What capabilities must today’s financial leaders have to be successful? To find out, we interviewed CFOs and human resources (HR) executives and identified the key required competencies. We wove them into a framework that you can use to develop your own leadership abilities and those of senior finance team members.

Let’s look at what we did and how you can apply what we learned.

TOP COMPANIES TAPPED

After reviewing recent research about financial leadership, we talked with 12 CFOs and HR vice presidents at some of the most successful organizations in the world. While many of them asked to remain anonymous, several agreed to have their comments attributed. We found that many leadership competencies identified 10 to 20 years ago are still essential to the job—including the importance of articulating a vision, developing talent, and building commitment among team members. But today’s financial leaders must also satisfy new demands. They must integrate Big Data and identify, negotiate, and manage a variety of risks. That has made the finance leader’s role even more complex.

The “What Are the Key Leadership Qualities?” sidebar at the end of the article summarizes some important insights from our interviews and the past 10 years of financial leadership research. And if you’ve wondered about the background of today’s Fortune 100 CFOs, check out “Where Do CFOs Come From?”

DEVELOPING WORLD CLASS LEADERS

In our literature review and interviews, CFOs and others agree that the changing role of the financial leader has boosted the importance of several skill sets, including technical expertise in new areas, critical thinking and strategy, negotiation, communication, and leadership. What’s the current practice at global firms? And what can we learn from that?

Most large firms use a model detailing key competencies to measure leaders’ performance and effectiveness. The models vary, just as firms’ missions and strategic goals vary. Perhaps that’s one reason why we found no clear consensus about competencies and the ideal financial leader profile. But many CFOs identified common elements that provide a starting point to assess core competencies.

We identified six competencies frequently named by finance and HR executives that we believe contribute to the development of exceptional finance leaders:

- Communicate a vision and path,

- Assess the competitive environment with an external orientation,

- Foster breakthrough thinking,

- Develop outstanding financial talent,

- Build team commitment, and

- Propel to action.

These competencies, also shown in Figure 1, can help finance professionals and their teams improve performance and create a climate suitable for meeting strategic goals. They can also assist in professional development, recruiting, and establishing performance metrics.

1. COMMUNICATE A VISION AND PATH

Great finance leaders develop clear aspirations and goals and communicate them with passion. They convey their corporate vision along with a detailed road map for achieving it as effectively as possible. And while they excel at understanding the steps needed to attain strategic goals, they also know the importance of instilling broad support.

All company employees can contribute to the organization’s goals. The leaders surveyed highlight the importance of sharing ideas and soliciting input from across the company in forming the corporate vision and attaining it. In addition, they encourage employees to take on new challenges and create an environment where actions and policies are easy to understand. Equally important, they seek to create a culture that encourages innovation and readily adopts novel approaches or methods.

“Good business leaders create a vision, articulate the vision, passionately own the vision, and relentlessly drive it to completion,” Jack Welch, former chairman and CEO of General Electric, says. Paul West, a senior executive who served in various management capacities for divisions of Unilever N.V. and was formerly president of Elizabeth Arden, puts it this way: “Keep your hand in the past but your head in the future.”

To communicate a vision and a path:

- Articulate a compelling customer-centric vision. Create it after listening to ideas and information from employees at different organizational levels. Incorporate their input.

- Share a clear implementation strategy.

- Disseminate the vision throughout the entire department/organization through a communication strategy that all employees will understand readily.

When creating a compelling road map for the future, financial executives must put the company first rather than the division, category, or country-based group they happen to be leading. They also must avoid a bias for personal or local projects.

2. ADOPT AN EXTERNAL ORIENTATION

A second key competency for finance leaders is an external orientation. Leaders describe it as the ability to analyze and make use of competitive information to develop and shape strategies and solutions. Patrick Cescau, former chairman and CFO of Unilever PLC, gives this advice: “To build world-class marketing and customer development capabilities, we have to be much more receptive to—and curious about—the outside world. As a leadership team, we have to walk that talk better than anyone else. Get out more and listen!”

An external orientation also exemplifies the difference between a good finance leader and a great one. A great leader anticipates trends in the marketplace and uses them to shape strategies and solutions. The leader is networked with many external partners and builds partnerships and alliances that enhance the company’s competitive advantage. Such individuals understand the influences that shape the business environment in which their company operates. This external orientation extends beyond a customer focus to include potential new markets, the supply chain, and regulatory or compliance issues. Investor relations also can fall under this competency.

