Reporting has come a long way since then. Today it’s used to quickly give companies a true picture of where they are, why they’re there, and how they can get where they want to be. Most businesses, in fact, now have access to scores of variables that can help them determine the likelihood of success. They track a multitude of separate data streams from divergent sources that generate countless spreadsheets and reports. Why? Because business leaders know the true story of their business is in the numbers. Unfortunately, finding that story can be a time-consuming, painstaking process.

Indeed, a common complaint from executive offices is that it’s nearly impossible to find a single, accurate picture of their business. That’s true for most companies because typically:

- Profit and loss sheets don’t speak to the balance sheets.

- Cash flow analyses don’t interact with customer profitability reports, sales and marketing budgets, or lead-generation requirements.

- Financial statements don’t inform plans for future quarters or years.

- Operational data lives in a world of its own.

And while nearly every company tracks its financial performance—including producing an annual budget for the year ahead with a variety of costed plans, expenses, and anticipated revenues—very few actually measure their progress toward each element of their plan. That’s why understanding performance relative to initiatives, goals, targets, and objectives is fundamental to running a successful business. Without that understanding and the insights that come from it, you’re basically managing by wishful thinking.

TRADITIONAL REPORTING VS. PERFORMANCE REPORTING

While traditional financial reporting describes a financial track record for a given time period, performance reporting reveals the narrative behind the numbers. It’s financial storytelling, revealing how you got to where you are and where you’re headed. At its most useful, it answers the “why,” explains any anomalies along the way, and advises on any needed adjustments to achieve the next goal. This additional focus on the “why” behind the financial results is similar to comparing traditional financially focused “board books” to performance-oriented “playbooks,” which take a more inclusive approach to explaining results.

Understanding the continuous narrative—why things work or don’t work—is essential to success. Business operations without this insight into key performance metrics are essentially running blind. By the time they discover a missed target, it’s too late to recover.

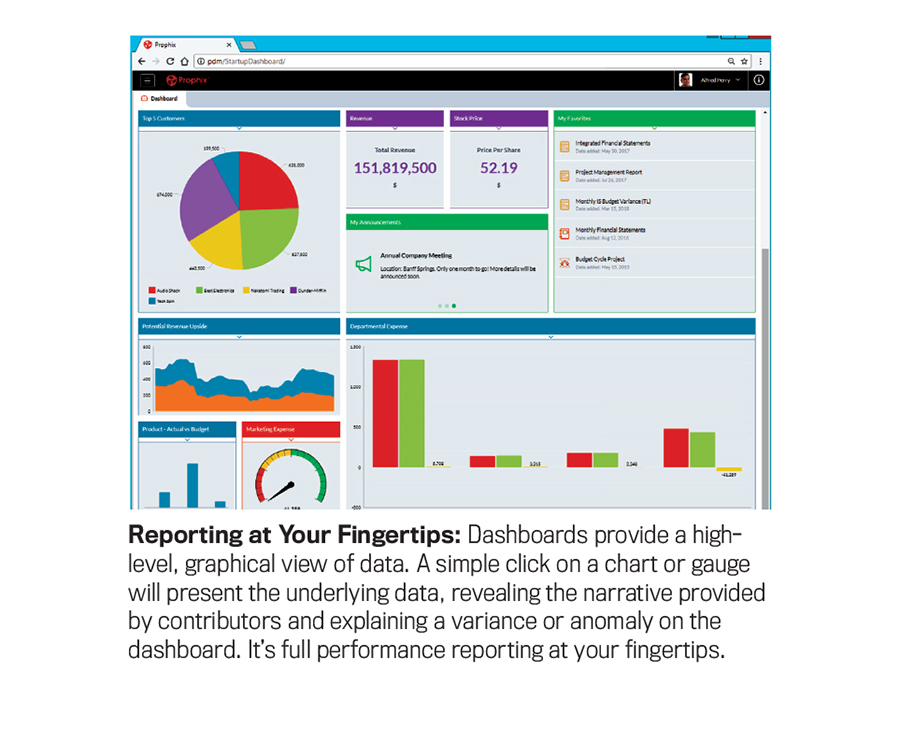

Equally important, performance reporting isn’t simply a monthly, weekly, or even daily profit and loss (P&L) analysis. When applied properly, it incorporates insightful nonfinancial data. Anything from client satisfaction, production run rates, inventory turnover, employee turnover, individual client profitability, or other factors affecting business success can be integrated into an at-a-glance dashboard. Such a tool is especially critical during challenging or evolving markets where the slightest competitive advantage can be critical. For example, being quick to market with a new product launch with accurate and approved product profitability, production schedules, and raw material suppliers all in line can make or break a business.

