In an educational setting specifically, the onus is on the instructor to create interesting, focused, and engaging case assignments that will offer students the best chance to succeed. We think we’ve found a very effective way to do that. We’ve created a framework that allows accounting instructors to develop case assignments that enhance student engagement and help them to retain core business concepts, such as those covered in management accounting curricula, by using episodes of the popular CNBC reality TV series The Profit.

Now in its seventh season, the series features entrepreneur Marcus A. Lemonis—chairman and CEO of Camping World, a multibillion-dollar company—sharing his business acumen and making capital investments to help turn around struggling businesses. Like other reality programs that center on entrepreneurs and start-ups (Shark Tank, The Pitch, etc.), The Profit’s popularity stems from its ability to entertain and instruct viewers with a combination of effective storytelling techniques and a variety of interesting business scenarios.

A WINNING FORMULA

Each episode of The Profit centers on a company that faces a serious business dilemma. The “overview” introduces the owners and provides discussion opportunities pertaining to the customer value proposition, while the issues related to the company’s business dilemma usually align with concepts such as understanding product cost, cost behavior, profit planning, and managing constrained resources.

As the episodes transition to Lemonis’s investment offer—in return for which he gets a piece of the business and a percentage of the profits—instructors can engage students in discussions about topics that include performance measurement (for example, return on investment or ROI) or budgeting. Then, once an agreement is reached with the company’s owners within the episode, relevant discussion topics arising from the implementation of Lemonis’s turnaround plan would include decision analysis, such as drop/retain and make/buy decisions, or cost-volume-profit analysis. The show concludes with an epilogue that summarizes the outcomes from the turnaround.

The structure of The Profit provides students with an opportunity to reflect on factors contributing to the successes (or failures) of the turnaround plan while aligning its key attributes within the framework of the balanced scorecard. Thus, our approach builds from the show’s ability to cover a wide swath of management accounting topics that focus on a single company in a way that allows students to take a real-world view of the material they’re learning.

EFFECTIVE STORYTELLING

In addition to the direct tie-ins to common management accounting topics, our case framework based on The Profit has several other benefits for accounting instructors. For example, the business issues that arise during the show are explained in an effective storytelling manner, which prior research suggests is associated with improved learning and retention. Moreover, episodes of The Profit commonly feature on-screen graphics that serve as visual aids to summarize and facilitate viewers’ understanding of key business and accounting measures (components of product cost, profitability impact of a decision, etc.). This is helpful for instructors because recent evidence indicates that using different forms of media in the classroom is an effective method of increasing student engagement.

Episodes of The Profit are available for a nominal fee on demand from various digital content providers, allowing students to conveniently stream an assigned episode on a tablet, smartphone, or notebook computer as a take-home assignment. This feature aligns well with the information-consumption habits of young learners who, according to a Forbes article, spend 3.4 hours every day watching shows and movies (see Jessica Baron, “The Key to Gen Z Is Video Content,” Forbes, July 3, 2019).

The Profit has an extensive library of episodes that feature a diverse set of companies across various industries (manufacturing, retail, and service) with mixed degrees of turnaround success—in some cases, Lemonis even walked away from the deal. This variety of industries and outcomes provides instructors the opportunity to modify the case as needed or assign multiple cases within the same term.

