These new leasing rules move operating lease liabilities out from the shadows of the notes to the financial statement and onto the bright light of the balance sheet. Deloitte estimates that the balance sheet liabilities of companies in the S&P 500 will swell by about $2 trillion under the new rules.

The new ASC 842 complicates the analysis of performance trends and may lead to unintended consequences, including violation of debt covenants and ineffective compensation packages. Brendan Houghton, partner of audit and assurance services at Deloitte & Touche, said, “Users of financial statements will need to adapt to the new accounting rules and may be surprised by the impact on key ratios and metrics. The ratios used to value equities and assess a company’s performance may look very different after the new standards are applied.”

If you’re an accounting or finance professional involved in benchmarking performance, raising capital, setting performance incentives, or acquiring assets, you’ll probably be impacted by the change. Among the key considerations, finance managers charged with explaining changes in performance and benchmarking against key competitors will need to understand how each company transitions to the new standard. They may also need to consider whether loan covenants have been violated as liabilities move onto the balance sheet and may need to work with commercial lenders to resolve the issue.

Human resources managers who help design compensation packages of key executives and align bonuses with profitability and asset efficiency measures may need to reassess and reconfigure profitability and other impacted metrics.

Company executives will need to communicate to investors and other stakeholders the impact of the change on financial statements and key metrics, including the free cash flow and debt equivalent metrics commonly used by analysts. Meanwhile, analysts and investors will need to focus on forecasting free cash flow, net debt, financial ratios, capital costs, and other valuation metrics.

Managers whose responsibilities include determining whether to acquire assets through purchase, operating leases, or financing leases will need to identify and categorize existing leases to include the determination of the discount rates used to value the lease liabilities. As future assets are acquired, it will be necessary to consider the impact of alternative approaches on key financial metrics and ratios. Very short-term leases may become attractive since leases with maturities under 12 months will generally remain off-balance-sheet.

Finally, data aggregators who provide financial statement data to clients through proprietary systems will need to adapt their systems to provide the new financial statement data and will have to be cautious of any higher-level analysis since comparisons between companies or over time by their users may be severely impacted by the leasing changes.

With all these changes, implementing ASC 842 and analyzing a company’s performance, liquidity, and solvency can be a challenge. The new rules can affect a number of areas, and keeping track of the changes will be vital.

KEY QUESTIONS TO CONSIDER

While the impact of the new rules may surprise some analysts, investors, and other financial statement users, most large public companies have been grappling with the issue for some time. Jay Ludy, a retired controller of Unilever, said, “Implementing the new standard in Unilever was one of the largest projects undertaken in my career. While the new rules provide better transparency and comparability into a company’s financial statements, it was an onerous task to manage and develop systems to accurately track the leases under the new rules.”

There are four key questions to consider:

- How has the accounting for leasing changed?

- Which industries are affected most by ASC 842?

- Where is the impact, and what information should we be looking for?

- How will the new standard impact financial statements and ratios?

- How has the accounting for leasing changed?

The new standard requires most lease obligations to be presented as a liability on the balance sheet, offset by a right-of-use asset related to the leased asset. Under prior standards, leases were deemed to be either finance or operating based on a number of conditions, including the lease term as a percent of the useful life of the asset and the lease value compared to the asset value. The assets and liabilities of leases that were deemed finance leases were reported on a company’s balance sheet, while the assets and liabilities of leases deemed operating leases didn’t appear on the balance sheet. Simply stated, short-term leases that didn’t involve a transfer of ownership were classified as operating leases. If most of the value and useful life of the asset was included in the lease, then it was considered a financial lease.

Upon adoption of ASC 842, companies can choose between restating comparative financial statements or adopting a modified retrospective approach where the company recognizes a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption. Proponents of the new rules note ASC 842 will help eliminate the guesswork surrounding the magnitude of a company’s lease obligations. In the past, lease analysis wasn’t straightforward and required a detailed analysis of the financial statement footnotes. Despite the accounting treatment, financial analysts, creditors, rating agencies, and some investors had long considered operating leases to be a liability like debt, and a variety of techniques were employed to adjust financial ratios and other information to treat operating leases as debt equivalents.

