POP QUIZ: What’s the modern definition of a robot?

1. Metal behemoth set on destroying humanity.

2. Powerful resource designed to free finance professionals from rote, repetitive (and frankly, inhumane) tasks so accountants can get back to the real work of accounting.

Accounting no longer is solely a human endeavor. Similar to what has already occurred in manufacturing, transportation, and medical industries, robots are now performing previously people-driven accounting and finance tasks, including transaction matching, variance analysis, and reconciliations.

Yet contrary to popular (and often terrifying) fiction, these accounting robots aren’t the hunky, clunky, end-of-the-world-generating Terminators. They aren’t angry cyborgs set on taking over the knowable universe, either. In fact, the only things these robots are “taking over” are the terrible, repetitive tasks that have bored many intelligent finance professionals for centuries.

Like fire, the wheel, and, for accountants, the slide rule, robots are set to radically change human existence for the better.

For management accountants who are accustomed to suffering through the frenetic monthly close, specialized finance robots are a welcome relief. Thanks to robotic process automation (RPA), overworked accountants no longer have to manually match millions of transactions, painstakingly aggregate flux data, or spend hours creating Excel reports that are out of date as soon as they’re printed.

By using RPA to eliminate manual and highly error-prone tasks from the human “to do” list, finance organizations have the opportunity to improve efficiency and increase accuracy at a lower cost while still freeing accountants to focus on the activities that humans do best: strategy, analysis, and decision making.

For both large and small businesses, robots are enabling the revolutionary practice of Continuous Accounting whereby period-end tasks are embedded within day-to-day activities, allowing the formerly rigid accounting calendar to mirror the organization as a whole. Continuous Accounting doesn’t just change accounting departments. It changes organizations by delivering the real-time, meaningful financial data—in real time, every day—needed to compete in an increasingly strange and fickle economy.

With access to real-time information, accounting teams are no longer the proverbial “day late and a dollar short” in delivering financial information. The C-suite doesn’t have to wait weeks—or months—for today’s balance sheet. As such, Continuous Accounting provides accountants with the means and methods to finally move away from the ages-old roles of bean counter or transaction-matching assistant.

In fact, those who practice Continuous Accounting quickly stop seeing themselves as spreadsheet jockeys and start functioning as highly valuable strategists. (For more about Continuous Accounting, see “The Blueprint for Continuous Accounting” in the May 2017 issue of Strategic Finance.)

THE ROBOTIC ACCOUNTING DEPARTMENT IN THEORY

Robot vs. human isn’t new. Here’s one example. Philip K. Dick was an American writer known for his science fiction stories. In his 1968 novel, Do Androids Dream of Electric Sheep? (the basis for the first Blade Runner movie), he posed this and other provocative questions about the interactions between androids and human beings and humans and machines.

Finance organizations have a more pressing question: “Do accounting robots dream of having their own cubicles?” While the answer to the first question is (as yet) unknowable, the answer to the second is simply, “No.” The robots that populate a Robotic Accounting Department (RAD) aren’t mechanical creatures at all—they are software robots who “live” virtually on servers and in the cloud.

As virtual resources, the new accounting robots have no need for cubicles, electric charging stations, or old-fashioned oil cans. Instead, they work behind the scenes in two distinct ways. For organizations that are ready to create a Robotic Accounting Department, it’s critical to know how these two different kinds of robots work and the advantages of each.

The first type of accounting robot is task oriented.

Designed to help humans by automating traditionally manual work, task-oriented robotic process automation or “robo-accountants” rely on a set of rules to perform sequences of events, such as pulling data from one system, manipulating the data, and moving the adjusted data to another system. Adjustable algorithms guide RPA into knowing what to do with accounting information and, just as critically, when to do it.

In simple terms, RPA is software that delivers automation for your daily activities. In those day-to-day activities, there are many repetitive (and occasionally some redundant) tasks. When these tasks are structured and follow logic that can be defined—in other words, they’re rules-based—they can be automated.

The biggest benefit of robotic process automation is that it can complete repetitive activities more quickly and accurately than humans can. RPA is ideal for tasks that require the manipulation of a tremendous amount of information, such as bank reconciliations. Prior to RPA, accountants had to match transactions manually, note discrepancies, and create journal entries. With the use of robo-accountants, human accountants can instead focus on investigating discrepancies the RPA tool discovers.

While the first RPA tools focus on tasks, the second type of robot streamlines and automates processes.

