The U.S. Department of Labor’s Bureau of Labor Statistics (BLS) reports that bookkeepers and accounting clerks will experience a 4% decline in employment during the decade ending in 2028, compared to a projected 6% increase in opportunities for accountants and auditors during the same time frame.

Most experts place the blame on technological change for the expected drop in employment growth for bookkeepers. Software innovations, such as cloud computing, have automated many of the tasks these individuals used to perform. As a result, the same amount of bookkeeping work can be done with fewer employees, which is expected to lead to job losses. As more of their routine tasks become automated, however, bookkeepers will be expected to take on more analytical and advisory roles. For example, rather than performing manual data entry, bookkeepers will focus more on analyzing reports and pointing out potential areas for efficiency gains.

On the surface, this negative growth rate indicates that the need for back-office support will decrease substantially in the near term. Yet when we looked deeper into BLS and U.S. Small Business Administration (SBA) data, professional journals, and mass-media articles—as well as the responses to our own small-scale survey—we found that the projections of lower employment and automation replacing bookkeepers may not be wholly accurate.

There will still be a strong demand for these professionals. Nevertheless, the combination of an aging population of current bookkeepers and fewer new entrants into the field will be insufficient to meet the needs of many companies, especially small and medium-sized enterprises (SMEs).

In this article, we’ll provide guidance for SMEs looking to secure employees who have the appropriate skill sets, outsource bookkeeping services, or adopt technology to automate their bookkeeping and other back-office tasks. In each case, the goal for the SMEs is to get the services they need at the best price and with the least disruption to the accounting function.

STAFFING SHORTFALLS ON THE HORIZON

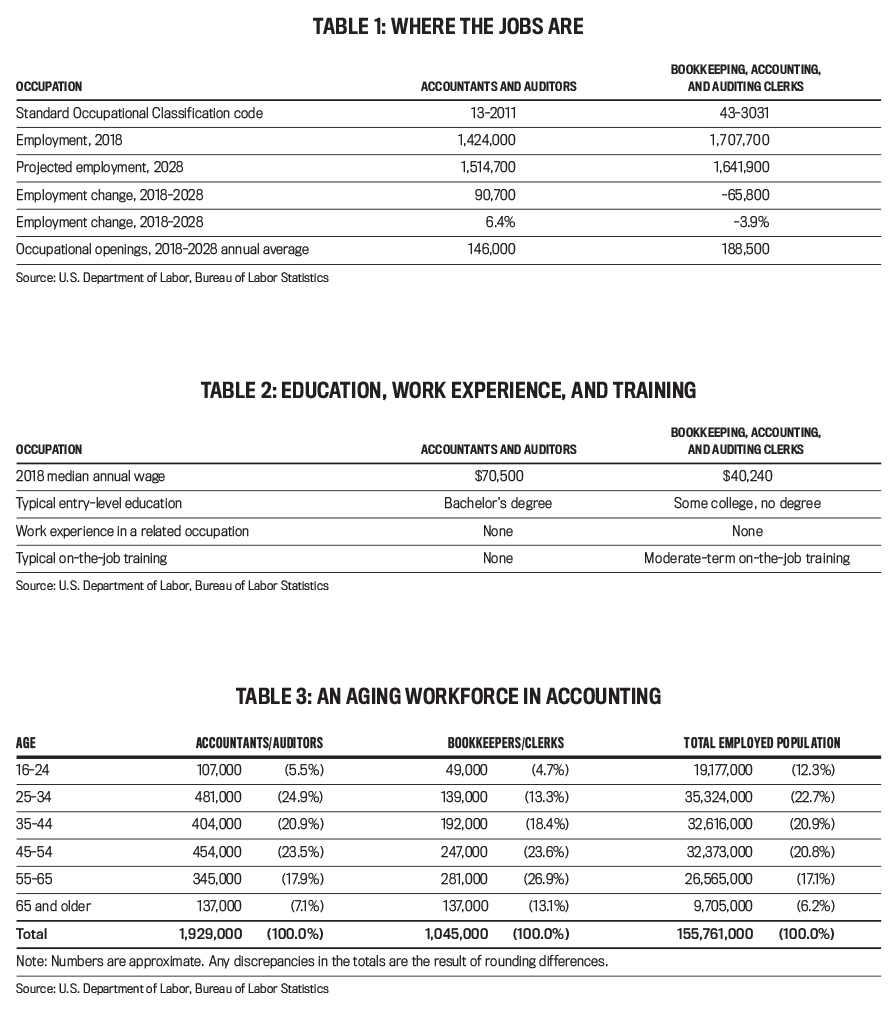

The projected shift in accounting jobs and functions can be seen in Table 1. BLS definitions of “Bookkeeping, Accounting, and Auditing Clerks” include bookkeepers, accounts receivable clerks, and auditing clerks, among others. “Accountants and Auditors” include public accountants, cost accountants, financial accountants, fund accountants, internal auditors, and tax accountants.

