As Tony Larkin, senior partner at law firm Darby & Larkin, LLC, drove home from the firm’s annual golf tournament to pick up his wife for the firm’s family picnic that evening at Rutland Park, he was thinking very carefully about what he had observed that day. In the past, the golf tournament at Oak Quarry Golf Club had always been a big hit with the employees. But, frankly, this year it seemed to Tony that the level of energy and laughter typical of this event was low.

Under Tony’s direction, the firm’s office manager had carefully designed the four-person scramble teams to help individuals from different law practice groups within the firm get to know each other better. So Tony was disappointed to see that most of his colleagues were choosing to sit with members of their own groups during lunch rather than with their golf teams.

Tony was concerned, but he wasn’t really surprised as he reflected on the past year at the firm. He and his retired partner, Shannon Darby, had originally designed the firm’s business model to create healthy competition between the professionals that form each practice group at Darby & Larkin, LLC. The firm’s annual bonus pool is substantial, and it is distributed based on operating profits for each practice group. Tony liked the competition. It kept everyone motivated to serve clients and grow business within their practice. It was supposed to help employees be more conscientious about costs in the firm. In Tony’s view, however, costs continued to be too high and overall firm profits this year were essentially flat. It was affecting everyone’s bonus as well as the distribution of net income to the partners.

After handing out the bonus letters the day before, Tony was expecting some disappointed comments, and he was correct. The comments capped off a tough week for Tony. Earlier in the week he had worked with the firm’s full partners to review performance, and that process had been painful. There were grumblings about costs—specifically about the amounts some practice groups were spending on travel and training. The discussion revived old arguments about how costs were being assigned across practice groups.

Further, Rohan Sharma, lead partner with the Corporate group, raised a new concern about profit reporting and performance analysis in the firm. Rohan commented that his group did a lot of development work to acquire and upsell Darby & Larkin clients on other law services, particularly services from the Tax, Property, and Bankruptcy groups. Rohan’s point was that his Corporate group was building business for other practice groups but receiving no benefit to its own bottom line. Rohan’s frustration made sense to Tony—operating profits for Corporate were down significantly from the previous year.

In addition to Rohan’s concerns, the complaints about travel and training cost allocations, and the disappointing overall profits, Tony’s week took another step back one day as he put his golf bags in the car. His new law associate in the Estate and Trust practice, Alicia Cook, approached him and said, “Hey, Tony, I need to let you know that I received an offer a couple of days ago from one of the big downtown firms, and I’m seriously considering it.”

Tony responded, “Wow, Alicia. I know we’ve talked before about calls you’ve been getting from headhunters, but I had no idea you were considering offers. I really value your contribution here at the firm, and I thought you were enjoying the work.”

Alicia stammered a bit, “I do enjoy the work we’re doing together, Tony, and I really appreciate your mentoring me in the Estate and Trust practice. This is the kind of law work I want to continue doing, so I really hadn’t taken these headhunter calls seriously.” Alicia paused, “It’s just that we had such a disappointing year in our practice group. And my bonus check yesterday was a hard pill to swallow. I’ve got big law school loans I’m paying back, and I can’t afford another year like this last one. You understand, don’t you, Tony?”

Tony did understand. He thanked Alicia for her honesty and asked her to give him 48 hours before taking the offer from the other firm. He promised to consider carefully what he might be able to do to hold on to one of the most promising new associates in the firm. Alicia agreed and shook his hand, but her smile was a little thin, and Tony’s concern about the overall profits at Darby & Larkin weighed on him even more heavily.

BUILDING THE DARBY & LARKIN LAW PRACTICE

Twenty-three years ago Shannon Darby and Tony Larkin debuted their firm as an estate and trust law practice. Shannon had been a partner with one of the large firms in downtown Los Angeles where Tony was a promising associate, having graduated three years earlier from UCLA near the top of his class. Shannon recognized Tony early on as a rising star and offered to become his mentor. As they worked together, she shared with Tony her dream to establish a small firm outside the city where she could build on what she had learned about successfully running a law practice. Tony was convinced, and soon they both tendered their resignations and signed a contract for a shared office space on Indiana Avenue in the city of Riverside, 60 miles east of L.A.