Instead of merely performing calculations and relying on humans to manage exceptions, these robots use evolving artificial intelligence to manage entire processes, such as the close, from start to finish, well in advance of the need for any human intervention.

Instead of routing discrepancies to people, process RPA is intelligent enough to send exceptions to the robo-accountants for further investigation. By enabling true Continuous Accounting, process-oriented RPA tools are the key to real-time financial information and freeing accountants to focus on strategy and analysis.

Let’s look at the work these robots can do and the processes they can manage.

THE ROBOTIC ACCOUNTING DEPARTMENT IN PRACTICE

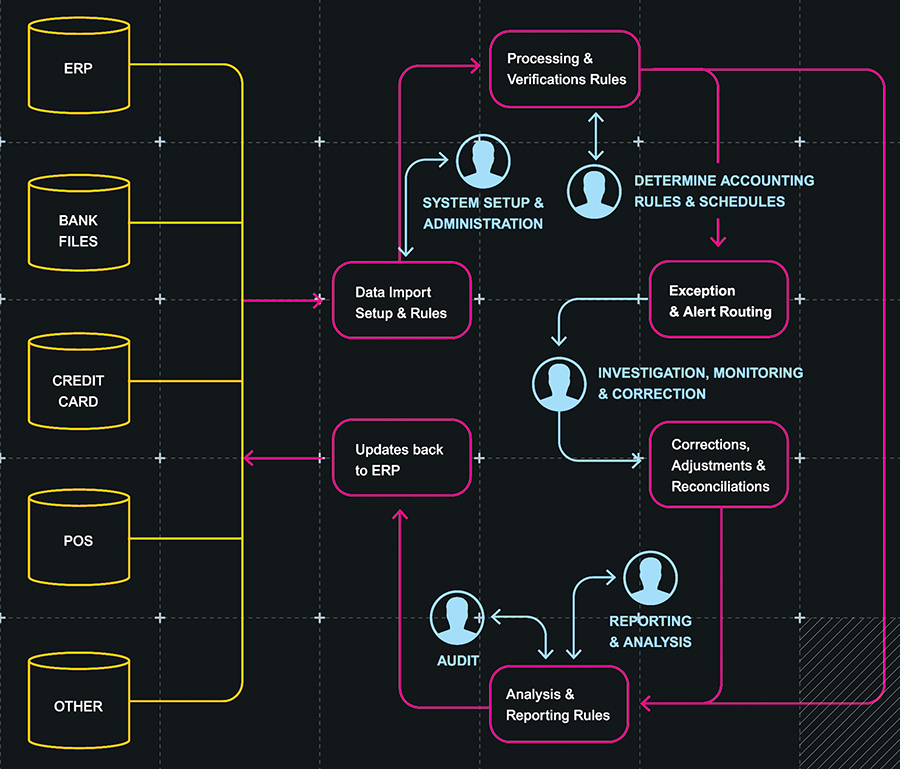

For organizations with a fully functioning RAD, previously tedious, end-of-month processes are performed automatically every day. Data is available as it’s needed instead of once a quarter. Behind the scenes, a Robotic Accounting Department is a highly complex, algorithmic-driven piece of virtual machinery. Yet while how it works may be complex, what it does is straightforward. (See Figure 1 for an example.) The day-to-day functioning of a RAD occurs in five steps:

- Data Import. First, the process-oriented robots pull and aggregate data from all connected sources: enterprise resource planning (ERP) systems, bank files, credit cards, point of sale (POS) software, and the like.

- Data Processing and Verification. After pulling in data from multiple sources, the robo-accountants perform data manipulations and calculations such as matching transactions between different systems, identifying fees, performing depreciation adjustments, certifying balances, and identifying suspicious fluctuations.

- Exception Management. Next, the robo-accountants identify exceptions. If the task robots can’t solve discrepancies, data is forwarded to a human accountant for further investigation.

- Reporting and Analysis. Robots then use the data to create reports and perform preliminary analysis. Humans perform secondary and more in-depth analysis.

- Auditing. Because the robo-accountants have performed most of the manual work, human accountants now have plenty of time to focus on ensuring integrity, accuracy, and audit functions instead of looking for and correcting human errors.

FROM BEAN COUNTER TO BUSINESS ADVISOR

If human accountants are no longer responsible for accounting’s manual work, does that mean every finance professional is out of a job? A thousand times no!

