Based in Austin, Texas, BabyFreedom produces a line of organic-certified clothing for infants and children. The company founder and president, Jennifer Thurman, started making the clothing when her niece was born with extreme sensitivity to the chemicals and dyes used in commercial children’s clothing. The organic clothing led to dramatic improvements in her niece’s condition. Jennifer then began to receive requests for her clothing from the neonatal intensive care unit (NICU) of the local children’s hospital and from parents referred by her niece’s pediatrician. As these requests increased, Jennifer rented a small office and production area in a commercial park, hired her first employees, and started commercial production of the clothing. Within two years, a full-time accountant and controller, an operations manager, and a marketing and sales manager were hired.

COMPANY INFO

BabyFreedom considers itself to be a mission-driven and stakeholder-focused organization. The company’s mission statement identifies three primary stakeholder groups: customers, business partners, and employees.

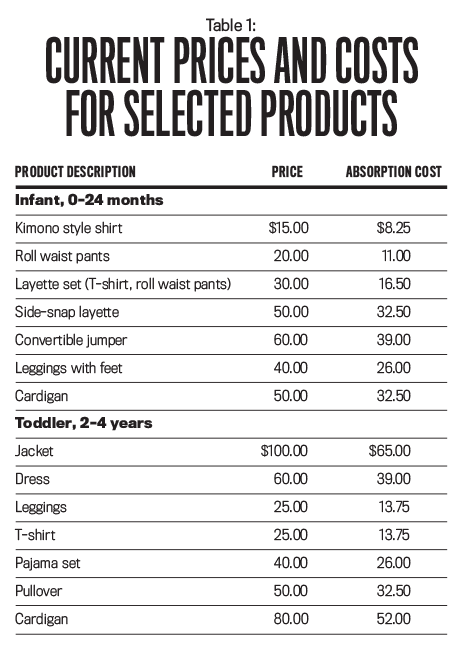

The company’s primary market is “medically necessary” clothing, subdivided into NICU and home orders, with both providing the option to customize clothing to accommodate medical devices. BabyFreedom’s management team is also developing a “natural clothing” product line to complement the medical market. Marketed primarily to parents interested in sustainably sourced and organically produced products, the natural clothing line for children is the fastest-growing market segment with a projected potential demand greater than the combined “medically necessary” segments. Table 1 presents a list of the most popular clothing items, their sales prices, and their costs.

Customers are extremely loyal to the company. Surveys indicate that customers greatly value ethical, trustworthy companies that are socially and environmentally responsible and that they perceive BabyFreedom to have those qualities. Customers for the natural clothing line (nonmedically necessary) are especially concerned with issues of sustainability, fair trade, and social responsibility. To address these concerns, BabyFreedom’s website includes a great deal of information about its suppliers and employees, including photos and interviews. The company also regularly solicits customer comments and suggestions on its website and from flyers included with product packaging.

Throughout its existence, BabyFreedom has emphasized good relationships with suppliers. It also maintains a policy of selecting suppliers with reputations for being ethical and socially responsible. To that end, company managers regularly visit supplier sites and make a point of speaking with employees there to ensure the suppliers’ reputations are based on fact. The suppliers tend to be smaller, family-run businesses, and BabyFreedom is usually their largest customer. To ensure reliability of supply and to build strong supplier relationships, BabyFreedom pays a premium for high-quality materials.

The company also has a reputation for being an excellent place to work. Jennifer insists on safe, comfortable working conditions and provides healthcare coverage for all employees. The employees are mostly Mexican and Asian immigrant women, often with small children, and BabyFreedom provides a company daycare room for preschool children and an after-school tutor for school-age children. Workers also are encouraged to continue their education. As a result of this culture, voluntary turnover at the company is almost nonexistent, and several production workers have taken on increasing responsibility in staff functions in accounting, supply chain management, and operations.

OPERATIONS AND INFORMATION TECHNOLOGY INFRASTRUCTURE

BabyFreedom leases a large building with combined production, warehouse, and office space in a small industrial park. The production process is very labor-intensive. Although product demand is high and increasing, it isn’t high enough to justify an investment in highly automated production. Furthermore, an automated system can’t handle the frequent customization required for the “medically necessary” clothing.

