After weathering (and often spearheading) the most dramatic changes in the recent history of U.S. corporate reporting, it comes as no surprise that Herz is again at the edge of a revolution. This time, he’s pushing the boundaries way outside the box into what he refers to as “the next generation of corporate reporting.”

INTEGRATED THINKING AS THE WAY FORWARD

From across the pond, Herz has been dubbed an “ambassador” for the London-based International Integrated Reporting Council (IIRC), which is the architect of Integrated Reporting (IR)—a framework for reporting key nonfinancial performance indicators and value drivers (below). Established by the Prince of Wales’s Accounting for Sustainability Project (A4S) and the Global Reporting Initiative (GRI), the IIRC includes major corporations, investors, global accounting firms, regulators, standard setters, and accounting bodies like IMA® (Institute of Management Accountants).

“I was very fortunate to be involved with the IIRC during the formative days of integrated reporting,” says Herz, who, as chairman of the FASB, attended the IIRC’s inaugural meeting in London in 2010. “Through these connections with international organizations and individuals, I’ve become much more aware of the potential magnitude and severity of the threats to our ongoing economic, environmental, social, and planetary welfare and of the need for better measurement and reporting as part of a global effort to address these issues.”

The international momentum toward “integrated thinking” (see above) is well documented and, as Herz explains, represents a much more progressive view on the relationship between business activities and society. He adds, “The IIRC’s vision is very much in line with my perspective on how reporting has to evolve. More specifically, it’s a vision of corporate reporting that brings together, in an integrated fashion, key nonfinancial performance indicators and value drivers, including a company’s efforts and impacts related to corporate responsibility and sustainable development.”

WHERE WE STAND ON INTEGRATED REPORTING

While the International Integrated Reporting Framework developed by the IIRC has received growing support internationally, U.S. companies have been slow to embrace the model under the weight of what’s often considered disclosure overload. More specifically, as Jeffrey C. Thomson, president and CEO of IMA, stated earlier this year to the International Federation of Accountants® (IFAC®), “Many corporations in the U.S. are hesitant to adopt it [IR] without a clear value strategy for internal users, investors, and other market constituents…Some enterprises in the U.S. simply don’t know if integrated reporting is worth the investment and are unsure how to fully commit.”

