I simply realized that debits and credits were no longer the confusing concepts I initially encountered during Principles of Financial Accounting; my Intermediate Accounting professor was explaining double-entry bookkeeping in a more relatable fashion than the previous instructor. As I absorbed the lecture, I envisioned ways to make this concept even more lucid; I knew I could improve the delivery of accounting concepts. My desire to teach was present even as I entered the accounting profession. This was the genesis of my career as an educator.

THE HEART OF A TEACHER

As I later progressed in my career with Hungerford Nichols CPAs + Advisors, I retained seeds sown during that late-1990s Intermediate Accounting lecture. I couldn’t escape the classroom’s siren call and eventually reached out to my alma mater, Grand Valley State University (GVSU), to explore opportunities as an adjunct instructor. I had successfully delivered continuing education sessions at the firm, and I had thoroughly loved the opportunity to convey complicated topics in a simple manner, a maxim that has guided my instructional endeavors. I discovered I was a CPA with the heart of a teacher.

In the fall 2005 semester, GVSU invited me to teach Principles of Financial Accounting; these three months permanently altered the course of my professional life. Mark Twain synthesized the concept by saying “Find a job you enjoy doing, and you will never have to work a day in your life.” I haven’t “gone to work” since I discovered my passion as an educator. To be sure, I sometimes encounter tasks, such as grading, that are less desirable than time spent in the classroom, and I occasionally endure administrative hassles I would prefer to circumvent. But on the whole, I look forward to each day that I guide students in their personal growth.

GVSU exposed me to new and exciting opportunities as I proved myself in the classroom. As an adjunct, I was privileged to teach Principles of Managerial Accounting, Intermediate Accounting, Financial and Managerial Accounting Concepts, Individual Income Taxation, and Entity Taxation courses while maintaining my “day job” as a practicing CPA. Although GVSU occasionally hinted that I should investigate a full-time visiting faculty position, my CPA firm and I weren’t certain this was feasible. Finally, after seven years teaching as an adjunct, I rolled the dice and accepted a visiting faculty position in the fall 2012 semester. This was a risky decision because GVSU policy limits visitors to a maximum term of three years. It was realistically possible that I wouldn’t have a full-time job or benefits after three years!

My gamble was successful. After two years as a visiting instructor I eventually secured a renewable affiliate position and ultimately advanced into my current clinical affiliate role. Visiting and affiliate positions intensified my grasp of GVSU’s School of Accounting, the Seidman College of Business, and the university as a whole. I broadened my repertoire, adding External Auditing to my regular course load. Most recently, I elevated my contributions by teaching in GVSU’s Executive MBA and MBA programs. Practical roots of my CPA upbringing have engendered success in the classroom.

Baseball teams value a utility infielder’s ability to play more than one infield position. Being a utility infielder for GVSU is a critical component of my success because I can teach a broad array of courses at both the undergraduate and graduate levels. My experience in a midsized CPA firm prepared me to teach myriad courses because a midsized firm inherently requires proficiency in more than just tax or audit. Although each new course presented unique challenges, I welcomed opportunities to expand my scope. An instructor who comfortably steps into a variety of courses offers value to the institution and its students.

I haven’t eschewed opportunities that arise outside the classroom. Service on committees and task forces not only exposes me to a broader view of the university, but also allows an opportunity to showcase value I bring to the Seidman College of Business and GVSU. If you are a “what’s next” person, leaping from the office to the classroom may also be the next stage in your journey.

YOUR PART ON THE STAGE

Are you a lifelong learner? Do you have the heart of a teacher? Are you able to break down complicated concepts into their most basic components? Do you enjoy serving others? Are you intrigued by the opportunity to transform individuals and guide their personal development? Do you want to help shape the next generation? If so, you may be destined for academia.

