Mention Enron, WorldCom, or Lehman Brothers, and thousands of people—including lawmakers and regulators—recall all too quickly how many lives can be damaged by the actions of a poorly run organization. It’s no surprise that business, and particularly big business, has a bad reputation in the eyes of the general population. Comprehensive new controls were put in place following the Enron disaster. That and other scandals led to passage of the Sarbanes-Oxley Act of 2002 and the creation of the Public Company Accounting Oversight Board (PCAOB).

Yet a 2017 Gallup report shows that since 2002, big business has been scoring about a 20% confidence rating. And it isn’t unusual to see newspaper opinion pages bemoaning the lack of honesty among businesses.

AN ECO IN THE NUMBERS FACTORY

Trust in the numbers—the data produced by the invoices, payments, and expenses of any business—isn’t just an esoteric concept. It’s as real as the extra costs in dollars, time, and even reputation that can be exacted when that data goes wrong.

Consider what can happen to an automobile maker when an error in design, say for a steering gearbox, travels undiscovered through assembly and into production. The error is finally discovered. The engineering group issues an engineering change order (ECO). The production line, already under way, must be stopped. Costs mount as the plant stops production. Time is wasted, and the company’s reputation may also suffer.

Accountants like to compare the accounting function to a numbers factory. The numbers (data) make up the disparate parts, and the accounting processes connect and form the numbers into larger components that go into the final products. These are the quarterly and year-end financial statements, which are reported to the public. If a material error in the numbers is propagated through to these reports, the resulting misstatement can do at least as much harm, in the cost of reputation, as the ECO did to the automaker.

For the finance department, and for the enterprise as a whole, a material error in accounting can also incur some serious penalties. Accounting staff may have to redirect their efforts to find and correct the error. Ongoing processes may have to stop and wait for the corrections. Labor costs jump up, other reporting might be delayed, and the damage to the reputation of the company’s officers can be significant.

Armanino LLP, one of the world’s largest independent accounting and consulting firms, published a 2016 study to examine how the CFO can spend less time on accounting management and more time on strategic value (bit.ly/2PwDf6n). It shouldn’t be surprising that five out of the six recommendations directly involve technology and processes:

- Standardize and improve processes.

- Drive improvement with technology.

- Provide effective key performance indicators (KPIs).

- Integrate technology.

- Provide accurate forecasting.

- Support growth and expansion.

The survey also found that 94% of CFO respondents feel they need better technology skills and 64% are currently working on upgrading their skills. The challenge isn’t just finding the time to learn but determining the best approach in the quest for excellence in the numbers factory.

TRUST IN THE NUMBERS MATTERS

By establishing and maintaining internal and external trust in the numbers, accounting organizations that can simultaneously deliver real-time and highly accurate financials do more than avoid fines and other costly penalties. Those that prioritize maintaining trust, both internally and externally, gain (and retain) public confidence. This creates a significant competitive edge and has the potential to achieve the following three benefits (see “Building Trust Company-Wide” below for more):

Reduce the likelihood of damage to the organization’s brand and reputation. The adage that “trust is gained in drops and lost in buckets” has never been more apt. Organizations with years of steady performance can be damaged by one (infinitely) shared tweet. Social media, a 24-hour news cycle, and declining levels of privacy for both people and organizations also mean that even small errors can quickly become big news.

Organizations can reduce the likelihood of this damage not by increasing budgets for crisis management and lobbying, but by establishing and maintaining protocols that prioritize trust. For the accounting organization, this means improving both tools and processes to facilitate the trustworthiness, transparency, and accuracy of every balance sheet.

Enable organizations to realize higher performance and increase access to business opportunities. Organizations that are considered trustworthy have better access to business opportunities and partnerships and, according to research by Trust Across America, “[outperform] the S&P by 1.8 times” (bit.ly/2ZD7vRJ).

The Trust Across America survey “What Causes Low Trust in Your Organization?” also shows that organizations that prioritize building and maintaining trust internally see lower employee turnover, attract higher-quality employees, increase productivity, drive more innovation, and experience long-term business success (bit.ly/2UWEGAH).

Equip leadership to make faster, more data-driven decisions. Rapid, real-time decision-making capability pays off. Research by Bain & Company over a 10-year period of more than 1,000 companies discovered a “clear correlation between decision effectiveness and business performance” (bit.ly/2ZB0NLG).

