Exploring industry issues such as the demand for quality entry-level accountants outstripping the supply of such accountants, Thomson points to factors such as an imperfect fit of the skills taught in university accounting programs vs. what entry-level management accountants need and the tendency of new accounting graduates to begin their career at a public accounting firm instead of starting in industry. This, in turn, affects the number of qualified entry-level management accountants.

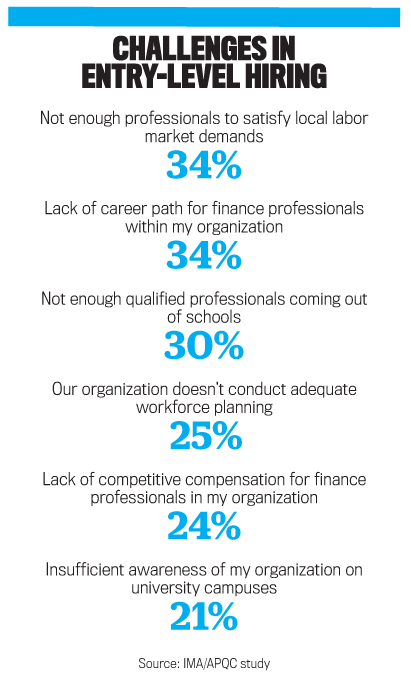

Likewise, The Skills Gap in Entry-Level Management Accounting and Finance, a study sponsored by IMA and the American Productivity & Quality Center (APQC), identifies multiple deficiency gaps between the skills that employers want to see in entry-level accountants and the skills those accountants actually possess.

These articles and others raise important questions: What steps can management accounting professionals take to more closely align the skills possessed by new accountants graduating from four- and five-year accounting programs with the skills needed on the job? And what can those in management accounting do to improve the hiring and retention policies for companies looking to hire these graduates into management accounting positions?

In our 52 years in the management accounting industry, we have hired and supervised hundreds of management accountants. Now, as accounting educators, we have taught hundreds of such future accountants. Our experience has led us to conclude that not only is there a need to improve hiring and retention programs for entry-level accountants, but the skills gap between the actual and ideal entry-level accountant must be closed. Here are eight suggestions that could help you, as a management accountant in industry, improve the quality of new hires.

SUGGESTION #1: Improve communication between schools and businesses.

The skills gaps detailed in the IMA/APQC study are extensive. Of the six top gaps cited, leadership, strategic thinking and execution, and change management are high-level skills that would be standard goals in most business degree programs. The other top skills gaps—planning, budgeting, and forecasting; cost management; and internal financial reporting/performance management—are more closely associated with accounting programs. A perusal of the typical objectives of most properly accredited accounting programs finds many, if not all, of these addressed in the accounting program. Why, then, do gaps still exist?

Educators are expected to please many groups when putting together their courses. This can involve meeting objectives set at a number of different levels, including the school of business, the university level, and the accrediting body, as well as objectives needed to meet professional exam requirements, to name a few. The university accreditation drives many of the curriculum decisions, and changing accreditation requirements will always be a challenge. Educators are very good at achieving objectives like these when they’re told to do so. If the skills gaps are communicated to the school more effectively, addressing them can become part of a course objective.

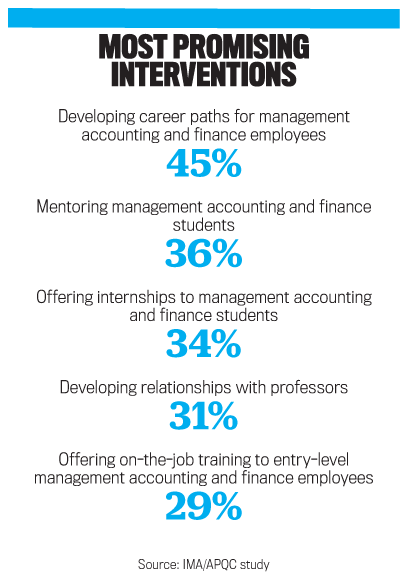

Communication between industry and the school can also be improved through company participation on school advisory committees or meetings with school administration and faculty. A number of corporations have had success with hosting a “faculty day” at a corporate facility. Having faculty at your facility creates a captive audience that’s ready to learn about your company. They can obtain your input and give you feedback about the formation of the next generation of management accountants.

As an aside, you’ll likely find more accounting faculty know your state’s requirements for the CPA (Certified Public Accountant) exam than they do the CMA® (Certified Management Accountant) exam requirements. You’ll also probably find more CPAs than CMAs on the school’s advisory committees. This CPA advantage didn’t materialize overnight. To get something changed in academia, it often pays to be the squeaky wheel. Be that squeaky wheel.

