When performing due diligence in anticipation of a merger or acquisition, one common mistake is to assume that because Company A and Company B are in the same industry, sell similar products, and are structured alike, they must do things the same way. This is rarely the case.

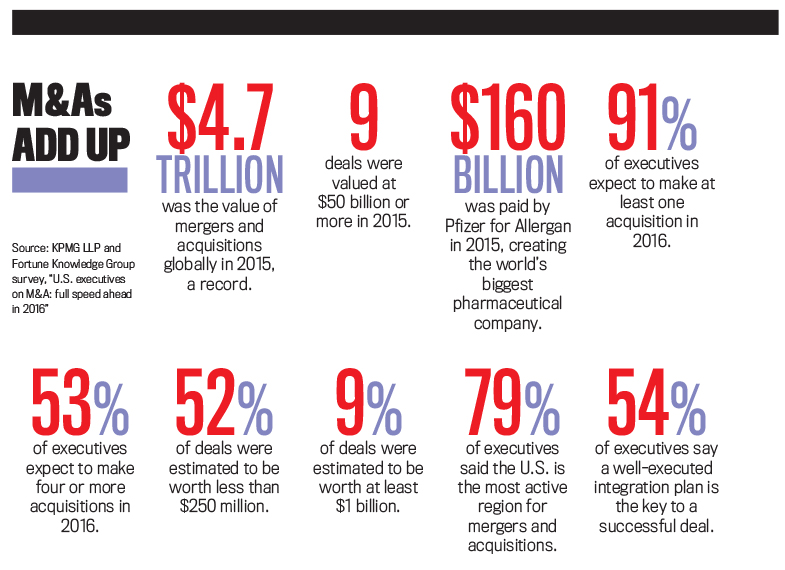

And this assumption can be costly. A review of M&A transactions over the past decade demonstrates that financial projections often underestimate the financial implications of human capital. While the management accountant’s role is basically to determine the status and success of a company, the due diligence process should begin with discovering the value of the human capital hidden within each company’s financial numbers. This isn’t an easy journey since there are no cookie-cutter approaches or shortcuts.

WHY TYPICAL FINANCIAL MODELS OFTEN MISS THE MARK

A common pitfall in constructing meaningful financial models is excluding critical human capital costs or too narrowly defining a company’s culture. In most cases, human resources’ cultural due diligence is limited to examining employee turnover data, exit interviews, and employee satisfaction surveys. But when it comes to gaining a truly accurate understanding of a company’s culture, these are only a few pieces of a much larger puzzle. In the same way that financial experts are needed to truly understand the story behind the numbers, human capital experts can help uncover the story behind the people.

According to research conducted by Harvard Business School comparing 435 publicly traded companies on the sophistication of their HR practices, firms in the top 10% saw their market value soar to more than 11 times their book value and generated five times the sales per employee compared to the bottom 10%. (For more, see The HR Scorecard: Linking People, Strategy, and Performance by Brian E. Becker, Mark A. Huselid, and Dave Ulrich, Harvard Business School Press, 2001.)

