In a recent study, McKinsey found that more than 40% of a typical CFO’s time is now spent on activities that fall firmly outside the traditional role of accounting, controlling, and budgeting. CFOs are dedicating more time to strategic leadership, organizational transformation, and performance management. (See “Are Today’s CFOs Ready for Tomorrow’s Demands on Finance?”)

It’s precisely these areas where digital finance transformation initiatives are often focused—applying automation to unlock accounting efficiency, which enables the organization to be more strategic and use data to achieve clear visibility into both financial and operational performance.

ACCOUNTING AND FINANCE MUST BE READY TO DRIVE

Successful transformation first requires fully unlocking the automation dividend. We’re already seeing accounting teams who fully embrace this and are spending 80% less time on daily and period-end accounting activities such as account or transactional reconciliations. Finance transformation also requires easing the ongoing burden of managing controls by applying the latest technology to automatically certify account reconciliations and perform balance sheet and profit and loss (P&L) fluctuation analysis.

Streamlining the management of risk and control matrices (RCMs) and provided by client (PCB) lists, which are used to document and support key controls and processes, is key. An RCM is a template that contains the pertinent data about each control in a process, such as a description of the control, risks mitigated, test procedures, frequency of occurrence, and more. A PCB list is a list of items that an auditor will need from the client to perform an audit and includes items that have a material impact on a company’s finances. Orchestrating the segregation of duties and approvals is essential as well.

Tomorrow’s finance and accounting organization will focus increasingly on planning, analytics, and advisory—this we know for sure. Achieving the full value of automation to enable this structural change requires the organization of tomorrow to not only change technology but also challenge and reimagine hardened accounting processes, such as audit support, single sign-on (SSO) or global closing tasks, and reconciliations. For example, once-manual reconciliations are now automated and centralized with controlled workflows, and global closing tasks are now consolidated with real-time access.

Success necessitates engaging every level of the organization to embrace digitization rather than fight it, reallocate where personnel spend their time, and develop a new talent mix from within the organization.

WHY IS CHANGE MANAGEMENT SO IMPORTANT TO DIGITAL?

The road to digital finance starts with automating core accounting processes and controls to enable efficiency, reduce risk, and ensure standardization. The good news is that the technology is already proven and experiencing mass adoption. For example, in “Critical Capabilities for Cloud Financial Close Solutions,” Gartner forecasts that in less than four years, 60% of midsize and large companies will deploy cloud-based applications to digitize their accounting processes with ready access to the latest close, intercompany, and reconciliation management technology; robotic process automation (RPA); AI; and analytics.

While the cloud has made powerful technology more accessible than ever, technology is only part of the solution. Reaping the full value, and reinventing processes rather than just migrating them, requires pairing new technology with a strategy for change management.

In many ways, change management is about motivating and incentivizing people to be open to embracing new possibilities. It’s about encouraging every level of the accounting and finance organization to both rethink and be open to replacing hardwired, often decades-old work routines with new processes and applications. It also requires empathy—understanding that people sometimes can feel threatened by change—and a plan so that everyone can see the full benefits and even detractors turn into promoters.

Without a strategy around change management, organizations face several risks to successful digital transformation:

- Merely running the same legacy workflows and processes on a modern finance technology stack often means underutilizing its capabilities—and a missed opportunity.

- Limited buy-in and training for employees who will use the new applications risk lack of adoption.

- Applications that aren’t continuously adapted and configured by accounting and finance stakeholders to reflect ongoing needs risk eventual misalignment and irrelevancy.

CHANGE MANAGEMENT MUST NOT BE LEFT TO CHANCE

Driving change requires a plan. When people genuinely invest in transition, a transformation is 30% more likely to stick, making it a vital way to tangibly increase the return on investment (ROI) of digital. (For more, see McKinsey’s July 2015 article “Changing Change Management”.)

In fact, in a 2019 survey of senior finance leaders by Grant Thornton, 91% of finance executives said it’s the CFO’s job to ensure the benefits of technology investments are realized, and 93% of CFOs said it was essential to foster an innovative culture—one that drives change—when pursuing technology. (For more, see 2019 CFO Survey Report: All systems go: CFOs lead the way to a digital world.) This report explores proven ways to drive organizational and procedural change: the roles and responsibilities to establish, obstacles to overcome, and practical techniques to get everyone on board.

Sustainable change management is critical to overcoming obstacles and roadblocks. For example, you want to avoid teams and/or accountants relapsing into old processes, as well as any glitches with systems or new processes that may arise during the change process. Maintaining a solid mission and vision for the team along with effective communication will provide you with a successful change management process.

Now let’s take a look at how you can work on your digital transformation to make it a success.

STEP 1: BUILD “TEAM CHANGE”

Everyone builds an internal team of project managers, accounting business process experts, and end users for rolling out new technology, but traditionally these teams disintegrate after go-live.

This was understandable in the days of on-premise software because it was almost impossible for those in finance and accounting to own and manage technology. They couldn’t easily make changes to rules, reports, or other business logic to tackle new business processes on an ongoing basis. Because upgrades were applied only every few years at best, learning how to tap into new features and communicate new capabilities was rarely required. But given today’s technology, that’s a mistake.