The company has a small administrative staff and a single production shift currently working at full capacity. BabyFreedom is in the process of hiring and training a small second shift with plans to reach full strength within three years. Because the company is fiscally conservative and has a policy of avoiding layoffs, production continues at a steady rate throughout the year, with minimal fluctuations in the volume of finished goods inventory. Since the special materials are so critical to BabyFreedom’s product lines, raw materials inventory includes large safety stocks.

During the previous year, management focused on the need to improve efficiency in both production and inventory management. A key piece in this effort was upgrading BabyFreedom’s computer systems. The old systems had been added piecemeal as the company grew, and it was difficult to share information among the inventory management, production scheduling, accounting, and customer management programs. In response, BabyFreedom has recently invested in a new, integrated system that can collect, share, and store data across all departments. The new system can also interface with BabyFreedom’s internet sales portal and with the website used by BabyFreedom’s shipping company. The goal is to have the new system fully integrated and operational before the new second shift reaches full strength.

Currently, the new accounting and customer relationship management (CRM) modules are working well. There are still issues with the inventory management and production planning modules since BabyFreedom’s small suppliers don’t have the ability to integrate with the company’s computer systems. As a result, incoming shipments must still be inspected, compared to invoices and purchase orders, and then manually entered into the inventory module. The operations manager is testing bar code readers as a way to automate this process. Once bar codes are integrated into the new inventory management module, BabyFreedom plans to help its suppliers begin bar-coding shipments by supplying the special printers and labelers. This will allow BabyFreedom to quickly link the inventory module to both the production scheduling and accounting modules.

