I would regularly ask, “If you can’t define innovation and what you’re striving for, how do you know when you’ve created value?” Further, if you don’t have a clear definition and declaration of innovation, you certainly can’t be in a position to measure and manage innovation value creation in your organization. Worse yet, will your employees know what you’re looking for? They may think they aren’t being innovative, but, in reality, they don’t understand what you want in terms of innovation.

INNOVATION CONTINUES TO BE MISUNDERSTOOD

Let’s first look at why organizations innovate. In the innovation workshops I conduct, I usually ask participants to respond to various strategic and tactical questions. In my three-day workshop, the first question I ask is, “Why do you want to innovate?” Here are the responses from one of the four inaugural sessions:

We then had very interesting and deep discussions around why their organizations wanted to innovate, including their various definitions of innovation, what had worked in the past, and what had failed. It was this first conversation around why that was so critical because people in these types of workshops and conversations want to quickly get to the how of driving and executing innovation. But the reason they fail is because they haven’t first clearly established the why of innovation. After digging deeper into these conversations, this inaugural group was better aware of that intricacy and the all-important first step of starting with why and determining how to set up their organization for successful innovation.

As time went on, this question gained more dimensionality as I looked at results from different participants and from different geographic regions then dug into how the answers and dialogue differed. Let’s look at responses to the same question by region:

The U.S. participants, specifically in Silicon Valley, were the only ones feeling heat from their CEOs to innovate. Dubai was heavy on driving growth, and China was heavy on reinvention to stay relevant. There definitely were many common themes, but there were also some stark differences based on geography with regard to regulations, government, competition, and evolving local economies. As you think about your own organization—especially if you have divisions, partners, or suppliers in different geographical regions—consider the value of talking about the goal of why you desire innovation and what specific value you’re striving for in your innovation endeavors.

Now ask yourself, “Why do you innovate in your organization?” I’d direct this question to the executive team first to ensure you’re on the same page before asking your employees to innovate. Get consensus and clarity as to what you want and expect for innovation value creation in your organization.

A CONTINUUM FOR SUCCESS

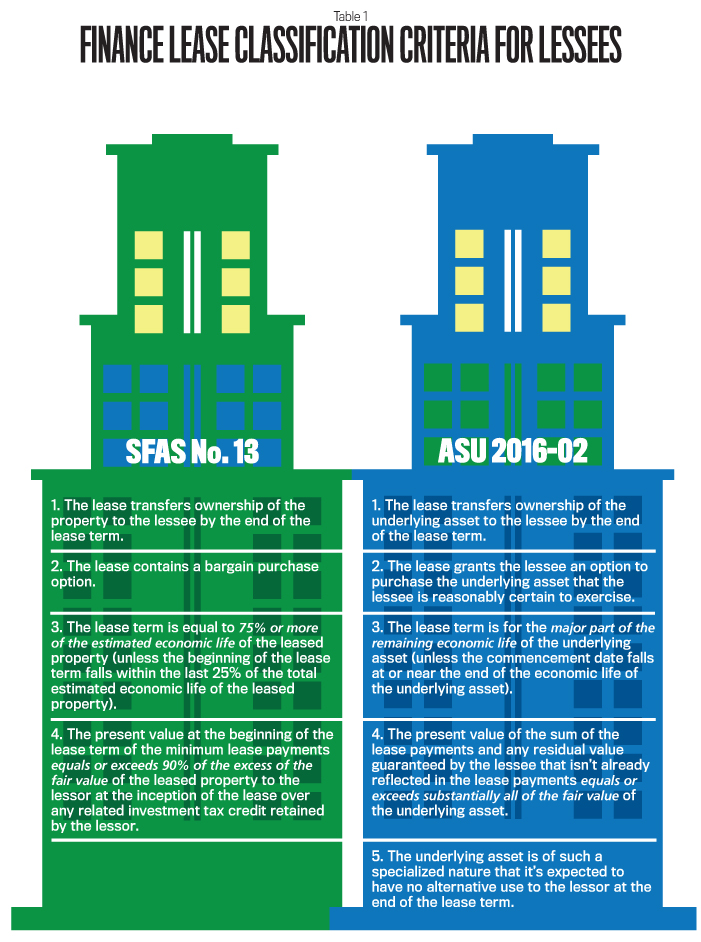

When I originally wrote Advancing Innovation, I toiled over how to describe and teach others the lessons I’d learned from implementing and driving innovation teams and efforts. I landed on three phases that I described as Galvanize – Enable – Measure. These phases are sequential and form a continuum in that first you need to galvanize your organization for innovation success. The Galvanize phase includes elements such as defining innovation, setting the appropriate culture conducive to innovation, and explaining from the highest levels the spirit and need for experimentation (and, yes, failure) to ultimately get to value.

