Management accountants must be prepared to plan for and engage in using digitalization—and its spin-offs, particularly AI—to maximize their organization’s decision-support capabilities. Operational information used on its own can make strides toward optimizing profitability, yet an organization’s ability to optimize outcomes can be significantly enhanced with monetary information designed to highlight operational problems and opportunities and to identify optimal tactical and strategic alternatives in decision-making scenarios.

Monetary information enhances organizational value creation when it’s relevant and applicable to the day-to-day business decisions of the managers and employees who build, deliver, or directly support building and delivering products and services to customers.

The challenge for finance to meet this need in the Digital Age is twofold:

- What kind of framework will best facilitate connecting monetary information with digitally driven operations to support internal decision making?

- What role can AI play in using monetary information to enhance decision support in a digital environment and optimize the achievement of strategic objectives?

STRUCTURING MONETARY INFORMATION

Modeling has always been a cornerstone of traditional management accounting. In fact, much ink and pixels have been spent debating (and arguing about) which method-centric models are better. The importance of modeling is best captured by a quote from Alfred R. Oxenfeldt, a longtime professor at Columbia University. In his book Cost-Benefit Analysis for Executive Decision Making, Oxenfeldt wrote, “The validity of our decisions depends upon our perception and understanding of reality. Good decisions require good models, and the caliber of our decisions reflects the quality and validity of our models.” The digital twin provides a perfect model of the reality that decision makers strive to optimize, but it isn’t a financial model (see “Digital Twin”).

The advent of the digital economy will greatly accentuate the differences between financial models for internal decision support and financial models for external financial reporting. It places a premium on forward-looking information, demands feedback in real time, and has limited use for historical information. Financial accounting is a lagging indicator; it only changes after action has been taken in operations, service, logistics, sales, or marketing.

In contrast, the aim of analytics and decision making in a digital economy is:

- Use readily available digital information to optimize the process of converting inputs into outputs, and

- Drive optimal action with multiple scenario analyses as soon as new information or new alternatives are identified.

Operational activities are leading indicators, and information systems that support operations have long focused on creating high responsiveness to facilitate decisions and action. In the digital economy, the ability to monetize operational scenarios instantly and with a forward-looking perspective isn’t just critical, we expect it!

Developing cost information in a digitalized world and for the effective use of AI requires a causally truthful model—one that monetizes operational cause-and-effect relationships accurately. In a stroke of foresight, or maybe as luck would have it, the accounting profession codified frameworks that use causality for creating internal decision support information:

- IMA’s Conceptual Framework for Managerial Costing establishes foundational principles and concepts for creating financial models and information purely for internal decision support. It says, “The guiding principle for operations modeling (and, hence, cost modeling) is causality, the ability to reflect cause-and-effect relationships. A useful cost model must efficiently guide a manager (1) from a monetary effect to the operational cause and (2) to clear and direct insight into the probable monetary effect of a particular operational action (or cause) being considered.”

- The International Federation of Accountants recognized the importance of causality in 2009 in its international good practice guidance document, Evaluating and Improving Costing in Organizations. In that document, Principle C states: “Cost models should be designed and maintained to reflect the cause-and-effect interrelationships and the behavioral dynamics of the way the organization functions. The information needs of decision makers at all levels of the organization should be taken into account by incorporating an organization’s business and operational models, strategy, structure, and competitive environment.”

Thus, all the proverbial ducks are aligned for management accounting to make the transfer to the digital economy.

THE ROLE OF AI IN DECISION MAKING

An organization will need time to prepare its physical assets, people, processes, information technology, and products and services for operating at the speed of digital. This means not only generating accurate digital information consistently and acquiring the ability to absorb and use digital information effectively, but also having the ability to rapidly implement adopted changes.

