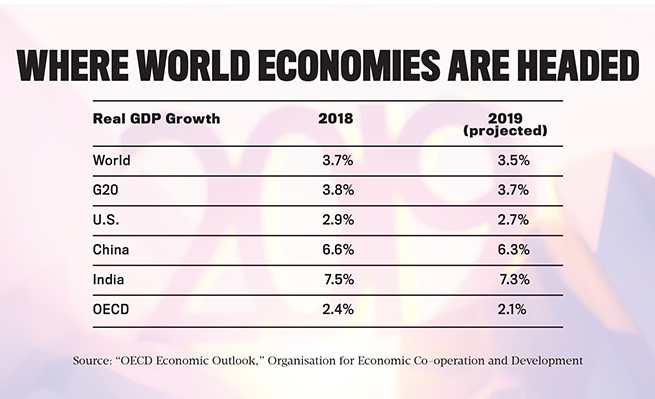

The Organisation for Economic Co-operation and Development (OECD) expects world gross domestic product (GDP) to decline somewhat, from 3.7% in 2018 to 3.5% in 2019. Decreases in GDP are also anticipated for the G20 and the United States, from 3.8% to 3.7% and 2.9% to 2.7%, respectively.

Accountants worldwide are generally concerned and, counter to the irrational exuberance of recent years, are showing signs of what could be called “irrational gloom.” According to the latest Global Economic Conditions Survey (GECS), a joint effort of the ACCA (Association of Chartered Certified Accountants) and IMA® (Institute of Management Accountants), global economic confidence fell in the fourth quarter of 2018 to its lowest level since the survey began in 2009. (The GECS is the largest regular economic survey of accountants around the world in terms of both the number of respondents and the range of economic variables it monitors.) The GECS for the fourth quarter of 2018 attracted 3,773 responses from ACCA and IMA members around the world, including 302 CFOs. (For more, go to http://bit.ly/2RFRAl3.)

Economic confidence in the U.S. fell sharply in the fourth quarter of 2018, according to the GECS. As with global confidence, it, too, is at its lowest level since 2009. In the U.K., sentiments are similar, due mainly to Brexit concerns, which we’ll talk more about later.

WHY SO GLUM?

The main story line for the U.S. economy in 2019 consists of, in no particular order, the impact of rising interest rates on consumer demand and companies’ cost of debt, increasing input costs because of tariffs and wages, and the fading effects of President Trump’s tax cuts. (The Federal Open Market Committee increased interest rates four times in 2018—to 2.5%, its highest level since 2008—and recently indicated that it will likely increase its key interest rate to 2.8% in 2019.)

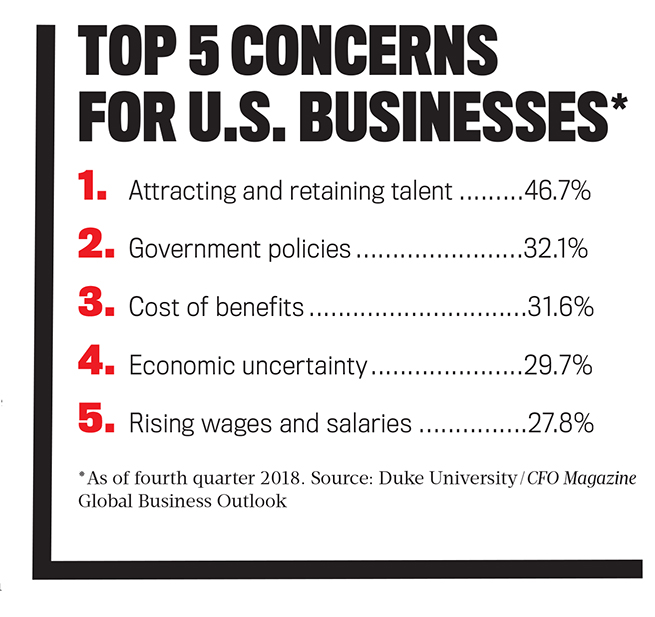

While most economists are bracing for slower growth in the U.S., CFOs are much more pessimistic. According to the Duke University/CFO Magazine Global Business Outlook for the fourth quarter of 2018, almost half (48.6%) of U.S. CFOs believe the country will be in recession by the end of this year, and 82% predict that a recession will begin before the end of 2020.

