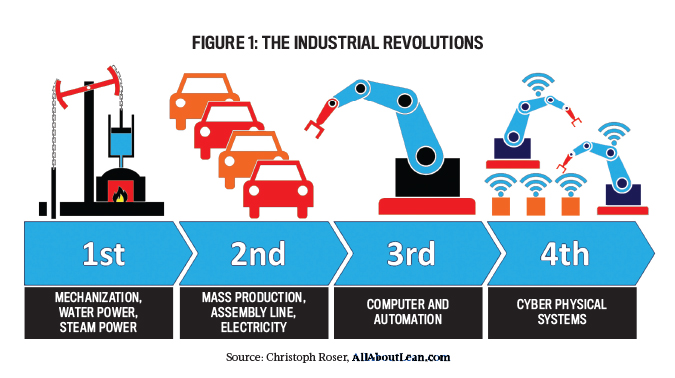

The impact of digital manufacturing is so momentous that it’s often described as the Fourth Industrial Revolution (see Figure 1). Large manufacturing organizations are already wrestling with and adapting their finance functions to digital manufacturing. They’re connecting finance more directly to digital manufacturing’s data-rich environment with cutting-edge data analytics, revising strategic plans and accounting practices to incorporate new approaches to the market, and building new partnerships and finance arrangements with technology and equipment suppliers.

Midsize and smaller manufacturers need to evolve to keep up with the wave of new technology to remain competitive. This involves internal adjustments, such as engaging more closely in strategic business and capital investment planning, preparing for new costing and accounting practices, and critically evaluating performance and compensation metrics. And since manufacturing organizations interface with an extensive supply chain that’s rapidly feeling the impact of the digital economy, this also means making improvements to customer and distribution channel data, planning for new forms of customer billing and financing, and improving coordination and integration with suppliers.

WHAT IS DIGITAL MANUFACTURING?

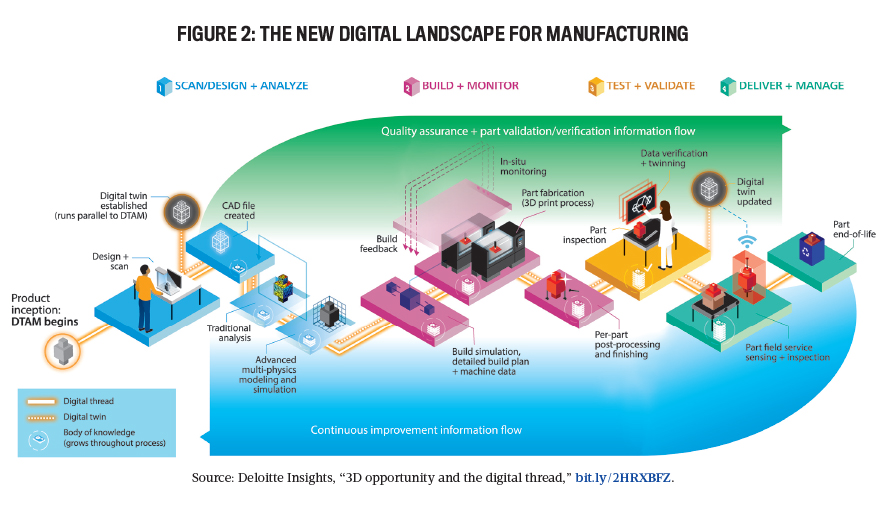

Digital manufacturing encompasses the nature of the manufacturing process, the supporting technology, and the nature of the products themselves. Digitization starts with a product or enhancement idea that is digitized into a design, visualized, simulated, and then optimized for manufacturing. The manufacturing process is physically different—machines and movement are highly automated to replace or augment the human workforce. The ultimate goal is that a batch size of one can achieve the same economy of scale and quality as a batch size of thousands. The physical factory has a digital twin where the humans work to coordinate the product design and product scheduling and to monitor the performance of the physical factory (see Figure 2).

The operations are also highly automated, with extensive uses of Internet of Things (IoT) technology feeding data on product quality, manufacturing equipment performance, forward-looking maintenance, and asset risk information and alerts. Advanced decision-making algorithms and AI often support product design, job scheduling, production monitoring, and maintenance activities.

Products designed for the digital factory frequently are part of the digital design and supply chain. They’re often highly integrated, customized, and produced in small batches for a unique, customer-focused experience. This doesn’t mean production is slow or small-scale. The digital enterprise also applies to the large-scale enterprises like automotive, aeronautics, defense, food and beverage, and so on. Some products have IoT technology embedded in them to monitor their performance and maintenance needs, communicate with other parts of a system, and communicate with the manufacturing, packaging, and distribution processes.