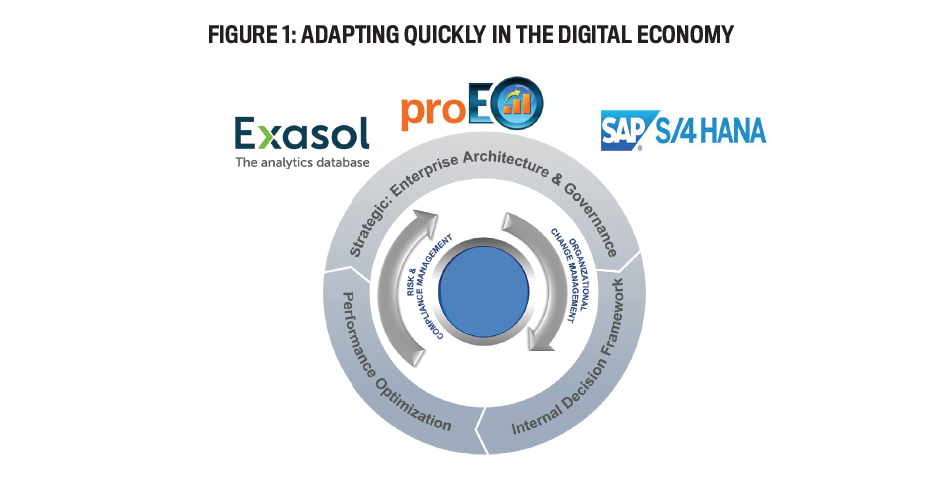

As illustrated in Figure 1, this kind of flexibility—going from opportunity to action in the shortest possible time continuously—will determine success in the Digital Age. Strategy and a corresponding enterprise architecture and governance structure enable risk and compliance management and control as well as organizational change management. These, in turn, support the internal decision framework and business analytics to rapidly absorb change and optimally accomplish revised strategic objectives.

It’s important to note that this isn’t an “all or nothing” scenario. The full structure doesn’t need to be in place to start reaping the benefits. Organizations are clearly capable of first walking before they run by carving out key portions of their value chain where the most gain in value creation exists.

AI is capable of autonomously making some decisions and executing the chosen operational actions. For example, the technologies exist today for AI to autonomously run a process manufacturing line. Yet in many instances, human intervention is still the final determinant of the action to be implemented. The technology does exist in some cases to remove human involvement, but incidents such as what happened with the Boeing 737 Max, where software overrode pilot inputs and put the planes into nosedives, highlight the challenge that lies ahead before autonomous or near-autonomous AI becomes fully accepted.

USING AI FOR FINANCIAL AND DECISION SUPPORT

Let’s take a look at some current examples of AI supporting managerial decision making. The technology tools shown in the following examples integrate digital operational and financial information and utilize Alta Via Consulting’s proEO, which is powered by Exasol, a high-performance analytics database with support for advanced analytics frameworks in R and Python integrated directly into the database. While our examples all include proEO, keep in mind that similar capabilities are also available on the SAP S/4HANA technology stack. The broader point is that AI is platform agnostic (which also means the barriers to entry in the AI space are relatively low).

Moreover, the incremental cost is low. When one mentions this kind of capability, the question arises whether the climb is worth the view. In the digital economy, the answer to that question is: What climb? There’s already a causal operational model in digital format established, just use the digital twin and its supporting operational information.

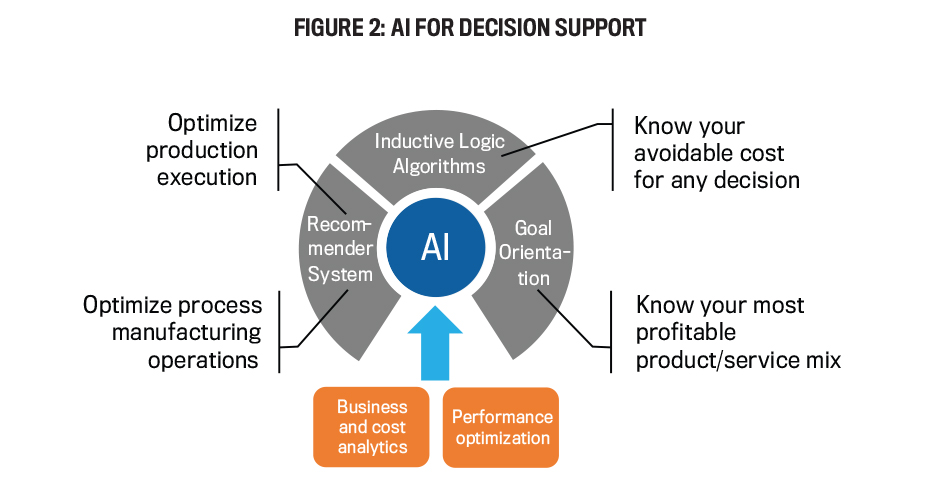

Figure 2 shows three generic categories of tools to create AI capability for financial and decision support:

- Recommender systems employ causal information and probabilities to suggest appropriate courses of action. We’ll present examples of recommender systems for optimizing (1) process manufacturing and (2) discrete manufacturing.

- Goal orientation captures the organization’s capacity constraints, resource outputs, their causal consumption by products and services, and product and service sales prices in a set of simultaneous equations to calculate the most profitable product and service mix. We’ll look at an example of a maximization goal-orientation algorithm.

