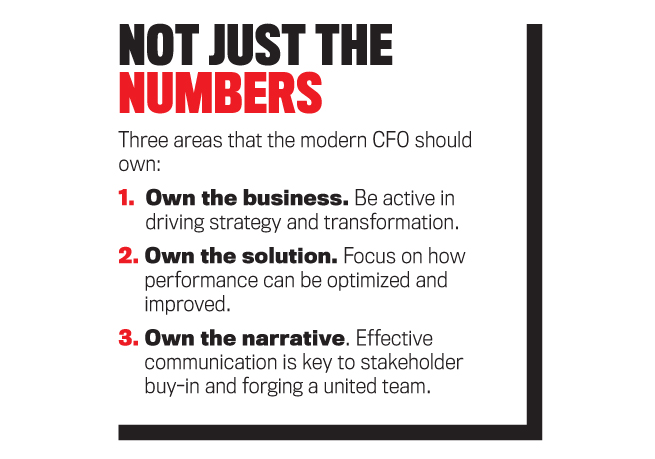

It’s been a long time since the CFO was expected to essentially be the Bean-Counter-in-Chief. Nonetheless, the last decade or so has cemented the CFO as a valued strategic counselor. The finance function of the past, with a focus on reporting, has evolved to be more actively involved in problem solving and decision making. A McKinsey study from 2016 revealed that four in 10 CFOs spent the majority of their time on strategy, transformations, or another area outside of finance (mck.co/2OwIwfE).

Today’s CFO needs to go beyond simply providing the numbers and instead help to interpret the information to aid the rest of top management and company leadership in tactical decision making. The modern CFO needs to be a skilled storyteller who can reveal the true story beyond the numbers, taking technical, complex data and translating it into a business strategy that wins hearts and minds. By taking on a more strategic advisory role, the modern CFO can drive forward organizational improvements and play an active part in shaping business transformation.

Becoming Solution-Oriented

In the years immediately following the 2008 financial crisis, the finance function, with the CFO at its helm, often acted as gatekeeper alongside other departments, such as compliance or legal. As time has passed, sentiment has thankfully shifted from a tendency to default to saying “no” toward a more productive mind-set focused on finding solutions.

In the current crisis, many changes are being imposed upon organizations to ensure business continuity. But within this, there’s an opportunity to implement change and challenge existing practices—to ask why a particular process is the way it is and to make improvements. For example, perhaps the frequency of reporting or investor communication should change to keep investors and the market sufficiently informed.

While communicating quarterly results already includes a remote component, a greater challenge CFOs may face relates to the next season of annual meetings. This is an area where the CFO’s thoroughness with regulations and the financials must meet finely tuned stakeholder management skills. Shareholder activist groups have largely opposed virtual meetings in the past, but in light of COVID-19, many have relaxed their opposition…for now. Going forward, CFOs will need to present solutions that somehow keep internal management, regulators, individual investors, and shareholder activist groups happy and promote confidence and transparency when it comes to the bottom line.

An Overarching View

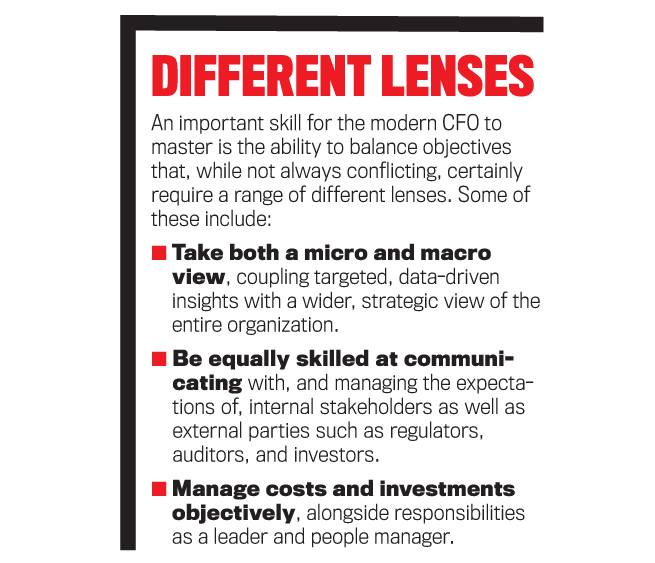

Having such a large range of stakeholders is inevitable given that the CFO is one of just a few individuals with a truly overarching view of any given organization. The traditional skills that will have played a major role in carving out a successful career in finance—being highly numerate, skilled at analytics, and able to interpret and synthesize risks, returns, and value—enable CFOs to decipher complex information while maintaining a view of the bigger picture.