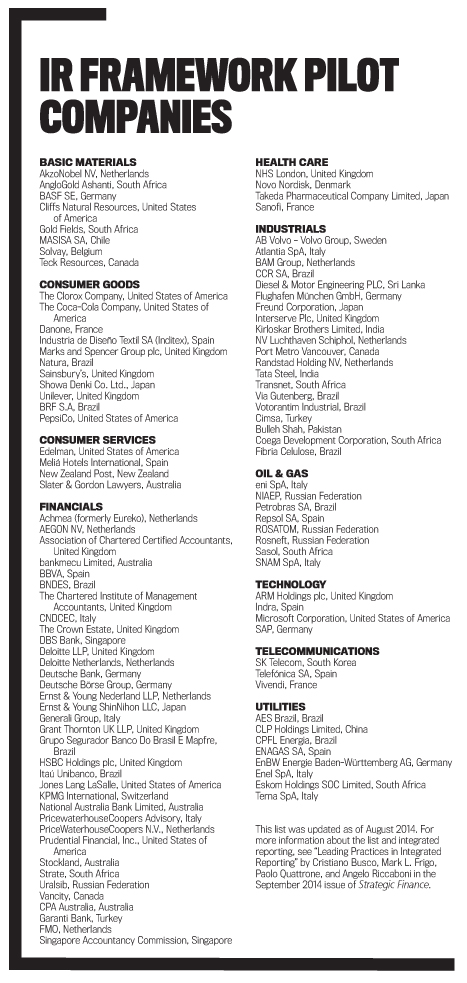

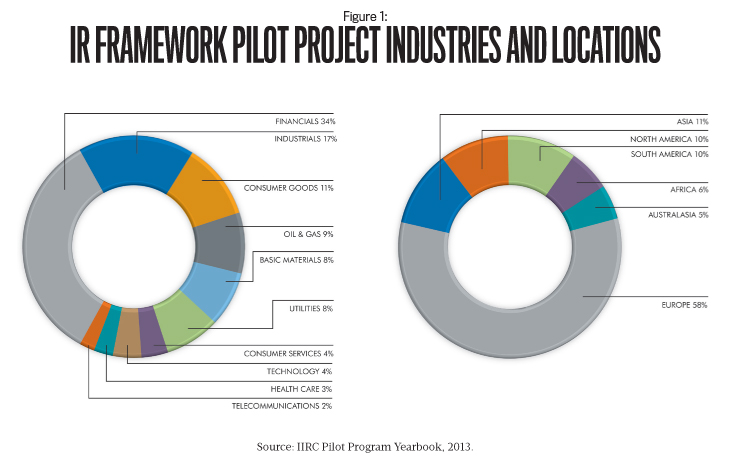

Despite the uncertainty in the United States, practical applications of IR are emerging globally, and to-date more than 100 companies worldwide participate in the IIRC’s IR pilot project. Roughly 60% of the companies in the pilot project are from the European Union, with just eight based in the U.S.: Coca-Cola, PepsiCo, Microsoft, Prudential Financial, The Clorox Company, Cliffs Natural Resources, Edelman, and Jones Lang LaSalle. (See the full list of pilot participants, plus breakdowns by industry sector and region, below. Details about the 2015 participants are forthcoming on the IIRC’s website, www.integratedreporting.org.)

In some countries, IR has already been acknowledged as a preferred framework for corporate reporting. In South Africa, for instance, companies listed on the Johannesburg Stock Exchange are required to prepare an integrated report.

According to Eumedion, a Netherlands-based foundation representing roughly 70 institutional investors and with more than €1 trillion in assets under management, approximately one-third of Dutch companies currently have plans to implement IR. In addition, based on its findings, Eumedion lists integrated reporting as the first of two key priorities for 2015, followed by the effectiveness of the internal control statement. In its annual focus letter sent to the managing directors of all listed Dutch companies, the foundation endorses IR as “a logical and necessary next step in corporate reporting.”

International accounting bodies are also recognizing the development of integrated reporting with special awards for demonstrating excellence in IR. For example, at its 2015 Global Management Accounting Summit in July, the Institute of Certified Management Accountants of Sri Lanka presented the CMA Excellence in Integrated Reporting Award to 10 companies in a variety of sectors. This year’s summit theme was “Business Resilience Through Integrated Reporting.”

Meanwhile, the international audit community is getting ready to play its role in the realm of IR. More specifically, the International Auditing and Assurance Standards Board (IAASB) has established an Integrated Reporting Working Group to:

- Explore emerging developments in integrated reporting;

- Gather further information about the demand for assurance, the scope of the assurance engagement, and the key assurance issues; and

- Explore how the IAASB can respond most effectively via international standards or nonauthoritative guidance (including staff publications) and in what time frame.

A SINGLE SET OF STANDARDS?

In spring 2015, Bob Herz joined the board of directors of the Sustainable Accounting Standards Board (SASB), an independent, accredited organization that develops industry-specific standards for voluntary use in disclosing material sustainability issues in filings to the U.S. Securities & Exchange Commission (SEC). The not-for-profit SASB, which is based in San Francisco, Calif., isn’t affiliated with the FASB or the SEC.

Forging stronger ties with those organizations has been rather slow to happen, especially with the SEC. Commissioner Daniel M. Gallagher claimed, “It is important to remember that groups like SASB have no role in the establishment of mandated disclosure requirements.”

So why would Herz, with his strong credentials, want to align himself with what many might think of as a fringe group? The answer lies in the fact that Herz is fundamentally a maverick in his own right, with unique insights into the future of corporate reporting. For one, he likes a challenge—someone might suggest that SASB is attempting the near impossible—and, second, when looking at SASB’s leadership, “fringe group” is really the last thing that comes to mind. Herz’s fellow board members include Michael Bloomberg, two Harvard professors, and three former chairs of the SEC, all of whom are backed by a large constituency of investors, nongovernmental organizations, and a growing number of for-profit companies.

Herz says a single rigorous set of standards for corporate sustainability reporting (CSR) is long overdue. One of the criticisms of CSR, and nonfinancial reporting in general, is that there are too many frameworks, making it difficult for investors to compare between companies and across industries. A recent survey conducted by Institutional Investor magazine on behalf of EY, “Tomorrow’s investment rules,” reported that “investors are struggling to find ways to meaningfully compare companies’ data, to understand which issues are most material to their [companies’] sustainable growth, and to draw quantifiable links between nonfinancial and financial performance.” (The survey is available at http://bit.ly/lj3u3om.)