IMPACT ON THE CFO FUNCTION

The CFO and finance organization within a manufacturer that adopts a digital manufacturing approach face a wide variety of challenges and opportunities. These changes can happen gradually or fairly rapidly, and the key element is to recognize and embrace the change rather than ignore and fight it. CFOs with a business-partner orientation and a high level of understanding and familiarity with manufacturing operations will be more aware and better able to provide support than CFOs who have a narrow focus on traditional accounting and financing responsibilities.

What will change? The short answer is potentially everything, but let’s examine six specific areas and some insights that will allow finance organizations to adapt and respond more effectively for their organization:

- The strategy and business model.

- Investment justifications and priorities.

- Financing options.

- Project management.

- Using information.

- Alignment of financial and operational data.

STRATEGY AND BUSINESS MODEL

The manufacturing strategy and business model will change, sometimes dramatically, because of the digital manufacturing process and the new capabilities that can be included in a product.

Let’s first consider the product, which is getting smarter thanks to IoT technology and the relatively lower price and greater capability of data and information processing. Manufacturers have always sold or leased products and associated support services. Increasingly, as a result of smart products, manufacturers are selling services and performance levels that are executed by their products; the information collected, processed, and analyzed by sensors within the products; and an installation, repair, or service team.

An example is a manufacturer of automated industrial valves. The sensors on the valves report maintenance condition and failure probabilities that the manufacturer, because of its research and proprietary software, is in the best position to monitor for performance and to respond to any issues. Thus, the manufacturer now provides the valves (and monitoring) to customers as a subscription service rather than a product while guaranteeing a level of performance in the contract.

The valve manufacturer’s CFO team faces changes to its financial reporting for revenue recognition, reserves for unexecuted service contracts, and inventory. Investment in process improvement still includes reducing manufacturing costs, but it now extends to product quality and data analysis to reduce the costs of providing service. Pricing needs to include much more than cost of goods sold, SG&A (selling, general, and administrative expenses) recovery, and a profit margin. Considerations like the upgrade of valves and data analysis software are necessary to maintain the level of performance in the contract and minimize visits to customers by service teams.

The second major change to the business model is production. One common goal of digital manufacturing is a batch size of one and the virtual elimination of setup time. This will cement the death of the traditional product costing model. Digital manufacturing is almost all overhead plus machine time and material cost. Mass quantities of overhead make the traditional concept of overhead nearly useless and most likely highly distorting in terms of information value if simple standard costing for financial reporting is used.

Cost modeling for both financial reporting (i.e., cost accounting) and internal decision support (i.e., managerial costing) can’t use the ideas you learned in your cost accounting class that were focused on inventory valuation, transfer pricing, and regulatory financial reporting. Cost models, particularly for managerial costing and internal decision support, need to reflect the operational model; cost collection must be designed to reflect the consumed resources and processes that result in a product.

These costs should include sales and marketing through research and development (R&D), production, delivery, installation, and ongoing service. A managerial costing model will need to include more than product cost. It should include a mix of managerial objectives such as product, customer, distribution channel, and support factors that need to be understood, modeled, and costed to accurately reflect cause-and-effect relationships and not create the appearance of a causal relationship where one doesn’t exist.

Of course, much of that focuses on internal decision support and managerial costing. Accounting rules define what is and isn’t included in inventory values and cost of goods sold. The divergence between the internal decision-support information used to manage the company and the accounting information in financial statements will grow. The more complex costing situation associated with digital manufacturing could have a significant impact on management and executive incentives that are traditionally tied to financial statement metrics.

CFOs may want to take a critical and strategic look at the potential behavioral and organizational performance impacts of existing executive incentives as the shift to digital manufacturing progresses. For example, incentives based on traditionally calculated product cost, such as gross margin, will no longer align well with the digital manufacturing process. Sales commissions may need to incorporate subscription services with product sales. Return-on-asset calculations need to be adjusted to incorporate intangible assets such as spending on R&D and training. And depreciation practices on equipment and software need to be adjusted to reflect continuous use and upgrading.

INVESTMENT JUSTIFICATIONS AND PRIORITIES

The leap to digital manufacturing typically isn’t a single giant step but a series of steps toward an increasingly capable and competitive state of production. Taking those steps requires a mind-set for investing in new, transformative technology. The CFO and finance staff are typically the key reviewers of a company’s business cases for new investments and can do much to facilitate or discourage the initiative.

