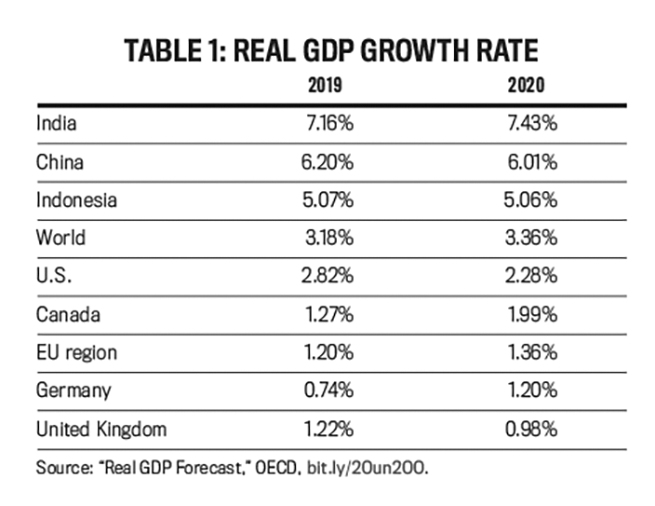

Yet opinions could change if slightly more bullish forecasts play out. Wells Fargo Economics, for example, has recalibrated its crystal ball to predict the U.S. gross domestic product (GDP) will grow approximately 2%, compared to previous estimates of 1.7% (bit.ly/2QEm9G5). This is in line with other estimates from the International Monetary Fund and the Organisation for Economic Co-operation and Development (OECD; bit.ly/2OA29Si). See Table 1.

While lagging behind overall global GDP growth of 3.36% (bit.ly/2Oun2OO), a somewhat less pessimistic outlook for the U.S. may change the finance chiefs’ gloomy foreboding. Also, in better news, the reversal of the inverted bond yield curve indicates that recessionary fears, although not completely squashed, may be calmed for the time being. According to Duke, issues top of mind for CFOs that are highly likely to spill over into 2020 include economic uncertainty (43%), difficulty attracting or retaining qualified employees (44.2%), government policies (36.2%), and weakening demand for products and services (24.6%).

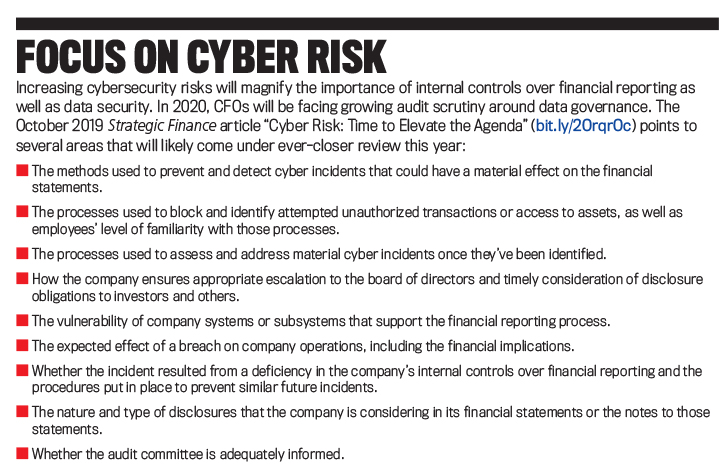

The story behind the numbers is a complicated one, and many factors are in play. Politics, technology, compliance complexity, cybersecurity risk, and talent acquisition have key roles in the unfolding drama.

The potential results of the 2020 U.S. elections are making risk assessments all the more uncertain. The final outcome of trade talks with China is an unknown and is impacting supply-chain decisions. As Carolyn Zhang, division CFO of Tekni-Plex, Inc., explains, the U.S.-China trade war is forcing companies like hers to weigh the risks of rerouting supply vs. rising input costs. Tekni-Plex is a private equity globally integrated packaging manufacturer employing 3,500 people throughout its operations in Belgium, China, Costa Rica, Germany, India, Italy, Northern Ireland, and the U.S.

“When we first heard about the trade war,” says Zhang, “the first thing that came to my mind as a supply chain operations business leader was, ‘Okay, we need to reroute supply out of certain areas of the world.’” In certain entities of the company, she notes, “One of the main ingredients is aluminum, and added tariffs would be a big hit for our bottom line.” But mitigating that risk isn’t that easy, forcing many companies to take a wait-and-see approach. “At the moment there’s nothing we can do about China,” Zhang notes. “It took years to establish our operation in China, and you can’t just wipe that out overnight. It costs money.”

She explains there’s also a problem from a technical perspective: Companies may not have the flexibility to reroute their supply chain. “You can’t just say to a customer like Johnson & Johnson that we’re shifting production from our Shanghai facility to somewhere else. Companies like that won’t accept it because the product certification takes years to obtain. So it just isn’t that flexible.”

This has a disproportionate impact on small to medium-sized companies, she observes. “A huge company that may have earned $50 billion in revenue may be able to do something. For example, they may use their local entity in China to only serve the local market.” She adds, “For companies like ours, that would involve a huge investment, so right now we’re hoping that the trade war won’t be a total disaster….It’s a difficult situation.”

