Marsha previously served as vice president and corporate controller for Cummins Inc., where she was responsible for external reporting, consolidation, finance systems, accounting policy, insurance risk management, and Sarbanes-Oxley Act compliance. She also served as an assistant controller and director of accounting at Corning Incorporated, leading all U.S. Securities & Exchange Commission (SEC) and external reporting, audits, Sarbanes-Oxley Act compliance, and M&A accounting-related functions.

Strategic Finance spoke with Marsha about the FASB and the future of financial accounting and reporting. Disclaimer: The following are Marsha’s personal thoughts, and the views expressed are hers and not necessarily the views of the FASB or other Board members.

SF: How did your experience in the corporate world prepare you for your work on the FASB?

Marsha Hunt:I participated in the activities of Financial Executive International’s Committee on Corporate Reporting for more than 20 years. This committee allowed me to interact with the FASB on its agenda and emerging matters. I also was fortunate that my employer supported my work as a member of FASAC [Financial Accounting Standards Advisory Council], where I had the opportunity to share my experience and thoughts as a preparer regarding FASB projects and initiatives.

While these activities kept me connected to the FASB agenda and exposed to its process, it’s my experience managing the consolidation, external reporting, and controls assessment at a global company that allows me to speak with experience and authority about the consequences of decisions to preparers and to share and inform the FASB staff and project teams about the practicality and control implications of decisions.

SF: What’s happening at the FASB that accounting and finance professionals should know about?

MH:Several significant standards have been issued in the past five years, with most already effective for large SEC registrants. Smaller public and private companies are still implementing these standards, including lease accounting. We have added landing pages on the FASB website (fasb.org) to assist with implementation of these standards and provide educational material for companies and auditors. If you work with a company involved in implementation, please check out these resources for your mutual benefit.

In 2019, we exposed for comment a proposed Accounting Standards Update that would provide optional guidance to ease the potential burden in accounting for reference rate reform. We recognize that the transition from LIBOR [London Interbank Offered Rate] to other reference rates will result in numerous modifications to debt, hedging, and other agreements that won’t expire prior to the cessation of the LIBOR and other IBOR [Interbank Offered Rates] rates. This update provides optional relief from existing accounting requirements for modification of agreements when the change to the agreement is related to a change in the reference rate. This proposal was well received, and a final update will be issued soon.

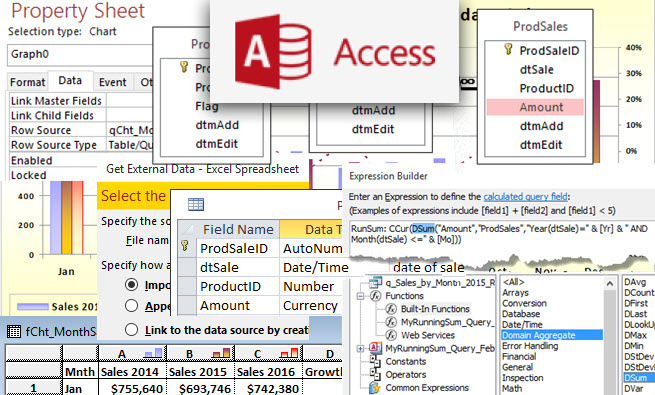

SF: How is reporting and compliance changing with further advances in technology?

MH:Technology can be a blessing and a curse depending upon the perspective. Implementation of new standards can require updates or changes to existing automated systems or at times the implementation of new systems altogether. While automation is helpful once installed, the implementation time for system changes can be protracted and, for companies with multiple instances of a system or multiple systems, much more involved. As the FASB considers effective dates for new standards, we seek input and consider the time necessary for changes to technology.

Those who consume financial information have made significant investment in technology and have the capacity to quickly absorb data. The process for the users of this information is easier if the financial data is presented in a tabular and standardized format.

SF: What new standards do you foresee in the next five to 10 years as the profession continues to evolve?

MH:The financial system is absorbing recently issued standards. The FASB is aware that the implementation of these standards continues to be the focus for many preparers and that investors are just beginning to understand how to use new disclosures in their processes and analysis. The FASB appreciates that stability in public reporting is desired by many of our stakeholders.

That said, where standard setting can simplify the accounting for transactions, there could be benefits that justify the ongoing effort to support change. One example is the current discussion about simplification of recording and reporting convertible instruments as well as recent updates simplifying hedge accounting. I expect the Board to continue to seek input and work on simplification projects.

April 2020