Financial literacy (which here can be defined as having an understanding of both finance and the implications that finance has for business decisions), economic literacy, and their connection to business and strategic objectives are often discussed but not applied at the organizational level. Analyzed through the lens of personal finance, financial literacy has a clear connection to individual objectives and goals. Likewise, understanding the connection between finance and broader business objectives should be explicitly discussed but often isn’t. Management accountants have the knowledge and skills to help bridge this gap, especially for small- to mid-sized organizations mapping out management goals and the finances required to execute these initiatives successfully.

ECONOMIC LITERACY

Economics and finance form the foundation of business decision making, and businesses are influenced in large part by external financial forces. The value that CMAs can bring to business owners, founders, and entrepreneurs is to help fill a knowledge gap. Management teams are focused on developing new product and service lines, bringing in new business, allocating resources to continuing operations, and developing a leadership pipeline. In other words, the management team is busy with the many duties and responsibilities of running and developing the business. In the current business environment, which is increasingly globalized and dependent on the agility needed to adapt, the reality is that such an environment requires a more thorough understanding of economic literacy (for example, how economic forces such as consumer sentiment and interest rates relate to specific business objectives).

The abilities to handle negotiations and to professionally resolve conflicts between other management professionals are also key skills developed in the CMA educational process. From my experience, and from what I have seen and discussed with prospective and current CMAs, the skill to bridge the gap between the quantitative and the qualitative is embraced during the studying process and is also a key skill for the workplace. A focus on the financial side of the business and the connection between finance and business operations provides CMAs with a leadership mind-set. Managing organizations and collaborating with internal and external partners aren’t simple or straightforward tasks, but CMAs are prepared for the challenge.

They also are well positioned to understand the needs of the business, management areas of focus and development, and the financing needed to achieve these objectives. Specifically, by focusing on the financial statement, how to leverage technology to achieve business goals, and how to develop leadership skills, these management accountants can see and evaluate business conditions from a comprehensive perspective. Economics, including interest-rate decisions and supply and demand calculations, influence business. One specific area that links the economic implications of business decisions to the goals of management is the idea of opportunity cost. For example, if management decides to pursue one course of action, the funds utilized aren’t available to be invested in other projects. That’s an opportunity cost. This can have a powerful effect on what projects and investments an organization decides to pursue. A real-world demonstration of this idea might be the following:

A mid-sized manufacturing firm owns the warehouse it uses to produce its products and has the following two options. It can either rent out space that is currently unused for a flat fee of $30,000 a month for the current year ($360,000 in total) or accept a special order from an existing customer that would generate $325,000 in revenue. The obvious dollar difference is $35,000, the opportunity cost. But the management accountant should advise leadership regarding the effect that a special order (with possible special pricing and other conditions) could have on ongoing business plans and objectives.

