The human capital element (also known as employees) within organizations has traditionally been considered a soft cost, difficult to put a price on when it comes to tallying the bottom line. That’s why risk management historically has been viewed as monetizing nonhuman activities that run the gamut of policies, procedures, and planning.

But human beings are involved in all aspects of running a business. People, not processes, are at the core of enterprise risks, and human actions can have far-reaching financial implications and impact a company’s bottom line, market value, and future growth. Any employer whose people fail to follow the company’s policies and procedures knows the resulting havoc that can ensue.

The role of Human Resources in risk management has broadened from regulatory compliance aimed at avoiding lawsuits to include a full range of people-related risks that can undermine your productivity, your business strategy, and your profitability.

There’s no question that HR compliance with government statutes and regulations is essential to the success of—if not the survival of—American business. Making sure you have the right policies and practices in place, along with a strategy to manage and enforce them, helps you manage your company’s risk and protect your organization from liability.

MONETIZING AND MITIGATING YOUR RISK

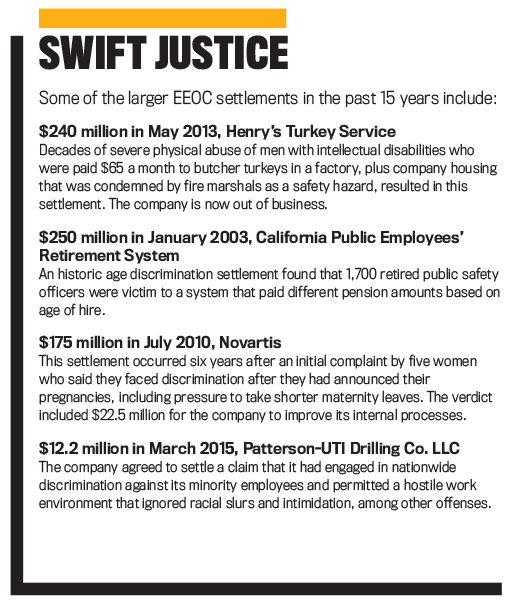

Risk exists in all types of business. In fact, without risk there is no business! Failure to acknowledge and deal with risk because you think it will save your company money is like burying your head in the sand. Think of it this way: How much money do you really save if you open yourself up to a complaint from the Equal Employment Opportunity Commission (EEOC) or to litigation resulting from a charge of harassment, retaliation, or discrimination?

The details of managing employer-related risk are crucial to ensuring your business stays on course. Though questions regarding these laws are endless, here are six areas to which you need to pay close attention.

1. WORKERS’ COMPENSATION

It’s easy to put a dollar figure on the number of hours lost to an employee’s injury or accident. You can further calculate costs based on open and close dates of medical claims. Yet those dollars show only a part of the financial hit you may be taking.

Your experience modification rate (EMR) is a number insurance companies use to gauge past cost of injuries as well as future risk. It tells insurance carriers how the rate of your company’s workers’ compensation claims compares to that of other companies. The lower the number for your business, the lower your workers’ compensation premiums may be.

Your EMR is unique to your company, and it has a strong financial impact on your workers’ comp costs. The formula to determine EMR typically considers number of claims, business size, and business classification, along with other factors, to determine expected losses. Expected losses are then compared with actual losses over a given time frame (usually three years) to develop your EMR from a neutral base number of 1. Insurance carriers typically multiply your workers’ comp premiums by your EMR to determine the premium your business will pay.

This is why similar businesses may pay vastly different amounts for workers’ compensation coverage. But there are ways to lower your risk and save money. Consider a company that manufactures replacement parts for appliances. It has an EMR of 210, which is considered fairly high for its industry. Of the 167 workers’ comp claims filed in one year, the company had a 70% litigation rate related to those claims. Initially, no attempt was made to determine whether a pattern existed.

A later internal investigation showed that the majority of incidents giving rise to litigated claims occurred on the early morning shift, in the same area of the company, under the same supervisor. When the supervisor on this team filed a claim for herself, it seemed apparent that the problems stemmed from her. The offending supervisor ended up resigning, safety training increased, and the number of incidents and claims dropped dramatically to only 10 the next year.

How to Lessen Your Risk: Listen to your employees. Talk with them when they have complaints to help identify where you may have potential problems. If similar complaints arise, find out if there’s a better way of addressing that issue. Investigate immediately when a claim or injury occurs: Was equipment being used correctly? Were proper ergonomics in place? Had employees been trained adequately?