One strategy that’s in play, Zhang explains, is stepping up her company’s secondary sourcing option that’s already in existence. “We always have a second supplier, which is located in Europe,” she says. “Sourcing more from Europe rather than Asia is a tactic we’re considering, but again it takes time to ramp up that volume.”

When it comes to impediments to trade, companies tied to a single source of supply will be facing even greater risks, explains Mark Mishler, a CFO and adjunct professor of finance and accounting at Seton Hall University and Rutgers University. For those companies, he says, “There are two types of supply-chain risk—one is of not being able to get product; the other is price risk where tariffs have an impact.”

Typically, a single source of supply means volume discounts, he says. “Their average unit cost will likely be lower than if they had two or three suppliers. So that’s the big trade-off—volume discounts vs. supply-chain risk….What CFOs can do is make the supply chain more collaborative, which means looking beyond the transactional price savings and looking at it as an investment into reducing risk. The more you collaborate within your supply chain, the lower the risk.”

Click to enlarge.

Click to enlarge.

TECHNOLOGY 2020

Digital disruption technologies like robotic process automation (RPA) and AI are forcing CFOs to rethink the efficacy of current processes and make hard decisions around investment and human resources. In 2020, most CFOs will be turning to automation technologies to reduce labor costs, streamline their finance function, and improve overall organizational efficiencies. Recent estimates from KPMG show that enterprise spending in the intelligent automation market, which includes AI, machine learning, and RPA, will grow from $18.3 billion in 2019 to $27.4 billion in 2020 (bit.ly/2QSU5z3). And Gartner reports that 72% of controllers will be using RPA in a wide range of traditionally manual accounting processes by 2020 (gtnr.it/35kahgD).

For Zhang, the main benefits of advanced automation of the finance function will be the added insights it can provide, the potential to reduce errors, and, ultimately, improved customer service. Digital transformation can help do that internally and then externally through the supply chain, making the supply chain more collaborative, says Zhang, and also promises to reduce lead times.

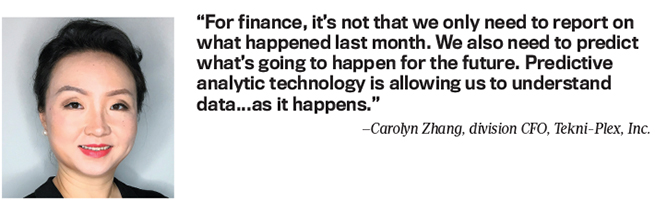

For 2020, Tekni-Plex is looking toward real-time data analysis technology and RPA. “For finance, it’s not that we only need to report on what happened last month,” she notes. “We also need to predict what’s going to happen for the future. Predictive analytic technology is allowing us to understand data...as it happens.”

In terms of data entry, such as for invoices, RPA will allow Tekni-Plex to process orders faster. “In the next five to 10 years, we’ll probably totally eliminate clerical accounting functions like accounts payable and accounts receivable. It’s all going to be automated….Our next level of thinking is about going digital in the cloud and about the social media platform necessary to support that,” she adds.

As to what this means for managing costs, companies that are making the transition to advanced finance automation technologies can expect short-term increases but long-term gains, says Mishler. “You’re initially going to have to pay more money for people to have the talent to work with advanced automation and likely start to buy packages from technology vendors,” he says. In the short run, he adds, costs will rise, but, in the long run, operational efficiencies and improved competitiveness will be the payback.

What’s important in the overall automation process, however, is that CFOs take a hands-on approach, he explains. “In many industries, IT reports through the CFO, but the CFO needs to be part of automation strategy, operational excellence, and managing the risks.” There are two issues CFOs need to be concerned about, he cautions: “One is the quality of the data—or as the saying goes, garbage in, garbage out. The second is access control—who can manipulate data and who can’t. And that’s really important because most people take for granted that their data is good, and I’ve found this is rarely the case.”

When it comes to using advanced analytic technologies, CFOs need to make sure to clean their historical data or be aware that it has big limitations, Mishler says. “Going forward, it’s the CFO’s job to make sure that the data they’re collecting is relevant. The IT function…knows how to do a number of things, but they can’t necessarily see what data is necessary or how it’s going to impact the business.”

For any advanced automation to work, according to Zhang, IT and finance need to be close collaborators. They need to work very closely together to understand each other’s language to support all these initiatives. And in that, she says, the CFO’s position will continue to evolve in 2020. “It isn’t just accounting and finance tasks anymore. It’s really managing the information system as well. Companies will be increasingly looking for talent and senior financial leadership that are technology-savvy. They need to be on the front line of technological innovation to help the business move forward.”