To adopt an external orientation:

- Monitor the external environment—including changing customer dynamics, market shifts, demographic patterns, and the economic, political, and social landscape of key markets.

- Anticipate customer needs.

- Maintain constant communication with a network of customers, suppliers, partners, and other stakeholders.

- Consider investor perspectives.

Pitfalls include dismissing the importance of outside networks, being complacent about customer needs or concerns, and failing to anticipate the impact of new tastes and trends.

3. FOSTER BREAKTHROUGH THINKING

The executives we surveyed agree that finance leaders’ ability to think strategically is critical. Improving revenue growth, creating innovative customer solutions, and creating firm value require the ability to analyze problems and identify solutions not obvious to others. Successful leaders can comfortably shift gears to meet changing needs and situations in a fast-paced global environment, and they can quickly correct course in unpredictable situations.

Breakthrough thinking means quickly adapting to challenging situations while others take time to adjust. It requires strong critical-thinking and problem-solving skills and the ability to create a collaborative environment where this thinking can occur.

To foster breakthrough thinking:

- Question the status quo, including products, mindsets, and processes.

- Encourage development of industry innovations, and don’t be afraid to shift focus.

- Use insight in complex situations to change existing patterns of working when needed. Sometimes it makes sense to ditch conventional work patterns and boundaries.

- Recognize when a current opportunity or problem is similar to a previous one, and use this experience to craft a solution.

- Think creatively about available resources when solving problems, and rethink processes.

- Consider how responding quickly to customer changes can facilitate business growth and provide new opportunities, instead of recognizing opportunities after competitors do.

4. DEVELOP OUTSTANDING FINANCIAL TALENT

The executives we interviewed believe that having the best people is vital to building a successful company. They said it was important to develop a diverse group of employees who have winning attitudes, live to have fun, and feel a passion for growing themselves, others, and the business.

In a 2013 Deloitte global finance talent survey, 92% of respondents agreed that talent management is a top important concern for the finance profession.

Successful leaders value nurturing their teams as much as they do achieving business results. Interviewees commonly felt that if they created an environment so good that top talent was always knocking on the door to get in, success would be inevitable.

An important requirement of this competency is that leaders must faithfully model the behavior they espouse—especially in challenging and difficult situations. True leaders take ultimate responsibility. They recognize that a “Do as I say, not as I do” philosophy is incredibly damaging to morale. Honesty and trust form the foundation of a collaborative environment, and leaders whose actions provide this inspire others and raise performance levels.

Paul West cited a favorite quote by Lee Scott, former CEO of Wal-Mart: “The people [who] report to you are more important than you are.” Great leaders are committed to others’ career development. They are skilled in identifying strengths and areas needing development, and they provide the required coaching and guidance to develop their team. They set clear goals and expectations, measure performance consistently, and reward progress. The end result is a team with the skills, desire, and motivation to outperform the competition.

To develop outstanding talent:

- Give practical support and assistance. For example, help others learn by providing expert advice or additional resources.

- Encourage employees to take risks and stretch assignments.

- Provide frequent and specific feedback.

- Partner with HR on development plans for key personnel, and identify skill deficiency areas.

- Follow up with individuals after development assignments to review performance and consider future improvement.

- Recognize your own development needs, and seek honest feedback. This will improve your performance, and you will be an inspiring role model for others.

Be wary of a climate of blame and finger pointing, where entrepreneurial behavior is discouraged. Don’t ignore long-term development needs by overemphasizing immediate tasks.

5. BUILD TEAM COMMITMENT

Finance leaders agree that without real teamwork their organizations will fail. A great finance leader builds an engaging and realistic vision of the organization’s future. Key skills mentioned in our interviews include the ability to build networks and relationships that enhance collaboration. Others are the capability to integrate across boundaries and the capacity to create an environment where all team members feel free to contribute. It’s essential to morale that leaders seriously evaluate the diverse ideas and other contributions they receive, whatever the source. Perhaps most important, a leader must enable the team to earnestly debate viable options and then present a united front in championing the selected path.

One of the executives interviewed likened this to everyone being on the same team with the organization’s name on the front of their jerseys. Employees are encouraged to embrace individuality but to remain indivisible. They are all one team and share a competitive spirit. Great finance leaders respect and support the team, care about members’ interests, and create respect. They quickly find common ground and identify the most efficient way to tackle problems.

To build team commitment:

- Create a winning mind-set and shared vision for team success.

- Develop team goals and roles requiring collaboration.

- Celebrate team successes while acknowledging individual contributions.

