Even beyond the coronavirus, there are new regulations, new assumptions about the business impacts, and other new considerations for accounting. Close processes were already resource-intensive, involving a myriad of people, technology, processes, and controls. Now things take even longer to complete.

But what is the real cost of maintaining traditional manual processes? How can CFOs, controllers, accounting managers, and accounting operations leaders measure their actual impact on the bottom line and identify where the most significant issues are? And can we quantify the value of shifting from manual to automated accounting processes?

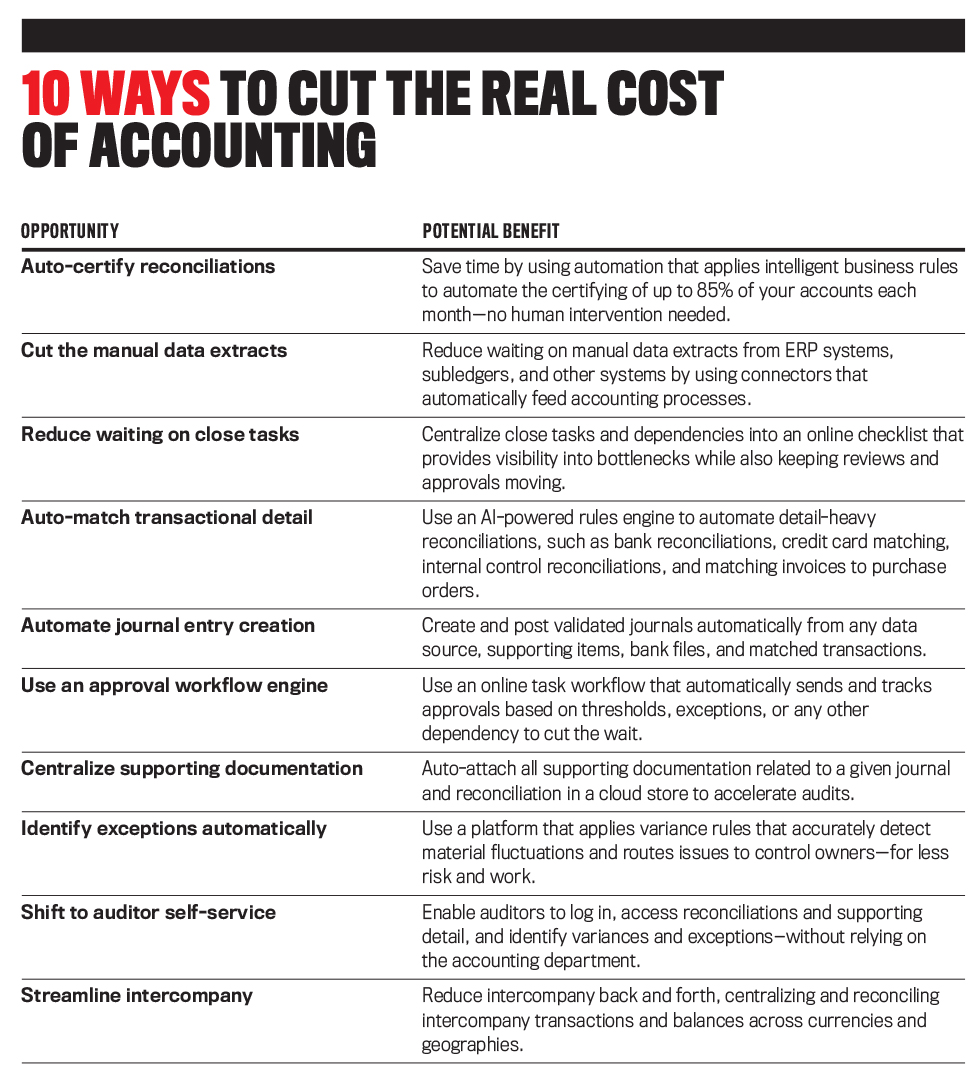

Click to enlarge.

