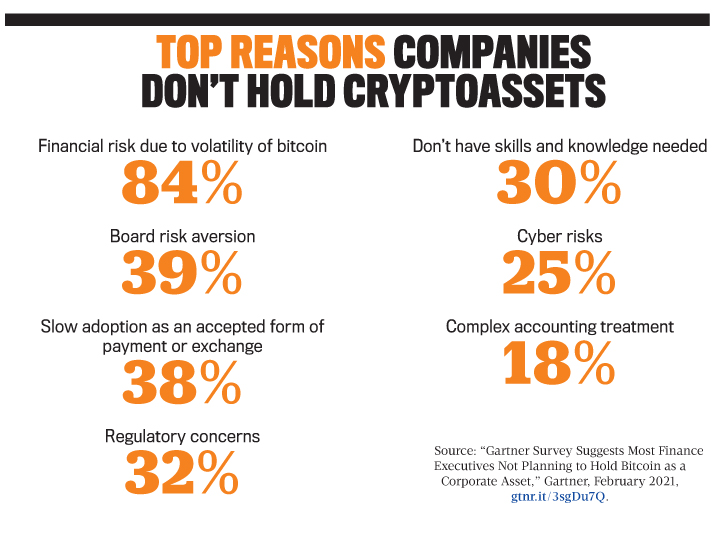

To date, most corporations have stayed away from this asset class, and, despite recent newsworthy windfalls, it isn’t likely that this will change in a big way any time soon. According to a recent Gartner survey of CFOs, just 5% said they planned to hold bitcoin as a corporate asset in 2021, and 84% said they would never hold bitcoin.

The main reasons for not holding cryptocurrencies? Volatility, followed by board risk aversion, slow adoption as a medium of exchange, and regulatory concerns (see “Top Reasons Companies Don’t Hold Cryptoassets”).

“Until we see significant market or regulatory changes that calm the price swings, most boards aren’t likely to give the green light to cryptoassets,” said T. Paul Rowland, former CFO of Brane Inc. and a blockchain entrepreneur. “And as long as cryptocurrencies aren’t as easily exchanged as fiat money, it’s likely to stay that way.”

VOLATILITY AND RISK AVERSION

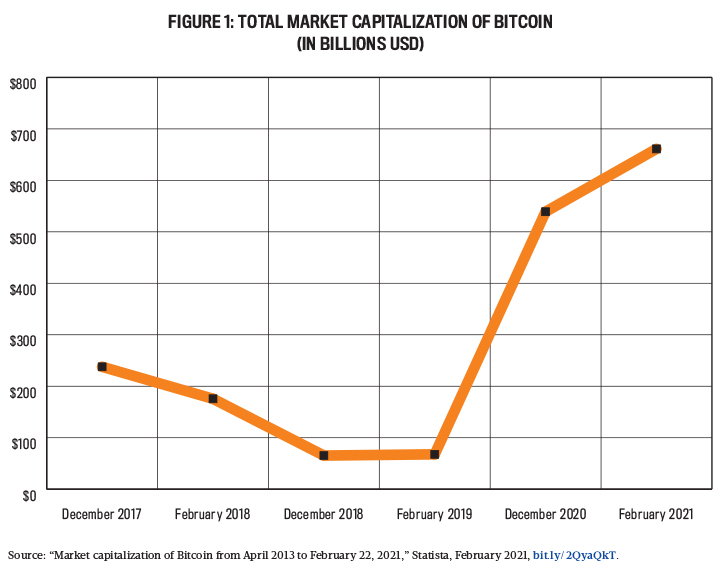

It’s precisely the volatility and lack of transparency with cryptocurrencies that regulators and financial market participants are now attempting to address (see Figure 1). When bitcoin was created in 2009, it was originally intended as a way to pay for goods anonymously, via blockchain, without needing the involvement of banks or other intermediaries. As such, its intent was to be available to all for the exchange of goods and services in a peer-to-peer environment that would, some suggested, ultimately lead to the disintermediation of the global financial system.

Instead of having the properties of cash, digital currencies behave more like commodities or securities. (Some virtual currencies, i.e., stable coins, have been developed to behave more like fiat money, but those have been the exception in the more than 4,000 cryptocurrencies that exist today. Go to CoinMarketCap for a list of current cryptocurrencies.)

To date, digital coins have primarily been the domain of digital prospectors, tech companies, speculators, and criminals. Bad actors are seen to benefit the most when digital coins are used as a medium of exchange. Some estimates suggest that 46% of all bitcoin transactions, or $76 billion annually, involve some form of illegal activity. It’s been calculated that this is roughly equivalent to the entire value of the U.S. and European Union market for illegal drugs (see Sean Foley, Jonathan R. Karlsen, and Tālis J. Putniņš, “Sex, Drugs, and Bitcoin: How Much Illegal Activity Is Financed through Cryptocurrencies?” The Review of Financial Studies, April 2019).

While the problems associated with cryptocurrencies aren’t likely to go away in the near future, there’s reason to believe that a solution may be coming down the road.