The three major areas of investment associated with digital manufacturing are:

- Digital manufacturing to improve current production methods,

- Developing and manufacturing new products that incorporate IoT and potentially a range of new services, and

- Information technology, including hardware, software, training, and consulting.

The key issue is to focus on why your organization is making the investment. In most cases, moving to digital manufacturing is a strategic and competitive necessity to ensure long-term survival in the market. In that situation, the return on investment of any specific project isn’t the driving factor because failure to develop digital manufacturing capability will lead to the loss of market competitiveness and the end of the business. This choice is most stark for smaller manufacturers with more limited resources and a more limited customer base. Digital manufacturing can be successful for a smaller enterprise, but it’s best to plan the transformation carefully.

The critical factors are primarily cultural, involving risk management and organizational learning. Are the investments structured for incremental success or failure? Can the organization tolerate, learn, and recover from a failure? Is the project structured to build on success? Are the criteria that define success clear? Are the risks and rewards clear to all relevant stakeholders? Have the project staff and executive decision makers acquired the knowledge and necessary expertise to manage the project, recover from setbacks, and exploit success?

Perhaps the greatest challenge for many manufacturers moving to digital manufacturing is the greater reliance on IT. Most CFOs have implemented new financial systems and know a good deal about the associated IT challenges. Digital manufacturing means converting the core value-creating operations of the company to a highly integrated and data-rich state. The company will soon have to have the same quality of IT support, reliability, and expertise available as it has in its traditional mechanical and electrical capabilities. CFOs can be strong advocates for developing this capability through training, hiring, and contracting well before it becomes a critical flaw in the plan. This impetus to create a more holistic organizational IT environment can mitigate significant organizational risks, such as IT security, and potentially create strategic competitive advantages.

FINANCING DIGITAL MANUFACTURING

CFOs know a great deal about financing. The slightly novel aspect of moving to digital manufacturing is that the suppliers of digital manufacturing systems and equipment are keenly aware of the financing and implementation challenges associated with innovation. Additionally, they’re familiar with the particular challenges and risks small and medium manufacturers face. Many are willing to provide digital capability manufacturing systems and equipment as a service in order to make longer-term sales or leases of their equipment and systems.

Additionally, nearly all suppliers of digital manufacturing equipment and systems can provide extensive information justifying the investment and supporting the business case. Some suppliers even include contractually guaranteed performance and savings from the resulting efficiencies to facilitate the purchase of equipment or systems. The manufacturer is normally required to carefully follow the supplier’s consultants’ installation and operating guidance and requirements.

CFOs will need to determine how this information and any contract terms apply to their organization and its competitive situation. A tense situation can occur if a vendor presents a compelling business case to senior operational or general management prior to the CFO having the time to study and evaluate the information. The best plan is for CFOs to be engaged with operations as the digital manufacturing exploration begins and study the business cases of various vendors from the start.

This brings into play more analytical challenges for the CFO since service agreements may significantly change traditional profit margins and cash flows. The question becomes: Is such an arrangement less risky than other options? Will the exposure result in greater organizational learning and enhance the speed of the company’s transition to digital manufacturing? Perhaps the expensive service arrangement will be offset by savings in training, hiring new expertise, and engaging consulting expertise.

PROJECT MANAGEMENT

Project management is a well-established body of knowledge, but the transition from traditional manufacturing to digital manufacturing will require more than having one well-trained project manager. It’s highly probable that many project managers will be focused on IT projects, which is a bit of a specialty in project management. Additionally, during the transition, communication will be important. Senior management, those providing support activities, and the participating and impacted employees will need various degrees of awareness and respect for the principles and language of project management.

Creating a project management governance structure and culture will likely pay dividends in the form of improving the chances of success and reducing the risk of failure, improving responsiveness to project demands, improving visibility and awareness, managing expectations and responding to setbacks, facilitating change management, and setting the stage for follow-up on projects to complete the transition to digital manufacturing. Key components to establishing a project management culture include:

- Project managers with strong communication, leadership, and technical skills,

- Appropriate training and certification of project managers,

- Project teams trained in good project management practices,

- Organizational changes that give clear authority to project managers,

- Timely and substantial recognition for project successes, and

- A powerful executive champion to initiate and establish the project management culture.

USING INFORMATION

Finance and accounting’s participation in a digital manufacturing initiative shouldn’t end with implementation and operations. Particularly for early projects, it’s critical to participate in the evaluation of the project’s current and potential future impact on the organization. The evaluation needs to focus on continuous improvement: What worked? What didn’t? What can be fixed? What needs to be done differently for the next project? What’s the impact on our people? What do they need to improve? What’s the value created for customers? Is it being promoted? How should the value affect pricing? Are there any changes to our business model to consider? What are the downstream savings or revenue opportunities?