Education is a labor of love marked by sacrifice. I forfeited financial gains to pursue my passion. I probably would have been a CPA firm partner at this stage of life, but that would have been a job! Remember Mark Twain’s words; I no longer go to work each day because I discovered my purpose in life. Teaching may eventually expose you to different opportunities for remuneration. I have authored test questions, led continuing professional education (CPE) sessions, and continued to serve in a consulting capacity for Hungerford Nichols CPAs + Advisors. Perhaps there is even a textbook or other publication in my future? Although you may encounter opportunities to supplement your income beyond a university W-2, be prepared to exchange some income for personal fulfillment and the lifestyle of an educator.

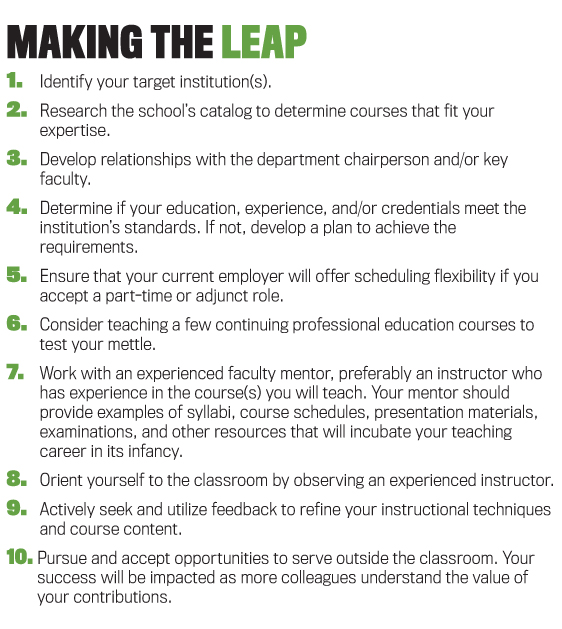

In William Shakespeare’s The Merchant of Venice, Antonio proclaims, “I hold the world but as the world, Gratiano–A stage where every man must play a part.” Although Shakespeare explains that Antonio’s part is “a sad one,” the polar opposite is true for teachers! College educators have the glorious opportunity to meaningfully impact individual lives, entire generations, and society as a whole. Are you ready to perform on the stage and play your part? (See “Making the Leap.”)

BUT I DON’T HAVE A PH.D.!

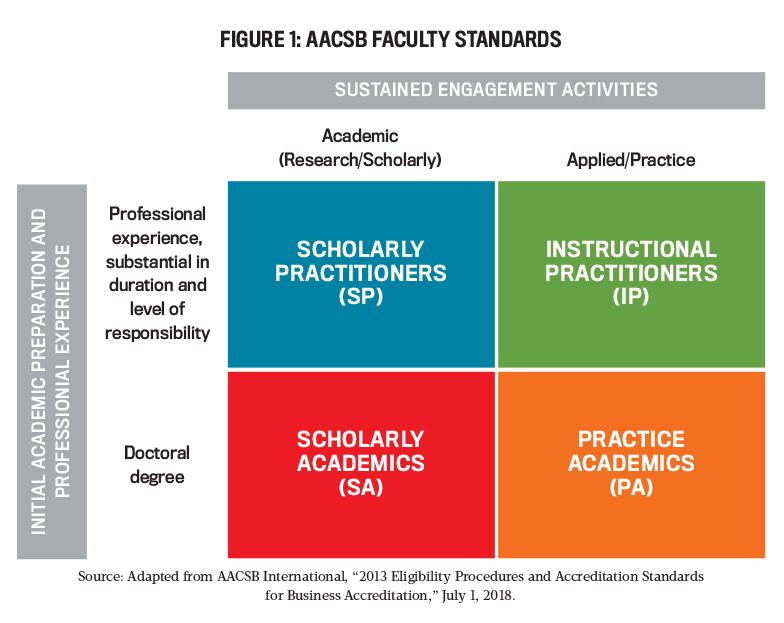

Although a terminal degree is the traditional path to the classroom, other options exist. Admittedly, a Ph.D. or other terminal degree is the ticket to the greatest level of job security and highest compensation. But there is room for instructors who have a wealth of professional experience. Each institution has guidelines that are likely driven by accreditation. For example, the Association to Advance Collegiate Schools of Business (AACSB), the accreditation organization for many notable business schools, places faculty in one of four quadrants (see Figure 1).

