Taxpayers can claim a depreciation deduction under Internal Revenue Code (IRC) §167 for a reasonable amount of cost reflecting the exhaustion, wear, and tear (including obsolescence) on property used in their trade or business or held for the production of income. Originally, the depreciation was based on the useful life of the property, but Congress has tinkered with the depreciation rules over the years out of concern that small businesses needed adequate economic incentive to replace existing property with new assets more quickly. The most recent modifications are found in the Tax Cuts and Jobs Act (TCJA) of 2017 (P.L. 115-97), where Congress increased the deduction amounts granted by the IRC §179 and bonus depreciation provisions.

CHANGES FROM THE TCJA

Section 13101 of the TCJA increased the maximum amount that a taxpayer may elect to expense for the cost of any IRC §179 property placed in service during the taxable year, raising it from $500,000 to $1 million for tax years after December 31, 2017. And to ensure that taxpayers can deduct this increased amount, the limitation for this deduction also was increased from $2 million to $2.5 million. If the total of IRC §179 property placed in service exceeds $2.5 million for any taxable year, then the dollar limit is reduced by the amount of cost greater than $2.5 million (but not less than zero). Therefore, large businesses that placed in service more than $2.5 million of equipment in a year are unable to take advantage of the IRC §179 deduction.

In addition to §179 expensing, a taxpayer may take advantage of bonus depreciation. Section 13201 of the TCJA temporarily increases the bonus depreciation percentage—also called “special” or “additional allowance” per IRC §168(k)—from 50% to 100% for qualified property placed in service after September 27, 2017, and before January 1, 2023. This essentially allows the entire cost of property to be deducted in the first year.

The bonus depreciation percentage decreases by 20% for each tax year from January 1, 2023, to December 31, 2026, which means bonus depreciation won’t be available for qualified property placed in service after December 31, 2026, unless the IRC is amended. But the TCJA introduced another change to IRC §168(k) that makes “used” qualified property now eligible for the bonus depreciation so long as it “was not used by the taxpayer at any time prior to such acquisition.” Better yet, this provision is permanent.

Because the TCJA made substantial amendments to IRC §168(k), the U.S. Department of the Treasury and the Internal Revenue Service (IRS) issued proposed regulations (REG-104397-18) that were published in the Federal Register on August 8, 2018, to provide guidance regarding bonus depreciation. Pending the issuance of the final regulations, taxpayers may choose to apply these proposed regulations to qualified property acquired and placed in service after September 27, 2017. The proposed regulations follow IRC §168(k)(2) to provide four requirements that depreciable property must meet to be considered qualified:

- The depreciable property must be a specified type;

- The original use of the depreciable property must begin with the taxpayer or be used as depreciable property meeting certain acquisition requirements;

- The taxpayer must place the depreciable property in service within a specified time; and

- The taxpayer must acquire the depreciable property after September 27, 2017.

TO ELECT OR NOT TO ELECT

As a matter of procedure, taxpayers must actively elect to use IRC §179 for any qualified property, and they must actively elect out of bonus depreciation for any qualified property. They can use IRC §179 or bonus depreciation or both provisions on any qualified property they see fit. Thus, decisions need to be made concerning these deduction options. This requires a thorough knowledge of the specifics of the depreciation laws and the eligible property for the depreciation deduction.