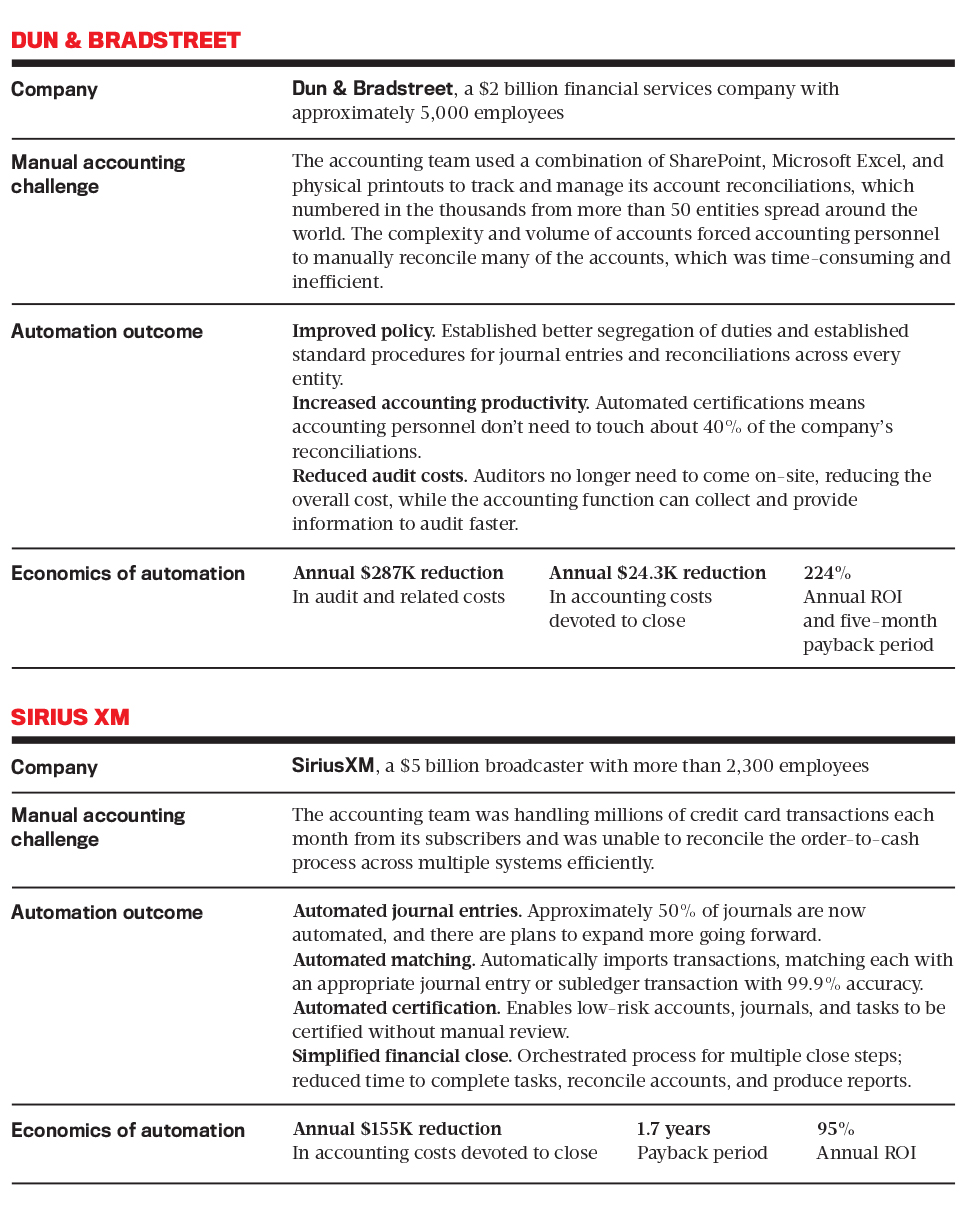

Click to enlarge.

COSTS OF MANUAL ACCOUNTING

There are five primary areas where manual accounting processes require and consume significant resources: time, cost, risk, audit and compliance, and talent. Let’s take a look at each one.

- TIME

It’s no secret that manual accounting at the end of a period (e.g., month-end) occupies valuable time often spent on compiling, validating, and processing spreadsheets and paper binders. Journal entries, allocations, adjustments, general ledger, and intercompany accounting reconciliations all suck up time.