Still, even the savviest of financial statement users struggled to accurately estimate the liabilities arising from those obligations. The new standard provides transparency regarding leased assets and resulting liabilities. It will also provide users of financial statements with comparability between those companies that lease and those that borrow to buy if the companies are reporting under U.S. GAAP.

- Which industries are affected most by ASC 842?

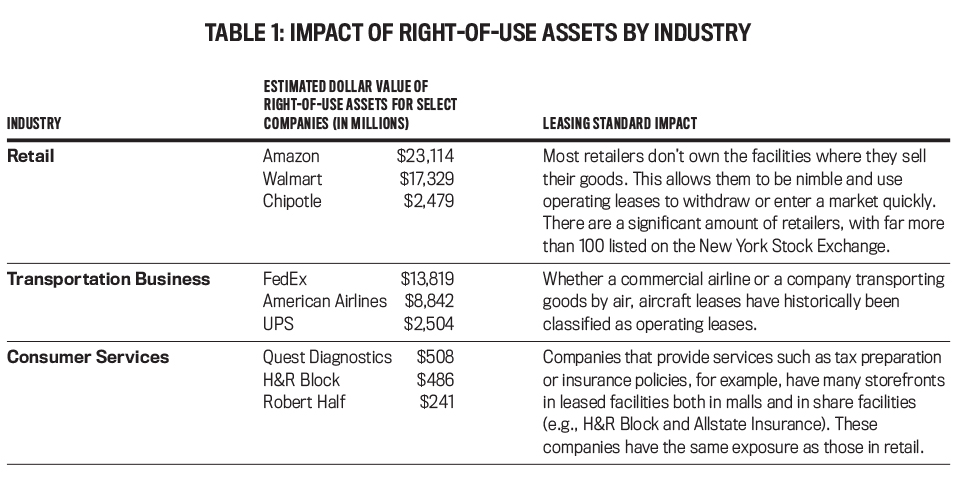

While not all industries will be impacted equally, most will grapple with the demands of identifying and reclassifying lease obligations. Companies in industries that heavily utilize operating leases—including retail, travel, transportation, and logistics—will feel the most significant impact. Even industries like consumer services, where there is heavy use of storefronts, will be impacted. Table 1 provides a sampling of the value of right-of-use assets in three of the industries likely to be affected.

Click to enlarge.

Click to enlarge.

- Where is the impact, and what information should we be looking for?

To understand the impact of ASC 842, it’s necessary to determine when the company adopted the standard and the transition approach it selected. Then search for relevant notes in the company’s financial statements for additional detail.

While the level of detail presented by a company may vary depending on the importance of the changes to the business model of the individual company, there’s a standard process that can be anticipated in most cases:

Step 1: Look at Note 1 and find Significant Accounting Policies where the company’s adoption of the new leasing standard is discussed. Step 2: Review the balance sheet. Step 3: Find supplemental notes on leasing.

We’ll use CVS Health to illustrate this process. For step 1, the company’s 2018 10-K shows that it didn’t adopt ASC 842 early, but it did include a statement about new accounting pronouncements not yet adopted that referred to ASC 842. In that statement, it noted, “The Company adopted this new accounting guidance on January 1, 2019 on a modified retrospective basis [emphasis added]. The adoption of this new guidance resulted in an increase in both assets and liabilities of approximately $20 billion as of January 1, 2019. The adoption of this new guidance is not expected to have a material impact on the Company’s results of operations or cash flows.”

The note is alerting us that adoption of the new standard for reporting in 2019 will lead to an additional $20 billion on the balance sheet related to operating lease right-of-use assets and liabilities. This represents an increase in total assets and liabilities of more than 10%. CVS Health also notes that it’s using the modified retrospective basis as its transition method for adopting the new standard.