PRICES AND COST STRUCTURE

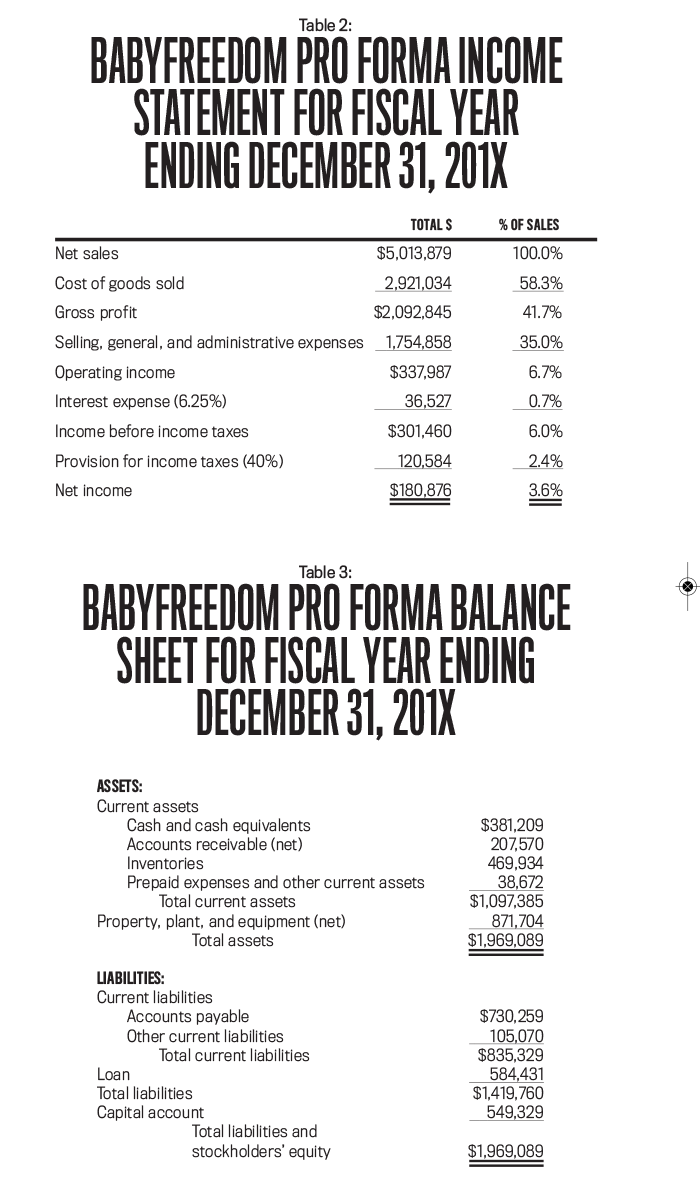

BabyFreedom carefully sources its raw materials to ensure that they haven’t been exposed to chemicals at any point in the growing, harvesting, dyeing, or weaving process. Because these materials are costlier to produce and process, and because the suppliers are small, independent companies, BabyFreedom’s material costs are greater than those experienced by manufacturers of standard children’s clothing. The labor-intensive nature of the manufacturing process as well as the company’s commitment to a living wage, healthcare, and socially responsible employee benefits contribute to higher labor and overhead costs. As a result, BabyFreedom’s prices are higher than those associated with regular children’s clothing. Nevertheless, the company tries to keep profit margins low (less than 5%) to make the clothing as affordable as possible while still ensuring it can maintain its social responsibility initiatives and reputation for a high-quality product. Based on current operations and plans, BabyFreedom’s management team created a pro forma income statement and balance sheet for the coming year, as shown in Tables 2 and 3. But then an exciting new offer was made that could change everything.

