Many charitable and not-for-profit organizations that are classified under Internal Revenue Code (IRC) §501(c) or similar laws rely on volunteers to accomplish their mission, including assistance in their tax reporting. As accountants, we may find ourselves being called on to assist these organizations by preparing their Form 990, Return of Organization Exempt from Income Tax.

Although Form 990 is relatively straightforward, it’s easy to miss the need for including a completed Schedule O. Even those that regularly prepare Form 990 have been known to forget to include this form. As its name suggests, Schedule O, Supplemental Information to Form 990, requires supplemental information and other narrative explanations for questions on the core form.

INCOMPLETE RETURN PENALTY

An organization that doesn’t include Schedule O is likely to get a letter from the IRS stating that the schedule is missing, incomplete, or blank. In addition, the letter will probably make the point that all exempt organizations filing Form 990 are required to provide certain narrative responses on Schedule O. That letter will probably request a reasonable cause explanation as to why the required information wasn’t originally submitted with the return. It will point out that failure to provide the missing or incomplete information with a reasonable cause explanation may result in penalties being charged for each day the return is late or incomplete. Per IRC §6652(c), these penalties could range from $20 a day if gross annual receipts are equal to or less than $1 million (for a maximum penalty of $10,000 or 5% of gross receipts, whichever is less) up to $100 a day if gross annual receipts exceed $1 million (for a maximum penalty of $50,000).

Even if you submit the missing Schedule O to the IRS and provide a reasonable cause explanation within the stated 30 days, don’t be surprised if you receive a penalty letter from the IRS. The net result is additional time will be required to gather the needed information to resolve the initial request for Schedule O and to resolve the penalty issue—all of which creates distress for a tax-exempt organization with a limited budget.FORM 990 FILING REQUIREMENTS

The Form 990 instructions state that all organizations filing Form 990 must file Schedule O, which is used to provide required supplemental information and other narrative explanations for questions on the Form 990, particularly the series of questions with “check the box” responses beginning with Part III on page 2 of the form and continuing to the end at page 12. Often these involve checking one of the boxes if relevant and then providing an explanation on Schedule O. If an organization has had to address a number of issues in the past, but they no longer need to check off any of the boxes or address any questions currently—and thus the explanations that may have been required in the past aren’t needed—then it’s easy to forget that Schedule O is still required and that there’s information that must be included even if there aren’t any other issues to be reported.

The instructions for Form 990 provide a “tip” at the end of Section IV, Checklist of Required Schedules, that states all filers must provide narrative responses to certain questions. The tip lists lines 11b and 19 of Part VI as specific examples. And what are the important disclosures on these lines? Line 11b asks the taxpayer to “Describe in Schedule O the process, if any, used by the organization to review this Form 990.” Line 19 asks the taxpayer to “Describe in Schedule O whether (and if so, how) the organization made its government documents, conflict of interest policy, and financial statements available to the public during the tax year.” Looking at that, it makes sense that the schedule is easily missed. Simply, if there are no other items or issues that need to be reported on Schedule O, then it’s possible to forget about lines 11b and 19.