A DESCRIPTIVE NARRATIVE

Performance reporting incorporates both operational and financial results into a descriptive narrative that enhances operational relevance. It provides a higher level of management reporting and offers a more detailed, data-informed description of how and why an organization is where it is. Rather than simply turning over spreadsheets, graphs, and charts to leadership, performance reporting incorporates the analysis from extensive financial and operational collaboration and data.

That can include inputs from enterprise resource planning (ERP) software, financial close, financial planning and analysis, and other systems. Today’s iterations of performance reporting software automate the process of uncovering the business narrative and provide a single, true picture. Performance reporting is the next generation of financial process management—planning, budgeting, analysis, and reporting—which can create a useful, actionable dashboard.

There are a number of features that you should demand from a performance reporting solution vendor. Among the most important is to make sure that the commentary or narrative is tied to the data that it’s describing. This will remove any uncertainty when it comes to understanding a particular anomaly in your numbers. Other important features include:

- Row Notes, which provide the ability to apply comments to a complete row of data. These notes are then carried with each data point in that row through all of your work, thus allowing a user viewing a report to see the original explanation for the values in the row. An example might be to explain a sudden drop in the number of units being sold due to discontinuation of a product SKU (see Figure 1).

- Cell Comments, which provide the ability to add text or attachments that are linked to a single specific number and are carried with that data point throughout the system. One example: an explanation of a product SKU anomaly (see Figure 2).

- Line-Item Detail, which provides the ability to enter additional lines of detail to support a single line item while entering data. This gives a reviewer insight into how a row of numbers was derived—for example, a breakdown of a particular product SKU (see Figure 3).

BENEFITS OF PERFORMANCE REPORTING

Speed and Timeliness

Organizations that have adopted automated performance management and performance reporting systems say they have reduced the time it takes to generate financial reports from several days or a week to mere hours. As a result, they spend more time on meaningful, actionable analysis than on collecting, compiling, and scrubbing data.

In cases where there are anomalous or unexpected results, explanations are linked directly to those numbers, saving finance personnel hours or days trying to track down and verify the data in question.

Improved Understanding

Managers engaged in the budgeting process—which often requires extensive back-and-forth communication and frequent reiterations—have the ability to link data to supporting documentation and commentary. This helps expedite the approval process. It also reduces or eliminates the time spent on email chains and in meetings, accelerating workflow and giving everyone extra time for more productive activities.

For example, something as simple as an additional expense in one department—say, $10,000 to attend a new trade show—could delay the budgeting process by days or weeks as the Finance staff attempts to get an explanation of the unusual expense from the department in question. Good performance reporting enables an explanatory link to be attached to the unusual expense, saving Finance the time and effort of tracking down an explanation.

Transparency

Performance reporting helps Finance understand the rationale behind budgeting assumptions in the moment. For example, revenue projections for one product line might drop to zero six months into the year. Finance professionals have no way of knowing whether it’s a mistake, a failure to enter data, or something else. Fortunately, performance reporting can tell them that one product line was replaced midyear by another, and it can direct them to the continuing revenue projected on another line. It tells Finance the story of the evolution of a product and its effect on the business.

Accountability

In traditional financial reporting, each data entry is tied to a specific department or function. In the real world, however, collaboration and interplay between various departments and functions affects these outcomes. Performance reporting enables senior management to understand where there are breakdowns in interactive functions that affect results or where collaboration is creating efficiencies.

Enabling Effective Action

Being able to identify the “why” behind data can greatly reduce planning time. Performance reporting can give employees a better understanding of the needs of a business; it also provides senior managers with insight into what employees need.