Based on Shannon’s reputation and financial resources, they were able to weather the first thin year as they began their practice in Riverside. Estate and trust work is based on a strong community network and good reputation, which both take time. Potential estate and trust clients initially came to the firm seeking tax advice, in particular for help filing amended tax returns. Both Shannon and Tony learned a lot about taxes, and the work certainly helped pay the bills that first year. More importantly, the relationship with these clients often evolved into a long-term one involving ongoing estate and trust work. Nevertheless, neither was a tax specialist, and Shannon was determined to stay focused on their core business. Tony worked very hard those first few years, and Shannon generously let him work his way into becoming a partner at an early stage of his career.

Within five years, Tony was a full partner in the firm, and Darby & Larkin, LLC had opened a separate, stand-alone office on Magnolia Avenue. The firm had grown to include two more associates and three paralegals. The initial work helping clients file amended tax returns was evolving into a full-fledged tax practice that complemented the estate and trust services. The tax practice became a second anchor for the firm with the arrival of a new partner who specialized in tax.

Shannon and Tony expanded the practice over the next 10 years to include family law services and corporate services for small to medium-sized businesses. The Corporate services eventually grew to become the largest practice group in the firm. The firm also expanded by acquiring a small, two-attorney specialty practice in property law.

One of the promoted associates also began a practice focused on bankruptcy, enlisting the help of her recently retired law school professor to serve in an “Of Counsel” role, which is a senior attorney who—while not actively involved in the day-to-day work of the firm—is either available for consultation related to his or her specialty or manages a particular practice or client(s) on a part-time basis. Part of the value provided by Of Counsel attorneys is the “star power” brought to the firm by associating the name of the individual with the firm (on stationery, the website, etc.) without requiring his or her full-time presence or compensation. Managing Of Counsel attorneys presents particular challenges (e.g., determining insurance and liability on the attorney’s decisions, setting and managing expectations of performance and behavior, etc.).

The Bankruptcy practice is at an early stage and is still evolving. In fact, Bankruptcy has yet to report an operating profit (though it’s close), which means this practice group isn’t yet participating in the bonus pool. The group is obviously concerned, and other partners are worried about the drag on overall firm profits.

THE FIRM’S COMPENSATION MODEL

As the firm grows, the separation between the practices is becoming blurred. This blurring is generally a good result, as clients access multiple services and some of the firm’s professionals become skilled in multiple practices. One result, however, is a greater sharing of resources across practices. In particular, the Estate and Trust practice often crosses over with the Tax and Family practices and sometimes requires Bankruptcy support. Further, the Corporate practice often involves working with the Tax, Property, and Bankruptcy groups.