AACSB standards specify how faculty receive an initial invitation to the game (doctoral degree vs. professional experience) and activities that allow them to stay in the game (research/scholarly vs. applied/practice activities). Some schools, like GVSU’s School of Accounting, receive supplemental accreditation for accounting programs. Each institution will determine the appropriate classification for a faculty member. While instructors who leap from the office to the classroom will likely be classified as either instructional or scholarly practitioners, rare circumstances may qualify such faculty as practice or scholarly academics.

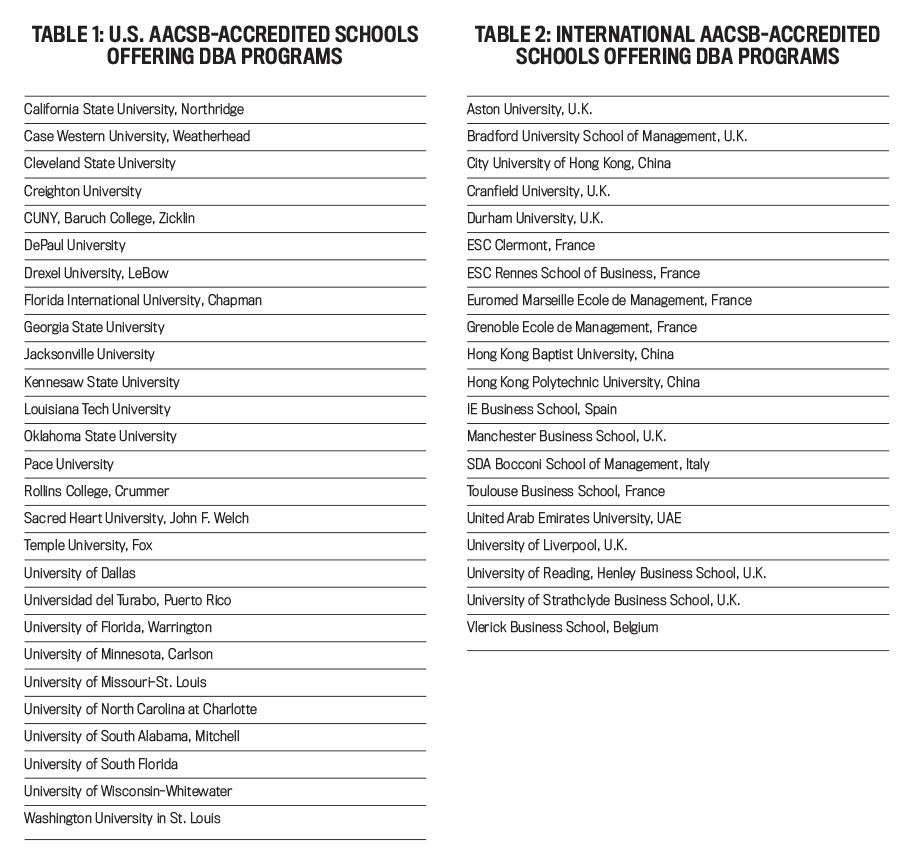

A terminal degree isn’t necessarily impractical if you have navigated the greater part of your career without it. You may begin teaching as a scholarly or instructional practitioner but transition to a scholarly or practice academic once you eventually earn a terminal degree. There are several doctoral programs that allow flexible options. For example, I have personally examined opportunities at both DePaul University and the University of Wisconsin-Whitewater that would allow me to earn a doctor of business administration (DBA) degree over three years while maintaining my position at GVSU in Michigan. These are two examples of numerous programs that may allow nontraditional faculty to secure a terminal degree. One online resource, www.dba-compass.com, identifies 27 U.S. and 20 international DBA programs offered by AACSB-accredited schools (see Tables 1 and 2).