Yet the ability to make effective decisions depends on access to trustworthy data, be it customer engagement statistics, return percentages, or the day-to-day balance sheet. Accounting organizations that can deliver highly accurate financial data in real time can help leadership make more informed, targeted, and successful decisions.

FOUR WAYS TO BUILD TRUST

Nearly 70% of global business leaders and finance professionals claim their organization has made a significant business decision based on inaccurate financial data. Almost 22% of C-suite respondents say it takes up to 10 days per month for their organization to identify errors and make adjustments, potentially wasting as many as 114 days each year.

These findings are from a global survey commissioned by BlackLine of more than 1,100 C-suite executives and finance professionals to gauge confidence levels in financial data and the perceived impact of errors on the business (bit.ly/2PtpLrW). The results reveal four essential ways that organizations can build and maintain trust in today’s increasingly unpredictable, rapidly changing business environment.

1. Deliver Accurate Data

Accountants have always held high levels of accuracy as a core value, but the rapid pace of business and the demand for real-time financial information have made it increasingly difficult for accountants to process the extraordinary amount of data flowing through modern organizations.

A continued reliance on manual or outdated systems means tremendous amounts of overtime are required to meet the competing demands of closing the books both accurately and on time. According to the Society for Human Resource Management (SHRM), overtime itself is a significant factor in poor performance and increased errors.

To maintain the trust of leadership, stakeholders, and shareholders, organizations must find ways to reduce and even eliminate the possibility of human error. How? By streamlining outdated, clunky, manual processes and giving accounting professionals updated tools that help them maintain high levels of accuracy, even as the pace of business accelerates.

2. Centralize Key Functions

It’s difficult to achieve meaningful transparency with legacy accounting systems because these systems make it difficult to quickly identify mistakes and discrepancies.

BlackLine’s global study found that 55% of respondents were “not completely confident” that they could identify financial errors in advance of reporting. Of those, 26% were concerned “over errors that they know must exist, but of which they have no visibility.”

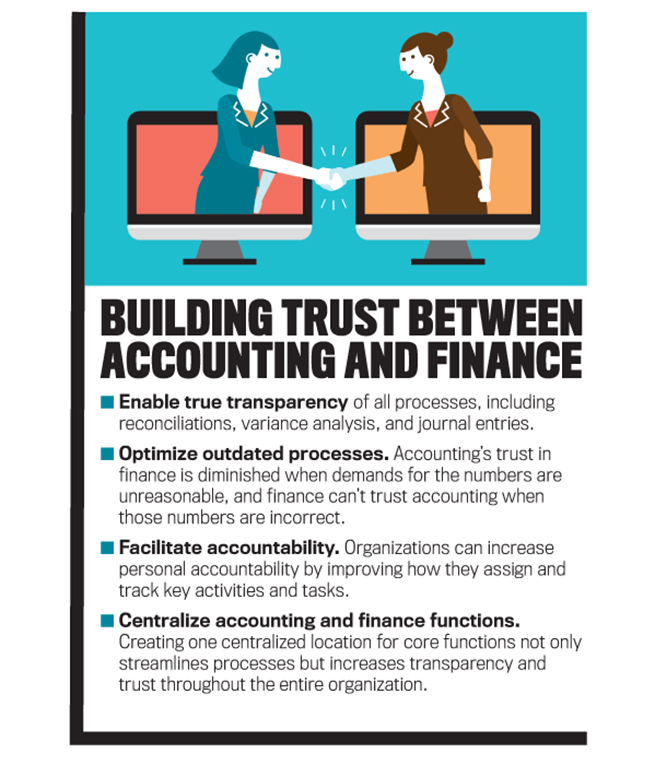

Transparency’s value in accounting and finance goes beyond increasing the visibility of errors and improving the accuracy of statements (see “Building Trust between Accounting and Finance” for more). Transparency also helps build trust externally, which, in turn, leads to large-scale business benefits. Studies show that organizations with increased organizational transparency:

Benefit from a reduced cost of capital. In the Journal of Accounting, Auditing & Finance, Mary E. Barth and Katherine Schipper state that “increased reporting transparency provides evidence of an association between transparency and cost of capital” (bit.ly/2GFPjz4). According to “Cost of capital and earnings transparency” by Barth, Yaniv Konchitchki, and Wayne R. Landsman, when an organization provides more transparency within financial statements, that organization experiences a lower cost of capital, primarily due to the fact that “uncertainty regarding the value of its equity may be lower” (bit.ly/2GvD3A2).