If an injury or accident happens, halt the work and hold a safety meeting immediately, if possible. It may cut into your work process for the day, but training that addresses the specific incident—at the time it happens—will benefit your company in the long run, with fewer claims and lower workers’ compensation premiums as your EMR drops.

2. SAFETY AND OSHA

Reducing your EMR and workers’ comp premiums is a good start on risk management, but you also have responsibility as an employer to maintain a safe work environment. The Occupational Safety and Health Administration (OSHA) monitors workplace safety and health programs, and it’s charged with finding and fixing workplace hazards to prevent on-the-job injuries and illnesses.

OSHA conducts periodic reviews of all businesses, and the higher your EMR, the more likely that it will be a frequent visitor to your company. And if even a single employee calls the agency with a serious complaint, an investigation will ensue. If the complaint is found to be valid, a couple of things may happen: OSHA may tell you to fix the problem, or it may tell you to fix the problem and also will fine your company for the violation. Either way, its representatives will be back to ensure that the problem no longer exists—or to levy stiffer financial penalties if violations are still occurring.

Not surprisingly, workplace health and safety violations, and exposure to OSHA rules and regulations, occur more frequently for some industries—construction as opposed to a computer-based environment, for instance—but all employers must practice due diligence to ensure the well-being of their employees.

How to Lessen Your Risk: If you notice safety or personal violations occurring (damage to equipment or to employees’ personal property, for example), stay aware and be observant. By tracking incidents, you’ll be able to calculate what these violations cost your business. You should also record the time spent on safety and training meetings that cut into your workday: Keep track of how many meetings are held, how long they last, and how many employees attend them. This is critical to mitigating workplace risk because, through these measures, you can calculate the cost of time spent in response to incidents.

Above all, don’t be tempted to ignore or push aside any OSHA mandates or fines because of changes in Washington, D.C. Though the current U.S. Congress has promised fewer federal regulations, including those that govern the workplace, the Department of Labor (DOL) has noted that the agency’s enforcement methods haven’t changed and that it remains committed to workplace safety issues. Failing to correct violations or pay fines is setting your company up for further penalties.

3. EEOC ISSUES

Like OSHA, the EEOC depends on federal funding to hire people to investigate complaints and may see its budget reduced. But that doesn’t mean that complaints to the agency or fines levied by it can be sloughed off or ignored.

Fines for a harassment or discrimination claim never go away until the problem is corrected. In other words, additional fines will be levied on top of existing fines for as long as the violation occurs. And if an investigation finds that a culture of harassment exists in your workplace, those penalties and fines can broaden to include not just current employees but former employees as well.

When an employee contacts the EEOC with a claim of harassment or discrimination, there will likely be an investigation. When the EEOC requests a response from an employer, it doesn’t mean that the agency is accusing your company of wrongdoing. But the Commission won’t tell an employee that he or she doesn’t have a valid claim (in a case of “he said, she said”) and at the very least will issue that employee a “right to sue” letter that an attorney can use to begin litigation against the offending employer.

How to Lessen Your Risk: Your company’s best defense against claims of discrimination or harassment is to show that you had a policy in place regarding discrimination or harassment, an avenue for employees to report either of these, and that once your company became aware of the concern, you undertook a prompt and thorough investigation and addressed any issues.

Ensure that your employees have completed anti-discrimination and harassment training and that supervisors are trained on effective employee coaching and counseling—important steps to reducing liability.

Create an open-door policy for communication between employees and supervisors, and train your supervisors how to respond to complaints. Conduct exit interviews, and look at your turnover data. If you see possible issues, ask questions. Find out what’s happening, and determine the cause. Make sure your company culture and the actions that your leadership team takes foster an atmosphere of respect, loyalty, and enjoyment.

Fix your company culture before there’s a problem. Assess the values and experiences that shape your current culture. Identify strategies and practices that will maximize your company’s strengths and create a positive, thriving environment.

4. EMPLOYEE RELATIONS

Success is all about your people. A well-developed strategy and a growth-minded company culture help attract top talent who are likely to remain with your company, lessening the financial impact of high turnover and costs to replace good employees.

Here’s an example of how one company, which we’ll call XYZ Cable, took a fresh look at its employees and turned around the high turnover rate.

XYZ had a lot of employees who were unhappy and leaving the company. This stemmed from a culture where employees were expected to drive close to 150 miles per day round-trip to do their jobs, were required to use their personal vehicles, and were made to pay for their own gas, which at the time was nearing $4 a gallon.