Here are some other possible solutions. A joint business/university effort to add a management accounting degree or a certificate program at your chosen school isn’t out of the question. Many times the largest impediment to accomplishing this is the school’s budget. Such programs or certificates can likely be built on a core of existing courses offered. But more courses may need to be added to the curriculum. Offers by industry to fund programs, faculty chairs, and scholarships will help sell such programs when you get that sit-down meeting with the business school dean.

SUGGESTION #2: It isn’t all about pay.

When examining the well-tuned recruitment machines operated by national accounting firms, you will quickly see it’s much more than just throwing money at students. In many cases, the benefits are more important to students than the actual pay. A consideration of work-life balance is instructive to this point. It isn’t hard for an accounting firm to capture the attention of a junior in accounting when it tells him or her that the firm offers 20-plus days off work annually, with pay, beginning in the first year of work. Likewise, it’s music to the ears of a senior in accounting with a pile of student loans to learn that the firm pays the cost of a CPA prep course, the cost of the CPA exam, and a bonus for passing.

Benefits offered by many national accounting firms are tough to compete with. Besides the benefits already mentioned, programs such as structured leadership and training programs score with new graduates as well. The response by industry must be multipronged. First, even if you aren’t interested in your newly hired accountant becoming a CPA or CMA, you should still have some incentive-based program in place to counter big accounting firm programs. Second, every company is different, but there’s almost always some dimension of work-life balance that your company does better than the competition. That dimension should be emphasized. Finally, you may have benefits the competition can’t match. As an example, some young accountants may not be joining your company because of your stock ownership program or your 401(k), but they are accountants and know what those things are. Be creative with benefits when you can.

SUGGESTION #3: It’s all about the internship.

Internships have emerged as the quintessential opportunity for companies and students to “test-drive” each other prior to making a firm hiring decision. A recent Michigan State University Recruiting Trends report cited internships as the key recruiting strategy. Internships were also at the top of its list of important campus activities, ahead of study abroad, leadership roles, and civic engagement.

Challenging internships that expose students to multiple facets of the company operations and provide meaningful work experience are a company’s best chance to secure the management accounting student they want. Schools like Washburn University in Topeka, Kan., where we teach, promote professional internships, offer college credit in many situations, and keep the employer administration burden to a minimum. Accounting firms have seized the concept and normally make the majority of their permanent job offers to those in their intern pool. Internships that once lasted a semester have grown into open-ended internships whereby companies lock in a commitment from the best students for multiple years until they graduate. Depending on the location of the company and the campus, internships can be full-time summer positions, full-time spring or fall positions (where the students take a break from school), or part-time opportunities during the school year.

With such fierce competition, companies are recruiting earlier to secure the best interns. Sophomore internships are now common for the best students, with many of the remaining students securing internships in their junior year. Wages are market-based. The Michigan State Recruiting Trends study found that, in the United States, most internships paid $10-$15 per hour for all degrees. Yet according to Glassdoor.com, national accounting firms and those industries competing with them for accounting interns commonly pay in excess of $25 per hour.

SUGGESTION #4: Help increase the size of the pie.

If your industry is hiring a less-than-desired percentage of new graduates because of a bias toward public accounting firms, you obviously want to take steps to increase this percentage. But similar results can be reached by increasing the number of students in accounting programs or other programs from where you recruit (that is, 10% of 150 is greater than 10% of 100). The number of students in these programs trends up and down over time. The AICPA (American Institute of Certified Public Accountants) recognized this fact years ago and established the Accounting Education Center to introduce high school students to accounting and to the AICPA. Industry efforts through organizations like IMA should help the cause but won’t yield overnight results.

Recruiting beyond the tried-and-true accounting major pool of graduates also should be considered. The pool of finance degree graduates is a much more lightly “mined” group of analytically trained young professionals. Finance students have biases when they interview for their first job, too, but only so many openings are out there for these graduates to conquer Wall Street.

Increasing the pool of hirable students may also require industry to fund a program richer in accounting coursework that graduates managerial finance majors or awards certificates. The axiom that “It is easier to make an accountant into a finance professional than it is to make a finance professional into an accountant” doesn’t have to be true!

SUGGESTION #5: Rethink how, where, and when you recruit.

The days of lengthy on-campus interview schedules aren’t entirely a thing of the past, but other venues are much more pronounced now. Online job postings on employer and university career service websites are a must. Third-party job-search site usage by students is growing, too. That said, face-to-face contact isn’t a thing of the past. Multiple opportunities for in-person contact exist on campus today, but you can’t rely solely on them.