While robots are critical to increasing efficiency and accuracy, human beings are the most important element in an effective RAD. From establishing how systems connect to one another to deciding how exceptions are determined, people—not robots—drive key decision making and analysis in the organization of the future.

Both task- and process-oriented RPA tools are freeing accountants to work up to their full potential. No longer stuck manually entering data into spreadsheets, accountants can focus on more interesting, meaningful work that contributes on a strategic level to individual and organizational success.

An article from CFO.com (“Death by Digital: Good-Bye to Finance as You Know It” by David Axson) predicts that “transactional tasks will move to integrated business services solutions that use robotics, which will automate or eliminate up to 40% of transaction accounting work by 2020. This shift means that finance staff can spend more time—more than 75% of their time, up from 25% today, according to Accenture analysis—on decision support, predictive analytics, and performance management.”

Leveraging technology not only improves the efficacy that accountants need to deliver better intelligence, but it creates real-time access to financial data so that reporting and analysis can be done continuously. This provides the relevant, timely data that executives need to inform business decisions and develop strategy along with full confidence in the numbers. It really is the only way forward, especially with the increasingly complex regulatory guidelines and ongoing changes to local statutory reporting. (For more information, read “The Finance Automation Journey” at and “The Robotic Accounting Department” whitepaper.)

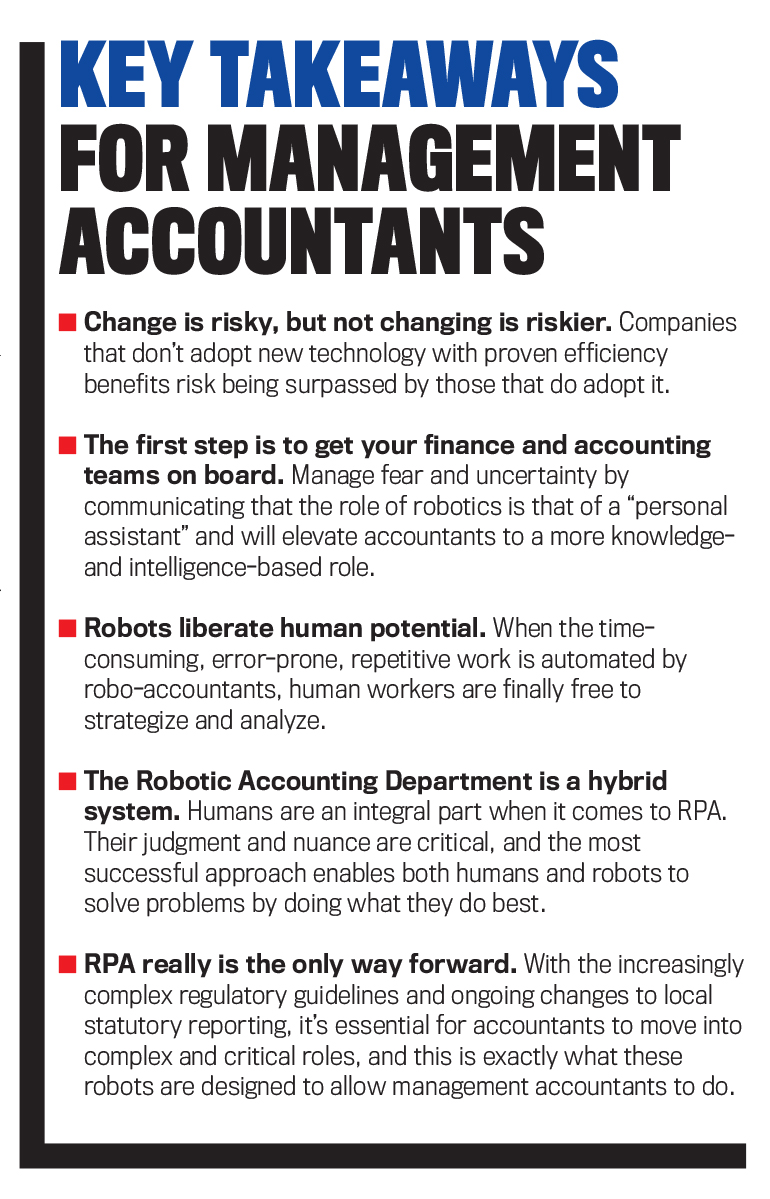

By implementing RPA tools, management accountants have the opportunity to perform six highly strategic and critical roles:

- Technical Guru

- RPA Standards Leader

- Business Advisor

- Fraud Detector

- Compliance Expert

- Auditor

- Technical Guru. With a background in IT and an understanding of accounting and finance, the technical guru plays a crucial role in implementing and managing RPA systems. As both technology and the business change, this role ensures that systems are kept updated and aligned with the finance organization’s needs.