There’s often little transparency into who’s doing what, which means even more time is wasted waiting on others to learn the status of tasks like the completion of a reconciliation. All of this extends the time to close the books, with more than five days typically separating top performers from those at the bottom end of performance. That translates to an entire workweek where accountants could be identifying exceptions and variances to further mitigate accounting or business risk, working on meeting new regulatory rules, or answering questions from business teams. Manual processes also cost time for those in financial planning and analysis—they must wait longer to get financial results so they can begin planning, forecasting, analyzing, and modeling in earnest.

According to The PwC Finance Benchmarking Report 2019-20, 30% to 40% of time can be reduced with finance automation and behavioral change. For example, eBay’s intricate system of accounts complicated its month-end financial close, resulting in a process that took up to 10 days. A significant reason for this extended cycle was that the company relied on a mostly manual, paper-based account reconciliation system. Employees were repeatedly tracking down supporting documents in three-ring binders, making copies, and then refiling.

When supporting documentation was required for several different legal entities, it set off rounds of phone calls and emails to track down and file the necessary paperwork. Language barriers, time differences, and planned or unplanned days off all contributed to potential holdups. A 24-hour lag time was even built into the financial close cycle to account for these inefficiencies. By moving away from manual accounting to automation, eBay cut its financial close time from 10 days to just three.

- COST

With so many organizations having a high degree of labor-intensive accounting, reducing the cost of accounting operations is an almost impossible proposition. Physical data extracts, spreadsheets, manual adjustments, and data entry take a heavy toll on efficiency because they often serve as the “glue” that connects accounting processes across a vast array of systems, data sources, and entities.

The average cost to run finance and accounting varies significantly across industries and company size, with larger enterprises often seeing benefits from economies of scale and shared services. But there remains a significant difference between bottom performers and top performers when comparing peer groups. The best achieve more than three times the efficiency of those at the bottom of their cohort. (See, for example, Mary Driscoll, “Metric of the Month: Cost to Run the Finance Function,” CFO.com. Typically, this difference is due to automation, standardization, and centralization.

As PwC reports, however, many CFOs often aren’t applying the savings back to the bottom line. They’re using it to drive more value from the finance budget: reinvesting those savings to provide business support for teams and legal entities, analytics, forecasting, and planning.

A few years ago, The Coca-Cola Company began reviewing its existing balance sheet reconciliation process across 50,000 general ledger accounts. Multiple systems and manual processes had created serious challenges—more than 800 associates were spending 14,000 hours a month on reconciliations alone. By moving from manual processes to automation, Coca-Cola was able to reallocate 40% of the team involved in manual and routine reconciliations. The team was then able to focus more on activities like metrics, reporting, IT controls, and change governance. Since the shift in 2015, the company has realized millions of dollars in efficiencies that have been reinvested into the accounting function.

- RISK

Manual accounting is highly correlated to financial statement integrity risk and elevates the chance of fraud. In a recent BlackLine survey of more than 1,100 C-level executives and finance professionals worldwide, 55% of respondents shared that they aren’t entirely confident they can identify financial errors before reporting results. (See Mistrust in the Numbers, BlackLine Study into the Potential Global Scale of Financial Data Inaccuracies.)

Nearly 70% of leaders said they’d made a significant business decision based on inaccurate financials. Even worse, just 38% of finance professionals—those who are closest to the process—said they trusted the numbers.

The reasons were manifold. Of those that didn’t trust the numbers, 41% blamed manual data inputting, and 56% highlighted the issues of no automated controls and checks, labor-intensive data extraction processes, and spreadsheet sprawl. Beyond financial statement inaccuracy, processes that are too reliant on human intervention also raise the specter of fraud.

In “Internal Control Weaknesses and Financial Reporting Fraud,” Dain Donelson, Matthew Ege, and John McInnis found an 80% to 90% higher incidence of fraud in companies with material weaknesses (Auditing: A Journal of Practice & Theory, August 2017, pp. 45-69). It may come as no surprise that the risk of fraud at companies with material weaknesses is significantly higher than the norm.

Manual accounting is usually a significant factor in fraud. Drivers include dependencies on spreadsheets and other files that can be altered or allowing too much manual control over journal entries and adjustments. The Association of Certified Fraud Examiners (ACFE) found that 40% of fraudsters created fraudulent physical documents and that 36% altered physical documents. In addition, 27% altered electronic documents or files, while 26% created fraudulent electronic documents or files. (See the ACFE’s Report to the Nations: 2020 Global Study on Occupational Fraud and Abuse). Manual account reconciliation processes are often fertile ground for fraud, with gaps in standardization, controls, flux analysis processes, separation of duties, balance sheet analysis, completeness, and spreadsheet dependencies. Journal entries create exposure due to sheer volume, correcting entries, lack of supporting detail and validation, top side journals, and other areas.