THE NEW OPPORTUNITY: A MAJOR OFFER FROM WALMART

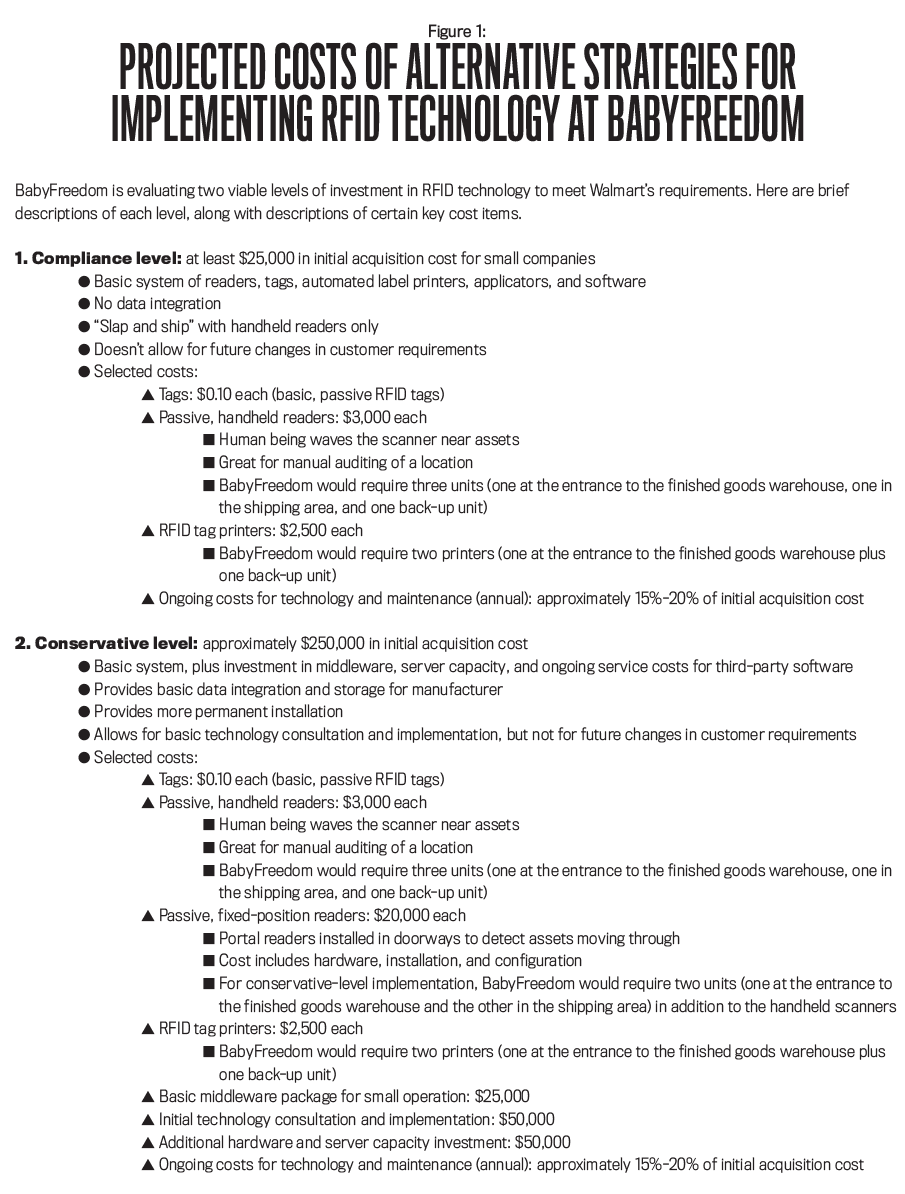

Toward the end of the current year, Walmart approached BabyFreedom about carrying the natural children’s clothing line in its stores. The potential business with Walmart would nearly double sales volume, but some changes would be required. Walmart is heavily invested in Radio Frequency Identification (RFID) technology in its distribution chain and requires all suppliers to use the technology. To accept the contract with Walmart, BabyFreedom would have to invest in and implement RFID technology, at least at a basic tagging level, and Walmart wouldn’t help with this cost. Further, BabyFreedom couldn’t increase clothing prices to cover the increased cost since Walmart also would require prices to be lowered significantly (sector apparel gross margin percentages are approximately 46.4%; Walmart would mandate reductions to 29.8%). The new lower prices would effectively eliminate profit margins, and BabyFreedom would have to reduce or eliminate its employee benefits and social responsibility programs.

To meet demand for both the Walmart contract and sales through current channels, BabyFreedom would have to increase production capacity significantly. The new increased demand could be met by bringing on a full second shift immediately and gradually adding a third shift. It’s estimated that using three shifts would provide enough production capacity for the next five years; after that, the company would need to lease additional production facilities and expand shift size.

The RFID tags could be integrated into the new system, either in addition to or instead of the bar code readers. Both systems could provide the data necessary to manage inventories. They also would provide more detailed data that would enable BabyFreedom to allocate shared costs across product lines more accurately. With a little assistance, BabyFreedom’s suppliers could begin effectively using printed bar codes; the suppliers wouldn’t be able to adopt RFID technology. As a result, BabyFreedom employees would need to scan the bar codes at the dock and then manually apply RFID tags.

Realistically, over at least the next five years, the company would be able to afford only the most basic “slap and ship” implementation of RFID technology, where a supplier simply attaches an RFID tag programmed with basic information prior to shipping the product to the retailer (with no attempt by the supplier to capture, analyze, or store data generated by the RFID tag). Though this would comply with the Walmart mandate, BabyFreedom would be unable to use the large quantity of data the RFID tags generate. To do that, it would need to purchase middleware—software that enables communication and management of data in distributed applications—and make expensive upgrades to the new inventory module while significantly expanding server capacity. It’s doubtful BabyFreedom would use the full level of detail generated by RFID; the company needs only basic data that could also be provided by bar code readers. Figure 1 presents basic information for the cost of both implementation options.

Walmart’s offer is for an initial contract of five years with a subsequent renewal option. BabyFreedom’s projected net cash flows for the five-year contract period, given a 40% tax rate and a 6.25% weighted average cost of capital (after-tax discount rate), resulted in a positive net present value (NPV) calculation. If the contract is renewed at the end of the five-year period, BabyFreedom would have to expand its facilities and infrastructure immediately to meet expected growth in its other market segments.

THE CONCERNS

Although the Walmart contract would result in accelerated growth for BabyFreedom over the next five years, there are important concerns to be addressed. If BabyFreedom can’t quickly expand capacity with a second shift, fulfilling the Walmart contract might create shortages and missed sales from BabyFreedom’s current channels. The relationship could create opportunities for expansion into other product lines; however, management is concerned that Walmart might not be a good channel for “natural” clothing (and the premium prices required by such products) and that Walmart would begin to press for a less expensive, lower-quality product line with the BabyFreedom brand name. Management is also concerned that shrinking profit margins would significantly alter how the company chooses to do business and its ability to maintain stakeholder relationships.

THE ANALYSIS

After reviewing the offer and the issues associated with adopting RFID technology, Jennifer summarized the situation in a special management meeting:

The Walmart contract is a great opportunity—the potential increase in sales is tremendous. We’ve done the analysis and feel we can meet the production and tagging requirements and still make a profit. But we need to be sure that this is a good cultural and strategic fit for our company. I’m very proud of our reputation for ethical behavior and the trust our employees and customers have in us—we need to be very careful not to hurt that reputation. From a purely financial standpoint, we can sign the contract, but I’m concerned whether we should do so from a nonfinancial perspective.