PIQUING STUDENTS’ INTEREST

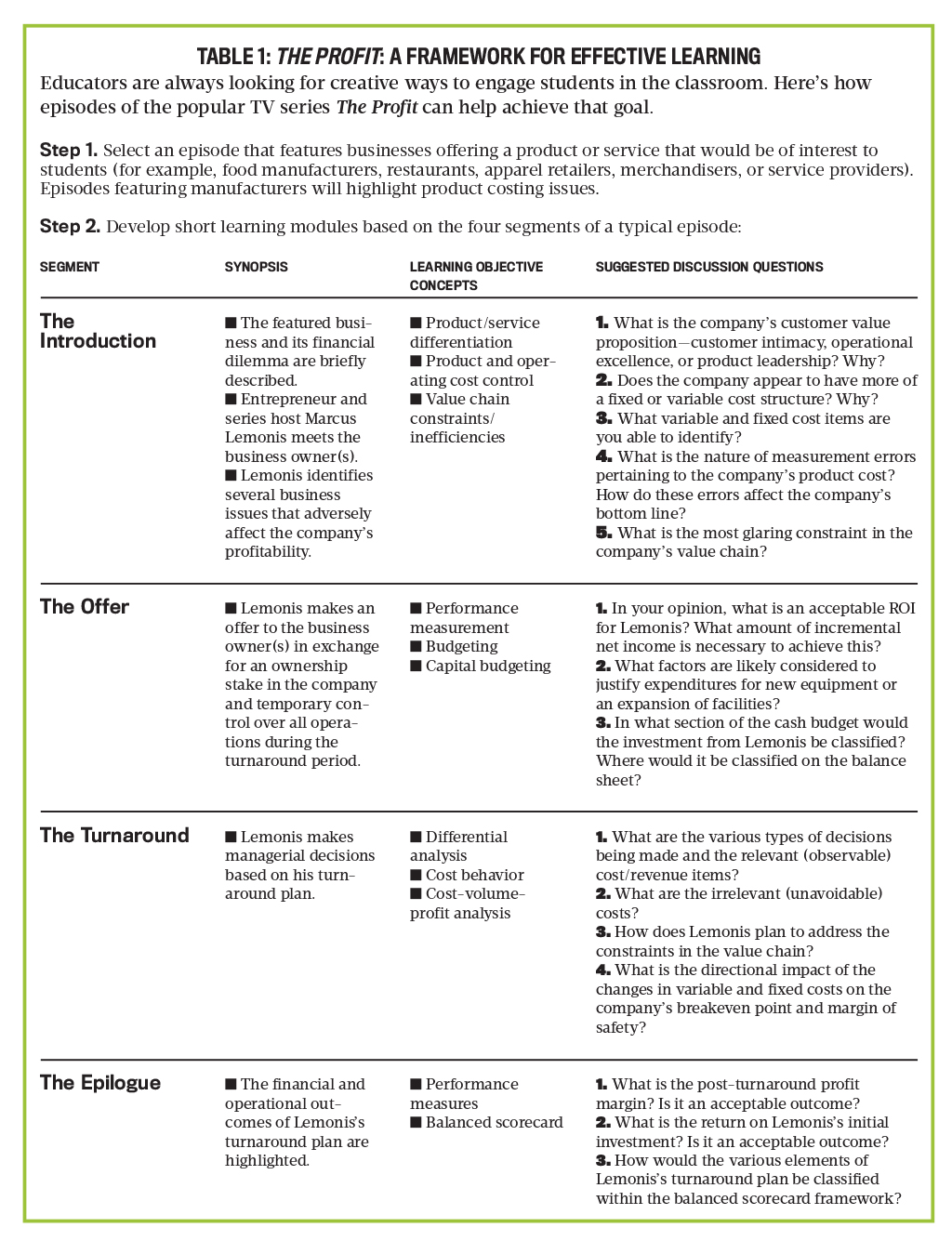

Table 1 contains the framework we’ve developed for using The Profit. In our experience, it has proven to provide a fun, innovative, and convenient way to engage students in management accounting courses. We recommend selecting episodes of The Profit that feature businesses offering a product or service that would likely be of interest to students. For instance, Lemonis frequently visits food manufacturers, such as bakeries, as well as restaurants and apparel retailers. These episodes highlight issues pertaining to product costing, which are prevalent in management accounting textbooks, but instructors may also use episodes featuring merchandisers or service providers to expose students to management accounting issues in non-manufacturing environments.

The framework follows the structure of a typical episode of The Profit. Each of the four main sequences discusses business aspects that can create learning or discussion opportunities. Let’s a take a closer look at each:

- The Introduction

Each episode begins with a brief description of the featured business—its history, products/services, strategic focus, and so forth—and its financial dilemma. In many cases, the company is unprofitable and insolvent despite offering a popular product (such as doughnuts!) or service.

Lemonis then visits the site to meet with the business owner(s) and observe current operations. During this information-gathering session, he identifies several issues adversely affecting the company’s profitability, the most common of which include ineffective product/service differentiation, an inability to understand or control costs (product and operating), and the existence of constraints or inefficiencies throughout the value chain.

- The Offer

After identifying the root causes of the company’s struggles, Lemonis makes an offer to the business owner(s) of a capital investment in exchange for an ownership stake in the company and temporary control over all operations and decision making during the turnaround period. The dollar amount offered is usually based on the necessary funding to cover outstanding payables, to buy out existing partners (if any), and/or to allow for any necessary renovations or expansion. This segment of the program is most closely related to performance measurement, budgeting, and capital budgeting.

- The Turnaround

After an agreement is reached, the segment focuses on the managerial decisions Lemonis makes to implement his turnaround plan, providing natural tie-ins to covering topics such as differential analysis (make-or-buy decisions; elimination or addition of products, services, or locations; and optimal use of constrained resources), cost behavior, and cost-volume-profit analysis.

- The Epilogue

The show wraps up by highlighting the financial and operational outcomes of Lemonis’s turnaround plan. (The series also includes “Progress Report” episodes, in which Lemonis revisits businesses from past episodes to provide updates.) To the extent that the episode offers sufficient information about the company’s improved sales and profits, students could be asked to calculate performance measures, such as the post-turnaround profit margin or return on Lemonis’s initial investment, and to discuss whether these outcomes were acceptable. Moreover, as an instructor, you may want to ask students to reflect on the various elements of the turnaround plan and discuss how they would be classified within the framework of the balanced scorecard.