- AUDIT AND COMPLIANCE

Overall, audit costs keep relentlessly ticking higher. While fees themselves have stabilized somewhat after the initial spike following the Sarbanes-Oxley Act of 2002, the increasing amount of accounting time spent meeting audit requests hasn’t.

Controls in the reconciliation processes that are both spread out and different across multiple locations and business units, and inadequate explanations and supporting documentation are often a factor. Lack of follow-up on aged items, incomplete reconciliations, inability to quickly answer auditor questions, and lack of overall visibility all tie up accounting resources further. In turn, this increases the overall cost of an audit.

Things are likely to become more painful over the coming years given the expanding regulatory and compliance landscape. New revenue recognition and lease accounting rules are taking a significant toll on accounting operations. And evolving Public Company Accounting Oversight Board (PCAOB) standards are creating further pressure by shining a brighter light on internal controls over financial reporting.

For example, Ascension, one of the largest nonprofit health systems in the United States, used a decentralized finance model that included various divisions using many different enterprise resource planning (ERP) systems. The accounting team for headquarters faced the task of 20,000 to 25,000 reconciliations that were typically tracked and shared on spreadsheets, which created a significant amount of effort at audit time.

By moving away from manual accounting to a more automated and centralized approach, Ascension was able to devote 400 fewer hours to audit and, in turn, reduce audit fees.

- TALENT

Repetitive period-end processes exact a final toll—one that’s increasing in urgency every year. The inability to attract or retain accounting talent due to lack of job satisfaction creates substantial operational risk. A talent crunch hampers the ability to execute new business initiatives or meet new regulatory requirements.

It also runs the risk of raising financial statement risk due to a lack of proper analytical scrutiny, not to mention the cost of hiring and retraining replacement personnel. Manual processes can also have other detrimental effects, reducing employee engagement, lowering productivity, and ultimately decreasing the bang for the buck of each full-time equivalent (FTE). For instance, Gallup found that an actively disengaged employee costs an organization $3,400 for every $10,000 of salary. That means an actively disengaged employee with a yearly salary of $60,000 costs the company $20,400 a year. (For more, see Paul Petrone, “How to Calculate the Cost of Employee Disengagement,” LinkedIn, The Learning Blog.)

Accountants who have a combination of finance and data expertise, those who are eager to use the latest technology, or those looking to rethink and reinvent business processes are susceptible to be lured away when they’re bogged down with manually matching transactions, respectively extracting data from their ERP system into spreadsheets, or manually entering journals. In a recent report conducted by the North Carolina State Poole College of Management and Protiviti, succession challenges and the ability to attract and retain top talent hit the number-two spot for the top risks of 2019, moving up from number six just a year earlier.

IT’S TIME TO AUTOMATE

Manual processes present too high a cost for accounting teams, CFOs, the broader business, and investor confidence. They sap time and resources, elevate risk, place a shadow over audit and compliance processes, and burn out talent. But more than that, in today’s fast-moving landscape—where companies are rolling out new business models, conducting mergers and acquisitions, and looking to direct more resources into planning and analysis—they can stymie business performance.

Modern accounting solutions unify data and processes, automate repetitive work, and drive accountability through visibility. They help organizations manage their core accounting and finance processes to the fullest degree of automation possible, especially when it comes to rote clerical tasks. (See “The Economics of Moving from Manual to Automated” for more.)

Click to enlarge.

Click to enlarge.

Purpose-built technology for finance and accounting results in greater control and visibility into the data with reduced compliance risk since employees are no longer using multiple-line spreadsheets to complete their duties.

But most of all, automating the most time-consuming, manual processes will transform the finance and accounting function by freeing professionals from the enormous amount of time they spend collecting and verifying data, providing the opportunity to redirect their efforts toward analyzing the data and being much more productive, strategic advisors to the business. The value of moving to automation has never been more apparent—and tapping into it has never been more accessible.

September 2020