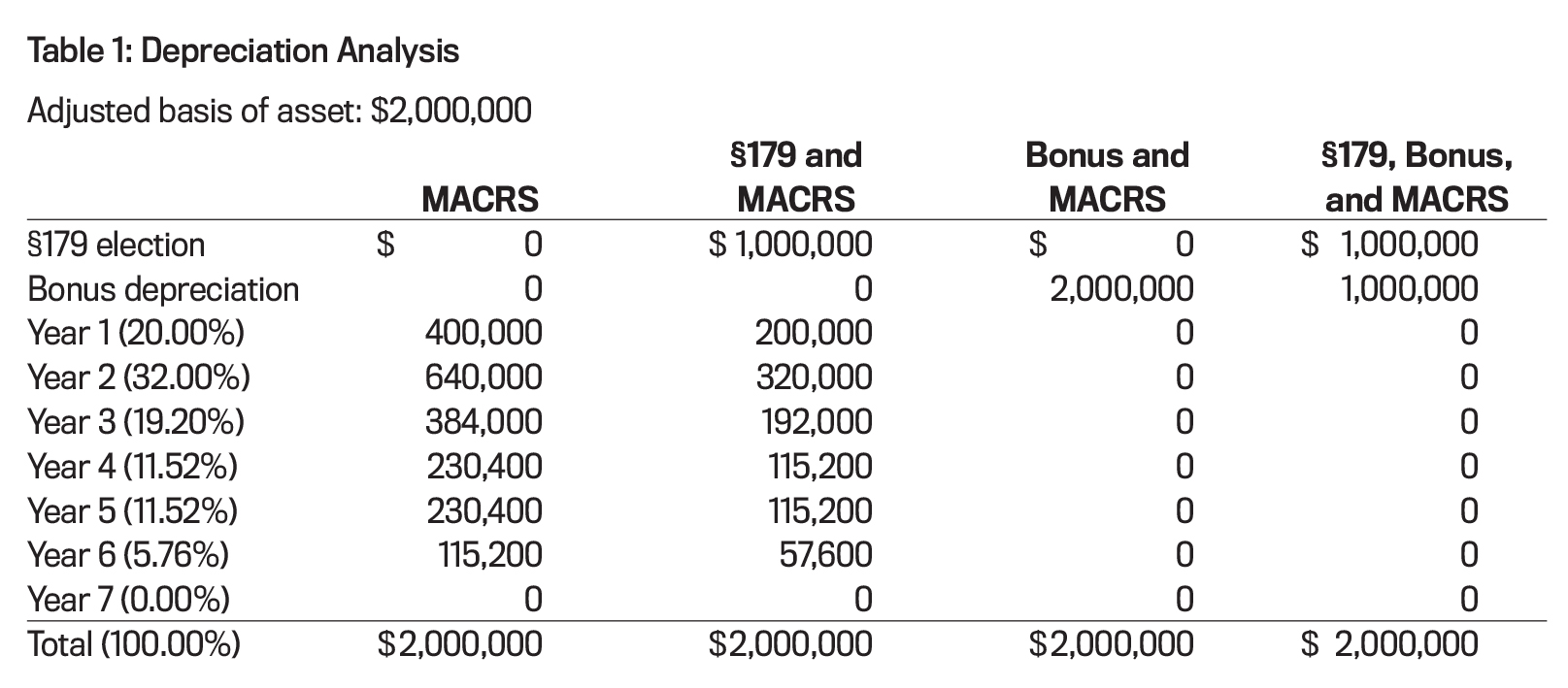

Consider the following example: Jamison purchased a five-year property for $2 million in 2018. What amount of depreciation can Jamison claim under the various options? Here are the potential options, as shown in Table 1:

- MACRS: Jamison could elect out of bonus depreciation and simply use the Modified Accelerated Cost Recovery System (MACRS); or

- §179 and MACRS: Jamison could elect §179, elect out of bonus depreciation, claim up to $1 million, and then use MACRS for the remaining $1 million; or

- Bonus depreciation and MACRS: Jamison could claim up to $2 million of bonus depreciation; or

- §179, bonus depreciation, and MACRS: Jamison could elect §179 up to $1 million and claim up to $1 million of bonus depreciation.

Which election is optimal for the business owner? That’s the challenging question. Unfortunately, you can’t always arrive at the best answer by simply creating a table analysis. Businesses need to consider the expected business tax rates in the future years of the property’s life. If rates are likely to increase, it might be better to delay some of the depreciation via MACRS to later years. Likewise, if rates are likely to decrease, it might be better to maximize the deduction in the current year.

Another issue is whether a net operating loss (NOL) will result by taking too much depreciation in the current year. IRC §172 was changed to amend the NOL rules. Specifically, a taxpayer can no longer carry back a NOL; rather, the NOL must be carried forward indefinitely. Moreover, the NOL deduction is limited to 80% of the taxpayer’s taxable income. Electing the IRC §179 deduction or not electing out of the bonus depreciation deduction may create net operating losses, which could create deferred tax assets that would need to be evaluated for potential use on future financial statements.

By expanding and increasing the IRC §179 deduction and the bonus depreciation deduction, the TCJA has provided the opportunity for small business owners to write off depreciable property faster. Due to the substantial changes made to the tax code, however, many businesses will need additional assistance in determining the optimal use of these tax provisions.

December 2018