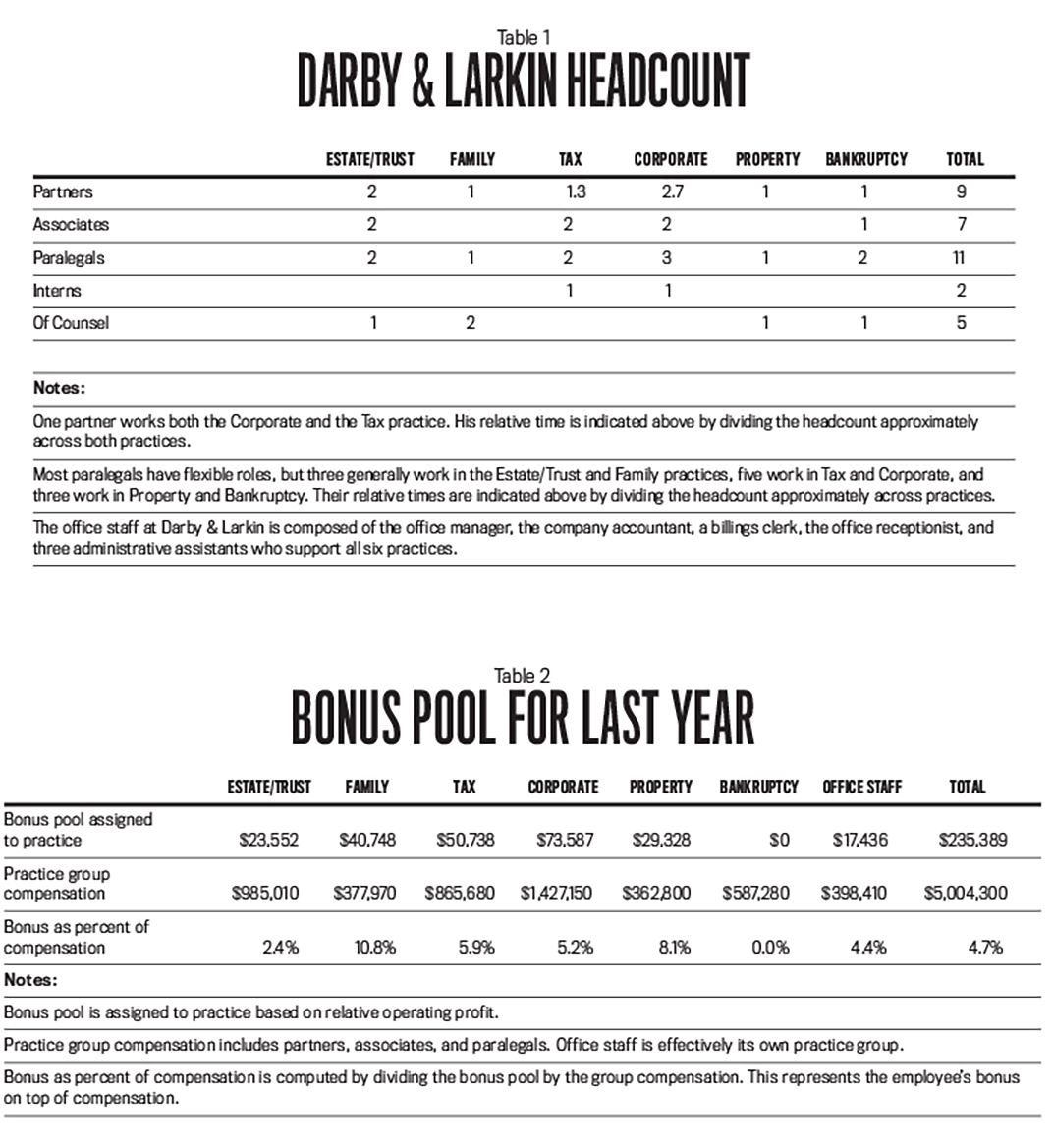

When Shannon retired three years ago, Tony became the senior partner. Shannon continues to serve as an Of Counsel attorney in the original Estate and Trust practice. Tony often seeks her advice on business development and employee management issues. Despite being retired, Shannon remains committed to the firm and continues to participate fully with all the partners in the firm’s net income. At this point, she is the only retired partner. The current headcount in the firm is shown in Table 1.

Early on, as the firm began expanding, Shannon introduced to Tony the idea that creating some competition between different practice groups could strengthen everyone’s focus on serving clients and building business. At the heart of the firm’s management model is the bonus pool. All full-time employees (other than interns) participate in the bonus pool, including active partners. The bonus pool at Darby & Larkin is designed to create a sense of ownership for all employees, not just partners.

