In November 2017, The New York Times published “Endowments Boom as Colleges Bury Earnings Overseas,” a report on offshore tax havens based on leaks to the International Consortium of Investigative Journalists (ICIJ) (see “Paradise Papers Show Secrecy and Tax Avoidance,” Strategic Finance, February 2018). The report shows that favorable tax treatment has mostly helped elite higher education institutions to accumulate total endowment assets of more than $500 billion.

Universities maintain and grow endowment funds to help finance their educational missions. Earnings on these assets aren’t federally taxed because they are designed to be of direct support to the schools’ stated not-for-profit activities. If income is received from an activity that isn’t “substantially related to the performance of the organization’s tax-exempt functions,” it’s subject to the unrelated business income tax (UBIT). Use of performance-enhancing investment techniques such as private equity and hedge funds could result in the imposition of this tax.

The Times story explains how using a corporation established in a low- or no-tax jurisdiction to own the endowment assets makes the corporation responsible for the UBIT tax, thus shielding the college or university from this obligation. The shielding function has resulted in the offshore corporations being called “blocker corporations.” Not only do the universities benefit—so does the wealthy and influential private equity industry. “They’re not cheating. They’re not hiding money or disguising money,” said Samuel Brunson, a law professor at Loyola University Chicago who has studied endowment taxation. “But they’re adding money to a system that allows people, if they want to hide their money, to do it.” According to Norman I. Silber, a law professor at Hofstra University, “Congress is essentially subsidizing nonprofits by allowing them to engage in these transactions.”

A December 2015 report by the Congressional Research Service (CRS) presents background information on university endowments and suggests alternative tax treatments. Public universities aren’t included in the report because they are in a different tax environment. As a legislative branch agency within the Library of Congress, CRS provides policy and legal analysis to committees and members of the House of Representatives and Senate, regardless of party. The report shows:

* In 2014, college and university endowment assets were $516 billion, with 11% of U.S. institutions holding 74% of all endowment assets.

* The largest endowments are owned by Yale University, Princeton University, Harvard University, and Stanford University, with each holding more than 4% of total endowment assets.

* The 2014 average rate of return on endowment assets was 15.5%, but the payout percentage was 4.4%. Larger institutions tended to earn higher returns and to have a larger share of assets invested in alternative strategies, including hedge and private equity funds.

* The 4.4% payout percentage compares with a mandatory 5% rate imposed on private foundations.

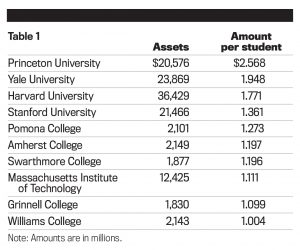

For example, according to a Chronicle of Higher Education story, the distribution of 2014 value of endowments per student varies considerably in private institutions.

Table 1 shows institutions that the article identified as having endowments greater than $1 million per student. Colleges and universities with between $500,000 and $1 million in endowment assets per student include Rice University, Wellesley College, The Cooper Union, Dartmouth College, Berea College, Washington and Lee University, Bowdoin College, University of Notre Dame, University of Richmond, Smith College, Emory University, Washington University in St. Louis, Bryn Mawr College, Claremont McKenna College, Trinity University in Texas, and University of Chicago.

The Tax Cuts and Jobs Act (TCJA) signed in December 2017 by President Trump includes an annual excise tax of 1.4% of net endowment investment income. The new provision applies to private colleges and universities with endowment assets per full-time equivalent student of $500,000 or more. The list of schools may change as the definition of full-time student, amount of endowment assets, and net investment income are yet to be determined by IRS regulations. Transactions related to the increase in stock market value since 2014 could also result in more institutions being subject to the new tax.

I urge all colleges and universities to follow the leadership of the Credibility Standards contained in the IMA Statement of Ethical Professional Practice: (1) Communicate information fairly and objectively, and (2) Provide all relevant information that could reasonably be expected to influence an intended user’s understanding.

March 2018