These supply chain misperceptions become obstacles to achieving indirect cost reduction and improved profitability. In order to achieve best practices, organizations must understand the misconceptions inherent in their procurement processes and combine that with an understanding of the supplier’s industry.

Expense Reduction Analysts (ERA), a global consulting firm that focuses on cost reduction for businesses (www.expensereduction.com), has identified 10 best practices that, when implemented, help companies achieve additional cash flow by generating savings in their supplier base without compromising supplier quality or service. Initial efforts are directed and designed to achieve significant savings, or “big hits,” from two or three opportunities from the organization’s supplier base. This leads to a process of continuous improvement that involves the supplier as a member of the team and process and creates a culture of change focused on achieving cost reductions and releasing cash flows. ERA’s experience through many successful projects suggests that most companies have the opportunity to save an additional 10%-30% across large cost or expense categories.THE OBSTACLES

No organization can maintain high levels of expertise in each and every supplier sector or segment of the economy. Doing so would be cost prohibitive. Suppliers, however, possess the expertise and in-depth understanding of their industry that’s essential for an organization to minimize costs incurred.

Yet suppliers are motivated to secure as much business as possible and at the highest possible margin. That often means they aren’t reviewing their existing customers’ consumption in order to identify cost reductions available through newer products or services or service packages. So companies need to periodically ask their suppliers for assistance and include them as part of the internal cost-reduction team.

While many companies dedicate resources to cost reduction in the area of cost of goods sold, they may not be able to deploy comparable resources or possess sufficient internal expertise to reduce costs in overhead expense categories outside of cost of goods sold. Real-time market pricing data is necessary to create the benchmarks for comparison and cost reduction across all expense categories. To achieve best practices, companies must first overcome the common procurement misconceptions.