If you’re a well-known employer and have historically been a successful recruiter on campus, having a mixer at the student union or staff at a table in the business school lobby are two inexpensive ways to meet students. If you are a less-well-known or smaller-scale recruiter on campus, such events don’t work as well and are more prone to have light student attendance. In those cases, having a table at the university career fair, volunteering to speak to a class, presenting to a business or accounting club, or having a booth at a Beta Alpha Psi Meet the Firms event work well. Use alumni from the school where you’re recruiting, and get them involved as soon as you can.

In all cases, recruitment is a multiyear investment. You may spend several years getting your name out at career fairs and university events before you get that first intern or permanent employee. Remember: These steps maximize your exposure to students. Then you still need to formally interview them either on campus or in your office.

SUGGESTION #6: Don’t be cheap.

That freshly minted accounting or finance major—or even the top-drawer intern—can be a challenge to hire. The best students will definitely have their choice of offers in the market today. They will be looking for the job that provides interesting, challenging work with opportunities for growth. Culture will be important, as will work-life balance. But when all is said and done, there has to be an enticing monetary component—the starting salary. In the case of starting salary, the offer should be market-based. Don’t be cheap; you won’t likely get a second chance. If you want to hire the best, expect to offer salaries in line with the best employers in the region. If your market requires signing bonuses for interns or employees, prepare to pay them. As mentioned before, benefit packages vary. If you have an advantage there, definitely make it a highly visible part of your offer. If benefits aren’t to your advantage, still accentuate the strongest parts of your package.

SUGGESTION #7: Remember that they think differently than you do.

You’ve probably already read more articles about hiring, motivating, and retaining Millennials than you care to admit. Having said that, it’s also dangerous to throw everyone of that age group into a single category as they come in all types and mind-sets. Yes, they were raised on technology, but, believe it or not, most of them know it’s rude to have your smartphone out in the office. And, no, they aren’t likely to think their first job will be their last. But an offsetting phenomenon often occurs: Young accountants today are so well-connected through social media to their friends, classmates, and yet-to-graduate accountants that if your company is viewed as a good place to work, everyone will soon know it. In those cases, you’ll find hiring the second management accountant from a specific school much easier than the process for the first hire from there.

Just like you, these up-and-coming accountants come with lifestyle and career predispositions. On the lifestyle side, partialities include social awareness, the environment, and work-life balance. On the career side, these include the biases for accountants to begin their careers at a national accounting firm and the finance majors to begin their conquest of the world on Wall Street. Right now, some of you are probably smiling as you wonder how work-life balance and national accounting firms and Wall Street coexist, but they do. These employers have studied the same Millennials you have and have crafted programs to get them hired, motivated, and producing. You can, too.

SUGGESTION #8: Demonstrate a career path.

If you poll the top 50% of accounting seniors in most universities, you’ll find most have a working knowledge of CPA firm progression levels (and if they’re honest with you, when they intend to step off the CPA career path, if that’s their intent). A similar accounting senior poll on management accounting career paths would indicate a less-informed student body. It’s true that management accounting career tracks are much less linear and more difficult to predict than career tracks at accounting firms. But in many ways, that’s the beauty of a management accounting career. Starting a career in one department in industry can lead to multiple opportunities following vertical, horizontal, and diagonal promotions. You’ll have limited opportunities to show this to students graphically. Waiting until the senior interview to discuss career paths is much too late.

A discussion of career tracks would also be incomplete without the discussion of four-year vs. five-year accounting programs. State requirements for the CPA have caused many schools to expand their accounting programs to be five-year programs with master’s degrees in accounting commonly folded into the educational outcome. The addition of the fifth year of education has allowed schools to broaden course offerings and internships and graduate more well-rounded, mature students. But many schools still offer four-year accounting degrees (alongside five-year degrees). While they likely leave the student ineligible to become a CPA, they still produce a solid student with degree in hand. A number of corporations have successfully targeted this group of students. Such an approach commonly involves a company job offer with an accompanying offer to fund an evening or online graduate degree at an accredited university, to be completed after the student starts the job.

During any academic career, students receive considerable advice on the benefits of passing the CPA exam—and to some extent the CMA exam, Certified Internal Auditor (CIA) exam, or other professional exams. Regardless of a recruiter’s opinions, it goes without saying that negative comments about any of the certifications hurt the firm during the recruitment process. Put another way, what do you think your odds are of hiring a student who has worked hard for five years to get to that degree and job offer (and certification) and then is told during the job interview the certification is unimportant? The best approach is a thoughtful, balanced approach that speaks to the quality of certifications and encourages students to follow their passion to attain the certification desired.

Opinions expressed in this article are the authors’ alone and do not reflect the views of their former employers in industry or those of their current employers in education.

June 2017