INCREASING COMPLEXITY

Another area of concern is how evolving standards and compliance requirements are creating even more complexity on the reporting front. For example, accounting pronouncements, like Accounting Standards Codification (ASC) Topic 326, Financial Instruments—Credit Losses, also known as Current Expected Credit Losses (CECL), will be an area of concern for CFOs in 2020, and not just in financial services, says Mishler. The guidance affects all entities in all industries and applies to a wide variety of financial assets, including trade receivables. A public business entity that is a U.S. Securities & Exchange Commission (SEC) filer is required to begin applying the standard in 2020.

The problem with the guidance is twofold, Mishler notes. First, it requires an enormous amount of judgment, and second, it isn’t high on nonfinancial companies’ radar. “CFOs that haven’t started on [ASC] 326 will be getting a big surprise around how much data and additional resources it will take to meet the disclosure requirements,” Mishler says. CECL, he explains, means companies can take a reduction for what they expect to collect vs. waiting until the collection has actually been incurred. “The expectations will require so much judgment. What’s going to happen in a manufacturing company that has accounts receivable is that their estimate of collectability is now going to change based on a future forecast of the economy. So the complexity around credit losses is mushrooming.”

And historical patterns of credit loss won’t cut it, Mishler adds: “The projections that you would make today wouldn’t be based on the trend analysis over time. In a highly uncertain economic environment, these estimates are volatile and risky. It’s an extremely complex evaluation, and people are just getting started.”

This has serious consequences for the understandability of financial reports. “As long as companies disclose the judgments that they’re making and their methodologies, or changes in methodology from one period to the next, it’s fine...but it’s up to the user to understand the conclusions. So this is going to become the law of unintended consequences, and it’s going to end up being so complex that users won’t be able to figure it out,” Mishler says.

For the CFO, meeting the CECL requirements in 2020 will mean more analytical rigor. “There are more steps they will have to go through and more depth to determining relationships or correlations,” Mishler says. “This will also require more internal documentation of the judgments that management made and how and why they made those judgments.”

The added compliance burden will make it all the more challenging for CFOs to fulfill their role as strategic business partner, particularly in small and medium-sized public companies, he warns. “I picture myself watching my CEO’s and board members’ eyes roll back as I try to explain certain accounting concepts. In other words, nonfinancial people are tuning out much quicker.”

Ultimately, getting the right answer to CECL boils down to available data and accuracy of data if the accountability lies with the data input in terms of getting the numbers right. “What is so concerning,” says Mishler, “is the number of times when I have asked, ‘How do you know this number is correct?’ and the answer is ‘Oh, it came from a computer.’ That’s why ‘garbage in, garbage out’ is so frightening because now data is so important, yet many people still aren’t looking at the quality of their data when they’re doing analysis and making decisions.”

THE SEARCH FOR TALENT

In the midst of the complexity, 2020 will be characterized by trying to find the right talent to fill the finance pipeline. As Judy Munro, senior managing director at Robert Half Executive Search and experienced CFO and board member, explains, the market for finance is increasingly competitive, and the talent pool is shrinking as the Baby Boomers are leaving the workforce.

At the same time, removing repetition through advanced automation is shifting demand to higher-value-added skills. “It’s no longer just enough to have [people with] strong technical accounting skills on your team,” Munro says. “There’s much more focus today on FP&A [financial planning and analysis] skills based on forward-looking information and trend identification through data analytics.”

There’s also far more emphasis on people who have very strong business acumen, Munro adds, which wasn’t necessarily a requirement in the past. “It used to be: ‘Must come from this industry.’ Now it’s: ‘We’ll teach them the business. We need transferable skills and very business-minded people.’”

One of the bigger shifts in professional development strategies, says Munro, is to put finance teams together with operations out in the field to get a firsthand look at what the business is. To get a foot in the door, however, finance professionals now have to be very tech-savvy because “Today and in the future, everything you do is going to be driven by technology,” she notes.

For Zhang, the human capital factor might be the biggest unknown in the coming months. “Finding the right people in this environment might well be my greatest challenge,” she says. “Regardless of location, I have to be creative in attracting and keeping the right people. My strategy is to engage and mentor. My motto is to trust and empower them. I give people the ammunition to excel.”

UNCERTAINTY IS THE NORM

All this complexity means a lot of guesswork is in the cards for finance teams going forward. Uncertainty is the bane of accounting professionals, and 2020 doesn’t offer much relief. CFOs are predicting that 2020 will be a very challenging year. With the U.S. a major consumer of world goods, CFOs who rely on Chinese inputs and trade will face escalating nervousness unless trade negotiations are settled between the two countries. Meanwhile, advances in technology are forcing CFOs to make investments in automation that will likely produce long-term gains but come with short-term cost increases—and all at a time when overall economic confidence is low.

CFOs will also see their daily jobs getting even more complex, as room for judgment in reporting standards could potentially yield more questions than answers around transparency and comparability in financial reports. And filling the finance talent pipeline in 2020 will continue to be a challenge. Accountants entering the workforce or looking to move between companies are well advised to get their technology hats on as advanced automation—the next frontier in the search for talent—is here.

© 2020 by Ramona Dzinkowski. For copies and reprints, contact the author.

January 2020