Sustainability strategies and performance are top priorities for many companies’ managers and investors around the world as a pathway for creating greater long-term value. It’s a challenge for management teams and boards to identify sustainability issues that impact the value of the company and develop metrics that will lead to better risk management and performance. Apart from risk management, there are also increasing calls for more detailed disclosures regarding sustainability strategies and performance in financial reports.

In his 2020 annual letter to CEOs, BlackRock CEO Larry Fink called for improved reporting and disclosure of sustainability initiatives by companies, stating, “BlackRock believes that the Sustainability Accounting Standards Board (SASB) provides a clear set of standards for reporting sustainability information across a wide range of issues.” This year, BlackRock is asking the companies that it invests in on behalf of its clients to publish a disclosure in line with industry-specific SASB guidelines by year end, if they haven’t already done so, or to disclose a similar set of data in a way that’s relevant to their particular business. CFOs and other management accounting and finance professionals have the unique skills to play a valuable role in this area.

SASB’S PROCESS AND STANDARDS

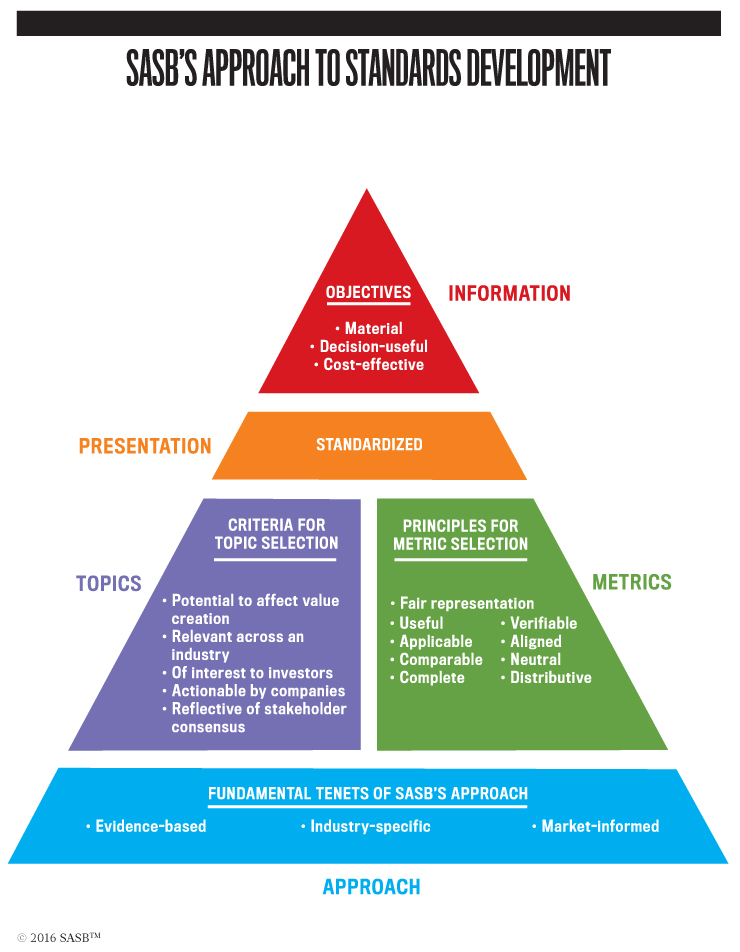

The SASB Conceptual Framework defines sustainability accounting “as the measurement, management, and reporting of corporate activities that maintain or enhance the ability of the company to create value over the long term” (see Figure 1). The objective of SASB standards is to help standardize disclosure and accounting metrics on the most crucial sustainability issues in a given industry. The disclosures are related to those environmental, social, and governance (ESG) topics that are likely to have material impacts on the financial condition or operating performance of companies. The SASB has developed standards to provide guidance for 79 industries in 11 sectors.

Figure 1: The SASB Framework

Source: SASB Conceptual Framework bit.ly/2TWaZxQ

To identify the disclosure topics that are likely to impact all or most companies in an industry, the SASB has developed its own industry classification system. The system differs from typical industry classification systems, such as the Global Industry Classification Standard (GICS), in that it classifies companies based on common sustainability issues. For example, the GICS identifies three industries in the technology hardware and equipment industry group, including communications equipment; technology hardware, storage, and peripherals; and electronic equipment, instruments, and components. But communications equipment, computers and peripherals, and office electronics have very similar sustainability issues. Accordingly, they are included in the same group (i.e., hardware) in the SASB’s sustainability-based industry classification system.

The SASB standards were primarily developed to provide guidance for financial disclosure by companies. The SASB used a systematic process to identify topics and disclosures that have a reasonable possibility of having a material impact on companies’ current or future financial position or operations. Therefore, the topics and accounting metrics provide a rich source of information for risk management. Also, the Committee of Sponsoring Organizations of the Treadway Commission’s October 2018 guidance, Enterprise Risk Management: Applying enterprise risk management to environmental, social and governance-related risks, addresses an increasing need for companies to integrate ESG-related risks into their enterprise risk management (ERM) processes.

RISK AND PERFORMANCE

To understand how sustainability standards link to risk and performance, let’s examine the household and personal products industry, which includes the Procter & Gamble Co., Avon Products, Inc., and Kimberly-Clark Corp. The SASB has identified the following sustainability disclosure topics and related accounting metrics for this industry group:

- Water management,

- Products’ environmental health and safety performance,

- Packaging life-cycle management, and

- Environmental and social impacts of each company’s palm oil supply chain.