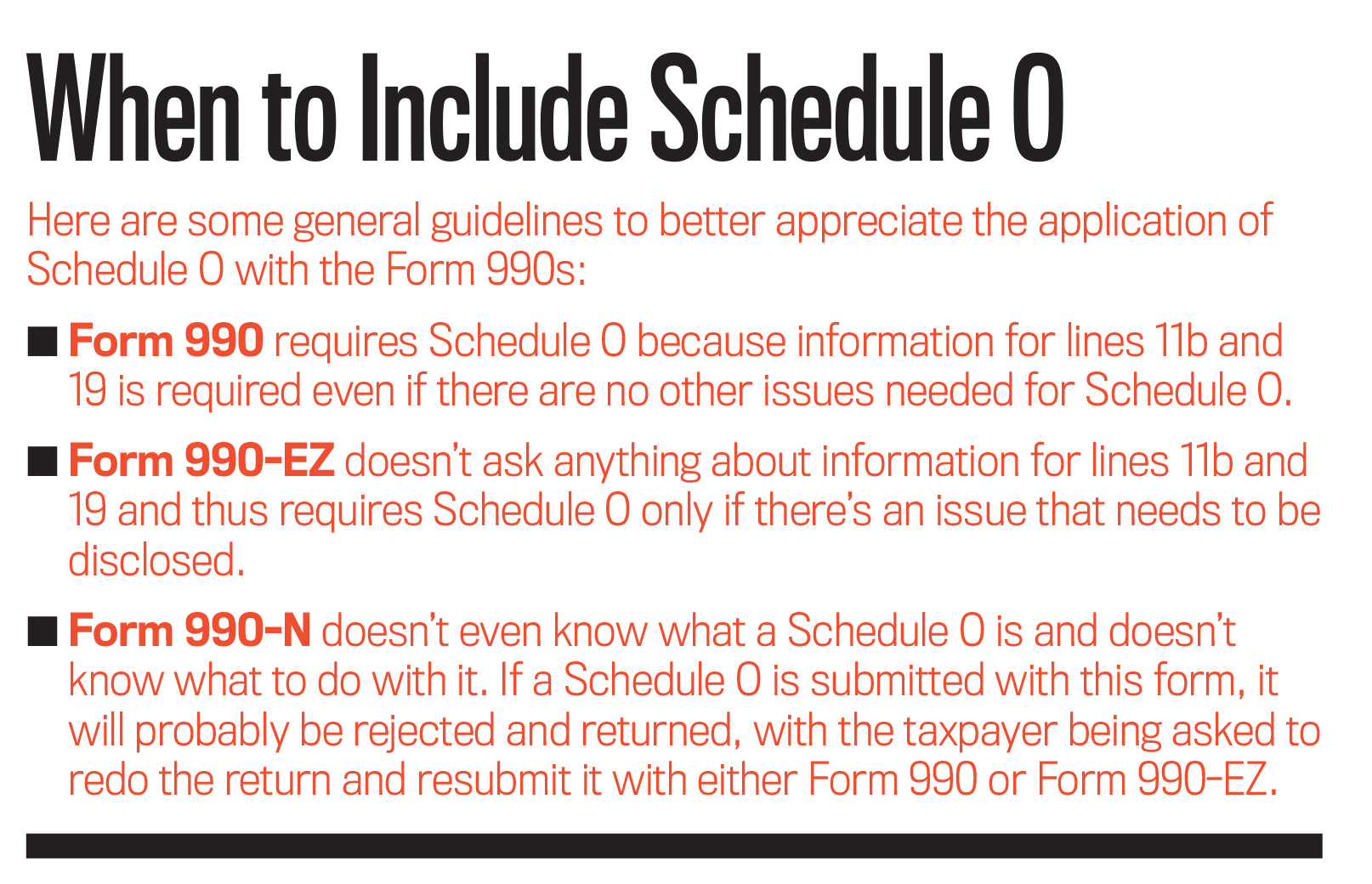

Schedule O also may be necessary when certain organizations file Form 990-EZ. The instructions for that form clearly state that “[a]t a minimum, the schedule must be used to answer Form 990, Part VI, lines 11b and 19.” But if a tax-exempt organization isn’t required to file Form 990 or Form 990-EZ and instead files Form 990-N Electronic Filing System (e-Postcard), Schedule O can’t be filed with this form and thus isn’t needed.

RESOLVING THE OMISSION

If the only additional information needed on Schedule O is the explanations for lines 11b and 19, chances are that a successful reasonable cause explanation will be enough to avoid the penalty. But the work involved to resolve this minor omission could include the need to prepare and file:

- Form 2848, Power of Attorney and Declaration of Representative;

- Schedule O (completed for only lines 11b and 19 since there was no other reason for the Schedule O);

- A signed declaration that the tax return is true, correct, and complete; and

- A reasonable cause explanation.

If a notice of penalty for the omission was issued, additional correspondence will be necessary to resolve these issues. Thus what was to be a kind gesture or favor has now turned into a nightmare—and maybe even a question about your competency. The moral of the story is simple: Don’t forget to complete and attach Schedule O to Form 990.

© 2016 A.P. Curatola

November 2016