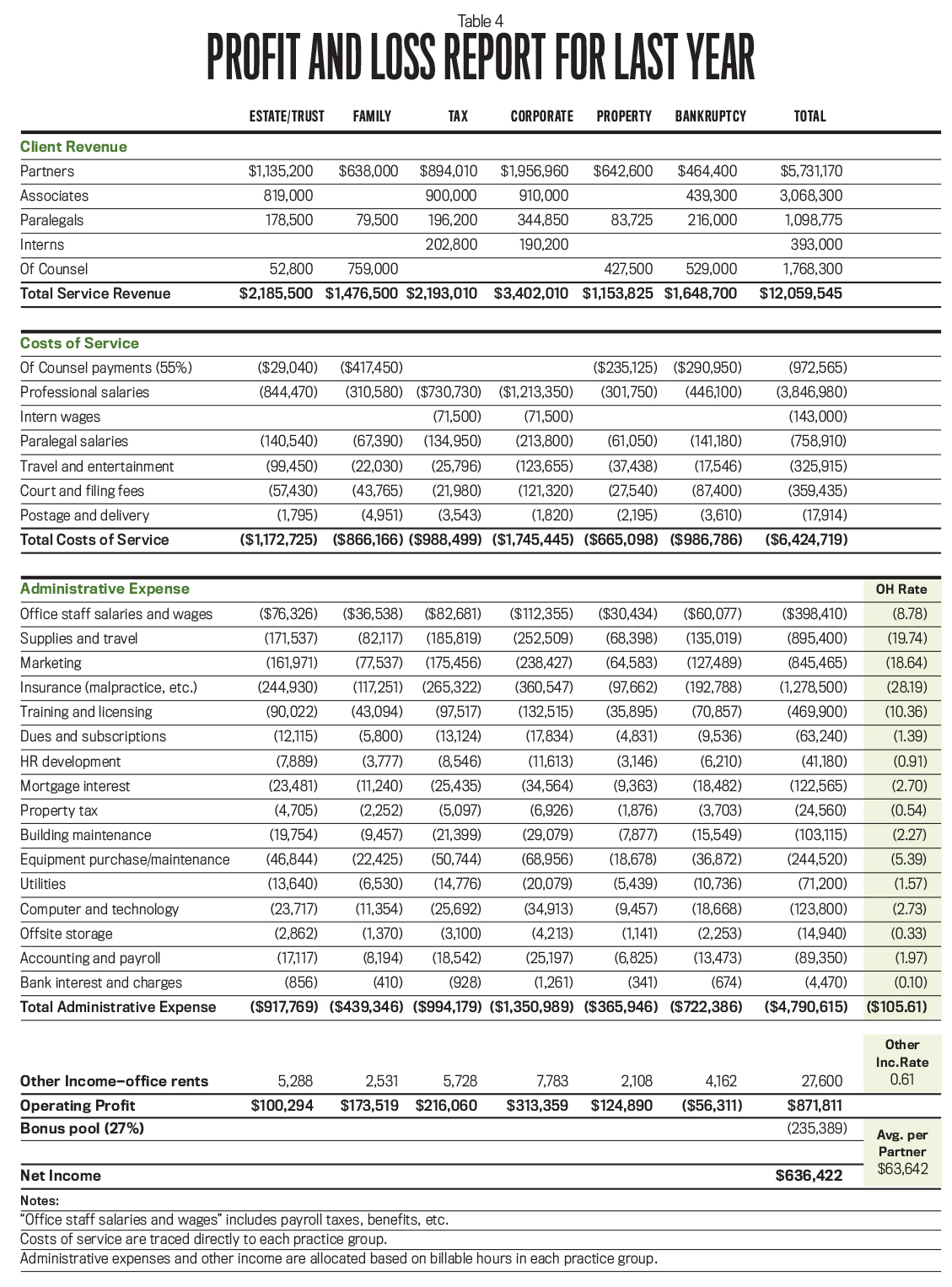

The pool is established as 27% of the firm’s total operating profit. The first 2% of the bonus pool is distributed to the office staff team. The remaining 25% is then distributed to each practice based on relative operating profit. Each practice allocates its share of the bonus pool to employees based on their relative salaries or wages. Allocations to employees who support multiple practice lines are handled by determining their proportional work during the year. Since individual salaries and wages are known only to the full partners, it isn’t possible for most employees to directly compare their bonus computations to those of their colleagues. Nevertheless, employees generally have a good sense of how their total compensation relates to that of others in the firm. Table 2 provides details of the bonus pool allocation for the last year.

Active partners participate fully in the bonus pool (retired partners don’t). Then all partners, including retired partners, are distributed an equal share of the available net income, computed as operating profit less bonus pool. (Five percent of net income is reserved by the firm for contingencies.) That said, junior partners work through a significant buy-in period as a process of becoming full partners. Specifically, 50% of each junior partner’s net income distribution is withheld until the buy-in is completed. The junior partners’ holdback is distributed equally to the full partners. Currently, half of the 10 partners are junior partners.