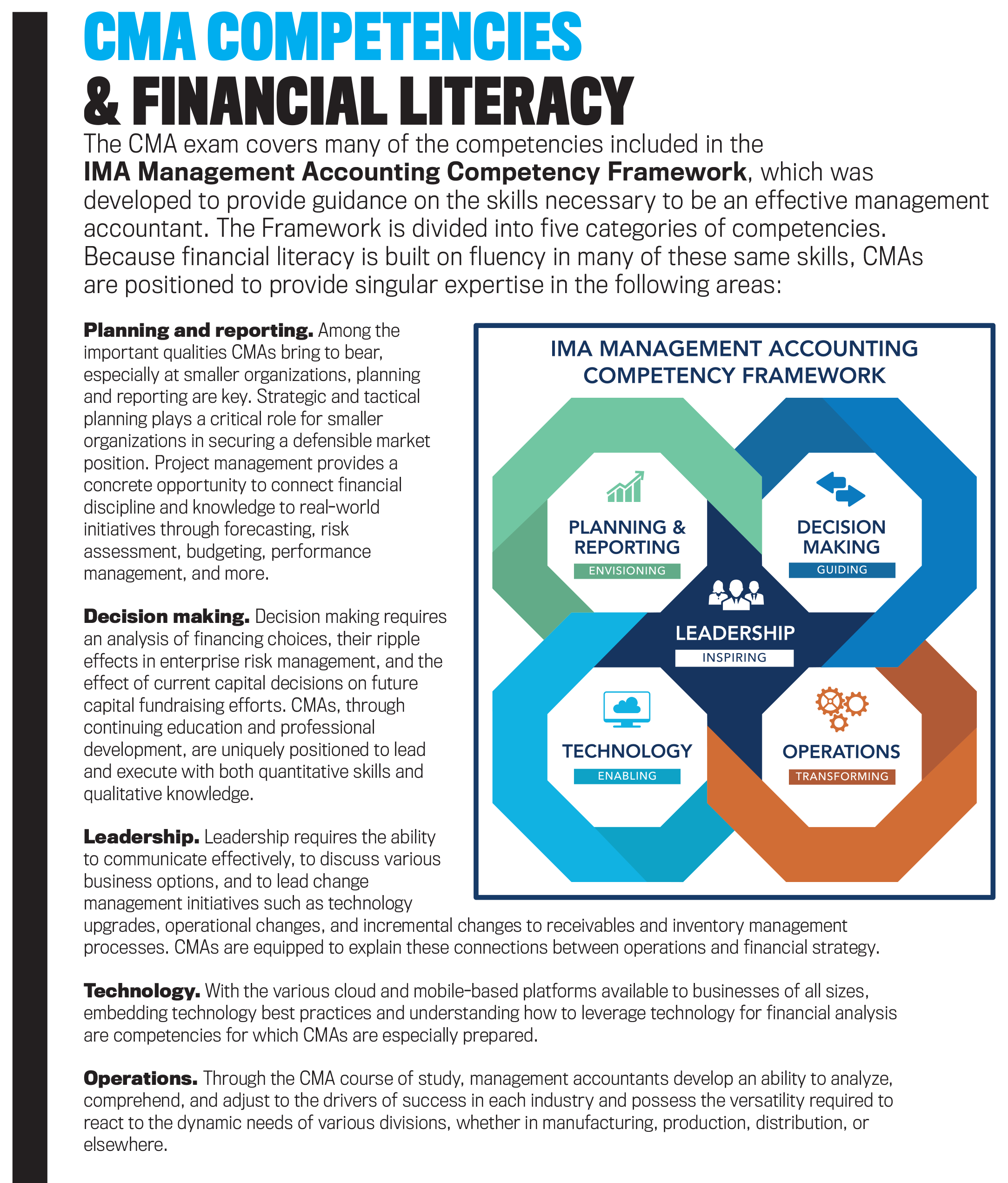

While the concept of opportunity cost, illustrated above with the comparison between renting and using the existing space to fulfill a special order, may seem clear-cut, CMAs can add value with a more thorough analysis. Mapping out the longer-term implications of accepting special orders or other decisions that involve tradeoffs and opportunity costs can trip up small- to mid-sized businesses, so CMAs can explain these ramifications to senior leadership. The training and competencies held by CMAs in these areas generate a competitive edge. Put simply, technology is radically changing the accounting profession, and management accountants must have the technical and leadership skills to make the most of these changes.

FINANCIAL LITERACY

One of the key pressures facing small businesses is to locate and understand the different sources of financing in the marketplace. Traditional sources of financing—including lines of credit, loans, private placements of debt, and even issuing ownership stakes in the company—involve a variety of fees, costs, and restrictions. Analyzing the pros and cons of these financing sources, including bringing in a new partner/owner who contributes both capital and expertise, adds higher-level analysis to a financial discussion. A CMA understands that the traditional pros and cons of debt vs. equity financing, including the advantages of business interest, the internet, and the mobile workplace, have resulted in the development of alternative forms of financing.

Kickstarter, while perhaps the most high-profile form of crowdfunding for startups and other small organizations, represents a growing trend. CMAs, who already keep abreast of changes in the marketplace through continuing education requirements, are well positioned to analyze trends like this and their impact for organizations. In addition to the quick financial capital that can be raised on a crowdfunding platform, additional benefits include the ability, through crowdfunding, to engage with current customers and also have a creative method to attract new customers. Bridging the gap between senior leadership and the economic terminology of the day is an opportunity for management accountants to play a more proactive and influential role in the management process.