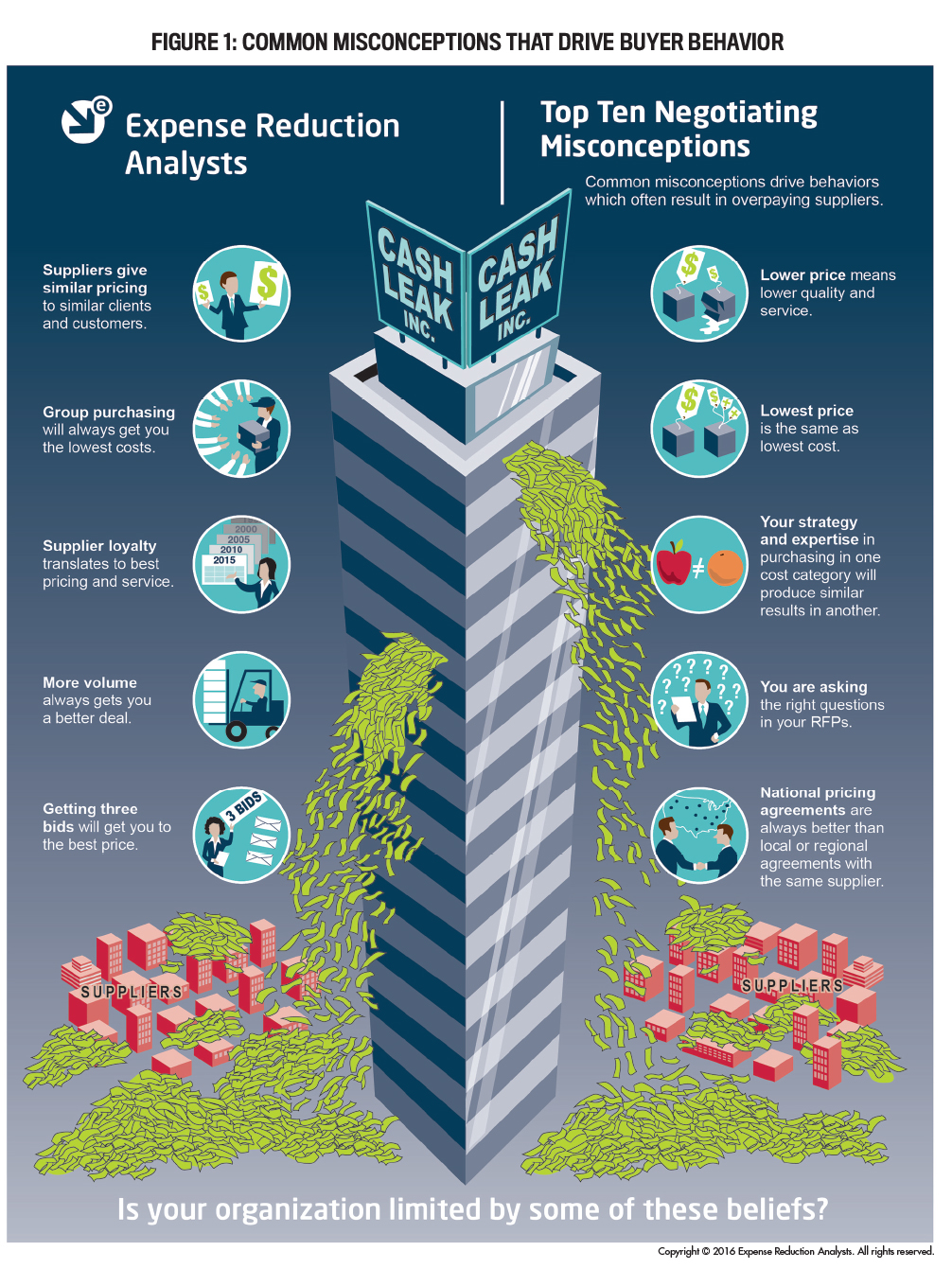

PROCUREMENT MISCONCEPTIONS

Figure 1 lists the misconceptions that ERA has identified. These beliefs incorrectly drive buyer behavior and can lead to cash leaks. When examined and understood, each can instead be applied correctly—and profitably—in most organizations.

Contrary to the misconceptions, the truth is:

- Suppliers do not give similar prices to similar clients and customers. New products, services, and service packages become available, and the services your company is paying for may periodically require updating.

- An organization’s strategy and in-house expertise in one cost category is not likely to produce comparable results in all cost categories. No company can cost effectively maintain expertise in all cost categories.

- National pricing agreements are not always better than local or regional agreements with the same supplier. You have to engage and ask your supplier representative if alternatives might better suit your current needs.

- Organizations may not be asking the right questions in requests for proposals. Again, include the supplier representative in periodic dialogues and to assist you in asking the correct questions.

- Supplier loyalty does not translate to the best pricing or service. Explore other options, and make sure you’re getting the best deal you can.

- A lower price does not translate to lower quality or service. Just because you’ve worked to negotiate the lowest price doesn’t mean you aren’t going to get good service. The supplier’s delivery person or service representative has no idea who has received the best pricing.

- More volume does not always result in a lower price or better deal. Even if you aren’t spending a lot of money, you can still work hard to find and get a good deal.

- Getting three bids does not always result in a lower price or better deal. You need to do more to get the best prices—include all your service requirements, ask important questions, ask about rebates or incentives, and so on.

- Group pricing will not always result in a lower price or better deal. You can get better pricing opportunities by going to suppliers directly with your total spend, explaining what you’re buying, and letting them bid on it.

- The lowest price is not the same as the lowest cost. Don’t buy more than what you need just because the unit price is lower.