Enable is the next phase and is all about how to execute and drive results. Enabling includes activation and engagement channels—and all the back-office enabling mechanisms such as incentives, communications, and tools—that are needed for your innovation team, champions, and employees to be successful in their innovation endeavors.

Finally, Measure is about the all-important area of measurement of innovation value: As the saying goes, “If you can’t measure it, you can’t manage it.” I stand by this 100%. All of your innovation strategies must be considered, reviewed, debated, and implemented in this sequential manner of Galvanize – Enable – Measure. This allows them to operate as a closed-loop system as you circle back to your innovation strategy and culture and make adjustments, pivot on your execution to drive more results, and continuously monitor your targets and competitive benchmarks.

SOME TWEAKS TO MY FORMULA

Today, after teaching multiple workshops and delivering countless speeches about how to lead and drive innovation for results, I’ve tweaked the Galvanize – Enable – Measure continuum and have expanded those three areas to:

Architect is a more universal word that people seem to grasp more quickly. They realize there are foundational elements that need to happen before you begin to execute and get into the how phase. So explaining this first fundamental element as “setting the architecture” has been logical and well received.

Next, I changed the Enable phase to Execute. How did I miss this originally?! The second element of how I explain and teach innovation is all about execution, so why not simply call it that? Enable originally came from the idea that you need to enable the entire organization for success: You set up activation channels; you do back-office work like innovation training and management; and you implement incentives, communications, and other processes as needed. Yes, this is all enablement, but now when I explain this phase, I take the broader view of execution.

Finally, I’ve evolved the Measure phase to a broader Optimize phase. This is probably the most significant update in my thinking and teaching over the last year. Many parts of the book, and many people who’ve reviewed it, have talked about innovation measurement being the critical new intellectual property that didn’t exist in the innovation realm before. As such, I identified measurement as the third element of innovation value creation, referring to the Innovation Value Score (IVS) balanced scorecard model I had created. (For details, see my article, “Advancing Innovation Whats Your Role” in the September 2015 issue of Strategic Finance .) Yet as Bob Kaplan, who coached me from his perspective of 25 years of balanced scorecard wisdom, told me, “It’s not just about using IVS for measurement, Patrick, it’s about the ongoing management of the results.”

Measuring is great—you have to measure something before you can improve it—but then you drive for better results by managing the inputs, outputs, and processes of your organization. So when you think of this third phase of the total innovation program, it’s about measurement and management, which I would best describe as Optimize. Optimize then allows us to take a “portfolio view” of our innovation advancements and manage that entire portfolio more actively, balancing the types, sizes, and returns anticipated in a mix of innovation projects over varied timetables.

This new three-phase model for driving innovation value is depicted in Figure 1. While its genesis comes from my book, it also reflects the evolution of the past year.

MEASURING INNOVATION AND COMPETITIVE BENCHMARKING

The subject of measuring innovation came up in every innovation conversation I had in the past year. The common theme across all these conversations? Innovation measurement isn’t easy, and, as a result, some organizations have simply chosen not to do it. To illustrate, here are the responses to another polling question:

I found the consistency of response D, “We don’t formally measure innovation,” to be staggering and totally in alignment with the original research for Advancing Innovation. There’s no question in my mind that innovation is hard to define, can be hard to execute, and certainly is hard to measure.