Many of these employees were paid minimum wage or barely above it and couldn’t afford to work for XYZ under these conditions. So they left, and the turnover rate topped 200% a year. A consultant suggested that the company conduct an employee survey to shed light on the situation and provide some honest feedback.

As expected, many of the comments were scathing. To its credit, however, XYZ responded to its employees’ concerns and began looking for affordable ways to help improve the situation. A reward program was put into place. When employees had perfect attendance for a predetermined number of days, for example, they would receive a $50 gas card—not a large expense for XYZ but enough of an incentive to employees that the turnover rate began dropping immediately.

How to Lessen Your Risk: Employees need to understand exactly how their work contributes to your organization in order to have a strong commitment to your company. When you develop a plan to measure, track, and reward individual employee performance, you’ll be able to articulate how every position supports your growth and helps your company create a competitive advantage. The result is improved performance and productivity, and you have a better workforce when you provide the training and support your employees need to improve in their jobs.

Listen to your employees’ feedback and concerns, and do some research to find what motivates them. It isn’t always more money. Develop a reward-and-recognition program to acknowledge the contributions your employees make to your organization because a happy, stable, engaged, and committed workforce helps improve your profitability.

5. EMPLOYEE CLASSIFICATION

The DOL and the Internal Revenue Service (IRS) always watch businesses and how they classify employees. Specifically, the IRS focuses on whether individuals providing services are properly classified as employees or independent contractors. The DOL seeks to ensure that employees are properly classified as exempt or nonexempt workers.

How you classify employees affects your compliance with state and federal tax laws, rules regarding overtime pay, and the Fair Labor Standards Act (FLSA). Misclassifying employees can mean hefty fines for your business.

Companies sometimes hope to treat employees as independent contractors to avoid the obligations of paying for employment benefits and taxes. If the DOL or the IRS finds an overabundance of independent contractors working for your business, they’re more likely to perform an audit, costing you time away from business to cooperate with their investigation.

To determine classifications, you have to look at the employee’s specific duties and how they measure up. Employees who are misclassified as exempt and work unpaid overtime may be entitled to back pay. If your company doesn’t keep detailed and accurate payroll records, the DOL will likely take the employee’s word, putting the company on the hook for one-and-a-half times overtime pay for hours the employee claims he or she worked, as well as other applicable penalties.

Depending on the severity of the claim and the DOL judgment, a claim by even a single employee can potentially cripple your business financially. Proper classification is vital and also somewhat complex.

How to Lessen Your Risk: Review your employees’ classifications regularly because your job descriptions may be out of date or inaccurate. Job duties help determine how an employee is classified, but job titles don’t determine exempt status. Guidance on proper employee classification is available from the DOL’s Wage and Hour Division.

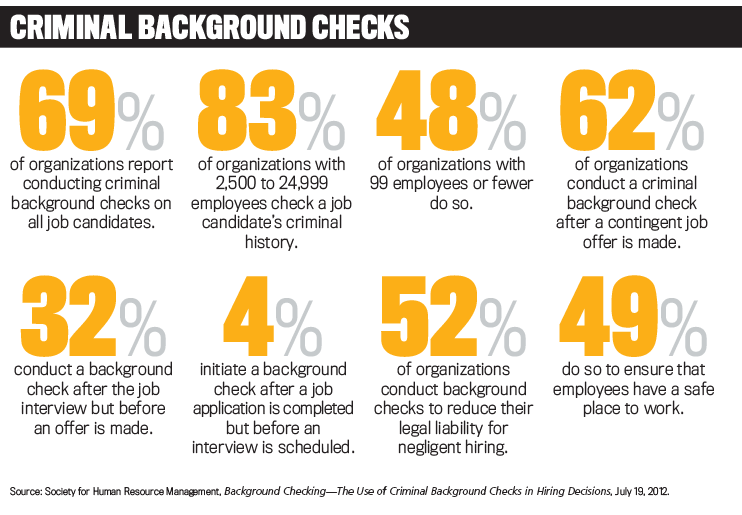

6. PRE-EMPLOYMENT SCREENING

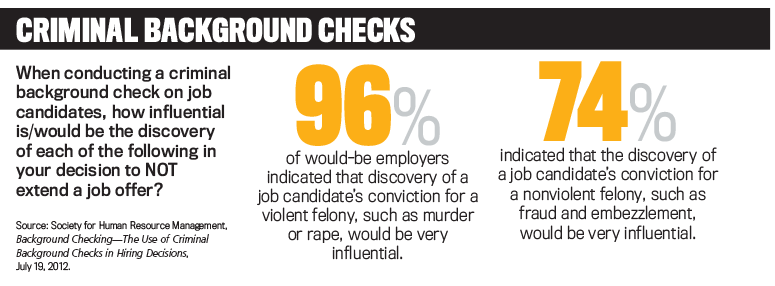

While it’s difficult to put a dollar figure on something that hasn’t happened yet, the well-being and safety of you and your employees isn’t something to be monetized or trivialized, especially when it comes to spending on pre-employment background checks.