Of course, if feasible, you could take a step back from daily obligations and devote full attention to a Ph.D. program. This will likely require you to devote four or five years almost exclusively to the pursuit of your doctorate. Practitioners considering a Ph.D. should investigate financial assistance from the Accounting Doctoral Scholars Program (ADS), which offers competitive opportunities for CPAs who are U.S. citizens (or permanent residents) and have at least three years of recent professional accounting experience.

ADS is working to address a looming shortage of academically qualified accounting faculty. Current demographics are encouraging for those looking to leap from the office to the classroom. According to ADS, more than 43% of college and university accounting faculty in the United States were age 55 or older at the program’s inception in 2008. Additional information and requirements for the ADS program are available at www.adsphd.org.

PROFESSIONAL EXPERIENCE BRINGS THE CLASSROOM TO LIFE

Working nearly 15 years in higher education has shown me how professional experience can enhance student learning. Educators with practical experience have unique opportunities to breathe life into topics that might be mundane in a traditional textbook-and-lecture setting. Students are more engaged in their studies when exposed to relevant applications. Previews of coming attractions provide invaluable context to accounting courses.

I recall a wonderful client experience I shared with External Auditing students (while, of course, ensuring that I didn’t violate client confidentiality). My firm was considering a going concern opinion for an audit client. This serious matter, which is typically the purview of partners or senior-level CPAs, exposed students to circumstances they might not encounter until much later in their careers. Students walked side by side with me as the process unfolded, seeing how we assessed facts, documented conclusions, prepared additional work papers, completed specific checklists, modified the management representation letter, revised audit opinion language, and engaged in dialogue with the client. It was unique for GVSU’s students to see a real-life application of a weighty situation that even seasoned CPAs rarely encounter.

Business schools must continually retool their curricula. Educators with professional backgrounds can distinctively influence course content and ensure its relevance. As a clinical instructor, I’m expected to maintain connections with business professionals, which allows me to measure the pulse of the corporate community and gain insight regarding employers’ expectations from GVSU’s graduates. With one foot in the classroom and the other in professional circles, I bridge the gap between academia and industry because I understand nuances and needs of both constituents.

OPPORTUNITIES ARE EVERYWHERE

There is no single recipe for success in the classroom; superior instructors develop a playbook that fits their personal style. Effective teachers are genuine and willing to be human. They experiment and update techniques, even at the risk of failure. They make (and admit) mistakes, but then they transform these situations into lessons by explaining how an error was identified and illustrating strategies for correcting it. Innovation in the classroom keeps material relevant and helps an instructor stay engaged despite years of teaching the same course.

Excellent educators learn from others—not only colleagues but also students. There is tremendous value in observing other instructors so you can adapt techniques. Superior instructors also ask others to observe them as a way to reinforce effective practices and to curtail bad habits. It’s important to seek and use feedback from your students; after all, they’re your customers. They will let you know what works, what’s valuable, and what’s ineffective. Plus, they will keep you young. I may not have discovered Snapchat if it weren’t for my wonderful undergraduate students.

Instructors should seek opportunities outside the classroom. I spent several years as a Beta Alpha Psi faculty advisor, which allowed me to connect with students on a personal level and exposed me to accounting educators at institutions throughout the U.S. I was the faculty advisor for Sigma Phi Epsilon; guiding this social fraternity provided insights into student life that I wouldn’t have experienced otherwise. Participating in freshmen orientation over the past three summers has reminded me what freshmen encounter during the transition from high school to college. Service outside the classroom has strengthened my understanding of the overall GVSU student experience.

Committees and task forces enrich collegiality that is the fabric of higher learning. I recently served on a task force charged with the selection of a new economics professor. Even though I don’t teach economics, I participated in the search because of my involvement with MBA and Executive MBA (EMBA) programs. This opportunity to interact with nonaccounting business faculty provided a more holistic view of my business college as I learned best practices and challenges faced by a different discipline.

Every job has its shortcomings; grading tends to be the most cumbersome task for teachers. This is where the rubric is your friend. A well-designed rubric allows you to be objective when evaluating student work. A rubric can erase the fear of grading and lend efficiency by breaking an assignment into its basic components, providing a road map for impartial and equitable assessment of student work.