Being able to share considered, relevant insights with colleagues from a wide range of backgrounds is a delicate skill to master. In the past, this has been complicated by the sheer volume of reporting and analysis being produced. In response to this, recent years have seen a shift from providing as much information as possible to a focus on producing increasingly targeted insights. These need to be accurate and comprehensive but also easy to understand. The importance of having good communication skills has already been stated, but the modern CFO should be able to translate data points into a sharp and compelling corporate story.

INCREASINGLY COMPLEX ORGANIZATIONS

Today’s organizations are increasingly global, and supply chains are more complicated than ever. The quest for greater efficiency has bred complexity, with value chains often spread across multiple jurisdictions and susceptible to choke points. As Geoffrey Gertz of the Brookings Institution notes, the widespread global disruption caused by the pandemic has revealed the vulnerabilities in our increasingly interconnected value chain (brook.gs/2B0WX77). This is a trend for CFOs to monitor closely, as it’s difficult to know what the far-ranging consequences may be.

A Cross-Functional Approach

Because finance’s influence spans all facets of an organization, the CFO is well-placed to identify potential issues both within finance’s extensive remit and across the business more broadly. Against a backdrop of economic disruption, the ability to harness information quickly becomes even more important. By ensuring that insights flow to where they’re needed, the CFO can champion efficiencies and mitigate issues as they arise. To do this effectively requires taking into account the particular needs of different departments. Only if the CFO truly understands the business can he or she be a constructive partner in it.

Professionals who have had greater exposure to parts of the business beyond finance, perhaps through sideways career moves, may bring with them a deeper understanding of the organization as a whole. As noted by KPMG’s 2015 report The View from the Top (bit.ly/2WZMUY8), the traditional linear career path has been disrupted, and finance professionals can no longer rely on success based on technical skills. By spending time in different functions or even within service centers, the modern CFO is likely to have a more comprehensive understanding of the challenges that may face any given part of the organization and be better prepared to navigate them effectively.

Working Together

In the current economic climate, where business decisions need to be made swiftly, organizations can’t afford to be siloed. This speaks to the need for CFO storytelling to go further and drive advocacy so that other parts of the business have sufficient understanding and agency to make dynamic decisions alongside finance, rather than at its behest.

Yet it can be challenging to get buy-in when leaning on other departments to take ownership of costs, performance, or risk management that might previously have been the responsibility of finance. By empowering the wider business with data and expressing the benefits for the end customer, the CFO can prompt other departments to become more responsive as well as free up those in finance for more strategic and forward-looking work.