FINANCIAL LITERACY AND BUSINESS STRATEGY

To develop a crowdfunding strategy, an organization must also develop and refine a social media presence. Depending on its resources, this may involve building an entirely new website, creating a social media presence, or putting together a new campaign to complement this capital funding campaign. Management accountants, working with leadership, can advise about and evaluate the various options in the marketplace. While accountants aren’t expected to build websites or develop mobile applications from scratch, informed accountants should be prepared to evaluate the options. For businesses seeking to expand and enlarge operations, the connection between innovation and strategy is key. Every strategic idea requires financing, and CMAs have the ability to be the go-to individuals to lead high-level planning.

FROM INNOVATION DREAMS TO REALITY

Innovation, regardless of the size of the organization, requires both financing and intellectual capital. Evaluating different options can call for varying levels of analysis, for example, assigning risk adjusted weights, which can be determined by comparing the proposed projects to historical records and market equivalents. Whether management is thinking of following what larger organizations have already launched (fast follower), focusing on making existing products and services better (incremental innovation), or thinking of launching an entirely new project, financial assessment comes first. The important point to remember is that, in addition to the financial analysis and assessment conducted by the management and accounting teams, it’s necessary to build a bridge between financial data and the broader business issues like customer retention, attracting better employees, emphasizing sustainability initiatives, and marketing to Millennials and Generation Z.

Management accountants can provide the link in the conversation on financial literacy, information, and the demand for new products and services by the marketplace. Understanding and accounting for the control issues, business development issues, and possible ethical dilemmas embedded in developing new ideas are added values that CMAs can deliver. Not necessarily as high-profile or flashy as debating the merits of updated battery technology, these topics nonetheless represent the building blocks of a sustainable strategy. Depending on the results of internal analysis, conversations, and feedback from other functional areas, the business development and innovation strategy can take various forms. One method of illustrating innovation and related costs is the Sprint model.

