Management accounting at its core leverages data coupled with relevant insights to advance the interests of an organization. Breakthroughs in technology have made it much easier for organizations to amass data at levels not imagined a decade ago. Capitalizing on these data assets creates value and competitive advantage, so it’s imperative for business leadership to invest in human and technological capabilities to unlock the value contained within an organization’s data stockpiles.

The convergence of data and technology has created career opportunities in data science that are critical to the evolution of management accounting efficiency and effectiveness.

WHAT IS A DATA SCIENTIST?

Data scientists have the coolest job in business right now—and the one with the most dynamic definition. For simplicity’s sake, there are two critical types of data scientists:

- Business-focused data scientists. Effective business-focused data scientists are a combination of data analyst, business intelligence analyst, statistician, and computer programmer. They can write applications that acquire data, run probabilistic models over the data, interpret the output, and present the results to their audience in a way that benefits the organization.

- Data science engineers. Typically published authors with doctorates, data science engineers write new models and applications used by business data scientists. Often they are self-employed, operating under a consulting arrangement to achieve a defined set of objectives.

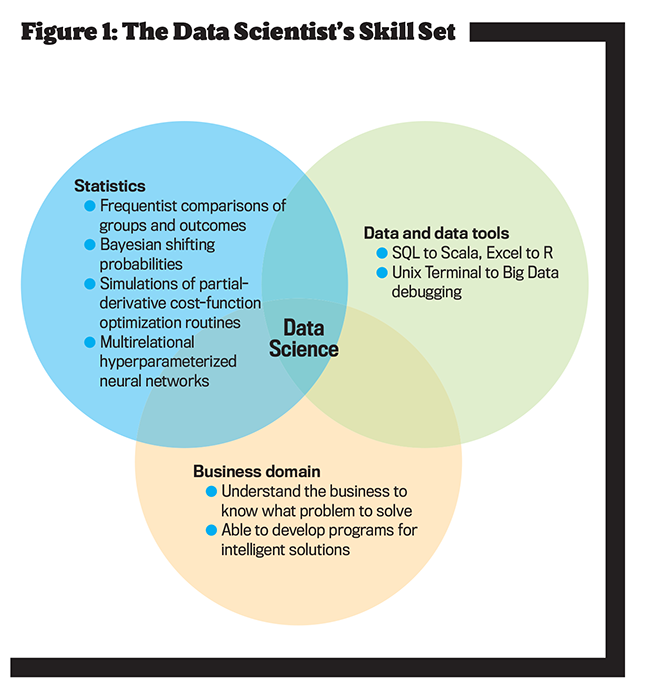

To succeed, business-focused data scientists require a broad set of skills, including capability—but not mastery—in areas covered by reporting and business intelligence specialists (see Figure 1).

The business data scientists’ specialized skills in converting data into information keep them in high demand. As part of an effective data-to-information conversion process, it’s critical that management accountants partner effectively with these experts. Management accountants who embrace the data science evolution (or revolution, some might say) will strengthen their own capabilities to create value within an organization.

MOVING BEYOND "JUST" BUSINESS INTELLIGENCE

For management accounting, what value do data scientists bring to the team? The partnership of business-savvy management accountants with business-focused data scientists can accelerate the data-to-information conversion process: Data scientists can chew up a great deal of data and return only the meaningful parts.

Imagine you need to do a supply chain analysis on customer payments. There are purchase orders, invoices, and payments in your internal transactional system and vendor details in your data warehouse. Data scientists are able to create a program to not only show trends in the order frequency and payment times but also create predictive models to understand the seasonal trends (i.e., the relatively consistent rise and fall of activity during a given time period) for similarly behaving groups of businesses.

With a seasonal model, you can now better predict purchasing for your inventory and budget based on payments. But data scientists don’t stop there. Purchasing is based on more than seasonal trends. To enrich the model, they’d construct web-scraping tools to get general economic indicators like employment and GDP, as well as specific indicators like the vendors’ annual and quarterly reports, the general sentiment of their social media, even the monitoring of news stories to get any data that might impact purchasing behavior, and grabbing any marketing data from internal sources to see how marketing impacted purchasing.

Data scientists would then run a model to see not only how all these different types of data impacted purchasing and payment but also how long they took to impact (this is called “lagging”). For example, it may take a few days or weeks for marketing to make an impact on an order. The dollars spent on marketing for a given day need to be compared to sales, purchases, payment, etc., to find all possible relationships. This forward-looking behavior of data science is why it’s considered predictive analytics. The relationship between a given event and an important value (such as sales) sometime later allows us to understand how an event today will impact performance in the future.

GO EVEN FURTHER

So your data science team has built an amazing series of applications, pulling in data from hundreds of sources and mathematically determining how your business is going to perform. Don’t stop there.

You now know what factors influence your customers, so you need to adjust your inventory based on the predicted order frequency. But why let the procurement department know through a report or email? By the time someone reads that report and decides, the opportunity of the prediction will already have passed. Instead, an analytically mature company allows its data scientists to construct an automated process.

Process automation based on predictive analytics is a quantum leap in analytics maturity that very few organizations attempt, let alone achieve. In our example, depending on the cost/benefit of order size vs. inventory holding cost, a pseudo-Just-in-Time inventory model would be developed with an automated process submitting new purchase orders based on what the customer will order instead of what the customer did order.

At this point, our example begins to move into the territory of the Internet of Things (IOT). The applications begin talking to each other. The predictive model says, “Inventory bot, you need to order 1,000 widgets because celebrity A was seen using a widget in the core demographic,” but the inventory bot would reply, “We have 300 extra widgets from last celebrity prediction; revise the model.” Creating a self-learning or artificially intelligent algorithm frees procurement from worrying about daily operations to instead focus on providing more valuable services such as new vendor identification and contract negotiation.

Management accounting professionals must fully embrace the integration of data, data science, and technology and partner with the experts in the field because it will have a transformational impact on future business and operating models. The limits or barriers on information flow are beginning to crumble. Those who prepare for this change will be at the forefront of accelerating value creation across an enterprise, and management accountants are well-positioned to drive this evolution as thought leaders.

May 2017