- Inductive logic algorithms use known causes and their effects to quantify an outcome. We’ll look at an algorithm that provides decision makers with the avoidable cost for a change they plan to introduce into the organization.

1. Using a recommender system and opportunity cost to optimize operational execution.

Those of you familiar with manufacturing metrics will have heard of overall equipment effectiveness (OEE), which is universally accepted as the best measure of equipment productivity and efficiency for discrete manufacturing. But OEE doesn’t work very well in a process manufacturing environment. The solution is Time-in-State (TiS), which defines and measures a series of variables that affect how efficient a process is running.

Take the example of a crusher at a platinum mine. (Crushers are the machines used to crush—reduce the size of—rocks, stones, or, in this case, ore.) The operational variables include the speed of the crusher, the number of metal balls added to help crush the ore, the viscosity of the sludge and ore mix (based on the amount of water added), the kilowatt-hours (KwHs) consumed, the bearing temperatures of the crusher, and the tons of crushed rock produced per hour. Each variable is expressed in a heat map where green indicates efficient values and red, inefficient values. The heat maps are then stacked to find the process’s optimal operating envelope.

Since “optimal” includes operating at the lowest cost, this is the point in which to integrate cost information. Management defines a stretch target for executing the process, and actual production data is then collected in real time for the current state. Comparing the current state with the stretch target shows how the operator is doing. The cost for the stretch target is calculated, and the deviation of the current state from the stretch target is compared in financial terms—namely the monetary value of current operations and the loss because the process isn’t running at the target level. The difference is the opportunity cost, which is calculated every 15 seconds and updated on the operator’s dashboard, with the average for the last minute.

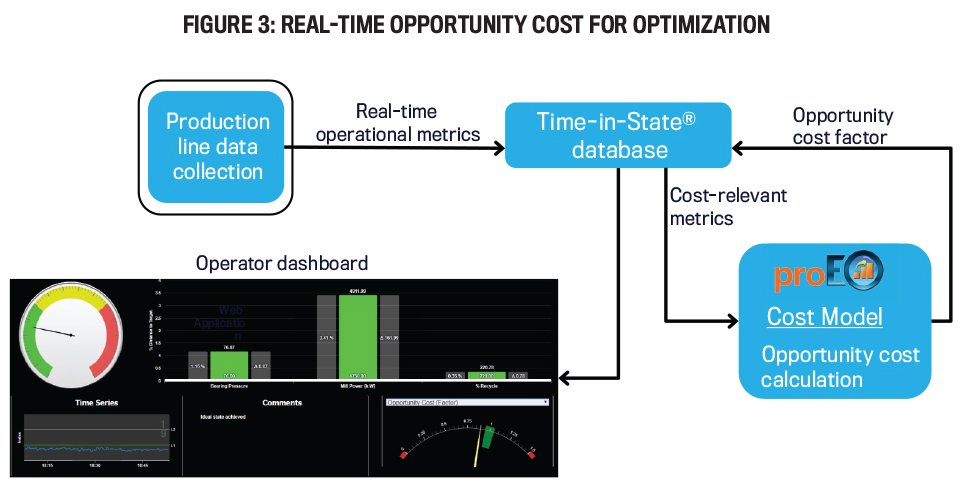

Figure 3 summarizes the process. The top left shows the real-time metrics of the crusher operation. The TiS database then passes the cost-relevant operating information to proEO to calculate the opportunity cost of the current state. In this instance, a total cost isn’t displayed to the operator but rather an opportunity cost factor showing the magnitude by which the operator is off target.

The operator dashboard displays the opportunity cost factor gauge and the comment field, where the recommender system displays a course of action to bring the process back toward optimal. The operator in the control room has a panel with switches and knobs to change the inputs into the process (i.e., the variables), such as reducing the speed of the crusher or adding more water.

There are a number of benefits to this system:

- The real-time feedback on the optimum operating envelope is much more of a proactive approach to optimizing the process.

- The process provides the ability to manage both operational and financial outcomes.

- Cost reporting by shift, day, week, month, etc., is now enabled.

- The new data also allows for gamification to drive results, e.g., posting the numbers and letting the teams of each shift compete.

- The opportunity cost information can be used as input for performance-based compensation.