The critical point for finance and accounting is that the story isn’t in the numbers—it’s in the operations, product, and customer impacts. Digital manufacturing creates a data-rich environment that’s disruptive and will drive new insights and decisions that businesses weren’t even aware they could make. Clearly, the technical landscape of R&D and operations will change, and finance will need to change as well in order to support these functions with costing and other information for internal decision making.

To take advantage of this new data-rich environment, finance may need to hire or develop in-house staff with data science and visualization skill sets. And to be part of developing strategies and driving changes to the business model due to digital manufacturing and products, finance needs to be closer than ever to operations and to customers. The goal is to shape investments, operations, and selling strategies that achieve the long-term business and financial results the company targets.

ALIGNING OPERATIONS AND FINANCIAL DATA

The operational information systems inherent in most digital manufacturing systems have gone beyond real-time data and are well into predictive and prescriptive monitoring of production equipment, process flow, and product quality. Thus, these systems have the potential to examine data continuously, identify trends, and create alerts so that corrective action can be scheduled before a problem appears. Finance and financial information must rise to the challenge of increased speed and complexity of decision making and decision support driven by digital manufacturing.

Outdated information and methods can’t be allowed to get in the way. This is important because financial accounting conventions for product cost can severely distort decision making in a manufacturing environment with low direct costs and high overhead and SG&A. In the digital manufacturing environment, direct product cost is an increasingly smaller element of any economic decision. Costs typically assigned to overhead and SG&A will have an increasingly stronger effect on profitability and performance.

Causally modeling the value chain from customer contact and relationship management through order placement, design, production, delivery, service, and customer feedback becomes critical to understanding the business. No cost model will be effective with distorting general or semicausal allocations. Internal decision-support information needs to be based on an operational model, with costs designed and collected to reflect all resources and operations in the value chain. Only in this way can the flexibility in design, manufacture, and customer needs be projected in a digital manufacturing business and production environment designed for a batch size of one.

IMA’s Conceptual Framework for Managerial Costing (CFMC) (see Figure 3) provides a good reference for how to think about costing purely for internal decision support. Its focus is creating an operational model that is costed based on the principles of causality for modeling and analogy for information use. Monetary data that’s designed and collected from the start to reflect operating resources and processes will be significantly more useful for decision making than trying to reconnect monetary information from the general ledger to the operational data from which it was stripped during the accounting process.

The CFMC is ideally suited to the decision needs of digital manufacturing because it models the causal reality of resource and process characteristics first with operational quantities and then with money. It isn’t constrained by financial accounting standards and conventions. This allows the real-time, data-rich environment of digital manufacturing to be represented financially in a timely, highly usable manner that will approach being a real-time cost simulation.

The bottom line is that when your organization has a real-time view of the design, production, delivery, and service part of the business, it should have a matching financial view. This extends to marketing and sales, both operationally and financially. Projections need to be established based on internal data as well as market data and trends. These projections need to be analyzed continuously against actual results. The potential internal and external causal factors need to be collected, hypothesized, and researched.

The financial impact on both revenue and expenses must be analyzed and presented. Corrective strategy options need to be devised, and decisions must be made. This requires financial data and analytics that go well beyond systems designed and oriented toward financial accounting and reporting. It requires causal decision support that’s oriented to integrated data encompassing all a company’s data as well as market data.

INDUSTRY 4.0

Manufacturing is well on its way to being digital and smart, and it’s important to recognize the changes aren’t confined to the production floor. It requires a leap in agility and responsiveness that encompasses not only production but also customer needs and satisfaction and the nature of both products and manufacturing work. The CFO and finance function need to recognize the nature of the change and adapt their perspective and skills. Otherwise, they’ll risk being perceived as merely low-value reporters of historical financial results rather than as contributors and partners to operations and the business.

Ideally, an organization’s integration of digital manufacturing will be methodical and well planned, but this carries its own dangers for finance. Initially, traditional practices supplemented with some enhanced financial planning and analysis will be enough to keep up. But finance needs to look beyond the horizon and start to plan for a radically different digital future. This future requires an evolution from traditional, historically oriented financial reporting and accounting to becoming full business and strategic partners in creating and implementing operational changes, developing the data analytics and systems capability to achieve real-time managerial costing and other business analytics, and finding the flexibility and means to adapt the manufacturing business model and management capability to a digital Industry 4.0 world.

May 2019