A COMPLICATED WEB

Josias N. Dewey, partner at Holland & Knight LLP, says U.S. lawmakers have been regulating digital currencies for quite some time, but thus far have been hamstrung by traditional thinking. “Policymakers and other officials have often struggled to apply laws crafted decades ago, in many cases, built on assumptions now being challenged by the technology,” he said. “No consistent policy has yet to evolve, with numerous states within the U.S. taking very different approaches to the technology, while the U.S. government has relied on its agencies to navigate the myriad of issues.”

To date, oversight of digital currencies in the United States is a complicated web of rules and regulations from any number of federal and state authorities. The Commodity Futures Trading Commission has oversight of derivatives transactions (cash, spot, and futures) related to a virtual currency to the extent it’s considered a commodity. The U.S. Securities & Exchange Commission claims federal jurisdiction over virtual currencies insofar as they have properties of a security.

The Financial Crimes Enforcement Network (FinCEN) regulates money services transmitters and has issued interpretative guidance for virtual currency exchanges. The U.S. Department of the Treasury and federal banking regulators also have certain levels of oversight of virtual currencies, and all 50 states monitor virtual currencies through various legal and regulatory regimes.

STEPS TOWARD TRANSPARENCY AND REPORTING

In recent months, U.S. regulators have attempted to address issues related to cryptocurrency transactions with two new regulations. The first is intended to stifle the activities of bad actors by requiring the virtual currency exchanges to know their customers. The second allows banks to form their own blockchains, exchange currency tokens for fiat cash, and make other transactions and payment activities using stable coins. This is intended to calm price volatility and provide security for digital currency investors.

On December 23, 2020, FinCEN proposed new rules requiring banks and money service businesses, including virtual currency dealers, to identify and verify hosted wallet customers who engage in transactions with unhosted or otherwise covered wallet counterparties (i.e., strictly peer-to-peer private key holders). The proposed rules would also create a new prohibition on structuring (i.e., engaging in transactions in a manner to avoid reporting requirements) applicable to virtual currency transactions.

While some are happy with the proposed ruling, pointing to the potential to expose bad actors and increase comfort for institutional investors, there has been some criticism from the digital coin industry.

According to then-U.S. Secretary of the Treasury Steven T. Mnuchin, “This rule addresses substantial national security concerns in the CVC [convertible virtual currency] market, and aims to close the gaps that malign actors seek to exploit in the recordkeeping and reporting regime.” The rule, he adds, “is intended to protect national security, assist law enforcement, and increase transparency while minimizing impact on responsible innovation.”

Yet the Global Digital Asset & Cryptocurrency Association (GDCA), which represents more than 110 organizations (including, for example, spot and derivative exchanges, custodians, decentralized technology organizations, and banks), isn’t convinced. Specifically, it argues that the proposed rule in its current form has the opposite effect and undermines the intended advancement of U.S. national security interests while harming global competitiveness and positioning of the U.S. in the global digital economy.

In its comment letter on the FinCEN regulations, the GDCA cautions, “...in a decentralized and privacy-centric infrastructure, such as is evolving in the Digital Assets industry, requiring the application of existing reporting rules may have the unintended effect of pushing participants to the grey markets, outside of effective U.S. jurisdiction. This may increase the difficulty and ability of regulators and law enforcement to identify illicit activity, eliminate nefarious actors, and further protect U.S. national security interests.”

Further, the GDCA suggests it will inhibit the contribution of the digital asset industry to job creation and economic growth in the U.S. “There are many budding enterprises in the Digital Assets industry that may not yet have the resources to implement the required protocols and framework necessary for compliance with the Proposed Rule,” it claims. “The Proposed Rule may, in effect, cause harm to U.S. business development and overall global competitiveness. The result may be the creation of a different, less liquid, and crippled market here in the U.S., while technological innovation, intellectual property, and global monetary influence is driven overseas.”

Jack Dorsey, CEO of Square, Inc. and Twitter, echoes these concerns, commenting that the proposal creates “perverse incentives for cryptocurrency customers to avoid regulated entities for cryptocurrency transactions, driving them to use non-custodial wallets or services outside the U.S. to transfer their assets more easily.” He adds, “By adding hurdles that push more transactions away from regulated entities like Square into non-custodial wallets and foreign jurisdictions, FinCEN will actually have less visibility into the universe of cryptocurrency transactions than it has today.”

BANKING ON CRYPTOCURRENCIES

Meanwhile, regulators provided the official go-ahead for banks to exchange in digital currency transactions. While some banks were making inroads in that space—Silvergate Capital, Signature Bank, and J.P. Morgan Chase have already gotten involved with cryptocurrencies in some way—the ruling marks the ongoing signaling that transacting in digital currency is a reasonable extension of traditional banking services.

On January 4, 2021, the Office of the Comptroller of the Currency (OCC) published Interpretive Letter 1174, proposing that banks can use independent node verification networks (INVNs, i.e., blockchain) and stable coins to perform bank-permissible functions, such as payment activities.