THE FUTURE OF CORPORATE REPORTING

SASB’s mission is to develop one set of rigorous standards for sustainability disclosure that will be widely accepted and used consistently by U.S. public companies in their SEC filings. Given his busy schedule, it’s clear that Herz didn’t join SASB as a director out of boredom but because of his long-standing passion for improving corporate reporting worldwide. In 2001, Herz coauthored a book with Robert G. Eccles (the first chair of SASB), E. Mary Keegan, and David M.H. Phillips titled The Value Reporting Revolution: Moving Beyond the Earnings Game, where they explain key nonfinancial performance indicators in relation to value drivers.

“I was kind of into that whole thing,” Herz notes in regard to understanding what’s commonly considered the “hidden” or more intangible measures of corporate value. “I’ve devoted a lot of my professional career to trying to improve the information that goes to the capital markets, and I’ve had a long-standing belief that financial reporting is a very important part of that, but it isn’t all that’s needed.

“When it comes to determining the underlying sustainability of a company or its capacity for growth, you’ve got to look at more than financial reporting if you want to understand what creates value over time or what can destroy value over time,” he adds. “When I was a partner at PwC, and before I became chairman of the FASB or a member of SASB, I advocated for more systematic reporting of information on key value drivers, so my interest in the subject of sustainability reporting goes back a long way.”

Herz’s role as a board member at SASB is multifaceted, but, as he explains, his prior experience with the FASB adds an important perspective. “Where I think I can add value from my standard-setting experience is to help develop a process to finalize our provisional standards—looking at how people view them, whether they’re cost effective and can be done in practice, and, very importantly, determine what investors think.” SASB soon will be piloting its disclosures with various companies as part of a robust program to finalize its standards.

SASB is approximately two-thirds of the way through that process, Herz says, which it expects to complete by 2016. The road forward, he clarifies, will be to determine the most useful metrics for the investor community, and he hopes that “as more people use the standards, they’ll become generally accepted, companies will see the benefits, and investors will ask for this information to be included in SEC filings.”

On June 25, 2014, SASB released perhaps its most ambitious standard, targeting heavy polluting industries, which are grouped as Non-Renewable Resources. The standard, titled “Non-Renewable Resources,” addresses approximately eight sustainability issues in each industry, including greenhouse gases, air quality, emergency management, and health and safety. Seventy-six percent of the suggested accounting metrics for evaluating these issues are quantitative in nature and will apply to more than 550 companies that trade on U.S. exchanges.

Herz predicts that the SEC and SASB will develop a more formal relationship in the coming years and that the demand for one set of comparable CSR standards will be market-driven. As evidence of this, he points to the current makeup of SASB’s board of directors, which includes three former SEC commissioners: Mary Schapiro, Aulana Peters, and Elisse Walter. He also notes that SASB has been meeting regularly with SEC staff to keep them informed of its progress.

“There’s clearly interest at the SEC,” Herz notes, “but it has to be an evolutionary process. They first have to see that there’s growing market acceptance and uptake and, as that occurs, then the regulators may begin to consider mandating such reporting.”

HOW IT MIGHT AFFECT YOU

Much of what SASB is currently crafting will likely affect U.S.-based financial professionals, whether they work for the Apples or General Electrics of the world or for a small to midsize organization. Here’s what Bob Herz thinks will happen—and what you can do now to prepare:

“First, I’d encourage you to go to the SASB website (www.sasb.org) and learn about the process. Read the standards and the accompanying industry briefs. You’ll see that we’re trying to get at finite sets of issues and metrics that really matter from an investment and value proposition on an industry-by-industry basis.”

Second, Herz says, while the sustainability folks in the company are usually involved in developing the information, ultimately it will be the finance function that will decide what to report in the 10-K and what internal controls to put around that information.

“Third,” he adds, “at SASB, we’re designing the sustainability reporting standards so that the information can be audited. If the markets want more assurance on this, we would want the auditors to be able to provide that assurance. And, ultimately, capturing the essence of material issues is the key consideration along with the cost benefit.”

While SASB claims to have only U.S. reporting interests in mind, its guidance could be well received internationally, thereby confirming SASB as the standard setter in the CSR space.

To-date, SASB has plans for standards in these sectors: Health Care, Financials, Technology & Communication, Non-Renewable Resources, Transportation, Services, Resource Transformation, Consumption I, Consumption II, Renewable Resources & Alternative Energy, and Infrastructure. In 2016, the Board—behind the combined talents of Herz and the other distinguished professionals mentioned earlier—is expected to have developed provisional sustainability accounting standards for more than 80 industries in the 11 sectors.

October 2015