ADOPT BEST PRACTICES

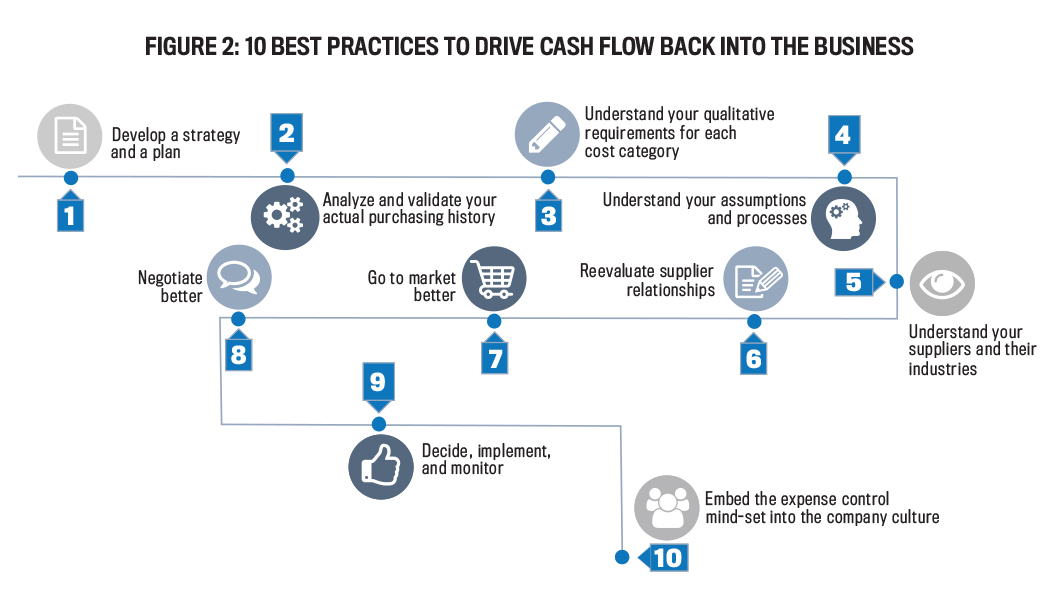

Companies can adopt the following 10 best practices (also shown in Figure 2) to reduce costs and redirect more cash flow toward better, more valuable initiatives.

- Commit

Develop a strategic plan for reducing costs in your procurement processes. To the extent practicable, include the supplier representative in the development process.

- Analyze

Analyze your company’s purchasing history to uncover the hidden opportunities. ERA often finds instances where clients aren’t actually spending what they thought they were. They might be paying incorrect prices for services no longer being delivered or never installed. They could be using more suppliers or making more off-contract purchases than they thought. They might not realize who was doing the buying or what and when purchases were being made. In many cases, these can simply be due to human error and are correctable.

Combing through invoices and contracts isn’t fun, but it will be very enlightening and profitable. When reviewing your company’s purchasing history, you’ll find that it isn’t what you think. Consider these examples:

- A supplier was billing different company locations using different pricing for the same items.

- A medical system company purchased lollipops and stickers for child patients from a primary medical supplier that was charging 10 times the market price.

- A headquarters-based contract with a shipping company (like FedEx or UPS) wasn’t fully implemented at all locations. The other locations were operating from old contracts at much higher rates.

- One company was able to retroactively recover $90,000 when it was made aware that it had been paying for a relatively obscure telecom service for 10 years—and the system had never been installed. This is an excellent example of what can happen when you don’t maintain an ongoing relationship and dialogue with your supplier representative.

- Define Qualitative Needs

The value of the supplier relationship goes well beyond just price. Remember, the objective is to get the most benefit at the lowest cost. The bidding process provides suppliers with an opportunity to maintain or improve their relationship, seek additional business, or add new business. This represents a number of opportunities, including the ability to: secure preferential payment terms to preserve cash flows; reduce or remove freight charges; secure price holds on products tied to commodities (which benefits the supplier as well); request long-term price increase notifications; request incentives such as rebates and prebates; seek noncontract discounts on future purchases not covered in the original contract; and, for nonprofit companies, request fundraising sponsorships at annual events.

- Understand Buying Assumptions

The assumptions and processes driving supplier requirements need to be reviewed to ensure they are still valid, appropriate, and necessary. Perceived “sacred cows” may represent costly beliefs, and the idea of “That’s the way we’ve always done it” isn’t a sufficient rationale.

Buying assumptions need to be reexamined systematically. Here are some examples of incorrect assumptions that, when challenged and corrected, led to significant cost savings for the companies involved:

“Purchase orders can’t be modified.” One company implemented purchase order schedules that, if modified, could reduce or eliminate minimum order fees, delivery fees, special handling fees, and additional fees. That led to savings of more than $37,000 per year.

“Insurance is necessary to protect from loss.” When a company compared its practice of insuring all product shipments to its actual claims history, it discovered that modifying this practice to insure shipments only in excess of $5,000 in value would result in savings of tens of thousands of dollars per year.

“Rates aren’t negotiated in advance.” A company had negotiated a favorable next-day air rate but was using the second-day service more frequently even though the second-day service was more costly.

“Employees understand the process.” A company had begun using disposable overalls that didn’t require cleaning in order to eliminate uniform cleaning costs. Later on, however, it discovered that employees were changing into new overalls after lunch, doubling the cost of the disposable alternative. An education process saved thousands of dollars each month.

“Insurance costs are fixed.” During an insurance review to reduce insurance rates, a safety issue was identified that could result in such significant exposure that a single incident could lead to bankruptcy and/or litigation for the company. New processes and training were implemented to avoid such a scenario.

“Buying locally is less expensive.” A company presumed that it was less expensive to deal with a local supplier located in the same business park. The supplier was charging a 50% premium on its printing cost relative to market cost.