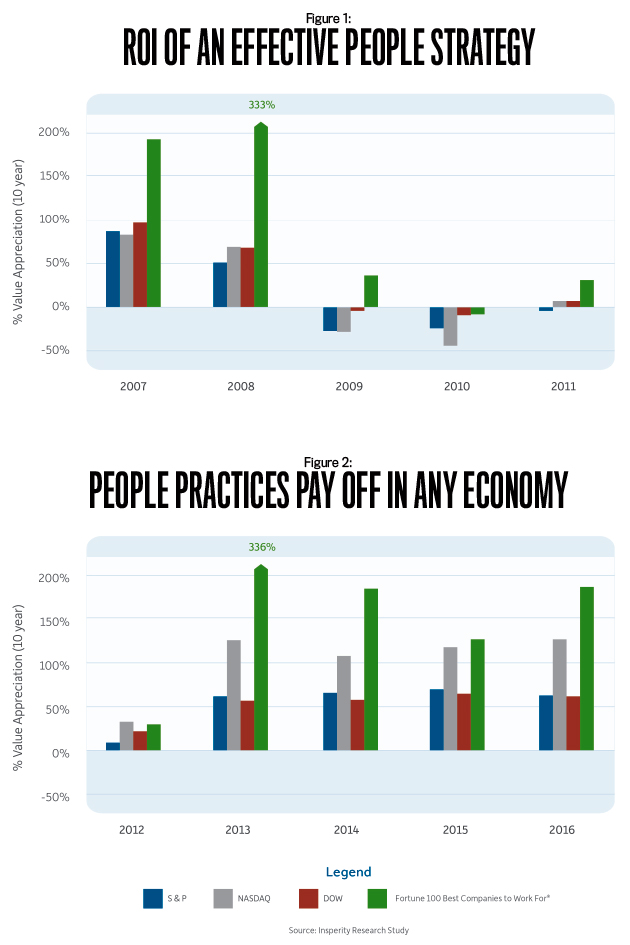

Insperity, a publicly traded human resources and business performance solutions company headquartered in Houston, Texas, analyzed the performance of companies listed among the Fortune 100 Best Companies to Work For® vs. the performance of other “like size and industry” companies traded on the major stock exchanges. (Fortune’s criteria include human capital best practices and policies, which are tied to a company’s HR practices.) The goal of the analysis was to determine whether the organizations on Fortune’s list significantly outperform their business peers.

Prior to 2009, Insperity found the value appreciation of the companies on Fortune’s list was significantly higher. Even in 2009, when the full impacts of the Great Recession were being felt, Fortune’s best companies lost some value, but they were able to maintain more value than their peers on the S&P 500, Nasdaq, and Dow Jones Industrial Average combined (see Figure 1). Taking Insperity’s analysis one step further, we also noted that Fortune’s best companies rebounded in 2010 much faster than their peer group. These results suggest that organizations recognized on Fortune’s list do outperform other similar businesses, perhaps because, as we believe, they understand the value of investing in human capital (see Figure 2).

Research suggests that newly combined entities may be susceptible to losing a percentage of their target annual revenue during the initial year following a merger or acquisition. Yet most projections never take into account the lack of synergy that occurs when, for example, two back office processes are folded into one. Every merger leads to changes, and while change is often difficult, it also can slow productivity measurably. Functions that once took employees hours to accomplish might now take a week as new approval processes and procedures are added to the mix.

Let’s face it, people are critical in every work process, work product, and service a company provides. Therefore, integrating processes during an M&A can often be a major challenge and, as a result, transactional value may be placed at risk.

MEASURING CULTURAL COMPATIBILITY

It’s surprising how many corporate leaders gloss over the importance of organizational culture during the due diligence stage of a transaction. But without understanding the various nuances of how each company operates to achieve its revenue and value estimates, how will an organization recognize what’s necessary to maintain value after the transaction closes? Without considering this level of detail, it’s impossible to truly estimate the cost of the transaction, especially as it relates to integration of personnel and processes.

Understanding the promise each company makes to its customers provides a neutral starting point for evaluating alignment between two organizations and defining integration strategies. Identifying potential pitfalls—and working with the organizations to develop a vision to move the combined entity forward—is critical for integration and, therefore, must be initiated at the beginning of any transaction process.

In the case of human capital, due diligence should allow leaders to answer the following questions across 10 categories:

- Recruiting: Will the newly combined company have the right bench strength to meet its short- and long-term targets? What is the selection process for hiring and identifying key bench players? What is the current turnover rate?

- Benefits: What does a comparable benefits package look like? What can continue to be offered, and what can be eliminated or is no longer available? How will ancillary benefits, such as 401(k), pension plans, and life insurance, be integrated?

- Compensation: Do salaries for similar positions match across organizations? Are the commission plans equitable, and, more importantly, do they encourage the right behaviors?

- Payroll: Are the pay cycles similar? Does one company pay in arrears while the other forecasts to close? (Forecast to close in payroll is estimating hours through a pay period and then cutting a check on the estimated hours. Adjustments are done on the following payroll run for any offsets.) Are all employees classified correctly?

- HR Support: How do HR policies, procedures, and current practices differ between each organization?

- Organizational Design: Which leaders from each organization will assume a leadership role in the newly formed organization? How will job titles change?

- Decision Making: Will the new organization come to consensus within the group, or will all decisions be made at the top, within a hierarchical structure?

- Performance: What are the current skills and abilities of the present workforce? What skills are required for future success?

- Training: What training is needed to educate employees about new product and service offerings?