The management team is tasked with reviewing the current pro forma financials, the projected costs of RFID implementation, and the qualitative and ethical aspects of the Walmart opportunity over the next week. In addition to doubling sales volume, assumptions to be used in the analysis include a 15% across-the-board reduction in selling price; a reduction in selling, general, and administrative expenses to 25% of revenue; 80% financing of the compliance option of RFID implementation (the remaining 20% will come from cash on hand); and 20% of acquisition cost for ongoing support and maintenance of the RFID equipment and software. Following a discussion of the outcome in next week’s management meeting, Jennifer will reply to the Walmart offer.

As part of the management team, you are expected to provide relevant information that will help inform the ultimate decision. The following questions will help you address the key issues. Be sure to provide support for each of your responses.

1. All companies need good information to be competitive. Technology, especially in the areas of data gathering, analysis, and data warehousing, continues to evolve to meet this need. Good information enables an organization to successfully develop and implement a strategy to achieve its mission. Yet there are important qualitative (including ethical) issues that must be addressed when evaluating investment in, and use of, these technologies.

a. Visit IMA’s website (imanet.org) and research the relationship between management accounting systems and strategy implementation. What is an accounting information system? Give some examples of how BabyFreedom could use its accounting information system to implement and monitor a competitive strategy.

b. Refer to the Confidentiality section of the IMA Statement of Ethical Professional Practice. What ethical issues are raised by adopting RFID technology? Should there be limitations on the customer information gathered or what’s done with such information? What internal controls could BabyFreedom implement to ensure that its use of RFID technology complies with the IMA Statement of Ethical Professional Practice?

c. Is BabyFreedom able to control the use of RFID technology attached to its clothing once the shipment leaves its dock? Why or why not? What implications does this have for customer relations and BabyFreedom’s image? How could BabyFreedom’s management address customer concerns about privacy and the use of RFID tags on BabyFreedom’s packaging?

2. While the Walmart contract is large and would result in greater sales, there are many important quantitative and qualitative factors to consider, including strategic fit and stakeholder perceptions.

a. Using the assumptions given to BabyFreedom’s management team and an initial acquisition cost of $25,000, construct a pro forma income statement incorporating the effects of accepting the Walmart contract. Use the mandated Walmart gross margin of 29.8%, and assume that BabyFreedom must maintain the same gross margin percentage for all revenues (in other words, it can’t charge a different, higher price to its “medically necessary” or natural clothing customers).

b. The initial report stated that there’s a positive NPV for the first five-year contract period with Walmart. Verify this by using Excel and the pro forma income statement constructed in 2(a) to calculate the NPV value, given a 40% tax rate and 6.25% weighted average cost of capital.

c. Michael Porter’s generic competitive strategies classify companies by how those companies pursue a competitive advantage across a chosen market. Which of Porter’s three strategies (cost leadership, differentiation, or focus/niche) does BabyFreedom use? Which competitive strategy does Walmart use? Would a contract between the two companies be a good strategic fit? Why or why not? Do you think BabyFreedom’s products in Walmart stores will alter how its brand is perceived? Explain.

d. BabyFreedom has a reputation for being a company with a strong sense of corporate social responsibility. BabyFreedom’s natural (nonmedically necessary) clothing customer base is strongly oriented toward issues of sustainability, social responsibility, and ethical corporate behavior and is very focused on the company’s reputation. Jennifer has stated that she doesn’t want to alter her company’s mission or values. Do you think a supplier relationship with Walmart reflects those values? Why or why not?

e. Beyond questions of strategic fit and company mission, are there other qualitative factors that should be considered in the decision? If the RFID technology wasn’t an issue, do you think BabyFreedom should accept the Walmart contract? Why or why not? List and discuss alternative partners or sales channels that BabyFreedom could use to grow the company.

3. BabyFreedom is positioned as a socially responsible company producing high-quality natural clothing. List the stakeholders affected by the decision to accept or not accept the Walmart contract and implement basic RFID technology, and identify how they would be affected by the decision.

4. Based on your analysis, what is your recommendation regarding whether or not to accept the Walmart offer?

For more information about 2018 Student Case Competition, please go the Student Awards and Competition page on the IMA website.

August 2017