- Put team interests above individual needs.

- Cultivate relationships and networks to ensure collaboration, integration, and alignment.

Avoid engaging in critical comments that impact team morale negatively or discourage open communication. Build a climate where firm success is deemed most critical and individual achievements are viewed as possible because of team support.

6. PROPEL TO ACTION

Executives we interviewed agree that growth and creating value are more important than winning an intellectual argument. That requires taking risks. Outstanding finance leaders stimulate open discussion and debate, but they can then move to implementing plans because they are able to envision and articulate the path to action. Once a decision is made, the team moves on with a united front. Superb leaders act with a sense of urgency and genuine passion for getting things done, and they deliver on commitments even in the face of obstacles. They view any resulting failures as opportunities for team learning and doing better the next time.

To propel to action:

- Don’t be afraid to proceed with less-than-perfect information.

- Don’t wait for 100% consensus.

- Once a goal is set, rally the team to deliver outstanding results.

- Allow space for taking risks.

- Reward good ideas and initiatives even when they don’t work out.

UPGRADING CRITICAL COMPETENCY SKILLS

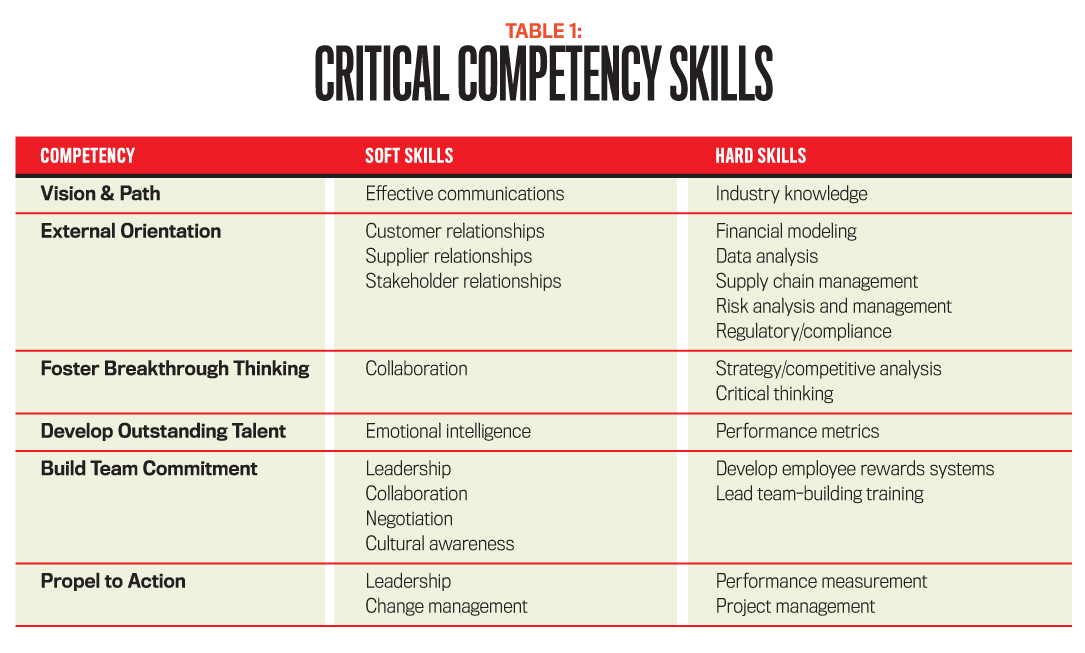

The six critical leadership competencies we’ve just discussed consist of both soft skills and hard skills. Soft skills are broader and are more social or emotional in nature. Hard skills include traditional intellectual, financial, and business capabilities. How complete are your critical competency skills? Which ones need an upgrade? Become familiar with the critical competency skills in Table 1.

The finance leaders who took part in this research were senior leaders in some of the world’s largest organizations. But all agree that the lessons are relevant for various business sizes and at all levels of leadership.

DEVELOPING EMPLOYEE AWARENESS

It’s important to make employees aware of the competency framework. How do the top finance leaders we interviewed educate finance teams and raise awareness of firm-specific models of leadership competencies?

Most of them use an initial widespread rollout of the competency framework via workshops led by some of their senior business leaders. Employees can access standardized plans and directions, along with online training, on a dedicated website. In addition, interactive training sessions and workshops let employees write descriptions of the competencies in their own words, focusing on competency characteristics and significance. Facilitators illustrate the competencies with examples of great leaders who displayed them, spotlighting the impact of leaders’ actions on the organization.