- Understand Suppliers and Their Industries

Don’t view the future from the rearview mirror. No industry is constant. It’s important to stay aware of changes, potential developments, and more. As we noted earlier, however, it’s impossible for one organization to maintain a high level of expertise in each industry. Use your access to your suppliers’ expertise to understand things such as market trends, pressures, cycles, new developments, alternatives, terminology or jargon, industry practices and novel contracting techniques, cost and price drivers, and pricing and contractual terms for similar companies with similar spending patterns in other geographical locations. The differentiating variables among competitors must be considered.

For example, suppliers use industry-specific jargon and terminology. Terms like “recertified,” “remanufactured,” “refurbished,” and “compatible” may have very different meanings and meet differing standards. An understanding of their precise meanings within each industry can lead to significant cost savings.

Shipping is another area where greater understanding can lead to cost savings. For example, one company used a more costly, customized box to replace a lower-cost alternative for shipping its products. The savings in packaging materials, warehousing, and shipping more than offset the higher cost for the customized boxes, resulting in significant net savings. Another company had very good shipping rates for the continental U.S. but was paying a large premium for items shipped to Hawaii, where it shipped a significant amount of its product. A renegotiation of pricing for this “ocean” component resulted in considerable savings. In addition, companies can frequently ship goods based on dimensional weight rather than standard weight to achieve substantial cost savings.

The receipt of shipments and deliveries is another area to consider. One company learned that its small package pickups had been scheduled to suit the convenience of an employee who was no longer there. These runs were eliminated when it was discovered that the carrier was making “special runs” at additional costs in order to fit the employee’s schedule. The company saved tens of thousands of dollars per year. And in another case, a company changed its receiving procedures to evening and night. Dock congestion was reduced, delivery costs were less expensive, error rates were reduced, and the cost savings were so significant that the cost for additional second- and third-shift staff was more than offset.

It’s also important to understand a supplier’s unique cost drivers. Ordering patterns, frequency, location, and timing all have different impacts on supplier industries. Each supplier industry has different “costs to serve,” and these costs will frequently be passed to the customer. In one case, 50% of overages over a four-year period were recovered from a supplier for leased equipment when the supplier later replaced the underlying leasing arrangement at a much lower cost. In this case, ERA identified $29,000 in cost savings.

Identifying trends and being aware of industry practices also have an impact. For example, a company was pleased that its printing supplier hadn’t raised rates for five years. During this period, however, the technologies underlying the costs had declined by 62%. A lower-cost provider was contracted to capture these savings.

Another company was told by a distributor that an industry-wide increase of 10% was to be passed through, as contractually agreed. Yet the industry increase was only 6%. The distributor was persuaded to adjust the price increase to the 6% measure.

Finally, a company negotiated with a new supplier to pay a contract termination penalty to eliminate a “bad” contract with an existing supplier, a common industry practice. The result was $32,000 in savings.

- Reevaluate

Take the new insights you’ve developed from all the work you’ve been doing, as well as insights from your supplier requirements, and apply them to your current supplier relationships through a continuous contract reevaluation process. You’ll likely see how you can restructure most of your current supplier relationships for better value to your organization. The suppliers will appreciate the opportunity to be involved on an ongoing basis and will want to earn (and keep) your business.

- Go to Market

Go to the supplier market with written bids 90 to 120 days prior to the expiration of every contract and ask questions that define your needs (as noted in practice 3).

This doesn’t mean you have to or will change suppliers. In fact, it’s most likely there won’t be a change. In ERA’s experience, the clear majority of the time the same supplier is chosen, only with a much better arrangement. Rebidding can produce thousands in cost reductions and savings.

- Negotiate

Leverage your new insights to negotiate more effectively. One key is to separate the negotiator from the relationship holder, particularly when pricing behavior and benchmarks are applied. All contracting alternatives must be understood in order to assist the supplier in achieving cost savings that might be passed on to you, the customer.

As you approach the expiration date for existing contracts, be proactive in negotiating new terms. Avoid letting “evergreen” or automatic-renewal clauses trigger renewal under existing terms.

- Decide, Implement, and Monitor

Decide which supplier alternative is optimal, and implement immediately. Understand that unrecovered cash flow is really the same as a cash leak. There are many cost or expense line items, and mistakes are made, including lost opportunities to reduce costs through eliminating off-contract purchases, the examination of published pricing and SKU changes, supplier rebates, incentives, credits, and a careful review of the supplier’s methods to achieve its internal margins.

A continuous and ongoing effort is required to guard against “price creep.” When implementing and managing new contracts, monitor all invoices for mistakes—both innocent and intentional. Keep in mind that new processes and procedures may apply. Be certain that rebates, incentives, and credits are applied correctly.