Uncertainty around how trade negotiations in North America will pan out and the outcome of the U.S./China tug-of-war has made companies nervous. The end of 2018 saw the impact of economic uncertainty on U.S. stocks. The VIX Index, which measures the stock market’s expected volatility over the next 30 days, swung wildly, and the Dow Jones Industrial Average fell to close down 5.6% in 2018, its worst year since the crash of 2008.

THE EFFECTS OF TRADE WARS

Although the decline in the Chinese renminbi has offset some of the worries, the impact of U.S. trade policy on overall exports remains a concern. Duke University’s most recent CFO survey on the topic, which was released in the third quarter of 2018, shows that U.S. companies are split as to the effects of the trade wars and tariffs, with an equal number saying trade conditions will help vs. hurt them. (In a widely quoted statement, Ford CEO Jim Hackett anticipates that taxes on steel and aluminum will cost the automaker $1 billion in 2019.) Companies impacted by the trade wars and tariffs will compensate by pushing costs onto consumers wherever possible, and, as the Duke survey reports, these businesses will reduce their capital spending for the year by 6%.

Against this backdrop, a tight labor market in the U.S., marked by low unemployment and rising wage costs, is expected to remain. Wells Fargo puts unemployment at 3.5% in the final quarter of 2019, a 49-year low. This compares with an unemployment rate of 1.6% for accountants and auditors in 2018. Therefore, it’s quite likely that attracting and retaining qualified employees will be keeping CFOs up at night in 2019 as it has in the past.

At the same time, CFOs will be looking to offset rising costs by further automating routine processes and investing in digital technologies that can give them greater insights into many aspects of their operations, such as managing supply chains, increasing the efficiency of working capital, and improving customer service, to name a few.

ATTRACTING AND RETAINING TALENT

Finding ways to thrive despite a very tight labor market may be the biggest challenge for companies as they head deeper into 2019.

According to IMA Chair-Elect Christian Cuzick, VP of finance at Johnson & Johnson and CFO of Johnson & Johnson Vision, a producer of specialized tools for eye surgery, the investment binge of the last five years has not only translated to low unemployment generally but has upped the ante for companies trying to find highly skilled talent. “The market’s so hot, you can’t find engineers, and it has become incredibly difficult to find talent in finance as well,” he says. “These days, I probably spend 30% to 40% of my time just trying to figure out how to get good talent.”

Compounding the problem is the fact that the skills companies are looking for today are far different from the ones a decade ago. “Ten years ago, the typical finance person was really strong in accounting, auditing, and compliance,” Cuzick explains. “Now, my higher priority is analytical work. We need people who are naturally business-minded and understand the industry. Half the time, their job will turn into portfolio management. It’s a totally different skill set, and it’s one that has evolved over the last five years.”

It’s especially hard, Cuzick adds, to recruit people who have knowledge of analytical tools and applied sciences. “Coming across people like that is like finding a needle in a haystack,” he says. “They need to know how to organize data, understand the database structure, and how to get quality information out of it. That’s the wave of the future.”

NOT JUST A U.S. PROBLEM

Elsewhere, CFOs’ hand-wringing involves the same key issue. As Declan Doyle, CFO at NOONAN, explains, “With the U.K. and Ireland reaching nearly full employment, companies are vying for skills by building brand awareness, and a big part of our strategy going forward is letting people know that we’re a great, innovative company to work for.” NOONAN, which is based in Ireland, has more than 15,000 employees who provide technical, security, cleaning, environmental, and ancillary services to a wide range of corporate clients.

When it comes to hiring its finance talent, Doyle adds, it’s particularly important to let people know that NOONAN embraces new thinking. “In the past, it was all about the old classic model of looking in the rearview mirror and crunching numbers, whereas today we’re far more interested in someone’s analytical skills and ability to communicate,” he says. “The generation that’s coming in now—particularly at the more junior levels—will be appalled to have to put together a set of numbers rather than just be given them. They expect your systems to be good, and having leading-edge technology in finance is a must-have.”