SPRINT MODEL OF INNOVATION

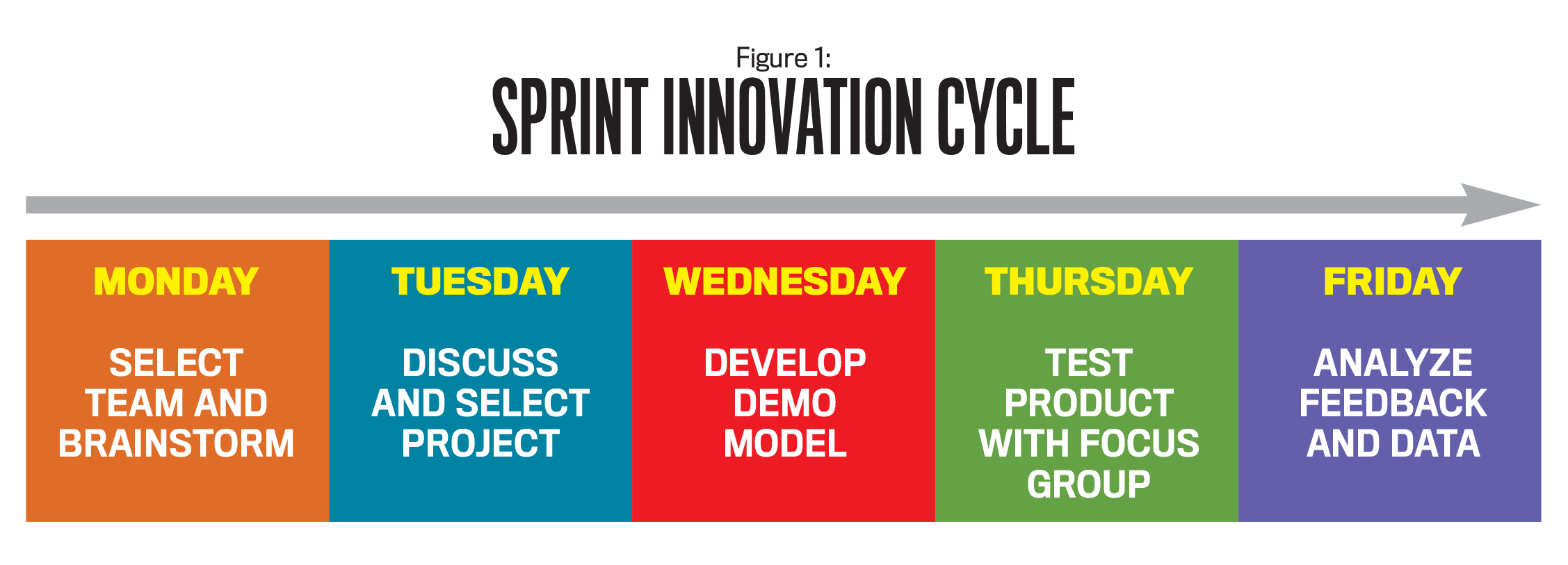

Despite the pressure to innovate continuously, it isn’t always realistic to invest large amounts of financial and human capital in long-term projects. The Sprint concept, illustrated in Sprint: How to Solve Big Problems and Test New Ideas in Just Five Days by Jake Knapp, reaps the benefits of a focus on creating new ideas but in a financially conservative manner. Once a test idea has been selected (see Figure 1), the Sprint cycle of steps can occur over the course of a week.

The Sprint model of innovation was embraced by the investment team at Google Ventures. It seeks to replicate the bootstrap mentality of a startup even if the initiative is happening at a larger incumbent organization. Isolating the Sprint team (in something as simple as a conference room) with supplies such as Post-it® notes, whiteboards, and a moderator (most likely a senior leader at the organization or an external consultant) to lead the initiative is the first and important step. Creating this team, and tasking its members specifically with this goal, helps mimic the singular focus found at startup organizations that the Sprint model seeks to emulate.

After the team is selected, a brainstorming session must be conducted to zero in on an idea that can be tested in beta mode within a week. Doing this in a compressed time frame provides an opportunity for CMAs to suggest cost-effective and time-efficient options.

After the idea is selected, usually accomplished by a vote by the Sprint team, the development of a beta product/service is finalized along with selection of a customer focus group for testing. Arguably the most important aspect of the Sprint is to test these ideas with actual customers and to not worry about getting the idea 100% finalized. For a new website or an adjustment to click-through strategies on existing websites, a test site that merely looks legitimate would be good enough for Sprint purposes. Putting this into more technical parlance, build the Sprint website in a test environment, not the production environment. After testing under realistic market conditions, the data and feedback from this test should be analyzed, discussed, and finalized. At this point, a decision should be made, based on the data collected, as to whether or not this concept will be pursued further. The specifics of how the Sprint is executed will vary from organization to organization.

With expertise in connecting finance, operations, and product development, management accountants add the most value in the “build/develop” and the “analyze feedback and data” phases. Here, CMAs can assume leadership roles within the innovation process and organization since they are equipped to select projects for viability, explain that viability to management colleagues, and analyze the market data collected from the testing phase. Emphasizing these strengths and deploying them in unique applications are definitive ways for CMAs to leverage existing competencies while simultaneously building a case for a more strategic role.

The Sprint model of innovation involves the following steps:

- Designate a team who will work solely on finalizing a demonstration model of a product or service for a period of five consecutive business days (one workweek).

- Sort through existing projects, initiatives, and ideas to determine which single project will be the focus of this Sprint. Any tiebreaker situations will be decided by a moderator, who should be either an external partner (perhaps a CMA with industry experience) or a respected internal leader.

- Develop a demo model of a product or service. It’s important to acknowledge that the item to be tested doesn’t have to be fully functional—it merely has to look the part.

- Simultaneously, while the demo item is developed, leadership should assemble focus groups for a customer review/test. Again, this is where a decision has to be made as to whether this new product or service should appeal to existing customers or be oriented toward attracting new business.

- When the product or service is finalized, customer tests should be tabulated on the final day (Friday). Following the Sprint, and depending on the feedback received, leadership can now make a better-informed decision on whether to engage in full-fledged development or to pivot to another project.

STRATEGIC LITERACY

Small businesses, whether located in the United States or across the globe, are the backbone of local and regional economies. They provide employment, service to the community, and, most important, an opportunity for individuals to better themselves. Too often, however, small- to mid-sized organizations are hamstrung, or even fail, because of a lack of capital and continuous funding. CMAs, with a blend of financial, managerial, and operational education, are uniquely positioned to bridge the gap between economic and financial literacy and the goals of the organization. They are especially qualified to serve as strategic partners, combining analysis of the financing requirements of the business with tactics to effectively implement the goals of the business. Now is the time for them to seize this opportunity.

April 2017