The tech guru role is continuously growing as more automation is implemented. It requires technical background, an understanding of systems and processes, and accounting knowledge. It’s the perfect role for a systems analyst.

As organizations move toward a Robotic Accounting Department, much setup will be needed. These connections and settings must be monitored and updated when things change, including systems, business models, or structure. Yet this isn’t purely a tech job because the people performing it must understand corporate entities, account structure, and accounting roles and workflows. They may also be involved in setting up templates for items like journal entries and reconciliations and establishing checklists for work performed by other humans.

- RPA Standards Leader. RPA tools require human guidance around exceptions, materiality, and flux parameters. The RPA standards leader, with a broad knowledge of accounting processes, is responsible for setting up and maintaining rules and risk profiles to guide the robots into correct action.

This role handles exceptions and discrepancies the robots can’t and manages any reconciliations and adjustments that still need a human touch. People in this role may set and monitor materiality, balance fluctuation, and other thresholds and risk profiles that determine when further investigation is required.

The RPA standards leaders oversee the processing rules to ensure the robots operate smoothly. They will resolve any discrepancies that the robots can’t handle as well as any human-performed corrections, adjustments, and reconciliations.

Today’s staff accountants are essentially RPA standards leaders, and the RAD requires fewer individuals in this role and more business advisors.

- Business Advisor. The business advisor provides analysis and advice to leadership based on the real-time reporting generated by the Robotic Accounting Department.

Access to real-time data is key to informing the business of where things stand and where they are going. Therefore, a Continuous Accounting model must be in place so the business advisor can deliver reporting at the point of need.

- Fraud Detector. The fraud detector is a highly specialized role made possible by RPA tools and enables the finance analyst or manager to add even more value to the broader business.

By providing real-time information, RPA tools enable this role to closely monitor, identify, and report on fraud as it happens. This is more of a private investigator approach based on an innate understanding of human psychology and motivations.

- Compliance Expert. While the fraud detector uses RPA tools to monitor the integrity of internal data, the compliance expert relies on the same tools to ensure the organization is aligned with external regulations. The person in this role is focused on understanding structure and verification, is very detail oriented, and likes checking the boxes.

Both the fraud detector and the compliance expert meet the growing need for establishing monitoring rules, overseeing controls throughout the organization, and dealing with any potential issues in these areas that the robots identify.

- Auditor. The final role is that of auditor. While this is simplified and streamlined in the RAD, there will still be a need for external review to verify that standards are being followed and accounting is performed properly.

In the RAD, the auditor can now focus on the important decisions the company has made in how it accounts for balance sheet items, with much less emphasis on the processing being done correctly. This will require broad knowledge and a high-level approach to perform analysis effectively while looking for deeper issues beyond human error.

All together, these six roles make up the Robotic Accounting Department.

ROBOTS ARE LIBERATING HUMAN POTENTIAL

An effective Robotic Accounting Department relies on robo-accountants, process-oriented RPA, and human beings to manage reconciliations, matching, variance analysis, and other activities crucial to the close and the bottom line. By uniting automation robots and knowledge workers and technology and human intelligence, finance organizations have the opportunity to finally evolve from back-office function to strategic force.

For the fearful, it’s important to note that robots aren’t taking valuable human jobs. Instead, they’re unlocking human potential by freeing accountants to participate in more knowledge- and intelligence-based careers. By automating time-consuming, error-prone, repetitive work, robo-accountants create more possibilities for human workers to do what human brains do best: creating, connecting, and analyzing.

Because robotic process automation is still relatively new—and accountants have been mired in task-based, manual work for centuries—the extent of that possibility is uncharted territory. Instead of mourning the loss of mind-numbing data-entry jobs, we can celebrate the opportunity to advance human potential and organizational success.

When financial data is available in minutes and smart humans finally have the time to analyze it, organizations can respond more quickly to the marketplace, capitalize on innovation opportunities, ensure continuous integrity, and, most important, uphold stakeholder and consumer confidence. Use your robots well.

IMA members who would like to view the archived version of IMA’s Inside Talk webinar by BlackLine on “Robotics in Finance and Accounting: Separating Fact from Fiction” may do so at http://bit.ly/2gAcf4Z.

November 2017