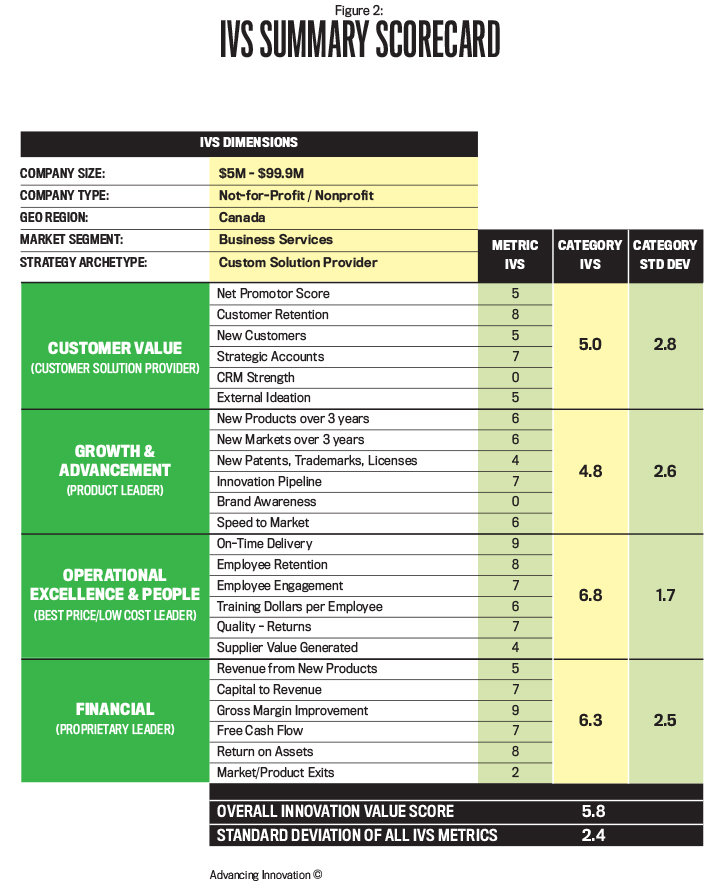

Enter IVS (www.innovationvaluescore.com). The simplest explanation of IVS is that it’s a balanced scorecard framework using 24 metrics to measure an organization’s innovation value creation. (See Figure 2 for the metrics and an example.)

The framework uses benchmarks from the APQC (American Productivity and Quality Center) for half the metrics, which they’ve accumulated from more than 5,000 organizations around the world. The other half of the metrics are less formal but generally accepted benchmarks. The IVS system prompts you to enter the results of these 24 metrics and gives you various reports that look at your innovation results from multiple perspectives, addressing questions such as:

- What are your results in relation to Incremental, Distinctive, and Breakthrough efforts?

- What are your results in Inputs, Processes, and Outputs of innovation investment?

- How do you compare to the aggregate APQC benchmarks?

- How do you compare to the APQC benchmarks in your specific industry?

In various discussions, participants found value in innovation measurement in two primary areas of questioning:

A. Using these 24 metrics as a framework, am I getting the types of results I expect and desire, or do we need to make course corrections to get different results? This creates strategic discussion and aids in driving action.

B. How do we compare to overall benchmarks, how do we compare within our industry, and how do we compare against the best industry in a particular metric so we can learn from it? This second discussion is strategic as well, but, looking outside, it forces a conversation on innovation value to differentiate an organization’s value proposition to drive more value, stay competitive, and/or achieve growth aspirations.

Going back to our original innovation research where we asked CFOs about innovation measurement, the highest-sought measurement was benchmarking against others within their industry. IVS now has this capability. You can enter your innovation measures into IVS and get basic reporting. If you choose, you can upgrade from the FREE subscription to now compare your company via industry verticals: manufacturing, business services, retail, healthcare, technology, and institutions. This allows an organization to compare within their industry and with industries that are executing best in class for a particular metric.

IMA President and CEO Jeff Thomson says: “No metrics, no dialogue.” While people can argue whether or not I have the perfect 24 IVS metrics or if my IVS construct would be better with this change or that change, the better conversation is the one that comes from looking at the IVS construct within an organization, debating the results, and then taking actions for improvement. That has been the goal of IVS since day one—not to be the perfect innovation value measurement system but to be a solid foundation with which to measure innovation, to create dialogue and strategic discussion around results, and then to optimize and manage the portfolio of innovation projects and activities. Regardless of whether you use IVS in its entirety or not, I’d highly recommend a construct like this to measure innovation value, determine areas for improvement, and compare and contrast against competitive benchmarks.