The differences in median wages, entry-level education, and experience and training are shown in Table 2.

According to the BLS, occupational openings represent the sum of net employment change and separations. Workers who change jobs within the same field don’t generate openings since there’s no net change from this movement. Although bookkeepers are projected to lose 65,800 available jobs from 2018 to 2028, the average annual number of openings during this time is expected to reach 188,500, which is 42,500 more than for accountants and auditors during the same period. A large number of openings in an occupation experiencing a decline may indicate a high need to replace existing workers who are separating, for example, due to retirement. As the aging population of bookkeepers prepares for retirement, opportunities to enter the occupation should be plentiful despite the projected decline in overall employment.

As Table 3 shows, bookkeepers and accounting clerks are generally older than accountants and auditors: 50.2 vs. 44.3 years old, respectively. This means that a shortage of bookkeeping professionals may be upon us faster than incoming accountants. Take a look, for example, at the two eldest age brackets: Baby Boomers and potential retirees. Workers ages 55 and older account for 40% of bookkeepers and 25% of accountants but make up only 23% of all employees. Of workers 65 and older, a staggering 13.1% of bookkeepers are still in the labor force—double the average of all employees—compared to just 7.1% of accountants and auditors.

ARE BOOKKEEPERS HEADED FOR EXTINCTION?

While statistics predict overall negative job growth for bookkeepers due to automation, a large number of new and replacement positions still exist, fueled in large part by an aging workforce entering retirement.

Granted, this looming crisis didn’t come upon us overnight. For years, accounting back offices consisted of large numbers of clerks and bookkeepers keeping busy with manual tasks from typing thousands of orders into one large database, to sending payments to vendors, to tracking customer balances and generating aging reports. Today “robots,” namely software, have automated these duties, allowing some large businesses to shrink their accounting and finance departments and thus lower their labor costs.

For example, Verizon Communications reduced its finance department costs by 21% over three years by closing more than 100 back-office locations, building a new hub for its accounting and finance operations, and, in the process, cutting jobs. In fact, it’s been reported that the median number of full-time employees in large finance departments has declined by 40% since 2004. Along with Verizon, other large companies such as GameStop and Pilot Travel Centers are among the industry leaders that have taken similar steps. (For more on this topic, see Vipal Monga, “The New Bookkeeper Is a Robot,” The Wall Street Journal, May 5, 2015, on.wsj.com/2EFCUJn.)

While large companies will no doubt continue to utilize high-powered software programs to automate finance and accounting functions in order to save money, the same software is too costly for most small businesses. The bottom line is that small companies—those defined by the SBA as having fewer than 500 employees—will still need bookkeepers, particularly in the short term, and a lot of them.

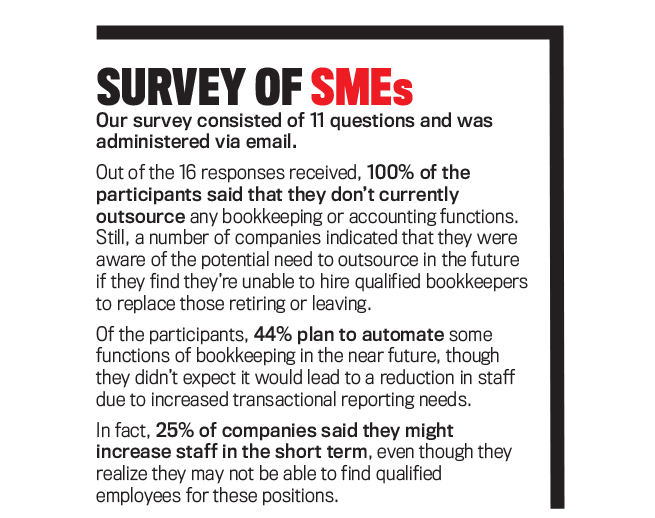

To test this assumption, we conducted a pilot survey of 16 U.S.-based companies to get a better idea of the current bookkeeping staff utilized by SMEs and of any plans they might have to automate these functions. In our sample, the average age of the bookkeeping staff was 54 years old—which classifies them as Baby Boomers—and all of our respondents said they utilize automated accounting to at least some extent.

