AS a CFO, I’ve had a very special work experience throughout the years. In 2009, I left Merck Pharmaceutical Company and joined a start-up company in China called Tengchuang Technology Group (TC Group) as executive vice president and CFO. When the global financial crisis hit the China market, the company almost failed because of an excessive shortage of cash in addition to the many human, financial, and material difficulties we experienced as a start-up company. With my leadership ability and knowledge of management accounting, I was able to pull the company out of the red with an innovative system and leadership style.

MANAGEMENT STYLE

In China, Columbus-style management is very common in business. That’s when management doesn’t know where the company is financially, where to go, how many resources are available, and how to allocate those resources—or they lack the know-how and methodology to make the company strategy a reality. This happens because financial executives aren’t happy that their companies don’t recognize them as valuable contributors.

When I joined TC Group, it lacked cash, strategy, and strong management. From our many heated discussions about what we should do, we realized that if we didn’t have a clear strategy, the company would lose direction; if we didn’t have business revenue, we couldn’t go anywhere; if we didn’t put financial management in place, we would be exposed to higher risk; and if we didn’t put performance management in place, the staff would lose motivation to move forward. Therefore, I came up with a system that linked strategy, business, finance, and human resources.

MY “STRING OF PEARLS” SYSTEM

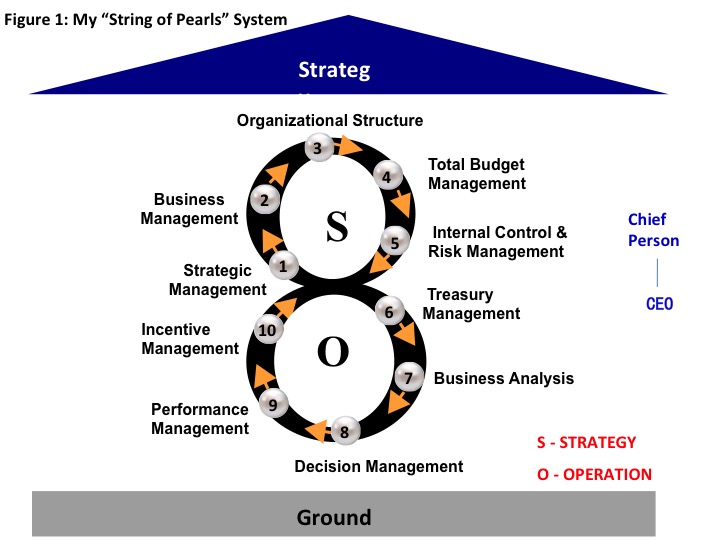

With the “String of Pearls” system I created, the small company grew its business 3,600% over three years and became one of the top 10 leading companies in the industry (see Figure 1 for an outline of the system).

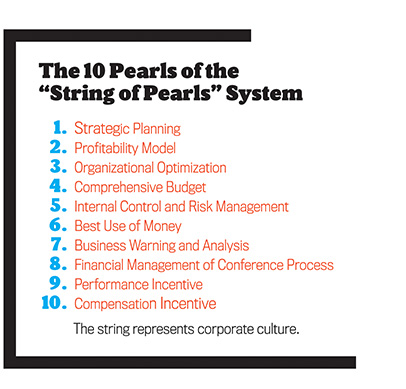

The “String of Pearls” forms a closed-loop system that drives company strategy. The system is composed of 10 “pearls” of management connected by a “string” that represents a common theme: corporate culture. (See “The 10 Pearls of the “String of Pearls” System” for the list.)

As an example in the area of strategic management, the CEO was concerned about the business’s direction and strategic objectives in the next three to five years. I proposed the following value propositions:

- How does the financial plan support the corporate strategy and business plan?

- Where, when, and how many resources should we invest to support the corporate strategy and business plan?

- How should the business objective, plan, and activities be expressed in numbers in order to support corporate strategy?

- How do we complete effective performance evaluations and set early warning signs according to the standards and rules of assessment? How do we send out early warning signs?

- How do we control financial and operational risk effectively?