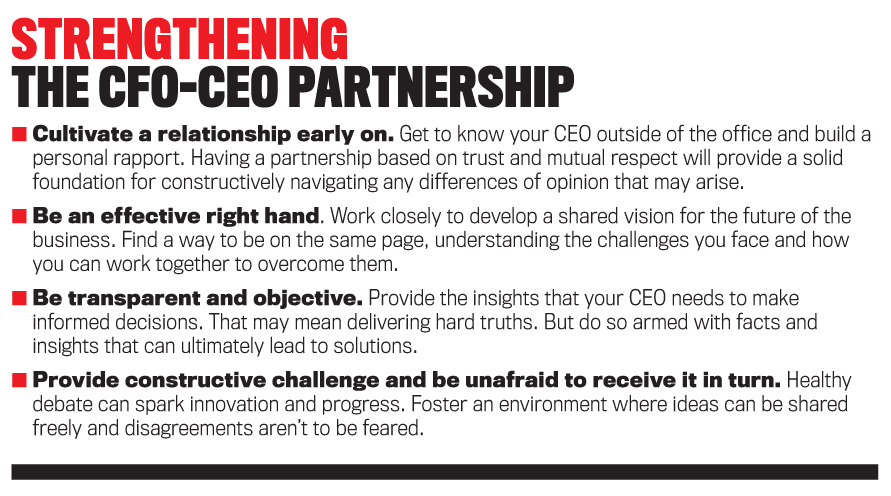

All of these considerations aside, there’s no partnership quite as critical to transforming the business as that of the CFO and CEO. Certainly, the modern CFO can be a highly effective leader of the business in his or her own right, but this dynamic works both ways, with the CEO lending support to the CFO in turn. For example, when trying to enforce a more disciplined risk or controls environment, backing from the CEO can be extremely helpful to achieve buy-in across the wider organization. Every CFO-CEO partnership will be different, but ultimately, both parties share a common goal for improving the fortunes of the business. Like all great double acts, they’re stronger together than they are apart.

A NEW WAY TO OPERATE

The fight against COVID-19 has forced many organizations to fundamentally change their day-to-day operations. Stay-at-home orders and social distancing measures have created a new normal of remote working, with less face-to-face exposure and increasing reliance on videoconferencing and other technology.

One reason that many businesses have been able to transition to a remote setup so swiftly is that globalization and migration were transforming the workplace long before the pandemic. A company’s finance function may already be spread across different cities, countries, or continents. For larger organizations, some aspects of analytics, intelligence gathering, and reporting may already be taking place in centers of excellence in places far from company headquarters.

Having the experience to successfully manage and unite dispersed teams with diverse viewpoints and cultural considerations is nothing new for a CFO. Indeed, in The View from the Top, KPMG noted that 48% of all surveyed CEOs considered global experience to be the most important attribute a CFO can possess.

Virtual Workplaces

This expertise will be more critical as COVID-19 has transformed the corporate workplace from one that was frequently optimized to fit more workers within less space to one where distance is the most important commodity of all. A recent Gallup Panel survey found that 59% of U.S. workers currently doing their jobs remotely would like to continue working from home as much as possible once restrictions on businesses have been lifted (bit.ly/3ejoSNB). Whether the workplace of the future can be made safe in a post-coronavirus world is a moot point if workers don’t feel confident coming into the office—or if caring responsibilities or travel restrictions make working in the office impossible.

Remote working obviously has cost benefits. We’re long past the era of one person, one job, one desk. Improving utilization rates has been a lever used by finance to improve efficiencies for some time, and the COVID-19 situation has proven that a more agile setup is possible and does work.

For any leader, changes to the workplace dynamic will require some acquisition of new competencies. Widespread remote working or off-shoring models may fall apart if there’s a sense that the manager doesn’t trust the team or have the know-how to delegate work effectively. Transitioning from the open-plan office to remote teams can create a fear of being “out of sight, out of mind,” with home workers putting in longer hours as a virtual proximity for presenteeism. In March 2020, virtual private network (VPN) provider NordVPN Teams reported that U.S. workers were working three additional hours per day on average, and those in Canada and the United Kingdom were adding two hours to their working day (cnb.cx/36s4iIg).

The modern CFO will need to maintain oversight of the business while at the same time resisting any instinct to overmanage remote teams. Embedding a strong shared sense of purpose can help to bring remote teams together. By building trust and visibility across multiple business areas and uniting a dispersed workforce behind a common goal, the CFO can encourage greater accountability and more robust risk management.

Assuming that remote working will remain a growing trend and that operations may become increasingly dispersed, creating that sense of partnership will become even more vital. For example, having service centers operating under a service-level agreement model where accountability could easily be shifted if something goes wrong just doesn’t work. By reminding members of a remote service team that they are a valued part of the onshore team and preventing the emergence of an “us vs. them” culture, the CFO can foster greater transparency, identify and resolve issues quickly, and preserve business continuity.

Keeping the Momentum

With the workplace turned upside down by COVID-19, the issue of business continuity has come to the fore. The CFO is often responsible for this area, given his or her overarching view of the business and focus on managing revenues. The experience of recent months is likely to force CFOs to think critically about what has worked well and what could be improved in this area.