- Technology: Which existing systems will be used to support the new organization? How much time, effort, and expense will system conversion require?

Each category provides critical insights into the assumptions and scenarios that should be included in business forecasts. Employing this level of detail when conducting due diligence should offer a more robust view of how the two cultures will work together after the acquisition.

FINANCIAL IMPACTS OF CULTURAL DIFFERENCES

By carefully considering the potential costs associated with all of the necessary steps and decisions that are required to successfully integrate two organizations, financial projections can account for some of the most commonly overlooked integration pitfalls, first and foremost of which are cultural differences.

For instance, consider the hiring process. While hiring practices may appear to be an operational issue, they provide important insights about the culture of the organization and can potentially raise red flags when considering integration. These red flags highlight potential costs that should be included in financial projections.

Here’s an example: Through the due diligence process, Company A uncovers the following specifics about the hiring practices at the target company, Company B: Company B allows all front-line managers to hire staff based on productivity needs. The hiring manager conducts all job interviews with no formal process or training. Each new hire is welcomed on his or her first day by a corporate HR representative and required to complete onboarding paperwork. But there’s no official new-hire program. It takes five to 20 days to fill positions at Company B, and the turnover rate is 12%.

By comparison, Company A has a robust hiring program. The process includes senior management headcount approval, which is tied to the annual budget. Interviews are conducted by panels of trained and coached employees, and new hires are required to take part in a standardized, one-week orientation process. Company A takes 90 to 120 days to fill a position, and turnover is also 12%.

This is a potential area where a culture clash may occur. Based solely on turnover data, someone might conclude that the two organizations are achieving comparable outcomes. But further analysis reveals their processes are vastly different. Without having a plan in place for mediating these differences, there will be tension between the two systems until one system prevails and is applied to the newly combined organization. By failing to address the differences and allowing employees to make decisions with no guidance as to which policies to follow, confusion bordering on institutional chaos is bound to ensue.

When encountering unfamiliar practices, some leaders may feel that the new organization is questioning their competency. This may motivate them, as well as other high performers, to leave an organization after they repeatedly feel devalued, demoralized, or dictated to. As a result, the overall value of the operations that were originally accounted for in projections diminishes because the company culture wasn’t properly considered in the integration process.

GOING IN, EYES WIDE OPEN

Recognizing key issues like hiring practice differences early in the process allows for a much less difficult transition. Once they are combined under the banner of one organization, stakeholders can work together to identify what the hiring process should look like moving forward. In an ideal situation, the best practices of both organizations will remain in place as opposed to having a one-size-fits-all mentality and forcing all of the acquiring organization’s policies, practices, and processes onto the acquired business.

In the case of hiring, for example, if all parties agree that a more thorough hiring process needs to be implemented, then leaders can predict impacts to productivity since the days to fill certain positions will most likely increase substantially. This directly affects the overall projections based on historical data because there’s an understanding that the new company will be functioning (at least initially) at less than 100%. Companies can also use the number of current job vacancies and the average turnover rate for scenario planning to estimate that, under the new process, a drop in productivity can be expected for the first few months while the new hiring process is being developed and put into place.

Proactively developing a new, overarching recruiting protocol—and including the potential implications of this new universal process in scenario planning—is an example of the benefits to be derived from digging into the cultural underpinnings of the target organization and comparing the results to the culture of the acquiring organization. Another potential benefit derived from a comprehensive forecasting effort is the ability to recognize when a drop in productivity is related to internal factors, such as a change in recruiting protocols. This level of understanding allows an organization to determine what strategies are required to counteract M&A-related challenges.

For example, if turnover is anticipated as the result of the transaction, now’s the time to adopt a proactive approach. Offering retention bonuses or incentives to key employees, preparing for the use of contingency staff, or offering town hall meetings to address groups with specific concerns are strategies that can be budgeted for and included in financial projections. For instance, the number of necessary contingency workers can be estimated and the cost included in the financial projections.

WHERE THE RUBBER MEETS THE ROAD

What is the single most critical factor in a successful integration? It’s the presence of a leadership team who understands and is willing to convey the importance of the deal. A successful M&A requires leaders who not only see themselves as stewards of the changes that need to be made but who also recognize the need to reinforce the why and how of the deal to their employees. These leaders never underestimate the importance of cultural fit between the target and the acquirer because they recognize the increased risk inherent in poor execution.