2. Using a recommender system and integrated operational and financial information to optimize operating execution.

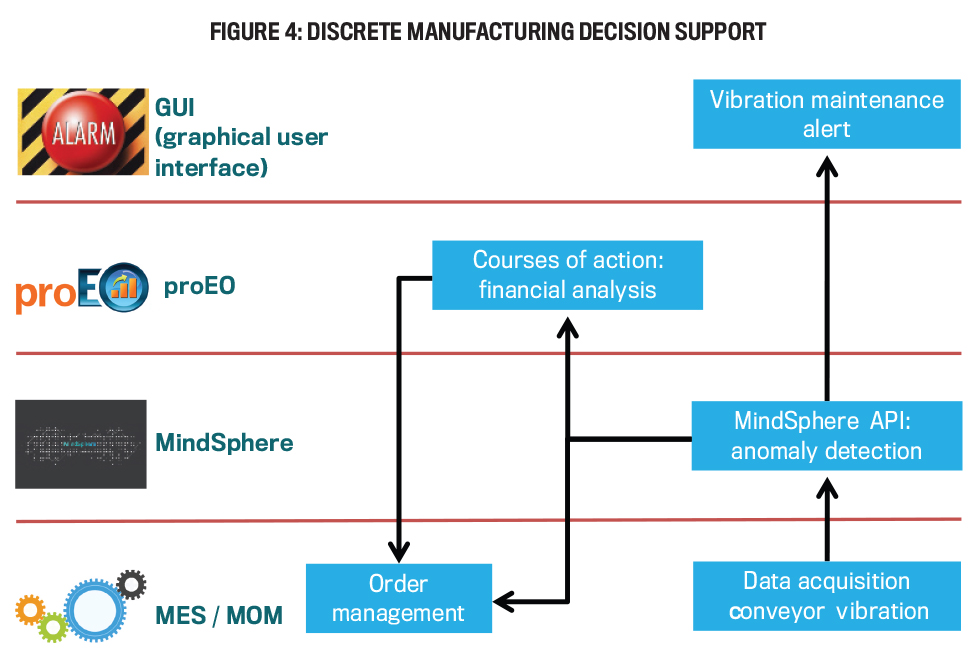

Figure 4 shows a joint solution with Siemens’s MindSphere system, an operating system for Industrial Internet of Things (IIoT) and Siemens’s manufacturing execution and manufacturing operations management solutions.

MindSphere continuously monitors IIoT sensors that can show when an equipment breakdown becomes probable. For example, it detects vibration information that shows an anomaly. MindSphere triggers two actions: (1) a maintenance alert and (2) an economic courses of action analysis in proEO, which compares the cost and revenue impacts of various scenarios—repair immediately; repair at the next production pause for setup, changeover, or shift change; or repair at failure.

The maintenance supervisor then selects the optimal (most profit-effective) course of action, and proEO triggers a module in the Siemens manufacturing execution system (MES)/manufacturing operations management (MOM) suite to execute the maintenance event. That may include rescheduling production activity to incorporate the necessary maintenance downtime, scheduling the delivery/ movement of the repair parts, and/or scheduling the maintenance personnel and equipment. In this instance, proEO runs in the background and uses the MindSphere front end, which is Tableau, to present the details of the financial analysis and the opportunity cost of shutting the line down under the various scenarios.

3. Using goal orientation to calculate the optimal product/service mix to maximize profit.

Maximizing profits is an objective for nearly every organization. Even governmental and not-for-profit organizations seek to maximize output or contribution to goals for a budgeted cost.

Although simultaneous equations are well known, they didn’t see wide adoption in financial decision support due to the problem of fluctuating unit fixed costs in absorption-based costing systems. Yet as noted in IMA’s Conceptual Framework for Managerial Costing, the fluctuating fixed cost problem has been eliminated for internal decision-support information.