With modern cloud applications, finance and accounting system administrators can make changes after deployment and accommodate ongoing needs without requiring extensive effort. Examples include:

- Changing the process of a bank reconciliation,

- Changing a rule to auto-certify an account reconciliation, and

- Creating more automated journal entry processes and validations.

Like financial close and compliance automation solutions, technology can often be extended to more users across the enterprise, such as business unit teams or auditors. All of this makes ongoing enablement and a more proactive approach to digital adoption essential.

“Team Change”: Roles and Responsibilities

Often, change management teams consist of staff who are fully allocated to driving the initiative and others with part-time responsibilities. A recent survey of 689 finance executives by CFO Research found that 56% of respondents devote about one-fifth of their full-time equivalent (FTE) time to digital transformation and change management, and 52% plan to boost FTE time further in the coming year. (See “The CFO Balancing Act: Facing the Future while Navigating the Now,” CFO.com, September 2018.)

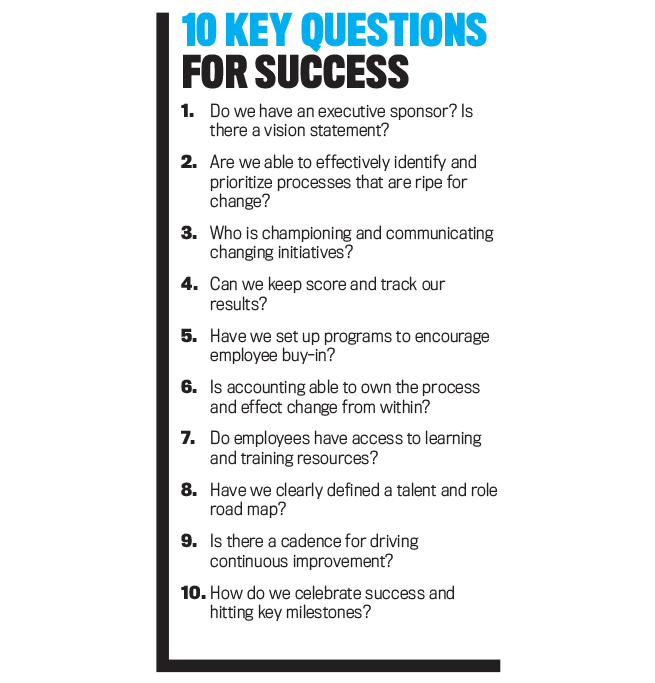

A successful project team will include people who understand the assessment, as well as the impacts and presumptions being made, to help drive the overall mission and vision for change. Prior to building the team, make sure the assessments, impacts, presumptions, and the right people are assigned. Consider carving out the responsibilities as shown in “Roles and Responsibilities” above.

STEP 2: PUT YOUR CHANGE MODEL INTO PLAY

Driving process changes is a team activity, so once roles and responsibilities are defined, you’ll want to ensure your team runs like one.

Key areas to consider include:

- Work with your Sponsor to craft a vision statement for the accounting and finance organization, such as the goals for the organization by 2020 or 2022. These may include driving efficiencies from automation in core accounting areas such as financial close, intercompany accounting, reporting, and reconciliations; allocating more time to business partnering; or building a greater competency in strategic planning and analytics. Identify high-level gaps and obstacles between your current and future states, and create a milestone-based road map.

- Engage Champions to operationalize the vision by establishing collaborative, cross-functional teams that include front-line accounting and finance team members to identify processes that are ripe for reinvention.

- Roll out the change program, leveraging Enablers who are incentivizing and enabling talent to adapt new work processes, such as transitioning Excel-based reconciliations to the digital cloud.

- Scorekeepers should measure the progress using quantifiable metrics to gauge success period over period, with feedback to the broader team on adoption and results. These metrics can include the reduction of days required to close the books, reduced preparer completion time, and increased accuracy for reconciliations.

STEP 3: TACKLE THE KEY OBSTACLES PROACTIVELY

What are some of the critical obstacles you’ll likely face on the road to change? Common issues range from a poorly defined vision that lacks buy-in to a reliance on tools that finance and accounting can’t own and manage themselves.

In its 2018 report Memo to the CFO: Get in front of digital finance—or get left back, McKinsey identified six common obstacles that change management initiatives face and solutions to overcome them. The obstacles are:

(1) The overall digital vision isn’t clearly defined;

(2) digital initiatives aren’t linked to overarching business strategy;

(3) there’s a lack of clear, strong mandates to digitize processes across the accounting and finance organization;

(4) there’s a backlash within the finance function over changes resulting from digitization initiatives such as role and process changes;

(5) there’s a lack of understanding between digital finance teams and business units; and

(6) there’s a gap between current capabilities and those required in a digital finance function. (See mck.co/ 2Vt2ZDB.)

STEP 4: INCENTIVIZE CHANGE, EMPOWER OWNERSHIP, ENABLE TALENT

Digital finance transformation and change management go hand in hand. Defining, enabling, communicating, and measuring change is a powerful way to ensure the maximum ROI from the latest technology. Without change, many organizations risk running old processes on new technology, tapping into only a fraction of their value.

Achieving digital finance transformation requires the right solutions, owned and managed by the accounting and finance department to drive change from within, and tools to ensure ongoing training and measurement. It also requires the accounting and finance team to commit to change by setting a clear vision and road map, defining roles and responsibilities, and investing in continuous improvement.

November 2019