From a risk management perspective, these disclosure topics become a starting point for identifying the risks and opportunities that should be managed. While all of these topics may not be relevant to a particular company in the household and personal products industry, considering them will help ensure that the company addresses all significant risks and opportunities.

The SASB standards also may be used to identify metrics for the company’s risk management system. For example, the SASB accounting metrics for water management include: (1) total water withdrawn and (2) total water consumed, with disclosure of the percentage in regions with high or extremely high-baseline water stress for each metric.

Under the topic of packaging life-cycle management, the SASB accounting disclosure metric includes (1) total weight of packaging, (2) percentage made from recycled and/or renewable materials, and (3) percentage that’s recyclable, reusable, and/or compostable. For virtually all companies in the household and personal products industry, these become metrics that should be used to manage and control performance around the use of water and the makeup of packaging materials.

METRICS AND BENCHMARKING

The accounting metrics in SASB standards may provide data for a company to benchmark its performance over time on measures that have been demonstrated to likely have a material effect on the company’s financial position or operations. In addition, as SASB standards become increasingly adopted for financial disclosure, the company can benchmark its performance against other companies in the same industry. This has the potential to significantly improve the risk management processes of all companies.

Many aspects of the SASB topics may not be appropriate for developing quantitative accounting metrics. For these items, the standards identify required qualitative discussions. For example, in regard to packaging and life-cycle management, the standards require a discussion of strategies to reduce the environmental impact of packaging throughout its life cycle. This information should logically flow out of the company’s strategic risk management processes.

Review of the standards applicable to a company helps ensure that the company’s risk management processes are robust with respect to its consideration of sustainability issues. Again, as the use of SASB standards for financial disclosure becomes more prevalent, companies will be able to benchmark their sustainability strategies with other companies in the same industry and other industries. This has the potential to significantly improve the risk management processes of all companies.

SPECIFIC RISKS

As indicated previously, SASB standards focus on financially material issues. In general, sustainability issues can impact the company’s revenue, cost, cost of capital, or the value of its assets and liabilities. Issues that have an impact on revenue are those that affect the demand for the company’s products or services, intangible assets, or long-term growth. As an example, a disclosure topic for nonalcoholic beverage companies is the “revenue from (1) zero- and low-calorie, (2) no added sugar, and (3) artificially sweetened beverages.” Low dependence on revenues from these types of beverages may put future revenue at risk as consumers move to healthier choices.

Sustainability topics that affect cost are typically related to operational efficiency or the cost structure of the company. For example, energy consumption is a disclosure topic for companies in many industries. SASB standards in this area generally require disclosure of “operational energy consumed, the percentage of grid electricity, and the percentage of renewable energy.” These metrics describe how the company is positioned to manage future energy costs.

Impacts to a company’s cost of capital generally are included in the areas of corporate governance, license to operate, and general risk. In this area, a disclosure topic for companies in a number of industries is a “description of processes to manage business ethics risks throughout the value chain.” A company’s processes in this area increase or reduce the overall risk of its business. Therefore, such risks generally affect the overall cost of capital for the company.

Risks to the value of a company’s assets or liabilities generally arise from factors that may impair the value of the company’s assets or those that create the risk of contingent liabilities. As an example, for the midstream segment of the oil and gas industry, SASB standards have a disclosure topic related to ecological impacts that includes disclosure of the “number of aggregate volume of hydrocarbon spills volume in Arctic, volume in unusually sensitive areas (USAs), and volume recovered.” Risks related to this topic generally involve potential contingent liabilities related to fines, sanctions, and clean-up activities.

In the solar energy industry, a disclosure topic includes a “description of efforts in solar energy system project development to address community and ecological impacts.” Ineffective efforts in this area can impact the value of acquired land rights.

CONNECTING SUSTAINABILITY AND FINANCE

CFOs can use this checklist to integrate SASB metrics for managing risk, performance, and sustainability strategy.

- Become familiar with the SASB metrics in your industry.

- Review how other companies are integrating SASB metrics in their external disclosures.

- Develop an action plan to publish disclosures in line with industry-specific SASB guidelines.

- Consider how sustainability metrics can be developed at your company in terms of driving sustainability strategies and long-term value creation.

- Consider how sustainability metrics can be integrated into ERM at your company.

- Develop the capabilities and expertise in the finance function related to SASB metrics, risk, performance, and sustainability strategy.

- Develop an action plan for your team to integrate sustainability metrics as part of the value proposition of the finance function of your company.

- Consider how your company can develop leading and lagging indicators on sustainability performance using strategy maps.

CFOs and management accountants have a great opportunity to play a leadership role in integrating sustainability metrics to create and protect long-term value and drive better risk management. SASB metrics can help management accountants to design and develop performance measurement systems that better support value-creating sustainability strategies, risk management, and performance. This will help CFOs and the finance function to develop disclosures regarding sustainability strategies and performance in financial reports, and internal reporting that will connect sustainability and finance with the ultimate goal of creating greater long-term value for all stakeholders.

This article is part of the Creating Long-Term Sustainable Value Creation series (see “Creating Greater Long-Term Sustainable Value” by Mark L. Frigo and Dominic Barton in the October 2018 issue of Strategic Finance magazine, bit.ly/2RfcMwm) and part of the Sustainability Accounting & Reporting Initiative, led by the authors, in the Strategy, Execution and Valuation Initiative and Strategic Risk Management Lab at DePaul University, which focuses on leading practices in sustainability accounting and reporting to help corporate professionals, advisors, and investors create and protect long-term value.

April 2020