Next, step 2 requires looking at the balance sheet to identify the assets and liabilities related to operating leases. This is where the most obvious changes will be since companies will now show the assets and liabilities associated with operating leases.

Table 2 shows CVS Health’s balance sheet from its Form 10-Q for the quarter ended September 30, 2019. Note that the operating lease right-of-use assets and operating use liabilities appear in 2019 only.

Click to enlarge.

Most companies appear to have chosen to adopt the modified retrospective approach. If the company elects the modified retrospective approach, it’s required to include annual comparative disclosures in the annual report. As we identified in step 1, CVS stated it has adopted the modified approach.

For step 3, finding additional disclosures, companies provide notes to the financial statements that disclose changes within operating lease assets, operating lease liabilities, reclassification of leases, and expected cash flows due to leased assets. Notes may indicate that some lease contracts are still off-balance-sheet due to type of contract signed or type of asset leased under the contract.

To clarify the changes for CVS, Note 1 of the company’s September 2019 Form 10-Q lists all the changes made to convert 2018 financial statement values to the new standard. A truncated version is shown in Table 3. Note that multiple accounts may be impacted by the adjustment since the accounting is complex, but the primary impact is on right-of-use assets and operating lease liabilities.As in the past, companies will also provide information on their capital and operating leases, including maturities, annual expenses, and the cash flows from each in the period. It may be helpful to locate the note providing lease terms and discount rates since this information is critical to determining the lease liability. In Note 5 of the CVS Health 10-Q, the company notes the weighted average remaining lease term is 13.8 for operating leases and 20.6 for finance leases. And the weighted average discount rates is 4.6% for operating and 7.3% for finance leases.

The terms of the operating leases are also of material impact to the financial statements. CVS Health has signed leases containing options allowing the company to renew the lease for an additional five years. Had this been considered reasonably certain of being executed, then the renewal option would have been included in both the operating lease right-of-use asset and also as an operating lease liability. As it stands, CVS Health judges that the leases aren’t reasonably certain of being executed and, thus, they aren’t listed on the balance sheet. The value of these potential lease options isn’t stated in the 10-Q. As the company states in Note 1 of its September 2019 10-Q, “…renewal options are not included in the lease term for non-real estate leases because they are not considered reasonably certain of being exercised at lease commencement. Leases with an initial term of 12 months or less are not recorded on the balance sheets and lease expense is recognized on the straight-line basis over the term of the short-term lease.”

- How will the new standard impact financial statements and ratios?

To answer this question, it’s necessary to differentiate between the immediate impact upon implementation and the medium- to long-term impact of utilizing an operating lease vs. a finance lease.

As operating leases transition to the balance sheet, operating lease right-of-use assets and operating lease liabilities line items will make material impact to noncurrent assets, current liabilities, and noncurrent liabilities. Operating lease liabilities on the balance sheet won’t qualify as debt, unlike finance leases.

When considering financial ratios, it’s expected that return on assets (ROA) will decrease due to the increase in total assets driven by the additional operating lease right-of-use assets in noncurrent assets. The current ratio will also see downward pressure due to increased current liabilities (from current operating lease liabilities) and no material changes to current assets. By contrast, liabilities to equity will be expected to increase due to an increase in total liabilities, which will come from the increases in both current and noncurrent liabilities driven by operating lease liabilities.