Darby & Larkin is unique in the extent to which it uses Of Counsel attorneys to enlarge its practice profile. This approach gives the firm flexibility to take on special projects or handle occasional spikes in client demand. But the model presents challenges when assigning costs. Of Counsel attorneys are paid at a rate of 55% of their billing rate. This works out to a higher annualized salary than even the most senior partner, but Of Counsel attorneys don’t participate in the bonus pool as employees, nor do they receive a distribution of firm profits like partners do.

Shannon Darby, who is now Of Counsel to the Estate and Trust group, only bills client hours occasionally. Most of her involvement with the firm is consultative, advising on firm management issues and occasionally on particularly difficult client issues. The two Of Counsel attorneys working with the Property and Bankruptcy practices are almost entirely focused on billable client work and require very little overhead support by the firm. They work out of their home offices and handle their own client communications. The last two Of Counsel attorneys, who are involved in the Family practice, maintain an office at the firm (despite working significantly less than full-time) and require significant staff and paralegal support.

FINANCIAL PERFORMANCE

Table 3 provides an analysis of Darby & Larkin’s client revenue for the last year. Billing rates are based on published studies of law practice in the surrounding areas and are managed to be competitive with other offices. In terms of client services, associates carry the lion’s share of the load, which is typical of most offices. Partners spend substantial time nurturing client relationships and developing new client business, paralegals provide support work that isn’t always billable, and interns are somewhat protected from being overworked. In addition, associates, paralegals, and interns participate substantially in training events both in and out of the office.

The last year’s profit and loss report is provided in Table 4. There are significant differences in both client revenue and costs of service across the practice groups. There is also a significant difference in how administrative expenses are being reported for each practice group. But it’s difficult to describe this as a “performance” management issue for practice groups since administrative costs are allocated based on an overhead rate computed using total billable hours. What’s clear, however, is that the differences in these various administrative expenses are sizable when computed as a rate based on billable hours.

Darby & Larkin rents out some of its office space to a property title company for $2,300 per month. This “other income” is also allocated across the practice groups as an offset to administrative expenses, resulting in a net overhead rate last year of approximately $105 per billable hour. Clearly, the volume of billable hours doesn’t actually create many of these costs. Otherwise, it would make no sense to ever bill clients less than $105 an hour as this would create a net loss on the client hour.

Tony Larkin is reasonably confident that even the average billable rate of $85 per hour for the paralegals is making money for the firm. What isn’t clear to Tony is the actual value (or margin) provided to Darby & Larkin on each billable hour across the different practice groups and for each type of professional. The average net income distribution to partners for this last year ($63,642) was below expectations. Either the volume of billable hours needs to increase or costs need to be reduced somewhere in the office (since client rates are largely set by the market).

THE DRIVE HOME

Tony was thoughtful as he drove home. He had no regrets about the decision to leave the big L.A. practice so many years ago and start his own firm with Shannon Darby. Overall, the firm had been a success. But profit performance over the last few years seems to indicate a leveling off or worse. As he drove, Tony resolved to gather the partners as soon as possible to discuss this situation. Before that meeting, Tony planned to spend some time with his old mentor to consider the firm’s situation before it became a crisis. By the time he pulled into the driveway, Tony had specifically laid out in his mind the issues to discuss with Shannon. He also resolved that outside help is needed. You have been retained by Tony to help him analyze the following issues as he works with the firm partners:- Each practice group is responsible for its costs of service, but the allocation of administrative expenses isn’t clear. What factors need to be considered in how costs are assigned and used in profit analysis and performance evaluation? What additional information is needed for this analysis?

- What should be done about the Bankruptcy practice? Does Tony need to take a different approach in analyzing performance and profit for this practice group?

- The overall management strategy at Darby & Larkin is based on competition for the bonus pool. Based on Rohan Sharma’s frustration about noncompensated work for other practice groups, is this the best approach to incentivize the professionals at Darby & Larkin?

4. Recently, Tony has had a series of lunch meetings with a five-attorney office in the city of Corona. This smaller firm specializes in personal injury and product liability work. The discussion has been about merging this office with Darby & Larkin to again expand the firm. The Corona office would be maintained as a separate location from the main office in Riverside. What factors should Tony consider with respect to this possible acquisition?

August 2016