Further, performance reporting instantly identifies the purpose and context of reports and empowers employees to make better business decisions. Supplementing reports with comments, line-item details, and notes linked to rows of data provides important contextual, technical, and advisory information that can help an organization succeed.

Trust between Departments

When finance professionals have access to the narrative behind plans and budgets, they can better understand departmental goals and what assumptions are being made. This greater level of transparency enhances trust. After all, who can trust a company, department, or person if they don’t disclose information, keep everything close to the vest, and refuse to share anything?

There are very few ways to build trust, but one of them is to be transparent. Providing an explanation of the data that you’re using in advance of being asked is a perfect example of being transparent in the planning process. The opposite of transparency is secrecy, which only erodes trust.

WHAT TO LOOK FOR WHEN SELECTING A PERFORMANCE REPORTING VENDOR

As with any sophisticated software application, choosing the right system and vendor is critically important to avoiding unnecessary expense, frustration, and disappointment.

Functionality

When looking at functionality, you’ll need to ask questions such as:

- Does the system meet your needs, solve your problem, and provide clear value?

- What are your organization’s pain points currently, and does the performance management software provably and effectively address them? For example, do you want/require a dashboard?

- What kinds of reports do you need to generate? Do you need text comments linked to data or only stand-alone?

- Where do you want to be able to enter commentary on data? On the data entry template? In workflow? Report analysis? Everywhere?

Flexibility and Performance

Typically, a major benefit of performance reporting is a significant reduction in the time it takes to generate useful reports. That’s the problem most users want to solve first. So, you’ll need to find out:

- Is the new system flexible/capable enough to pull data from multiple sources?

- Is it seamlessly integrated with your corporate performance management system, or is it a separate tool, application, or module?

- With which other programs is the application compatible, and how long will it take to pull and assimilate the data?

- Can that process be automated?

- Is there lag time when accessing the data once it’s in the software? Does the system bog down once you’ve been using it for a while? Can it pull data from anywhere with a data connection and a mapping table?

- Is the performance reporting system cloud-based or on-premise? Most users choose cloud-based as a more cost-effective solution, and most providers offer a cloud-based option.

- Is it a native cloud tool, or has it been adapted to the cloud?

Cost

Because cost is often a significant consideration, you should conduct a cost-benefit analysis based on lifetime cost. A low-cost system that doesn’t provide the functionality to produce meaningful benefits could become an unproductive investment. A system with significant annual upgrade and maintenance fees could ramp up the cost to a point where the cost-benefit isn’t worth it.

Ease of Use

This variable also figures into total cost of ownership, so you’ll need to determine:

- Is the software relatively easy to ramp up?

- How much time, effort, and expense are required to train employees in its use?

- How much maintenance time is required?

- What is the learning curve for those outside of finance?

If nonfinance employees hate using it, they will avoid it, delay its adoption, find unofficial and perhaps problematic work-arounds, complain, and otherwise undermine the system’s potential usefulness.

Support and Innovation

It’s important that your vendor be committed to innovation. Make sure you know:

- Does your product choice have a clear development path and excellent product support, or are you going to be committed to an outdated, poorly supported system?

- How often does your vendor innovate or upgrade its software?

As with any important application, look for vendors that are financially healthy, have a record of innovation and product development, offer performance level or ticket response commitments, have best-in-class support, are adequately staffed, and can demonstrate an understanding of your business/sector. Find out:

- What is the ratio of staff to users?

- Does the vendor listen to its customers?

- Is there a format or credit mechanism for feedback?

Culture

This is an often overlooked variable that can sink a working relationship, so you’ll want to evaluate:

- Is the partnership a good fit?

- Does the provider understand your values, respect them, and share them?

DO YOUR HOMEWORK

Because performance reporting is one of the fastest-growing areas of corporate competitive advantage, many organizations want to get on board. But as with any important business initiatives, organizations can greatly enhance the value they get from a system by assessing up front how and where they will find the greatest benefits.

This includes prioritizing their needs and wants, understanding their cost-benefit trade-offs, and undertaking sufficient due diligence to ensure they choose a partner that suits them best. By putting in the work ahead of time, most organizations will find that performance reporting is highly effective at finding and sharing the story in the numbers and enabling leaders to make smarter decisions to benefit their customers, employees, and other stakeholders.

October 2018