For each competency, firms offer specific examples illustrating high-level vs. lower-level performance. For instance, they might compare one propel-to-action case with a bias-against-action case. Distinguishing high-level performance from modest or weak performance helps employees see what’s expected and how to achieve it.

ACHIEVING LEADERSHIP SUCCESS

As financial leadership roles have started to grow in complexity, companies have begun to develop leadership competency frameworks. These serve to educate employees about performance standards, ease professional development, and identify deficiencies. The framework we presented can help you and your finance team develop exceptional leadership skills. Start upgrading the skills in your financial leadership toolbox today. SF

Barbara Magi Tarasovich, CPA, CGMA, DPS, is assistant professor of accounting and director of the Master of Science Accounting Program at the John F. Welch College of Business, Sacred Heart University in Fairfield, Conn. She has more than 25 years of experience at Unilever and has worked on many acquisitions and integrations. She is also a member of IMA’s Waterbury Chapter. You can reach Barbara at (203) 416-3513 or tarasovichb@sacredheart.edu.

Bridget Lyons, DPS, is professor of finance at the John F. Welch College of Business at Sacred Heart University in Fairfield, Conn. She has more than 20 years of experience in corporate finance and valuation. Bridget is also a member of IMA’s Coastal Fairfield County Chapter. You can reach her at (203) 365-7673 or lyonsb@sacredheart.edu.

SIDEBAR: Where Do CFOs Come From?

A 2012 analysis of every Fortune 100 CFO’s career path found:

- 69% were promoted internally

- 31% were external recruits, usually with relevant industry experience

- 50% had served as a divisional CFO

- 40% had significant corporate accounting experience

- 36% had significant general management experience

- Women represent 10% of Fortune 100 CFOs but

- 20% of appointments over the last three years.

- CFO appointments over the previous three years showed growing emphasis on strategy roles and international experience.

Source: Russell Reynolds Associates, “Where Do CFOs Come From? 2012 Update: Profiles and Career Patterns of Fortune 100 Chief Financial Officers,” 2012 (www.russellreynolds.com).

SIDEBAR: What Are the Key Leadership Qualities?

Nuggets from financial leadership research and our financial leader interviews:

- In their book The Leadership Challenge, James M. Kouzes and Barry Z. Posner name five practices of exemplary leadership: model the way, inspire a shared vision, challenge the process, enable others to act, and encourage the heart.

- Former IMA Chair Bill Brower, former group vice president of finance at Johnson & Johnson, told us that the six Cs of leadership credibility are conviction, character, care, courage, composure, and competence.

- In their April 2007 Harvard Business Review article “The Leadership Team: Complementary Strengths or Conflicting Agendas?” Stephen A. Miles and Michael Watkins describe four pillars of alignment: shared vision, rewards for achieving common goals, constant communication, and trust that each team member has the firm’s best interests at heart. The pillars support leadership team members’ distinctive strengths and enable the team to deliver far better results than each could achieve as individuals.

- Alan Wunsche, VP of global risk management at Scotia Bank, wrote “The CFO as Strategist and Catalyst in Building a High-Performance Culture” (Ivey Business Journal, November/December 2007), in which he discusses the Four Faces of the CFO: catalyst, steward, strategist, and operator. He notes that these roles may be divided and shared by the finance leadership team, but the team needs to work as an integrated whole.

- In a January 2013 article for McKinsey & Company titled “Today’s CFO: Which profile best suits your company?” Ankur Agrawal, John Goldie, and Bill Huyett investigate the changing role of the CFO. They analyze the experience, credentials, and backgrounds of CFOs at the 100 global companies with the largest market capitalization and identify four distinct CFO types: the finance expert, the generalist, the performance leader, and the growth champion.

- A 2013 Accountemps survey of more than 2,100 CFOs from companies in large U.S. markets revealed that the most common reason an employee failed to advance was poor interpersonal skills. In earlier Accountemps surveys, when CFOs were shown similar accounting and finance candidates, 31% of the CFOs said personality or people skills trumped technological or industry-specific experience.

- A September 30, 2013, article by Terri Eyden titled “ACCA/IMA Report Reveals Ten Key Skills for Future CFOs” discusses a recent joint survey by the Association of Chartered Certified Accountants (ACCA) and IMA® (Institute of Management Accountants), “Future Pathways to Finance Leadership.” The survey found that accounting and finance professionals need to focus on the skills that matter—and the top skill mentioned was leadership

March 2015