PUT IT TO WORK FOR YOU

Our series of learning modules using episodes of The Profit is designed to provide a creative way to engage learners that’s aligned with their information-consumption habits. We find these cases are an excellent complement to traditional classroom lectures and textbook readings. We’ve successfully used cases developed from our framework at universities in the Midwest and Southeast United States, with MBA students as well as with second-year undergraduate students taking a management accounting class required of all business majors.

Although The Profit airs on CNBC, a business news channel owned by NBCUniversal News Group, the business-related dialogue in the episodes is accessible to a wide viewing audience. As such, completion of the learning modules wouldn’t require any background knowledge beyond the learning objectives covered in a typical management accounting course. Because many of our undergraduate students express an interest in starting their own businesses, they find the assignment interesting and relevant. In addition, several of our MBA students have management experience and have encountered many of the business issues addressed in the episodes.

We’ve used two approaches with this framework. The first is using selected episodes that are assigned for out-of-class viewing, with answers to the case questions submitted as written work or for subsequent in-class discussion that counts as a small (but nontrivial) component of the course grade. The second is assigning a project—for students to work on individually or in small groups—toward the end of the term after most of the concepts have been covered in class. As a more unstructured case assignment, rather than providing a list of discussion questions, you can ask the students to assume the role of a management accountant who accompanies Lemonis on his business visits and have them prepare a report for him that summarizes the various accounting issues discovered both during the visit and during the turnaround.

Finally, when assigning the project, we tell our students that this is a capstone activity that’s a fun way to apply what they’ve learned during the semester. The assignment requires very little (if any) quantitative analysis; rather, it focuses squarely on analytical and critical-thinking skills.

We won’t go so far as to say that a TV series like The Profit is a magic bullet to learning—much of which depends on your skills as an educator who can relate to young people—but it’s an effective way for the next generation of management accountants to learn in a manner that’s both familiar and comfortable to them.

CASE STUDY: Making a Pie Company Profitable

One episode that has worked well in the classroom is episode 8 of season 2, when Lemonis visits Key West Key Lime Pie Company (KWKLP), an award-winning pie maker located in Key West, Fla. Let’s take a look at the case and examples of the questions for each section:

The Introduction

The owners, Jim Brush and Alison Sloat, purchased the business more than 10 years ago for $1,200 and began selling pies from a roadside stand. Despite its growth and accolades—including the opening of a second location—the company has yet to make a profit and is experiencing severe cash constraints.

During Lemonis’s site visit, he learns that pie sales make up about 80% of KWKLP’s annual revenues, but he’s surprised to find that the pies aren’t made from all-natural ingredients and that more than 60% of the floor space at the main store (Green Street) is devoted to the sale of low-margin key lime products—cookies, juices, cocktail mixes, and so forth—from third-party vendors. Lemonis also learns that KWKLP’s operating losses are disproportionality attributable to the second retail location (Big Pine), which accounts for only 10% of total revenues.

Some of the questions we use for this section include:

- What are some of the product cost items associated with making the pies under the current process of buying premade ingredients?

- What are the implications of KWKLP’s cash flow problems? Discuss how a master budget (in particular, a cash budget) could have helped the owners manage (or even avoid) these issues.

The Offer

After evaluating KWKLP’s operations, Lemonis offers to invest $450,000 for a 51% ownership stake. He also agrees to pay Brush and Sloat a commission in perpetuity of $1 per pie sold in addition to their 49% minority interest.

Questions include:

- How would Lemonis’s investment be classified on the cash budget? How would it be classified on the balance sheet?

- What is the impact of the commission on unit contribution margin for each pie sold? How does it affect breakeven sales?

The Turnaround

Lemonis makes several key operational decisions to increase sales volume and improve operational efficiency. The first is to have KWKLP begin using a proprietary recipe to make its pies from all-natural ingredients. In addition, KWKLP plans to expand and remodel the Green Street location while also closing the Big Pine location, with its remaining lease commitment to be satisfied by subletting the space. Finally, key personnel will receive higher base salaries plus commissions based on sales volume.

The discussion questions we use for this section include:

- What are the relevant cost items associated with the decision to make the pies from scratch rather than assembled from premade ingredients?

- Based on the new strategy and pricing, would KWKLP most likely increase ROI through higher asset turnover or higher margins?

The Epilogue

The episode concludes with the grand opening of the renovated Green Street location. In a follow-up episode (“Progress Report”), Lemonis notes that since the turnaround, KWKLP has seen an 18% increase in sales and reported an operating profit of $100,000. Nevertheless, he had to nearly double his investment to cover outstanding payables that weren’t disclosed by Brush and Sloat, whom he has since bought out. He appoints Tami Forbes as operating manager and gives her a 25% ownership stake in the company.

A sample discussion question to ask is:

- Discuss the impact of Lemonis’s turnaround plan within the context of the four perspectives of the balanced scorecard: financial, customer, internal business process, and learning and growth. Specifically, classify strategic changes implemented during the turnaround into one of the four perspectives and discuss how these changes map to KWKLP’s improved financial performance.

August 2020