It’s all well and good to have a business continuity plan in advance, but what do you do in an unprecedented, evolving situation? It’s unlikely that many organizations will have had a continuity plan that fully covered the scope of a global pandemic. As we wait to see whether the coronavirus will be a seasonal or ongoing threat, the CFO will need to lead from the front when it comes to identifying new opportunities while insulating the business against potential shocks.

NEVER STANDING STILL

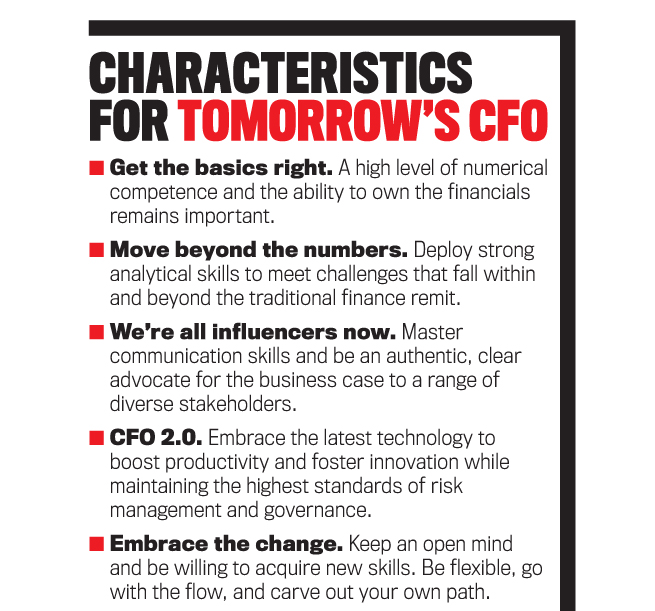

Today’s CFOs have already had to adapt to a significantly expanded remit. They’re expected to remain a safe pair of hands, overseeing the traditional responsibilities of the finance function, while also excelling as a strategist, communicator, influencer, people leader, risk manager, and more.

In the context of the challenges already discussed, what key skills does the modern CFO need in order to thrive?

Inspire and empower: With a range of departments sitting under the finance function, the modern CFO needs to be an engaged people manager for direct reports as well as a respected figurehead for the wider organization. The modern CFO will be comfortable with placing trust in his or her teams, delegating responsibilities where appropriate, and empowering their colleagues to make decisions. With capable teams that take ownership of finding solutions and embrace accountability, it’s no longer necessary for the CFO to feel the need to be the smartest person in the room.

Steer the strategy: As a valued member of top management, the CFO can provide timely strategic counsel based on accurate, relevant data. The modern CFO must also be mindful of benchmarking against peers and understanding the marketplace as a whole—in other words, being able to consider a range of internal and external factors to inform decision making or identify opportunities. Once the direction of travel is agreed upon, the CFO has a key role to play in giving the green light from an investment perspective and explaining its value to stakeholders.

Protect the bottom line: The CFO’s traditional responsibilities haven’t gone away. With a unique oversight of the business and the technical skills and experience to provide insights and challenge where needed, the modern CFO remains the primary custodian of the bottom line. But while stewardship of the health of the balance sheet remains as important as ever, the modern CFO will communicate and collaborate with other areas of the business to foster shared ownership of costs and delivery.

Own and mitigate risk: Much like the cost agenda, it’s increasingly important for all areas of a business to take ownership of risk. That said, risk ownership remains a key part of the CFO’s mandate. The modern CFO should be a role model for good risk management behavior as well as taking an overarching view of the business to help identify potential challenges. With considerable experience in adapting to and embedding new regulation, the CFO is a key point of contact for regulators, legal and compliance teams, and auditors. Maintaining a constructive, collaborative dialogue with these stakeholders is a core skill.

Overall, the pandemic has brought to the forefront a variety of company challenges and vulnerabilities that CFOs can help address. But this isn’t the end point. The CFO of tomorrow will need to continue to acquire new skills to thrive in the business landscape that emerges in the immediate aftermath of COVID-19. The next great test may be economic, regulatory, technological, or something else. Whatever it is, the modern CFO is up to the challenge.

July 2020