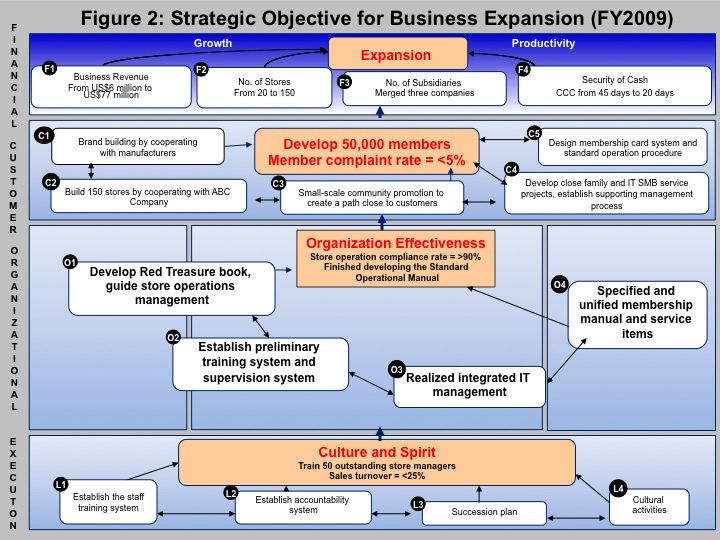

Based on that list, I introduced the strategic balanced scorecard into our strategic management system (see Figure 2 for the company’s strategic objective). This enables the integration of short-term and long-term work and the combination of financial objectives and nonfinancial targets. Based on financial, customer, organizational, and execution factors, we established our “from strategy to operation” system, ensuring our short-term and long-term growth and development.

The strategic objective of our group was business expansion, so we focused on growth strategy and productivity strategy. Strategic objectives came from four perspectives—financial, customer, organizational, and strategy execution ability—based on annual achievement and taking into account long-term development. Our objective was to provide a clear path of development for every employee of TC Group. Here are the details of the four levels:

- Financial Perspective. Our strategy was to increase the business revenue from US$6.5 million in Fiscal Year 2008 to $81.7 million in FY 2009, reduce our cash conversion cycle from 45 days in FY 2008 to 20 days in FY 2009, and expand the number of stores from 20 in FY 2008 to 150 in FY 2009.

- Customer Perspective. Our strategy was market-driven to increase customer retention and improve customer satisfaction. Specifically, we needed to develop 50,000 members, ensure the member complaints rate was less than 5%, and build up the strategic cooperation with other companies.

- Organizational Perspective. Our strategy was to enhance the store operational compliance rate by more than 90% and complete the Standard Operational Checklist (SOC).

- Execution Perspective. Our strategy was to train 50 outstanding managers and ensure the turnover rate of the sales force was less than 25%.

Under each strategy, the path decomposition was carried out with the emphasis of risk management and resource allocation.

THE RESULTS

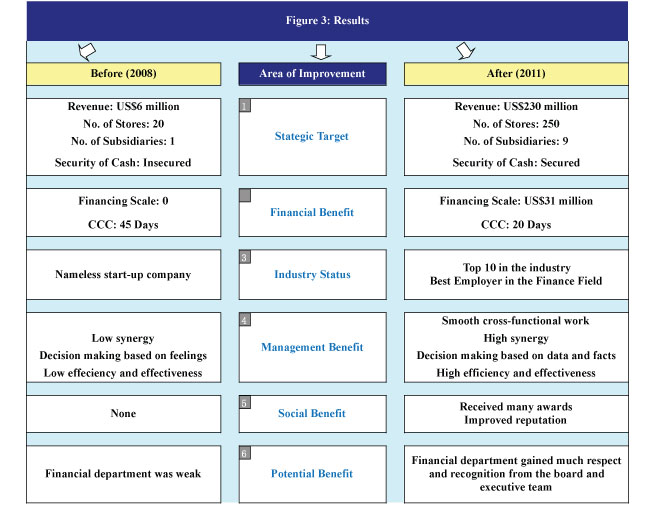

After we implemented the “String of Pearls” system and strategic balanced scorecard, we saw many positive changes. The company’s revenue increased from $6.5 million in 2008 to $245 million in 2011. Our return on equity (ROE) improved from -0.75% in 2008 to 10.31% in 2011, and our cash conversion cycle improved from 45 days in 2008 to 20 days in 2011. The company also increased net income by $49,000 for reducing the cash cycle a day. The number of stores we owned increased from 20 in 2008 to 250 in 2011. (See Figure 3 for a full list of results.)

Other companies caught on as well. I introduced the “String of Pearls” to Teamsun Technology Group, Pera Global Technology Limited, ECOIC Technologies Company, and Volkswagen in Jiangsu Region. More state-owned businesses are realizing they lack structure and leadership but recognize the value the “String of Pearls” can add to their business.

For information about the IMA Leadership Academy, visit www.imanet.org/programs_events/ima_leadership_academy.

August 2015