If your company isn’t screening employees properly and an event like fraud or workplace violence occurs, your company may be held responsible for negligent hiring and face hefty penalties and/or damages.

Screening guidelines should be developed for your company’s specific needs, taking into consideration industry requirements, state and federal laws, and local ordinances. Background checks should be run only on items pertinent to the job description—tasks that require the handling of money, for example—but be sure you run the same check on all applicants for the same position to avoid charges of discrimination or bias.

In 2012, Pepsi Beverages agreed to pay $3.1 million and provide job offers and training to resolve a charge of race discrimination stemming from a criminal background check policy that unfairly discriminated against more than 300 African-American applicants who had been arrested and had pending criminal charges against them. All were denied permanent jobs, even if they hadn’t been convicted of an offense. In its ruling, the EEOC said the policy violated Title VII of the Civil Rights Act of 1964, which makes it a crime to discriminate on the basis of sex, race, color, national origin, and religion.

How to Lessen Your Risk: If you’re tempted to forego the time and the money of a background check—which is usually a nominal cost—think again. If the accountant you hire because you think he’s a great guy ends up embezzling funds, it’s hard to say whether a background check would have prevented the theft, but it might have revealed issues that made you think twice before hiring him. Likewise, if an applicant was convicted for cocaine possession 10 years ago, yet subsequently has a clean record and you reject him or her, you might have missed out on a good employee.

In other words, don’t automatically disqualify people from being hired who may have made a mistake in the past. Offenses should be weighed against the specific job role. There are three factors that are relevant to assessing whether an individual should be excluded based on a criminal record, including the nature of the conviction, how long it has been since the crime occurred, and the relationship to the position.

The EEOC’s guidance on using arrest and conviction records in employment decisions provides additional factors in conducting an individualized assessment. You can find those on the EEOC’s website.

STAY VIGILANT!

As you can see, risk management is a serious responsibility for any company, large or small. The regulatory environment is increasingly complex, as are the financial penalties for organizations that fail to comply. Standardized procedures provide operational continuity and give you data that helps you make better risk-mitigation decisions. Reduced exposure to risk can help save your company money and provide you with peace of mind, knowing that you’re up to date with the many compliance regulations and requirements.

And as you’ve also seen, pre-employment screening can save your company time, money, and trouble, making it doubly valuable as a smart business expense and a wise investment in your business.

Finally, your company’s HR practices and procedures are your best defense against exposure to unnecessary risk. Don’t take them lightly! Moreover, your organization’s reputation with regard to how it treats its most important asset—human capital—rests on your ability to distill the laws, regulations, and guidelines into a corporate culture that puts employees first.

Should You Run Credit Checks on Applicants?

You’re ready to make an offer to a mid-level accountant who comes to you from a competing firm across town. You’ve done a criminal background check, which showed nothing of concern, but what about a credit check? After all, this person will be responsible for tracking large amounts of corporate funds, so wouldn’t it make sense to get a glimpse into how he handles his own money?

Even if you think that’s a wise step to take, several states have laws restricting or prohibiting the use of credit checks. Some states require written notice to the applicant or employee that a credit check is being requested, based on certain job-related duties, as prescribed by local, state, or federal law.

Courts have ruled that certain types of background checks may have an adverse impact on certain demographics, referring to employment practices that appear neutral but have a discriminatory effect on a protected group.

As early as 2010, the Equal Employment Opportunity Commission began exploring the use of credit checks for employment screening and whether that could have a disparate impact on protected classes of people. That year, the EEOC filed a discrimination lawsuit claiming that an employer allegedly rejected applicants based on their credit history but in reality was using the checks to unlawfully discriminate against applicants because of their race, which violates Title VII of the Civil Rights Act of 1964.

Bottom Line: Unless you’re hiring someone who’s working directly with money, it may be best to skip the credit check.

That said, use extreme caution with credit reports, and be aware of federal and state laws as well as your obligations as an employer under those laws. If you choose to run credit checks on job applicants, there should be a clear business justification for it, and it must be necessary for the role in question.

June 2017