Since many M&A transactions lead to job loss, turnover is one of the largest people-associated risks that leaders need to thoroughly manage and account for when developing projections. One of the most common reactions when an employee learns his or her organization is being purchased is fear. The first question many will ask themselves is, “Will I have a job in the new company?” As such, leaders should clearly identify what’s in it for the employees. For most, simply being told that they will have a job in the new organization isn’t enough. After initially hearing about the transaction, most employees actively monitor the situation, continuously looking for signs that signal their level of safety.

Therefore, in every successful transaction process, leaders must make certain they are prepared to answer employees’ questions. They recognize, too, the importance of retaining their teams to maintain a competitive advantage. The first step in this process is to identify who on the leadership teams, from both the acquirer and the target organizations, is responsible for addressing the integration efforts. Once that combined team understands how to best support the strategic initiatives of the new business, they can communicate what matters most to employees, which is paramount to a successful integration process.

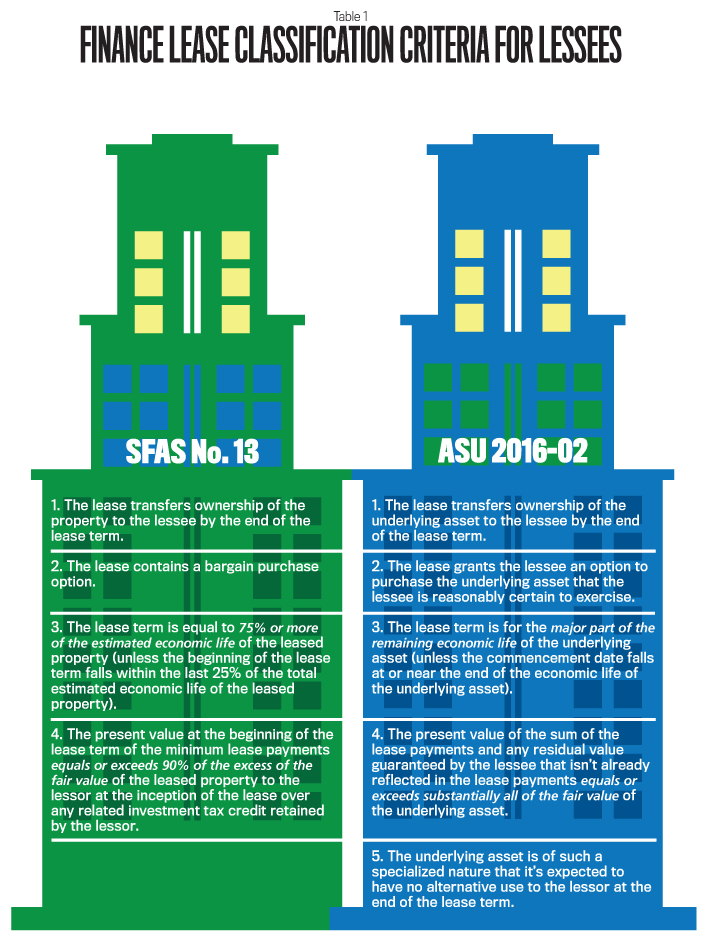

Some of the crucial questions to address during the process of scenario planning and developing financial models are shown in Table 1. If leaders can provide the answers, then employees will feel more comfortable that their concerns are being considered.

WHAT IT MEANS TO YOU

By investigating and addressing critical people-associated risks as early as possible, management accountants will be able to provide even greater value to their companies during M&A transactions. Financial projections that address the issues highlighted in this article will allow an organization to position itself for increased productivity, innovation, and creativity and will allow businesses to move at a pace necessary to experience true value growth.

While risks associated with M&As are diminished by identifying and managing the cultural implications of the transaction, the traditional approach for combining two organizations rarely includes these considerations. By addressing these challenges early, an organization can build more effective and predictive models.

Many within the company, however, may view taking the time and effort to do this as an unnecessary distraction. This is where a talented management accountant can make a difference. The management accountant’s role is critical in championing the paradigm shift that people-associated risks need to be evaluated and addressed as early as possible during the due diligence process. This high level of involvement will make integration planning smoother and mitigate much of the financial risk for both organizations involved in the M&A as well as for the workforce responsible for driving the future value of the transaction.

November 2016