Increase sales. In another study cited in a Harvard Business Review article by Ryan W. Buell, making the costs and processes of various products transparent, including the amount of markup, led to a dramatic jump in sales. By providing full operational transparency for one product, a wallet, researchers were able to increase sales by 26% (bit.ly/2IFnqtn).

Increase stakeholder confidence. Research compiled by Harvard Business School showed that increasing the levels of operational transparency within government agencies positively influenced citizen attitudes toward government. Revealing the “hidden work” increased the self-reported level of trust by 14% (hbs.me/2WcwMQB).

Accounting organizations can address the need for more transparency by transitioning from outdated and often manual accounting operations that hamper visibility to more centralized, modern processes and solutions. Instead of using and storing spreadsheets on multiple servers (or with multiple accountants), organizations can create a central location for all close data and operations. Centralizing key accounting functions—reconciliations, task assignment and management, journal entries, and analysis—enables a more holistic approach to the financial close process and ensures immediate, real-time visibility into all activities.

3. Enable Efficiency and Accuracy

Numerous studies have demonstrated how trust increases efficiency. Researchers from the International Monetary Fund (IMF) and Duke University found that employees who trusted each other were more willing to expend effort and less likely to “monitor” the behavior of others, thus becoming more efficient in their roles (bit.ly/2PsVSbg).

Lee Caraher, founder and CEO of Double Forte, a national public relations and digital media agency, also correlates inefficiency with a lack of trust, stating, “When we don’t trust our colleagues, we develop muscle memory that drives inefficiency up—preparing for others to drop the ball” (bit.ly/2IVm90A).

Less has been written about the reverse statement, how efficiency itself increases trust. From an accounting and finance perspective, efficiency enables the timely completion of key processes and the delivery of data crucial to decision making.

Accounting teams that can be more efficient—without compromising accuracy—can better support the controller, the CFO, the CEO, and external stakeholders. Efficiency within accounting drives trust because it enables others to do their jobs and accomplish key tasks on time. But efficiency is hard to achieve when accounting professionals are dependent on manual accounting processes and outdated tools.

By streamlining repetitive activities like data entry and increasing the use of automation, organizations can see improved efficiency and simultaneously increase trust in accounting teams, processes, and data.

4. Build a Culture of Accountability

According to the U.S. Office of Personnel Management, organizations with a culture of accountability—an environment where employees take ownership for results—see improved employee performance, as well as commitment to work, morale, and satisfaction (bit.ly/2DzUzlV). These organizations also see greater trust internally, between both individuals and teams. How can organizations build a culture of accountability within the accounting function? It requires more than a segregation of duties.

First, leaders must have an engaged view into who is performing what and when to more quickly identify errors and challenges, rebalance workloads, and, most critically, offer support, including both constructive feedback and praise.

Second, individuals must be able to take real ownership of and have equal visibility into their tasks and activities as well as performance standards and timelines for completion.

START WITH EMPOWERING ACCOUNTANTS

In an age when trust in public and private institutions is on the decline, organizations that can create and maintain trustworthiness have a tremendous competitive edge. It can be argued that establishing that trust starts with the numbers.

After all, for both internal and external stakeholders, it’s the numbers—not the brand, the boilerplate, or the press release—that deliver immediate and actionable insight. Numbers are the first tangible indicator of success and the first indicator of challenges to come.

“Unlocking the value of information and financial data is much more important than routine reporting, and if done well, a key competitive advantage,” says Tony Klimas, principal and Global Performance Improvement Finance Leader at EY. “Yet many companies still haven’t implemented technology to enable this capability, despite the many advances in automation and cloud-based solutions, which reduce the required investment and time to implement. It is time for businesses to treat their financial data like an asset and invest in the technology, tools and people to turn information and data into strategic insights.”

And if trust starts with the numbers, then organizations must prioritize improving the processes that enable trustworthy balance sheets. This means giving accounting professionals the technology that empowers them to simultaneously practice the core values of accuracy, efficiency, and transparency and keep up with the ever-increasing pace of business.

June 2019