Progressive instructors embrace technology in the spirit of continuous improvement. I utilize light board videos so students can absorb concepts outside the classroom on their own schedules. You can obtain a sense of the light board experience by viewing my cost-volume-profit (bit.ly/HarperCVP) and financial statement analysis (bit.ly/HarperFSAnalysis) videos. I am currently expanding my video library with the plan to “flip” my Principles of Accounting class in the fall 2019 semester. A flipped classroom will require students to view lectures outside the classroom, thereby allowing more hands-on, practical experiences when we meet in person. Recall the suggestion that effective instructors seek student feedback; flipping the classroom was inspired directly by insights gleaned from my student evaluations.

An example of Professor Harper's light board demonstration video

It’s important to know each student individually. Learning student names is just the beginning. An instructor can enrich the educational experience by understanding each person’s learning style, hurdles, and natural approaches to problem solving. Personal knowledge helps an instructor craft relatable, meaningful examples that circumvent roadblocks (see “A Student’s Perspective: Tessa Keena, CPA”, below). I once had an entrepreneurial student who operated her own candy confectionary. When the student needed clarification regarding variance analysis, I developed an illustration involving a standard quantity of two cups of coconut per batch of candy to illustrate a materials quantity variance. This example also benefited her classmates when we expanded the scenario to demonstrate both materials quantity and price variances during class.

CREATING PROFESSIONAL AND ACADEMIC SYNERGY

If done properly, you can develop a symbiotic relationship between your academic and professional endeavors; there are plenty of opportunities to create synergy. After all, professional experience is supposed to provide context and color to the classroom. Instructors should be able to leverage professional networks to obtain real-world examples for the classroom.

Sometimes academic lessons even trickle back to the workplace, creating bidirectional value because seasoned accountants may forget valuable concepts they don’t routinely encounter. Last year I presented a continuing education session to business owners, CPAs, and other accounting professionals to discuss cost-volume-profit analysis, breakeven calculations, and segmented income statements. Several business owners walked away from the presentation asking me to help implement these techniques in their businesses. Something as simple as dividing an expenditure by the contribution margin ratio to assess its reasonableness or measuring a breakeven point can be powerful in a business setting but may not be in a seasoned professional’s toolkit because they haven’t contemplated the concept since their undergraduate or graduate studies.

Classroom instruction typically qualifies for significant continuing education credit. Professionals who require CPE for licensure know the importance of continuing education. While state-specific limitations probably won’t allow you to earn all necessary credits from the front of the classroom, instruction should help cover a sizable chunk.

ARE YOU READY TO LEAP?

Timing is ideal for accounting professionals who are drawn to the classroom. The aging population of university and college accounting instructors should provide ample opportunities for new faculty. If you haven’t developed relationships with leadership at aspirant schools, start now. Conversations will reveal your suitability as a candidate and inform you of steps to accomplish. You might just unearth a new and exciting chapter in your professional journey.

A Student’s Perspective: Tessa Keena, CPA

I have always loved learning from others. One highlight of my college education was learning from professionals with experiences from different walks of life. The professors who impacted me the most were those who brought real-life examples into the classroom and challenged students beyond the textbook. Many college subjects can be hard to grasp, so having the ability to bring real-life examples into the classroom speaks volumes to the learning process and provides opportunities for more engagement and conversation.

Not all professors are created equally, and lack of humility and an unwillingness to accept constructive feedback can hinder the learning process for many students. I had frequently sought feedback from other students when scheduling my classes. Professors whose comments were filled with praise for innovation and helpfulness were the ones whose classrooms filled up the fastest. Professor Harper’s passion for teaching, mentoring, and classroom innovation make him a great role model for students who take one of his classes or have him as an advisor.

Tessa Keena, CPA, is a senior manager with Hungerford Nichols CPAs + Advisors in Grand Rapids, Mich. Tessa can be reached at (616) 949-3200 or tkeena@hungerfordnichols.com.

August 2019