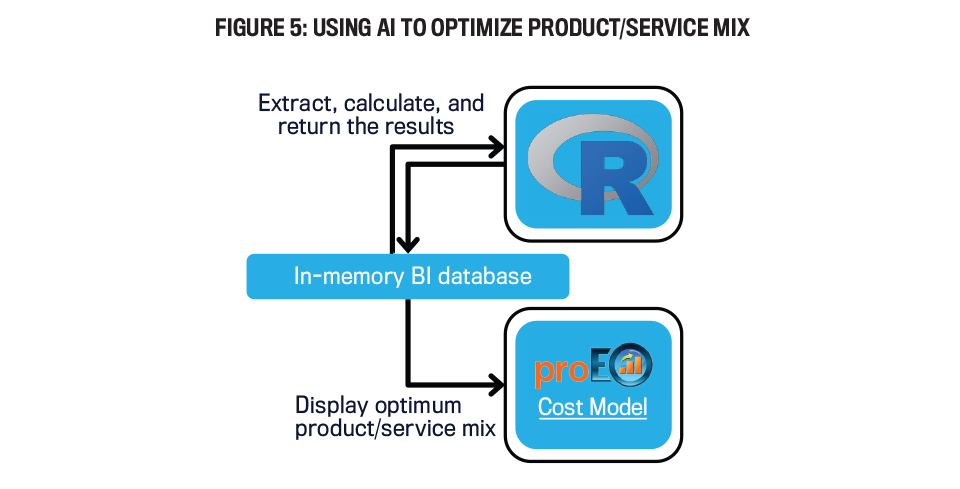

The solution shown in Figure 5 utilizes known variables (product prices, costs, and margins) to highlight opportunities for higher profit. It isn’t always possible to make drastic changes to the product or service mix in the short term, but the output from the solution can also be used to focus or redirect sales and marketing efforts over the longer term. Because the algorithm uses current capacity and capabilities, it also highlights the resource constraint that the organization should invest in to maximally increase profit.

The solution also can be used to evaluate smaller scope changes such as process improvement and reengineering projects and prioritizing them for implementation based on their contribution to the bottom line.

4. Identifying the avoidable and unavoidable cost for any decision and making optimal resource application decisions.

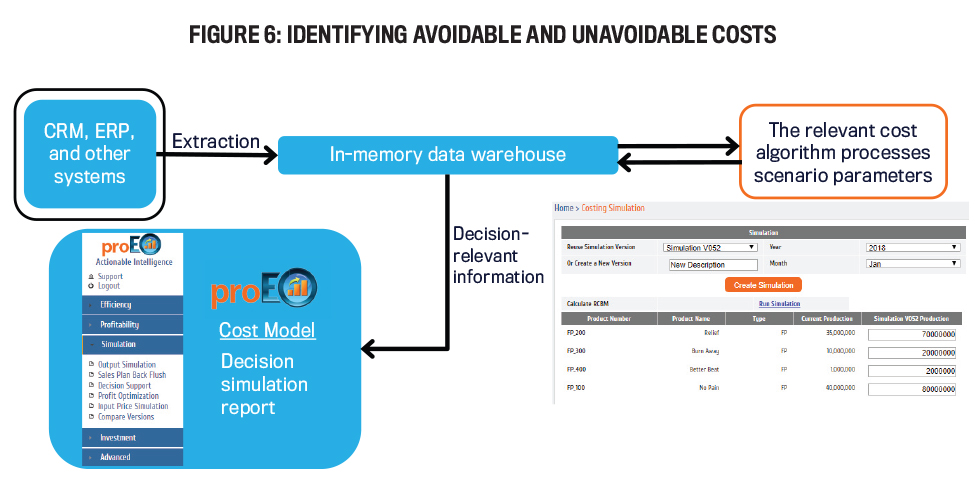

The example in Figure 6 widely applies within an organization because it addresses the ability to arrive at the optimal solution in any management decision. The algorithm will compute all the relevant decision cost concepts for any combination of changes in inputs and outputs in the model. The decision maker specifies the changes being considered, such as input resource price or quantity changes, or output product/service volume and mix changes.

The algorithm then “crunches the numbers” and shows:

- The avoidable cost for the change;

- The unavoidable cost for the change, for example, your decision results in excess/idle capacity in a resource that you can’t eliminate;

- The incremental investment when capacity has to be expanded to accommodate the change; and

- The net impact on profitability because of the decision being considered.

The benefits to this process include providing the accurate information on resource requirements for changes in input and output. It also helps the decision maker(s) understand the cost impacts of reducing or expanding capacity, the impact of decisions on profit, and how to optimize both operational and financial outcomes.

ADAPT WITH DIGITALIZATION

Much like the switchboard operators from yesteryear (a job, incidentally, that was around for 100 years before quickly succumbing to digitalization), management accountants make the connection between operational quantities and their monetary impact to provide decision-support information.

Yet general ledgers and historical financial reporting are archaic for internal decision use. Decision makers need causal and real-time information. Thus, success in the digital world requires some refocusing for management accountants. As organizations and processes become digitalized and are supported by digital systems, monetary information must keep pace to provide insight into the value of decision alternatives.

Everyone in an organization needs to be aligned with its operational metrics and strategic objectives. Operational metrics are designed primarily for internal decision making in real time, and management accounting information for internal decision support must be aligned with that cadence. Causal modeling is the foundation for such financial internal decision support information. The AI examples presented show a range of technological complexity. The overriding commonality is they’re designed to support business decisions at the same pace as operational information and decisions.

A little more than a century ago, engineer H.L. Gantt addressed how accountants could use cost information to enhance the productive technology of the last industrial revolution. Today, with Industry 4.0 and the digital economy rapidly expanding, management accounting needs to rise to the challenge and demonstrate its capability to adapt and support value creation in the Digital Age.

February 2021