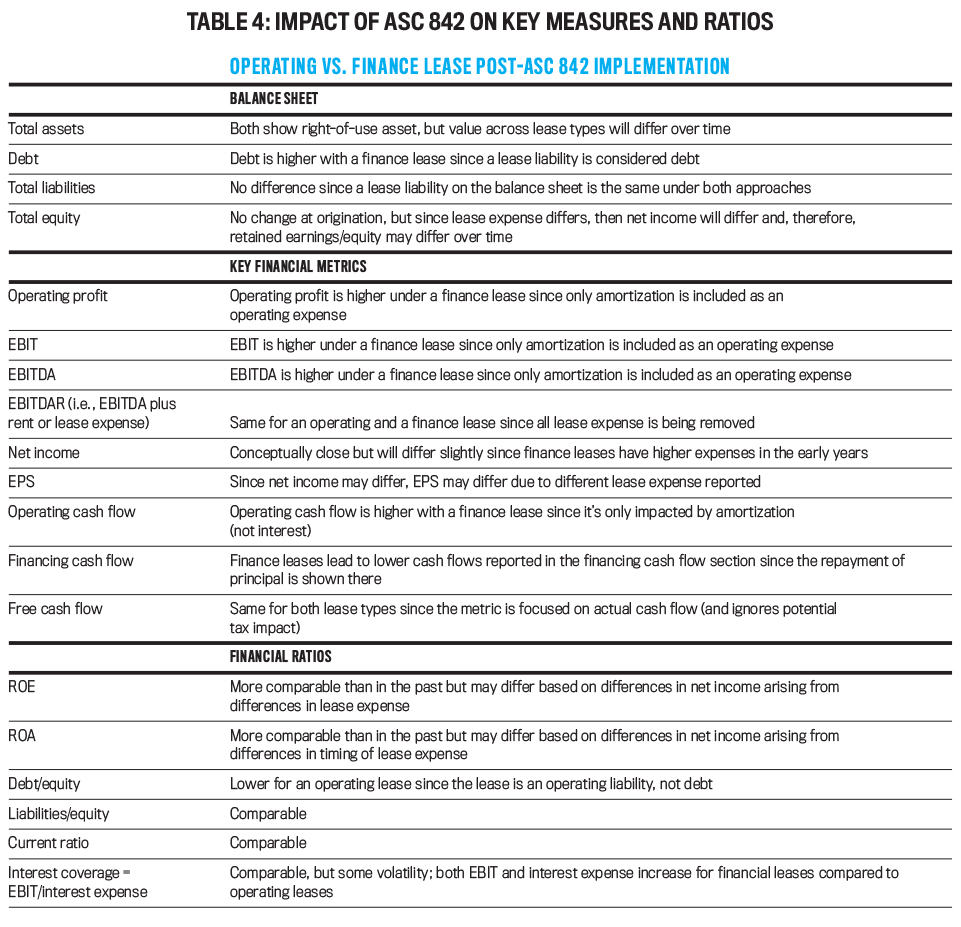

Table 4 highlights the differences between operating and finance leases. Managers, analysts, and others will need to understand the impact of the different lease classifications on financial statements when comparing operating and finance leases going forward.

Click to enlarge

KEEP THE DIFFERENCES IN MIND

Now that we’re in 2020, many companies will begin reporting operating lease assets and liabilities on their balance sheets for the first time. Investors and others who benchmark performance, finance managers monitoring debt covenants, and data aggregators servicing their clients should take particular caution. Comparability of financial statements, ratios, and metrics will be especially challenging since companies aren’t required to restate prior years (see “Benchmarking Performance at Four U.S. Airlines” at end of article).

The new leasing rules also will have a material impact on ratios such as ROA and liabilities to equity for companies with significant operating leases. HR professionals designing compensation packages and those involved in acquiring assets should revise their strategies in light of the new standards. Answering the four questions described here and following the three steps we identified will help you get started.