So what did we learn? For one, none of the companies reported outsourcing any of their accounting functions, though some indicated that they had plans to further automate these tasks. That said, none of them believed that this increase in automation would reduce staff. Downsizing or plans to downsize also weren’t in their future. These findings support our initial assumptions about the continued need for, and imminent shortage of, bookkeepers, which means that SMEs would be wise to assess their back-office accounting needs immediately. (For more on our survey, see “Survey of SMEs.”)

WHAT SMEs CAN DO TO PREPARE

With these shifts in the workforce comes the question that all SMEs must address: What can we do to continue to ensure that our internal accounting and bookkeeping needs are met? Although there’s no “one size fits all” answer for every SME, here are five proven strategies that we’ve identified:

1. Hire part-time or temporary employees.

Temporary staffing agencies are still a popular outlet for many small businesses to help fill open accounting positions. Staff from these agencies almost always come with some type of previous experience and may be available on a full- or part-time basis. If your company doesn’t have the resources or volume of business to hire a full-time internal accountant, this may be a viable solution. Temporary staff often transition into full-time or permanent part-time employees after payment of the agency’s fee.

2. Partner with trade schools and community colleges.

SMEs should initiate discussions with local private business schools and community colleges that offer accounting or bookkeeping programs. By working closely with Career Services or placement offices, companies can gain access to viable candidates in a reasonably short time. In many cases, schools hold career fairs designed specifically to connect employers to graduates. Providing paid internships is an especially cost-effective way for SMEs to try out new candidates before hiring them permanently.

3. Educate existing staff.

Small businesses may not provide education benefits as a rule; however, managers may consider offering tuition reimbursement to an employee who’s willing and able to pursue training, certification, or a degree in accounting. In many cases, existing employees are the best candidates because they already have strong ties to the company and understand how it operates. Basic accounting courses, training in accounting software (such as QuickBooks), and some on-the-job training can transform an existing employee into a skilled bookkeeper. The challenge is to identify a qualified individual whose hours are flexible or whose duties can be shared—or ultimately assumed—by someone else in the company.

4. Automate certain back-office functions.

Small businesses will continue to rely heavily on bookkeepers and accounting clerks because they’ll be more cost-effective than the software programs utilized by larger companies. That said, these companies also need to realize that use of this technology will continue to spread and, as such, should begin looking at efficient, low-cost ways to help supplement and assist staff bookkeepers as the business grows.

Bills.com and Ledgersync are examples of software that can help streamline the accounting functions for small businesses. These applications—as well as other popular small-business apps, including Square, PayPal, and Stripe—can integrate directly with online accounting software, thus streamlining most of the daily entry processing that bookkeepers face.

5. Consider outsourcing.

Independent bookkeepers (often self-employed retirees) offer accounting and bookkeeping services at reasonable prices. In many cases, this is a good fit for SMEs. But if a steady workload or a more permanent presence is required, this option could become costly.

Several local and national companies whose main focus is outsourced bookkeeping and accounting services are popping up and becoming viable options for SMEs. (Popular cloud-based accounting software such as Xero and QuickBooks allow many companies to provide services for clients in a completely virtual environment.) Payroll companies can also provide a cost-effective alternative for small companies, especially those with multistate filings or other complicated payroll situations, as opposed to hiring full-time payroll clerks.

In the U.S., many public accounting firms are able to provide SMEs with bookkeeping services, as needed. According to a report from the National Society of Accountants released in 2017, bookkeeping advisory services accounted for 3.6% of total gross income for those firms surveyed. Accounting firms also may have the capacity to train and supervise employees to become qualified bookkeepers, whereas SMEs often don’t have the time or financial resources to provide on-the-job training.

WHAT’S AHEAD?

Our interpretation of the BLS and SBA data reveals that even though the trend is toward lower employment and automation replacing bookkeepers, the aging population of bookkeepers and accounting clerks currently in the workforce, combined with the number of new entrants into the field, won’t be sufficient to meet the needs of many companies, especially SMEs. This means that small companies with bookkeepers and clerks in the Baby Boomer demographic need to begin planning for replacement staff while also making sure cutting-edge technology is being used in a productive and cost-effective manner.

With some advance planning—and by following one or more of the strategies that we’ve detailed—it’s possible to avoid getting caught flat-footed in a shifting work environment. In the process, you’ll develop the skills to acquire and nurture the accounting and back-office talent you need to assure your company’s success today and in the future.

December 2019