NEW IMPERATIVES

In 2019, some companies will continue down the path of transforming the finance function through automating routine processes, digitization, and implementing artificial intelligence technology as part of a longer-term strategy. For finance, it means eliminating data-entry errors, improving efficiencies in processing customer and supplier invoices, and further streamlining shared-service tasks. For audit, transformative processes can augment human review and enhance the control environment, reduce the compliance burden, improve the audit process by accelerating the collection and validation of information, and reduce time to close, among other benefits.

As Cuzick notes, Johnson & Johnson is exploring all of these avenues—and more. Robotic process automation (RPA), a type of computer code that automates certain high-volume procedures, he explains, could make a whole lot of sense, especially with transaction processing where something is done repetitively. (See “What’s RPA?” for a more complete description.)

For other companies that intend to remain competitive, new investments in technology are on the horizon to help defray rising input prices. As Mark Schoolcraft, CFO of Midwest Industrial Supply, explains, inflationary pressures on input prices are driving several productivity initiatives in his company, a dust control and soil stabilization firm based in Canton, Ohio, serving heavy industry, quarry and mining, construction, and other infrastructure sectors across North America.

“The cost of steel and other raw materials has risen in the U.S.,” Schoolcraft says. “This is starting to impact the cost of anything on wheels that’s produced here. And as large fleet owners, we really have only two choices: Either we push increasing costs to our clients, or we look for ways to improve efficiencies. In my view, I think it’s critical to our future to invest in the technology that will allow us to work better, faster, and more accurately.”

Midwest Industrial Supply, he explains, is very “data hungry” and will continue to invest in its IT infrastructure in 2019. To that end, the company is in the process of building its data analytics to help management make better decisions, and, because its workforce is dispersed all across North America, has initiated a project designed specifically to get better data from the field and to communicate with its employees more effectively.

RIPPLE EFFECTS

As to how this environment is impacting the role of the management accountant, and more specifically the CFO, it’s all about business acumen, understanding Big Data, and building the right teams.

“Because accounting is the language of business, we need financial people who can embrace the new technologies that allow us to better understand our entire operation and, at the same time, provide good financial management,” Schoolcraft says. “As we apply new technology to transactional work, analytics will become their core competency. So as CFO, I have to be involved in systems—not only financial systems but business systems—and making sure I have the right people on my team.” For accounting and finance talent in particular, it’s important to keep on a lifelong learning path, he adds. “Technology seems to be moving faster every year, and we need to be the champions of continuous improvement.”

In addition to considering how improvements in data analytics can impact the finance function, Cuzick also works to keep in touch with the developments in Europe in the face of an unknown Brexit outcome. “For any multinational business, no matter how big or small, it’s a risk,” he explains. “So my big concern is making sure we are thinking about business continuity planning and looking at alternative options. The challenge has been that everything’s been sped up because it doesn’t look like they’ve been able to reach any agreement with the EU on the terms of the exit, which has left everyone very uncomfortable. “I think everyone’s planning for the worst and hoping for the best,” he adds.

AN EVER-CHANGING ROLE

For Cuzick, the role of the CFO is a moving target going forward. Up until now, he says, the CFO had served as the “go-to” person when it came to finance and accounting.

“Now, we have to be much broader than that,” he insists. “We have to be experts in enterprise risk management and understand all the elements of risk to the corporation beyond finance. We also have to understand how technology can reduce the costs of the finance organization as a service provider. We also need to be better at recruiting and leading people.”

CFOs are like detectives these days, Cuzick adds, dealing with massive amounts of information to find those nuggets of data that are most meaningful, and therefore most helpful, to the organization. “It’s important to recognize that we as CFOs don’t have all the tools for everything and need to build the teams that can provide the answers we’re looking for.”

The Stats

48.6% of U.S. CFOs believe that the United States will be in recession by the end of 2019.

Source: Duke University/CFO Magazine Global Business Outlook, www.cfosurvey.org.

February 2019