In other words, the proposal allows banks to issue digital coins and exchange existing coins for fiat currency. This comes with a variety of robust custody responsibilities.

For banks, according to the OCC, engaging in blockchain technologies may enhance the efficiency, effectiveness, and stability of payment activities and achieve the benefits of real-time payments already enjoyed in other countries. The OCC also concludes that such activities “may be more resilient than other payment networks because of the decentralized nature of INVNs…. INVNs allow a comparatively large number of nodes to verify transactions in a trusted manner.” In addition, the OCC says, “an INVN also acts to prevent tampering or adding inaccurate information to the database. Information is only added to the network after consensus is reached among the nodes confirming that the information is valid.”

What does this mean for banks and their customers going forward?

“It’s a new dawn for digital currencies,” Rowland says. “The ruling will likely drive demand. Banks want to be in this space; they’ve recognized there’s a future there.”

In terms of how banks will need to proceed in the world of digital currency, they “must also be aware of potential risks when conducting INVN-related activities, including operational risks, compliance risk, and fraud,” the OCC says. “Among the compliance risks, banks should guard against potential money laundering activities and terrorist financing by adapting and expanding their compliance programs to ensure compliance with the reporting and recordkeeping requirements of the Bank Secrecy Act and to address the particular risks of cryptocurrency transactions.”

MORE THAN A TRICKLE INTO THE MAINSTREAM

Against this backdrop, other financial market players are making big digital currency plays faster than they can be reported. For example, on January 13, 2021, the OCC announced it would grant conditional approval for the conversion of Anchorage Trust Company, a South Dakota-chartered trust company, to become Anchorage Digital Bank, National Association, a crypto-based bank.

Visa is working with Anchorage to allow customers to buy and sell digital currencies. It also is experimenting with open APIs (application programming interfaces) to allow other banks access to Anchorage’s digital infrastructure. Other market players are also facilitating the use of digital currencies as legitimate cash. PayPal is now working on rolling out a service in 2021 that will enable customers to use cryptocurrency to pay for goods and services with its 29 million merchants worldwide.

Digital currencies are gaining more acceptance in the U.S. Lawmakers are taking bold steps to prevent the exchange of cryptocurrencies for illegal purposes. At the same time, the world of digital payments using cryptocurrency has been opened up to the U.S. banking industry with the official nod of the OCC. Major market players are also expanding the potential for cryptocurrencies to actually live up to their original intent as a medium of exchange for goods and services around the world.

Rowland says these measures are a significant step on the legislative road forward.

“This is what was needed to get cryptoassets out of the dark, into the light,” he says. “I think it’s something that the industry has been calling for, for a few years. Regulators are now beginning to come to grips with the fact that cryptocurrencies are not going away.”

Will CFOs embrace these market and regulatory developments on the horizon? Gartner suggests not, but at this point in the world of cryptocurrency, anything is possible.

Some companies have begun to take the plunge. Tesla made headlines with a $1.5 billion bitcoin investment in February 2021. That same month, business analytics company MicroStrategy added 19,452 bitcoins to its holdings, bringing its total to 90,531 bitcoins. It then added an additional $15 million worth of bitcoin in March. Overall, the company reports having spent a little more than $2.2 billion on bitcoin. At the time of the purchase in March, the value of its total bitcoin holdings was approximately $5.2 billion. It remains to be seen how quickly other companies will join.

SAMPLE CRYPTOCURRENCY REGULATIONS OUTSIDE THE U.S.

Canada

- Cryptocurrencies are not legal tender.

- Cryptocurrency exchanges are required to register with the Financial Transactions and Reports Analysis Centre of Canada after June 1, 2020.

- Cryptocurrencies are subject to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.

Japan

- Cryptocurrencies are legal and treated as property.

- Cryptocurrency exchanges must register with the Financial Services Agency.

- Recent regulations include amendments to the Payment Services Act (PSA) and to the Financial Instruments and Exchange Act (FIEA), which took effect in May 2020. The amendments introduce the term “crypto-asset” (instead of “virtual currency”), place greater restrictions on managing users’ virtual money, and more tightly regulate crypto derivatives trading. Under the new rules, cryptocurrency custody service providers (that don’t sell or purchase cryptoassets) fall under the scope of the PSA, while cryptocurrency derivatives businesses fall under the scope of the FIEA.

United Kingdom

- Cryptocurrencies are not legal tender.

- Cryptocurrency exchanges are legal and must register with the Financial Conduct Authority (FCA).

- Starting January 10, 2021, all U.K. cryptoasset firms (including recognized cryptocurrency exchanges, advisers, investment managers, and professionals) that have a presence or market product in the U.K., or that provide services to U.K. resident clients, must register with the FCA. Critically, these groups must comply with Anti-Money Laundering/Combating the Financing of Terrorism reporting and customer protection obligations. FCA guidance stresses that entities engaging in activities involving cryptoassets must also comply with the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017.

For coverage of international virtual currency regulations, see “Cryptocurrency Regulations around the World,” ComplyAdvantage.

© 2021 by Ramona Dzinkowski. For copies and reprints, contact the author.

May 2021