BENCHMARKING PERFORMANCE AT FOUR U.S. AIRLINES

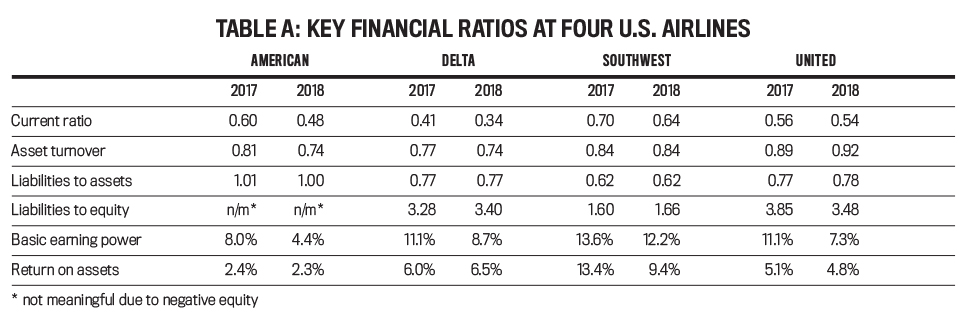

Because the new leasing rules don’t require companies to restate prior years, comparing results during the transition can be a challenge. It’s important to make sure you’re using numbers that are appropriately comparable. Let’s consider an example using four major U.S. airlines. Table A (below) shows key financial ratios calculated from the financial information presented in the 2018 Form 10-Ks of American Airlines, Delta Air Lines, Southwest Airlines, and United Airlines.

Click to enlarge.

Which companies have experienced an improvement in performance? A quick analysis suggests the following:

- As measured by the current ratio, 2018 performance weakens for all companies, with American and Delta deteriorating most on a percent basis.

- Total asset turnover has decreased for American and Delta but increased for United.

- Liabilities to assets is fairly constant.

- Liabilities to equity increased for Delta and Southwest.

- Basic earning power (EBIT/total assets) weakens across all four companies, with United and Southwest impacted the least severely.

- ROA deteriorates for all companies except Delta.

Based on this, you might conclude that United is outperforming its peers, while performance at American and Delta suffers. Yet the challenge when interpreting these results is that American and Delta were early adopters of ASC 842. Upon adoption, both companies chose the modified retrospective approach and, therefore, didn’t restate prior years. This makes trend analysis difficult.

While 2017 results make for a fair comparison in the industry, the 2018 results aren’t directly comparable because American and Delta have now moved operating lease assets and liabilities onto the balance sheet. ASC 842 requires showing operating leases on the balance sheet as a right-of-use asset and as an operating lease liability. The impact of these changes can be significant, especially in industries such as airlines.

As it moved to adopt ASC 842, American added more than $9.5 billion of operating lease liabilities onto its balance sheet. Since United and Southwest didn’t adopt the standard early, operating leases remain off-balance-sheet in 2018, leading to lower overall assets and liabilities and complicating cross-company comparisons.

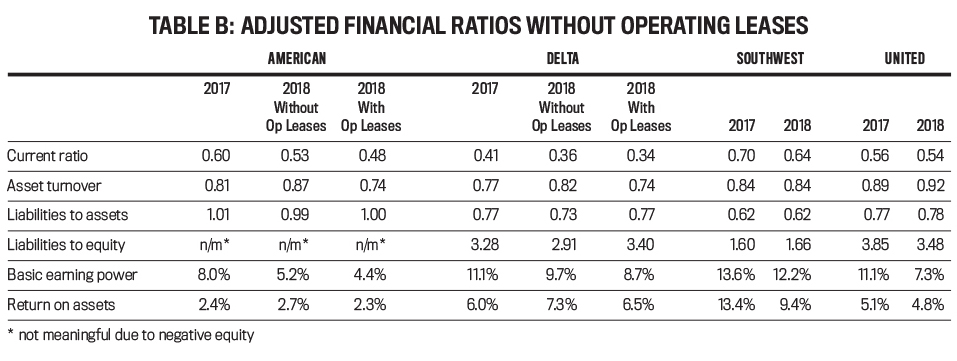

In Table B (below), we remove operating lease assets and liabilities from American and Delta to facilitate comparisons with other companies. (For purposes of this exercise, we simplified it a bit since there are other adjustments related to adoption of ASC 842).

Click to enlarge.

Note the impact of the new standard on the ratios at American and Delta. While American and Delta seemed to lag in performance in the first table, it’s now clear that much of the deterioration was due to the accounting change. If we remove the impact of ASC 842, there appears to be far more parity between the companies than was implied by the unadjusted financial ratios.

February 2020