OPTIMIZING THE PORTFOLIO

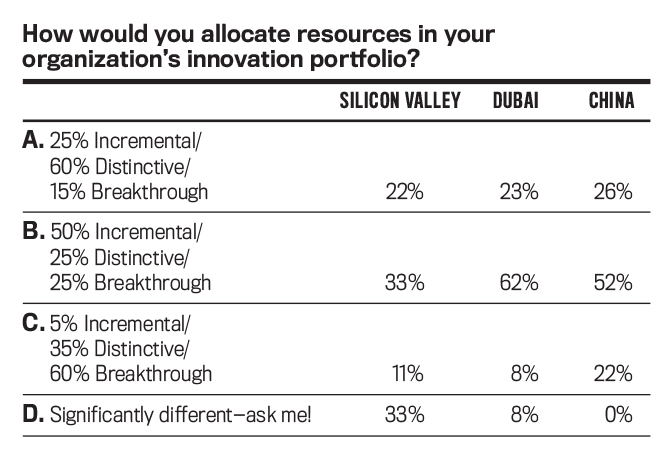

One poll question I regularly ask has been a source of some fun and spirited conversation over the past year. This relatively simple question has been eye-opening for some, validating for others, and highly agitating for others!

The reason this is such an interesting question is that it allows me to first find out how many people have had this very discussion in their organizations. Some have, but many haven’t. Often I’ll ask, “Have you had a meaningful discussion around how to allocate your innovation resources and the results you’re striving to achieve?” and “If you haven’t had this discussion, how do you expect to get close to the results you expect?”

If you’ve had this discussion in your organization, you probably argued about what your value proposition is, at what point of maturity it is, and then, ultimately, where you need to drive innovation to create value. But if you aren’t having this intentional conversation around the types and sizes of innovation that your organization needs, you’ll likely not get the results you desire. This optimization discussion can and should occur in many forums in your organization—including within strategic planning, capital planning and allocation, and operations reviews. Every day as leaders we’re optimizing our portfolio and acting as stewards of the organization’s resources to get the best value. Innovation needs to be at the core of these optimization discussions and decisions, not managed separately.

WHO’S DRIVING THE INNOVATION BOAT?

Who’s leading and supporting innovation in your organization? In more and more places, I continue to find that CFOs and their chief lieutenants are the ones who are getting tapped to engage in innovation. In their natural role, they oversee capital, budgeting, and many times planning and operational execution, so why not expand that to cover innovation? While this may seem unnatural or something outside the CFO’s wheelhouse, with some basic training and education in innovation—and by tapping into existing strengths like core analytics and decision-making skills—CFOs and their teams can bring tremendous value to the innovation realm with thoughtful governance, strategic guidance, and enhancement of employees’ ideas.

Consider, too, the impact that you could have based on your current responsibilities, your access to strategic data, and your intimate knowledge of how your organization functions. It’s highly likely that not many people understand these things as well as you do.

WHAT NEXT YEAR MIGHT HOLD

There’s clearly a good deal of work that many organizations need to do to drive successful and valuable innovation. If you haven’t yet defined and declared your innovation agenda, then you aren’t clear about what you’re striving for. If you don’t enable the organization to drive that execution, you’ll collectively founder. If you don’t measure your innovation and business results, how can you have a dialogue on how and where to improve to get better results? These basics won’t change much in the coming year. Beyond these basics, however, I see other innovation challenges and opportunities in 2017. Three are key.

First, according to some reports, there will be 4.77 billion cell phone users in 2017. Think of this the next time someone in your organization says, “We don’t need a mobile strategy; we don’t run our business that way.” Much of commerce is now done via smartphones, and it’s only going to get bigger. Organizations have to innovate their value propositions to include customer engagement trends, which today are focused on mobile and other digital components.

Second, China is a burgeoning consumer market. China is going through massive change and reform as a country and as a market. There’s a rising middle class, reforms are happening at both high levels and grassroots levels (consider healthcare reform and political changes in places like Hong Kong), and there will be more consumerism and demand for products in this market than ever before.

Third, management accountants will become “value optimizers.” I picked this up from several recent conversations in China. Different people in various meetings talked about management accountants evolving to roles that were better defined as “value creators.” In one circumstance, a leader actually changed his department’s name to “Department of Value Creation”! As value optimizers, management accountants will not only need to advise and facilitate improvements to bottom-line performance and top-line productivity, but they will need to drive value in all aspects of an organization’s value proposition to get the most optimized value for the firm and its customers.

If you think about the broad role of management accountants today and add onto that role the responsibilities of driving or supporting innovation leadership and management, you really are value creators and optimizers and can add incredible value to your organizations, industries, countries, and the global economy.

So ask yourself this before you end your workday and head home: Are you and your team value creators?

Ordering Information:

Advancing Innovation: Galvanizing, Enabling & Measuring for Innovation Value! (IMA, 2015), is available at http://bit.ly/2fBluCT.

December 2016