- Change the Culture

The best short- and long-term results are achieved when an expense control mind-set is embedded in the company’s culture. Establish techniques, policies, and procedures where no cost is sacred. Cost-saving suggestions and recommendations should be encouraged, investigated, pursued, and integrated into an internal reward system.

Do your employees spend company money like it’s their own? Do they understand that $1,000 saved might be comparable to $5,000 to $10,000 in additional revenues? When rewarding an employee for cost savings, be certain that these rewards are publicized within the company. These rewards will reinforce a desirable mind-set.

TAKE ACTION

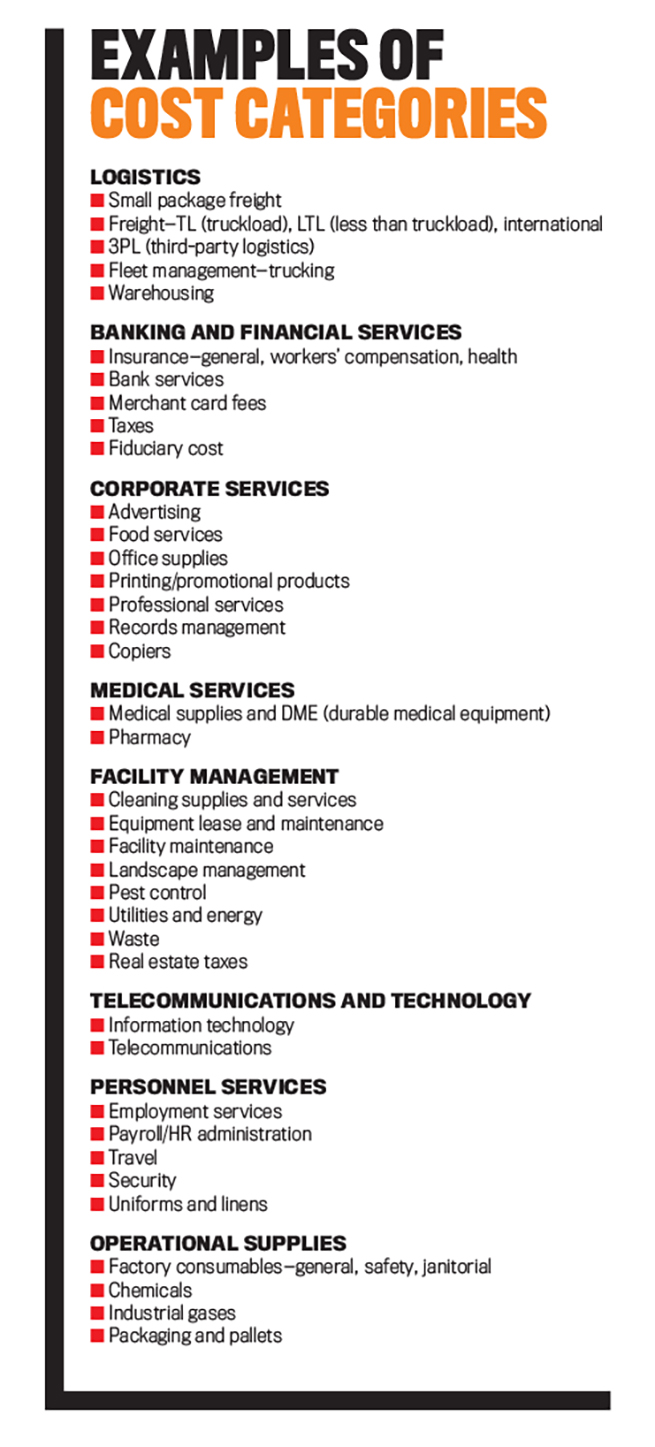

Initiate, establish, and maintain a culture of cost control using these practices. Begin by ranking and identifying your highest costs for exploration. Identify approximately 40 cost categories or classifications for initial investigation. If you can identify two or three items in the first round that could generate significant savings, the culture change has begun. Employees will become motivated to find additional savings.

These early successes will create the “no cost is sacred” culture necessary to motivate everyone to spend company money as if it were their own and to understand the concept that a dollar saved is better than a dollar earned.

Consider rewarding employees for identifying and developing cost-savings ideas. If an employee is willing to develop expertise in a particular cost category or classification more fully, these efforts should be rewarded. If an employee saves the company more than $100,000 per year, perhaps a bonus is warranted. Everybody wins!

May 2018